Printable North Carolina Articles of Incorporation Template

Find Other Popular Articles of Incorporation Templates for Specific States

Llc Articles of Organization Nj - Potential investors may scrutinize the Articles for insight into the corporation's intentions and plans.

For individuals looking to establish control over their financial and legal matters, a well-crafted document can be instrumental; consider utilizing our comprehensive Power of Attorney options to ensure your interests are effectively represented.

Ohio Business Central - Changes to the Articles may require amendments and further filings.

Misconceptions

Here are six common misconceptions about the North Carolina Articles of Incorporation form:

- Only large businesses need to file Articles of Incorporation. Many people believe that incorporation is only for big companies. However, small businesses and startups also benefit from formal incorporation.

- Incorporation is too expensive. While there are fees associated with filing, many find that the benefits of liability protection and tax advantages outweigh the costs.

- Once filed, Articles of Incorporation cannot be changed. In reality, amendments can be made to the Articles of Incorporation if business circumstances change.

- Incorporation is a lengthy process. The filing process can be completed relatively quickly, often within a few days, depending on the method of submission.

- All businesses must incorporate. Not every business needs to incorporate. Some may choose to operate as sole proprietorships or partnerships based on their specific needs.

- Incorporation guarantees business success. While incorporation provides legal protections and structure, it does not ensure profitability or success. Business planning and management remain crucial.

Documents used along the form

When forming a corporation in North Carolina, the Articles of Incorporation is just the starting point. There are several other important documents that are often needed to ensure your business is compliant with state regulations and operates smoothly. Here’s a list of essential forms and documents that you may need alongside your Articles of Incorporation.

- Bylaws: This document outlines the internal rules and procedures for managing the corporation. It covers everything from how meetings are conducted to the responsibilities of officers and directors.

- Initial Report: Some states require a report to be filed shortly after incorporation, detailing the corporation's initial activities, directors, and officers.

- Employer Identification Number (EIN): Obtaining an EIN from the IRS is essential for tax purposes and is often required for opening a business bank account.

- Business Licenses and Permits: Depending on your business type and location, you may need various local, state, or federal licenses and permits to operate legally.

- Rental Application Form: Landlords often use a OnlineLawDocs.com to access templates for rental application forms, essential for screening potential tenants effectively.

- Shareholder Agreements: This document outlines the rights and responsibilities of shareholders, including how shares can be sold or transferred.

- Operating Agreement: For LLCs, this document serves a similar purpose to bylaws, detailing the management structure and operational procedures.

- Minutes of Organizational Meeting: After incorporation, it's crucial to document the initial meeting of the board of directors, including decisions made and actions taken.

- Annual Reports: Most states require corporations to file annual reports to maintain good standing. These reports typically include updated information about the business and its officers.

Having these documents prepared and in order can save you time and potential headaches down the road. Make sure to consult with a professional if you have questions about any specific requirements for your corporation in North Carolina. Taking these steps now will help ensure your business is set up for success.

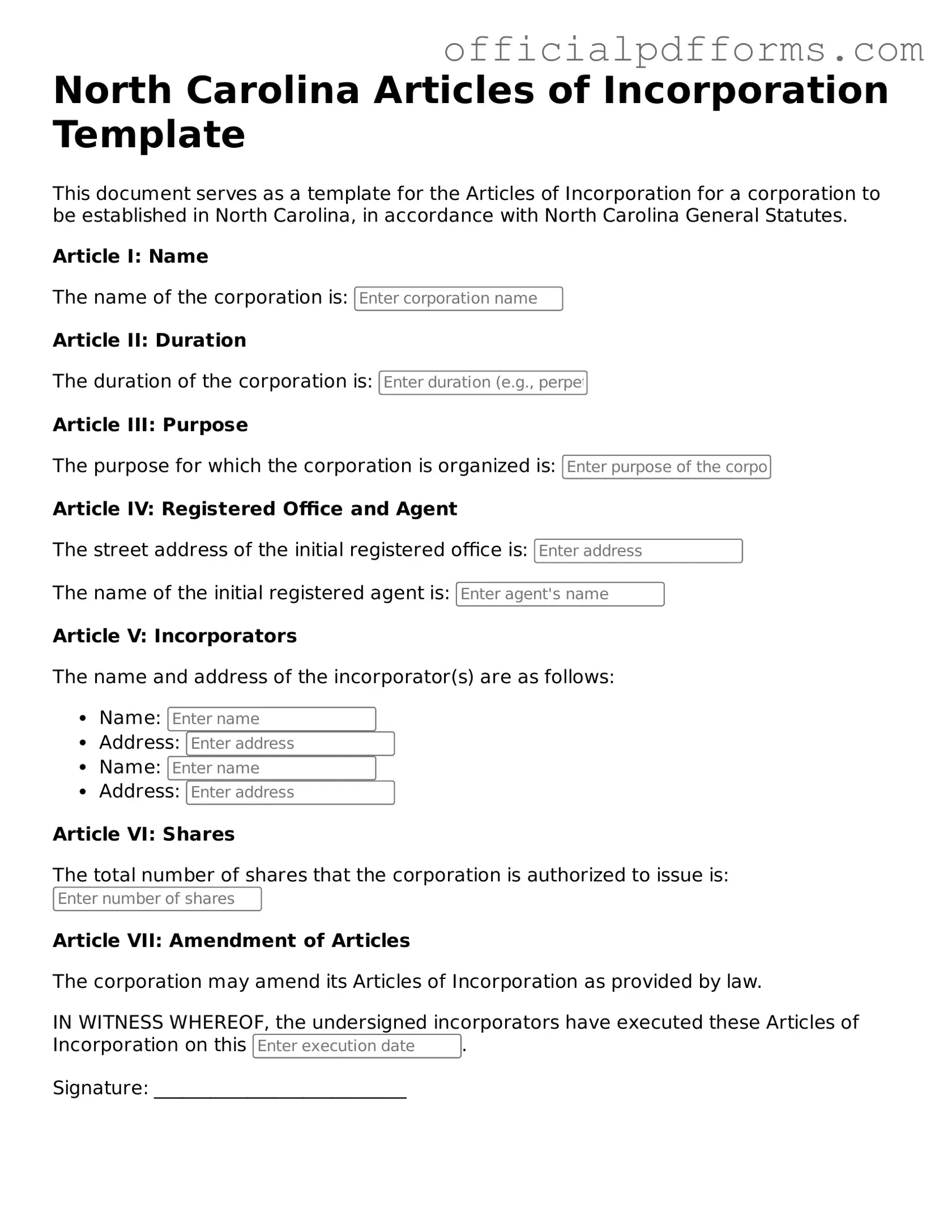

Steps to Filling Out North Carolina Articles of Incorporation

Once you have gathered the necessary information, you are ready to fill out the North Carolina Articles of Incorporation form. This form is essential for establishing your business as a legal entity in the state. Follow these steps carefully to ensure that all required information is provided accurately.

- Begin by downloading the Articles of Incorporation form from the North Carolina Secretary of State’s website.

- Provide the name of your corporation. Ensure that the name is unique and complies with state naming requirements.

- Indicate the duration of your corporation. Most corporations are set up to exist indefinitely unless specified otherwise.

- List the purpose of your corporation. Be clear and concise about the business activities you intend to engage in.

- Fill in the address of your corporation's principal office. This is where official correspondence will be sent.

- Provide the name and address of your registered agent. This person or business will receive legal documents on behalf of your corporation.

- State the number of shares your corporation is authorized to issue. Include the par value of these shares if applicable.

- Include the names and addresses of the incorporators. These individuals are responsible for filing the Articles of Incorporation.

- Sign and date the form. Ensure that the signature is from an incorporator listed in the document.

- Submit the completed form along with the required filing fee to the North Carolina Secretary of State. You can do this online or by mail.

After submitting your Articles of Incorporation, you will receive confirmation from the state. This process typically takes a few days. Once approved, your corporation will be officially registered, allowing you to conduct business legally in North Carolina.

Common mistakes

-

Incorrect Business Name: Choosing a name that is already in use or does not comply with state regulations can lead to rejection. Ensure the name is unique and includes the required designator, such as "Inc." or "Corporation."

-

Missing Registered Agent Information: Failing to provide accurate details about the registered agent can cause delays. The registered agent must have a physical address in North Carolina and be available during business hours.

-

Incomplete Purpose Statement: Not clearly stating the purpose of the corporation can result in confusion. Be specific about what the business will do to avoid ambiguity.

-

Improper Filing Fee: Submitting the wrong amount for the filing fee can lead to processing issues. Check the current fee schedule to ensure the correct payment is made.

-

Omitting Signatures: Forgetting to sign the form can halt the incorporation process. Ensure that all required signatures are included before submission.

Get Clarifications on North Carolina Articles of Incorporation

What is the North Carolina Articles of Incorporation form?

The Articles of Incorporation form is a legal document that establishes a corporation in North Carolina. It outlines essential details about the corporation, such as its name, purpose, and the number of shares it is authorized to issue. Filing this form is a crucial step for anyone looking to form a corporation in the state.

Who needs to file the Articles of Incorporation?

Anyone planning to start a corporation in North Carolina must file the Articles of Incorporation. This includes individuals or groups who want to create a for-profit or non-profit corporation. It is important to note that different types of corporations may have specific requirements, so understanding the intended structure is vital.

What information is required on the form?

The Articles of Incorporation form typically requires the following information:

- The name of the corporation.

- The purpose of the corporation.

- The address of the corporation's principal office.

- The name and address of the registered agent.

- The number of shares the corporation is authorized to issue.

Additional information may be required depending on the type of corporation being formed.

How do I file the Articles of Incorporation?

To file the Articles of Incorporation in North Carolina, you can complete the form online through the North Carolina Secretary of State's website or submit a paper form by mail. Ensure that you include the required filing fee, which varies based on the type of corporation. It’s advisable to double-check all information for accuracy before submission to avoid delays.

What is the filing fee for the Articles of Incorporation?

The filing fee for the Articles of Incorporation in North Carolina generally ranges from $125 to $250, depending on the type of corporation. Non-profit corporations typically have a lower fee. It is essential to verify the current fees on the North Carolina Secretary of State's website, as they may change.

How long does it take to process the Articles of Incorporation?

Processing times can vary. Typically, online filings are processed faster, often within a few business days. Paper filings may take longer, sometimes up to two weeks or more. If you need expedited service, check for available options and associated fees on the Secretary of State’s website.

Can I amend the Articles of Incorporation after filing?

Yes, amendments to the Articles of Incorporation can be made after the initial filing. If there are changes to the corporation's name, purpose, or structure, an amendment form must be filed with the Secretary of State. This process ensures that the corporation's records remain up to date and accurate.

What happens if I do not file the Articles of Incorporation?

If you do not file the Articles of Incorporation, your business will not be legally recognized as a corporation in North Carolina. This can lead to personal liability for business debts and obligations. Additionally, you may miss out on certain benefits and protections that come with corporate status, such as limited liability for shareholders.