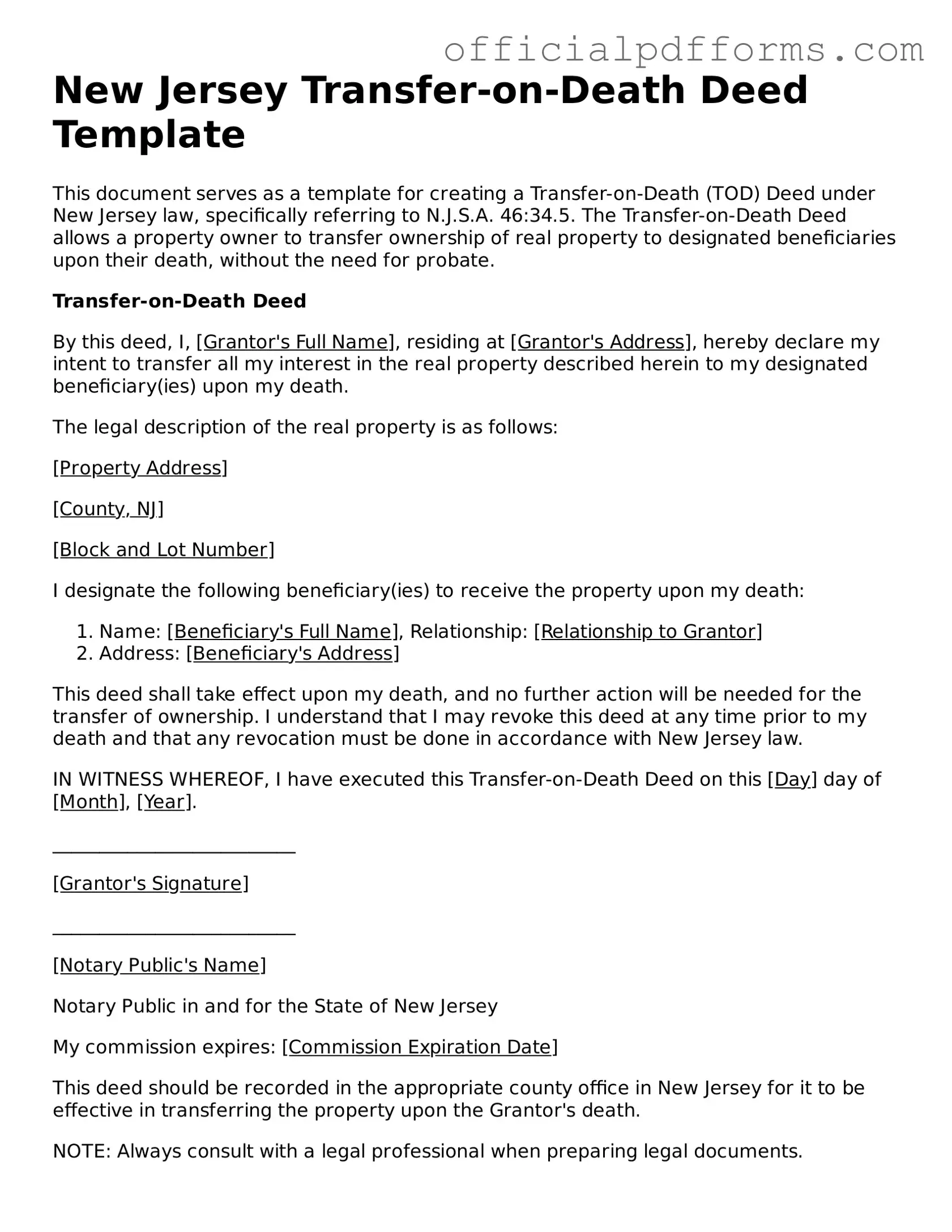

Printable New Jersey Transfer-on-Death Deed Template

Find Other Popular Transfer-on-Death Deed Templates for Specific States

Does a Beneficiary Deed Avoid Probate - Transfer-on-Death Deeds can be a useful tool for estate planning.

Does Pennsylvania Have a Transfer on Death Deed - Transferring property using a Transfer-on-Death Deed is generally an uncomplicated process requiring minimal paperwork.

When purchasing an RV in Texas, it’s crucial to utilize the correct documentation. A thorough understanding of how to create an RV Bill of Sale template ensures that both buyer and seller are protected in the transaction. For more details on crafting this document, check out our guide on how to effectively use the Texas RV Bill of Sale.

Transfer on Death Deed Form Ohio - It may have different legal implications based on state-specific regulations.

How to Gift a House to a Family Member - Beneficiaries named in the deed receive the property directly, without the need for legal intervention.

Misconceptions

Understanding the New Jersey Transfer-on-Death Deed can be challenging due to several common misconceptions. Below are seven prevalent misunderstandings, along with clarifications for each.

-

Misconception 1: The Transfer-on-Death Deed automatically transfers property upon the owner's death.

In reality, the deed allows the property to be transferred to the designated beneficiary only after the owner's death. Until that time, the owner retains full control over the property.

-

Misconception 2: A Transfer-on-Death Deed is the same as a will.

While both documents relate to the transfer of property, a Transfer-on-Death Deed specifically bypasses probate, whereas a will typically requires probate proceedings to validate and execute.

-

Misconception 3: You cannot change or revoke a Transfer-on-Death Deed once it is filed.

This is incorrect. The owner can revoke or modify the deed at any time before their death, provided they follow the proper legal procedures.

-

Misconception 4: All types of property can be transferred using a Transfer-on-Death Deed.

Not all property qualifies. For example, certain types of property, such as joint tenancy or property subject to a mortgage, may have different rules governing their transfer.

-

Misconception 5: The beneficiary inherits the property immediately upon the owner's death.

The beneficiary does not gain ownership until the death certificate is filed and the deed is recorded. Until then, the property remains part of the owner's estate.

-

Misconception 6: A Transfer-on-Death Deed eliminates the need for a will.

This is misleading. While it can simplify the transfer of specific property, a comprehensive estate plan should include a will to address all assets and personal wishes.

-

Misconception 7: The Transfer-on-Death Deed can only be used by individuals.

In fact, certain entities, such as trusts, can also utilize the Transfer-on-Death Deed to facilitate the transfer of property. However, the rules may vary based on the entity type.

By dispelling these misconceptions, individuals can better understand how the New Jersey Transfer-on-Death Deed can fit into their estate planning strategies.

Documents used along the form

The New Jersey Transfer-on-Death Deed form allows individuals to transfer property to a beneficiary upon their death without going through probate. Several other forms and documents are commonly used in conjunction with this deed to ensure a smooth transfer process and to clarify the intentions of the property owner. Below is a list of these documents.

- Will: A legal document that outlines how a person's assets should be distributed upon their death. It can provide additional instructions and clarify the wishes of the deceased.

- Beneficiary Designation Form: This form is used to specify a beneficiary for certain assets, such as life insurance policies or retirement accounts. It ensures that these assets pass directly to the named individual.

- Power of Attorney: A document that grants someone the authority to act on behalf of another person in legal or financial matters. It can be useful if the property owner becomes incapacitated.

- Affidavit of Heirship: This document is used to establish the heirs of a deceased person. It can help clarify who is entitled to inherit property when there is no will.

- Deed of Gift: A legal document that transfers property ownership as a gift while the owner is still alive. It can be used to transfer property before death, avoiding probate issues later.

- Motor Vehicle Power of Attorney: This form allows a vehicle owner to designate someone else to manage vehicle-related tasks. For more details, visit OnlineLawDocs.com.

- Notice of Death: A formal notification that informs interested parties of an individual's passing. It may be required in certain situations to ensure that all stakeholders are aware of the change in ownership.

These documents complement the Transfer-on-Death Deed by providing clarity and ensuring that the property owner's wishes are respected. It is essential to consider each document's role in the overall estate planning process.

Steps to Filling Out New Jersey Transfer-on-Death Deed

Completing the New Jersey Transfer-on-Death Deed form is an important step for individuals wishing to designate beneficiaries for their property. After filling out the form, it must be signed and filed with the appropriate county office to ensure that the transfer takes effect upon the owner’s passing. Below are the steps to fill out the form accurately.

- Obtain the New Jersey Transfer-on-Death Deed form from a reliable source, such as the New Jersey Division of Taxation or an online legal resource.

- Begin by entering the name of the property owner(s) in the designated section. Ensure that the names are spelled correctly and match the names on the property title.

- Provide the address of the property being transferred. Include the street address, city, state, and zip code.

- Identify the beneficiary or beneficiaries. List their full names and addresses. If there are multiple beneficiaries, ensure that each is clearly identified.

- Specify whether the transfer is to be made to all beneficiaries jointly or individually. This distinction is important for how the property will be managed after the owner’s passing.

- Include a legal description of the property. This may involve referencing the property’s tax lot and block number, which can typically be found on property tax documents.

- Sign the form in the presence of a notary public. The notary will verify your identity and witness your signature.

- Make copies of the completed and notarized form for your records.

- File the original form with the county clerk’s office in the county where the property is located. Be aware of any filing fees that may apply.

Common mistakes

-

Not including all required information: It’s essential to fill out every section of the form completely. Missing information can lead to delays or even rejection of the deed.

-

Incorrectly identifying the property: Make sure to provide a clear and accurate description of the property. This includes the address and any relevant details that distinguish it from other properties.

-

Failing to sign the deed: The deed must be signed by the person transferring the property. Forgetting this step can invalidate the entire document.

-

Not having witnesses or notarization: Depending on the requirements, you may need witnesses or a notary public to sign the deed. Check the rules to ensure compliance.

-

Using outdated forms: Always use the most current version of the Transfer-on-Death Deed form. Older versions may not be accepted.

-

Not understanding beneficiary designations: Clearly identify the beneficiaries. If the beneficiaries are not named properly, it can lead to disputes or complications later on.

-

Failing to record the deed: After completing the form, it must be filed with the county clerk's office. If this step is skipped, the transfer may not be legally recognized.

Get Clarifications on New Jersey Transfer-on-Death Deed

What is a Transfer-on-Death Deed in New Jersey?

A Transfer-on-Death Deed (TOD Deed) is a legal document that allows an individual to transfer real estate to a designated beneficiary upon their death. This type of deed enables property owners to pass their property directly to their chosen heirs without the need for probate, simplifying the transfer process. In New Jersey, this deed must be properly executed and recorded to be effective. It is important to note that the property remains under the control of the owner during their lifetime, and they can sell or mortgage the property without any restrictions.

Who can be designated as a beneficiary in a TOD Deed?

In New Jersey, any individual or entity can be named as a beneficiary in a Transfer-on-Death Deed. This includes:

- Family members, such as children or spouses

- Friends

- Trusts or organizations

However, it is crucial to ensure that the beneficiary is legally capable of receiving the property. For instance, minors may require a guardian to manage the property until they reach adulthood. Additionally, if multiple beneficiaries are named, it is advisable to specify how the property will be divided among them.

How do I create and record a Transfer-on-Death Deed in New Jersey?

Creating a Transfer-on-Death Deed involves several steps:

- Obtain the appropriate form, which can typically be found on the New Jersey Division of Revenue and Enterprise Services website or through legal resources.

- Fill out the form with accurate information, including the property description and the beneficiary's details.

- Sign the deed in the presence of a notary public to ensure its validity.

- Record the completed deed with the county clerk's office in the county where the property is located. This step is essential for the deed to take effect.

After recording, the deed will become part of the public record, and the designated beneficiary will have rights to the property upon the owner's death.

Can I revoke or change a Transfer-on-Death Deed after it has been executed?

Yes, a Transfer-on-Death Deed can be revoked or changed at any time before the property owner's death. To do this, the owner must execute a new deed that explicitly revokes the previous one or file a written revocation with the county clerk's office. It is advisable to follow the same recording process as the original deed to ensure that the revocation is legally recognized. Additionally, if the owner wishes to change the beneficiary, they can do so by creating a new TOD Deed that names the new beneficiary, effectively replacing the old one.