Printable North Carolina Bill of Sale Template

Find Other Popular Bill of Sale Templates for Specific States

How to Transfer Car Title in Nj - It helps ensure transparency in the sale transaction.

For those looking to complete an ATV transaction in Arizona, utilizing resources like Top Document Templates can help ensure that all necessary information is included in the bill of sale, making the process more straightforward and legally secure.

Ohio Bill of Sale Word Template - This form may contain warranties regarding the condition of the item sold, providing additional protection for the buyer.

Misconceptions

The North Carolina Bill of Sale form is an important document for recording the transfer of ownership of personal property. However, several misconceptions surround its use and requirements. Here are five common misunderstandings:

-

Only a Notary Public Can Witness a Bill of Sale.

Many believe that a notary public must witness the signing of a bill of sale for it to be valid. In North Carolina, while notarization can add an extra layer of authenticity, it is not a requirement for the bill of sale to be legally binding.

-

A Bill of Sale is Only for Vehicles.

Some people think that a bill of sale is only necessary for vehicle transactions. In reality, this document can be used for various types of personal property, including furniture, electronics, and recreational vehicles.

-

All Bills of Sale Must Be Printed.

There is a misconception that bills of sale must be physically printed to be valid. However, electronic versions of the document are acceptable, as long as both parties agree to the terms and conditions outlined in the agreement.

-

Once Signed, a Bill of Sale Cannot Be Changed.

Another common belief is that a signed bill of sale is set in stone. In fact, both parties can agree to amend the document if necessary, as long as the changes are documented and signed by both parties.

-

A Bill of Sale Guarantees Ownership.

Lastly, many think that having a bill of sale guarantees that the seller has clear ownership of the property. While it serves as proof of the transaction, it does not necessarily confirm that the seller has the right to sell the item. Buyers should always do their due diligence to ensure the seller has the authority to transfer ownership.

Documents used along the form

When completing a transaction in North Carolina, a Bill of Sale is often just one part of the paperwork you may need. Here’s a list of other important forms and documents that can help ensure a smooth process.

- Title Transfer Form: This document is essential for transferring ownership of a vehicle. It includes details about the buyer, seller, and the vehicle itself.

- Vehicle Registration Application: After purchasing a vehicle, this form is needed to register it with the state. It provides proof of ownership and allows you to obtain license plates.

- Odometer Disclosure Statement: This form is required for the sale of most vehicles. It verifies the vehicle's mileage at the time of sale to prevent fraud.

- Notarized Affidavit: Sometimes, a notarized affidavit is necessary to confirm the identity of the seller or the authenticity of the transaction.

- Sales Tax Receipt: This document shows that sales tax has been paid on the vehicle purchase, which is often required for registration.

- Goods Transfer Receipt: This document serves as a formal acknowledgment of the transfer of goods between the buyer and seller, providing a clear record of the transaction. For more information, you can view the Goods Transfer Receipt.

- Purchase Agreement: This contract outlines the terms of the sale, including the price and any conditions. It protects both the buyer and seller.

- Insurance Documents: Proof of insurance is usually required before a vehicle can be registered. This ensures that the vehicle is covered in case of accidents.

- VIN Verification Form: This form confirms the Vehicle Identification Number (VIN) and is often needed to register a vehicle, especially for out-of-state purchases.

- Power of Attorney: If someone else is handling the sale on your behalf, a power of attorney document grants them the authority to act in your stead.

Having these documents ready can simplify the buying or selling process in North Carolina. Always check local requirements, as they may vary by county or city.

Steps to Filling Out North Carolina Bill of Sale

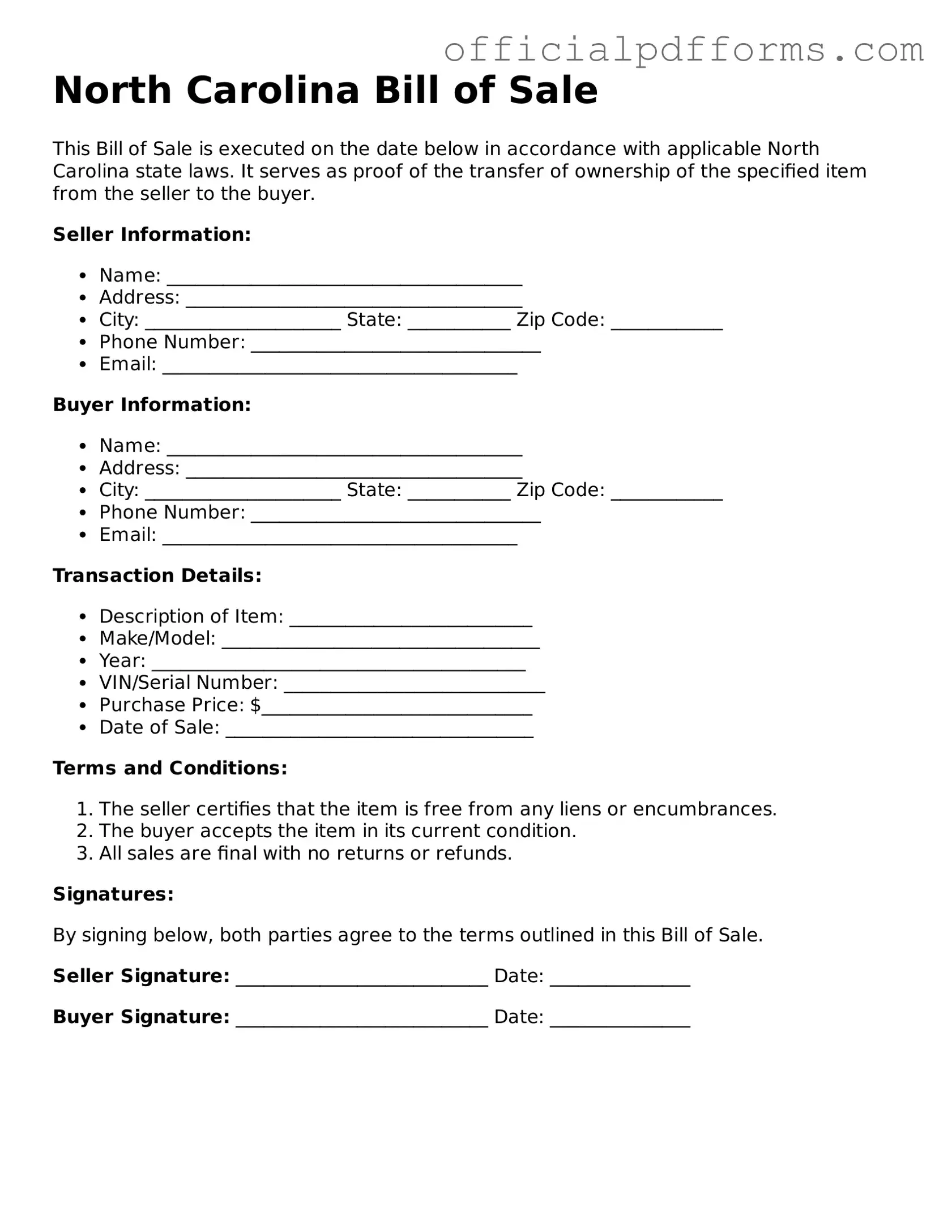

Filling out the North Carolina Bill of Sale form is a straightforward process that helps document the transfer of ownership of personal property. Once you have completed the form, ensure that both parties keep a copy for their records. Here are the steps to fill out the form correctly:

- Gather Information: Collect all necessary details about the item being sold, including its make, model, year, and VIN (if applicable).

- Seller Information: Write the full name and address of the seller. Make sure this information is accurate to avoid any issues later.

- Buyer Information: Fill in the full name and address of the buyer. This is crucial for the transfer of ownership.

- Item Description: Clearly describe the item being sold. Include specifics like condition, color, and any relevant identifying numbers.

- Sale Price: Indicate the agreed-upon sale price for the item. This should be a clear figure.

- Date of Sale: Enter the date when the transaction is taking place. This helps establish a timeline for the sale.

- Signatures: Both the seller and buyer must sign the form. This signifies that both parties agree to the terms outlined in the Bill of Sale.

Common mistakes

-

Incomplete Information: Failing to fill in all required fields can lead to delays or complications. Ensure that every section is completed, including names, addresses, and vehicle details.

-

Incorrect Vehicle Identification Number (VIN): Mistakes in entering the VIN can cause issues with registration. Always double-check this critical number.

-

Wrong Sale Price: Listing an incorrect sale price can create problems for tax purposes. Make sure the amount reflects the agreed-upon price.

-

Missing Signatures: Both the buyer and seller must sign the document. Omitting a signature can invalidate the Bill of Sale.

-

Not Including Date of Sale: The date of the transaction is essential for record-keeping. Always include this information.

-

Neglecting to Provide a Bill of Sale Copy: Failing to give a copy to the buyer can lead to disputes later. Both parties should retain a copy for their records.

-

Not Notarizing When Required: Some transactions may require notarization for legal validity. Check if this step is necessary for your situation.

-

Ignoring State-Specific Requirements: Each state has its own rules regarding Bills of Sale. Be aware of North Carolina's specific requirements to avoid issues.

-

Using Outdated Forms: Ensure that you are using the most current version of the Bill of Sale form. Outdated forms may not meet current legal standards.

-

Failing to Disclose Known Issues: Not mentioning any known defects or issues with the vehicle can lead to legal complications. Transparency is essential.

Get Clarifications on North Carolina Bill of Sale

What is a North Carolina Bill of Sale?

A North Carolina Bill of Sale is a legal document that records the transfer of ownership of personal property from one party to another. It serves as proof of the transaction and outlines the details of the sale, including the parties involved, the item being sold, and the sale price. This document can be particularly important for transactions involving vehicles, boats, or valuable items.

Why do I need a Bill of Sale?

A Bill of Sale is crucial for several reasons:

- It provides legal protection for both the buyer and the seller.

- It serves as a record of the transaction, which can be helpful for tax purposes.

- It can prevent disputes over ownership or the terms of the sale in the future.

What information should be included in a Bill of Sale?

When creating a Bill of Sale in North Carolina, ensure it includes the following information:

- The names and addresses of both the buyer and the seller.

- A description of the item being sold, including any identifying details like VIN for vehicles.

- The sale price.

- The date of the transaction.

- Signatures of both parties.

Is a Bill of Sale required in North Carolina?

While a Bill of Sale is not legally required for every transaction, it is highly recommended. For certain items, such as vehicles, a Bill of Sale may be necessary for registration purposes. It can also be beneficial in establishing proof of ownership.

Can I create my own Bill of Sale?

Yes, you can create your own Bill of Sale. Many templates are available online that you can customize to fit your specific transaction. Just make sure to include all necessary information to ensure it serves its purpose effectively.

Do I need to have the Bill of Sale notarized?

In North Carolina, notarization is not required for a Bill of Sale to be valid. However, having it notarized can add an extra layer of authenticity and may be required by some parties or institutions, such as banks or DMV offices.

What if there are disputes after the sale?

If a dispute arises after the sale, the Bill of Sale can serve as a critical piece of evidence. It outlines the terms agreed upon by both parties, which can help resolve misunderstandings or disagreements. Keeping a copy of the Bill of Sale is essential for reference.

How does a Bill of Sale affect taxes?

A Bill of Sale can have tax implications, particularly for significant purchases. It serves as proof of the sale price, which may be necessary for calculating sales tax. Additionally, both buyers and sellers should keep records of the transaction for their tax filings.

What if I lose my Bill of Sale?

If you lose your Bill of Sale, it can be challenging, but not impossible, to address. You may be able to recreate the document by gathering information from both parties involved in the transaction. If necessary, consider seeking a written statement from the other party confirming the sale.

Where can I find a Bill of Sale template for North Carolina?

Templates for a North Carolina Bill of Sale can be found online through various legal websites or state resources. Many of these templates are free and can be easily customized to fit your specific needs. Just ensure that the template complies with North Carolina laws.