Printable New Jersey Tractor Bill of Sale Template

Find Other Popular Tractor Bill of Sale Templates for Specific States

Do Tractors Need to Be Registered - This form is adaptable to different states, ensuring it meets local requirements for sales.

To ensure a smooth transaction when buying or selling a trailer, it is advisable to utilize a reputable resource for the necessary documentation, such as the OnlineLawDocs.com, which provides the New York Trailer Bill of Sale form that outlines all essential details for a legal transfer of ownership.

Misconceptions

Understanding the New Jersey Tractor Bill of Sale form is essential for anyone involved in buying or selling a tractor. However, several misconceptions can lead to confusion. Here are eight common misconceptions about this important document:

- The form is only necessary for new tractors. Many believe that a Bill of Sale is only required for new purchases. In reality, it is equally important for used tractors to provide proof of ownership and transaction details.

- A Bill of Sale is not legally binding. Some think that this document holds no legal weight. On the contrary, a properly completed Bill of Sale serves as a legally binding contract between the buyer and seller.

- Only the seller needs to sign the form. There is a misconception that only the seller's signature is required. Both the buyer and seller should sign the Bill of Sale to validate the transaction.

- The form does not need to be notarized. Many individuals assume that notarization is unnecessary. While it is not always required, having the document notarized can add an extra layer of security and authenticity.

- It is acceptable to use a generic Bill of Sale template. Some people think any generic template will suffice. However, using the specific New Jersey Tractor Bill of Sale form ensures compliance with state laws and requirements.

- The form is only for private sales. There is a belief that the Bill of Sale is only relevant for private transactions. In fact, it is also important for sales through dealerships or auctions to document the sale properly.

- Once the form is signed, the transaction is complete. Some assume that signing the Bill of Sale finalizes the transaction. However, it is crucial to also transfer the title and register the tractor to complete the process.

- Buyers do not need a copy of the Bill of Sale. Many think only sellers need to keep a copy. In reality, both parties should retain a copy for their records to avoid future disputes.

By addressing these misconceptions, individuals can navigate the process of buying or selling a tractor in New Jersey with greater confidence and clarity.

Documents used along the form

When completing a transaction involving the sale or purchase of a tractor in New Jersey, several additional forms and documents may be necessary to ensure a smooth process. Each document serves a specific purpose and helps protect the interests of both the buyer and the seller. Below is a list of commonly used forms that often accompany the New Jersey Tractor Bill of Sale.

- Title Transfer Form: This document is essential for transferring ownership of the tractor from the seller to the buyer. It contains details about the vehicle, including its identification number and the names of both parties.

- Vehicle Registration Application: After purchasing a tractor, the new owner must register it with the state. This application provides necessary information for the state's records and enables the issuance of a new registration certificate.

- Odometer Disclosure Statement: If the tractor is less than ten years old, federal law requires the seller to disclose the odometer reading at the time of sale. This statement helps prevent fraud and ensures transparency in the transaction.

- Motor Vehicle Bill of Sale: Essential for documenting the sale of a vehicle in Florida, this legally binding contract not only acts as a receipt but also is crucial for the transfer of the vehicle's title. For more details, visit smarttemplates.net/fillable-florida-motor-vehicle-bill-of-sale.

- Sales Tax Exemption Certificate: In certain cases, buyers may qualify for sales tax exemptions. This certificate outlines the reasons for the exemption and must be completed to avoid paying unnecessary taxes.

- Affidavit of Identity: This document may be required to verify the identity of the seller or buyer, particularly if there are any discrepancies in the information provided during the transaction.

- Bill of Sale for Personal Property: While the Tractor Bill of Sale is specific to tractors, a general bill of sale for personal property can also be used to outline the terms of the sale, including payment details and any warranties.

- Insurance Documentation: Before operating the tractor, the new owner may need to provide proof of insurance. This document confirms that the tractor is covered under an insurance policy, which is often a requirement for registration.

Utilizing these forms and documents in conjunction with the New Jersey Tractor Bill of Sale can help facilitate a clear and legally compliant transaction. Proper documentation minimizes the risk of disputes and ensures that both parties are protected throughout the process.

Steps to Filling Out New Jersey Tractor Bill of Sale

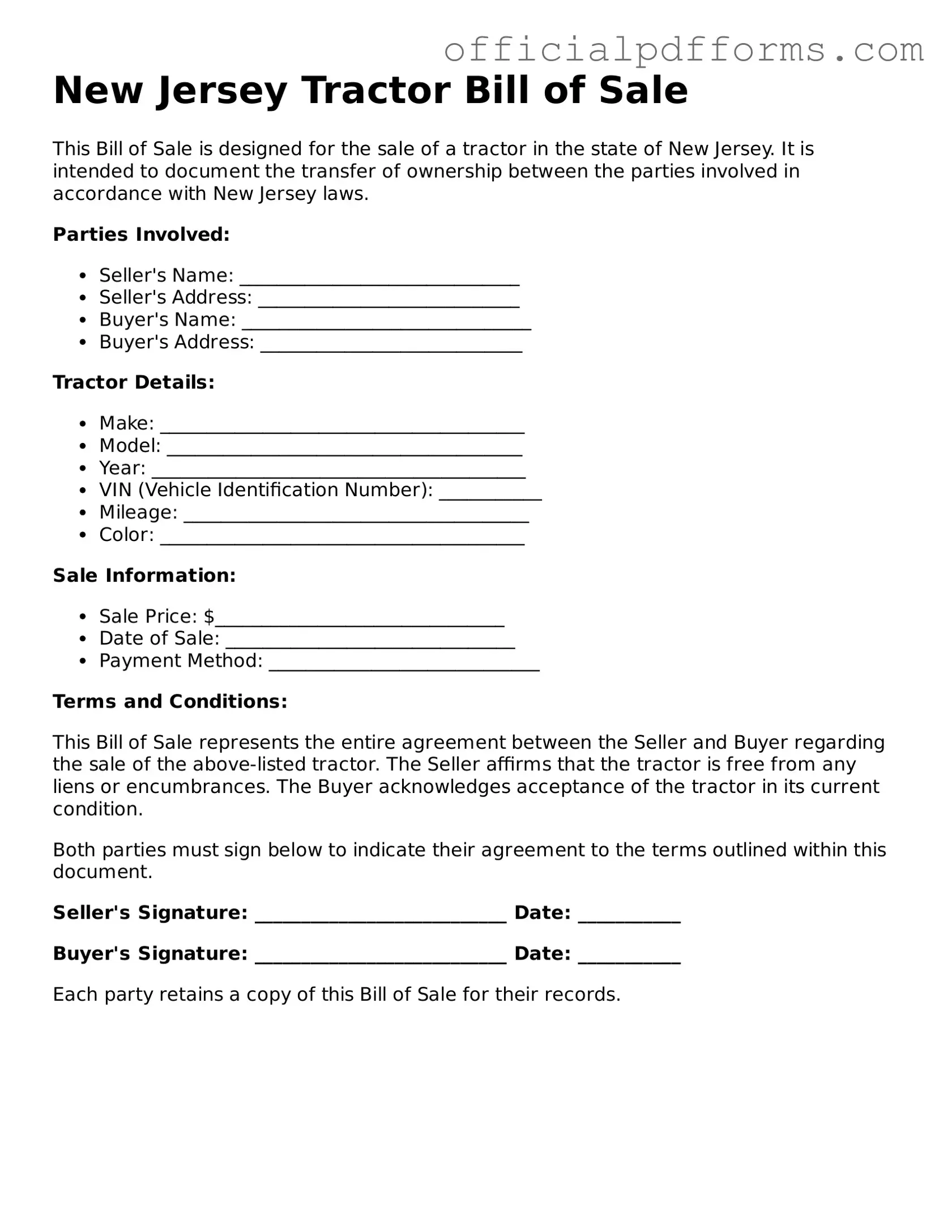

After you have gathered all necessary information, it’s time to fill out the New Jersey Tractor Bill of Sale form. This document is essential for transferring ownership of a tractor. Make sure to have all details at hand to ensure a smooth process.

- Obtain the form: Download the New Jersey Tractor Bill of Sale form from an official source or get a physical copy from a local office.

- Fill in the date: Write the date of the sale at the top of the form.

- Seller information: Provide the full name and address of the seller. Ensure that all details are accurate.

- Buyer information: Enter the full name and address of the buyer. Double-check for any typos.

- Tractor details: Include the make, model, year, and Vehicle Identification Number (VIN) of the tractor. This information is crucial for identification.

- Sale price: Clearly state the sale price of the tractor. Make sure it reflects the agreed amount.

- Signatures: Both the seller and buyer must sign the form. This indicates agreement to the sale.

- Date of signatures: Write the date when both parties sign the document.

Once the form is completed and signed, keep a copy for your records. The buyer should also retain a copy for their documentation. This ensures both parties have proof of the transaction.

Common mistakes

-

Incomplete Information: One common mistake is failing to provide all necessary details. Buyers and sellers should ensure that the form includes complete names, addresses, and contact information. Missing any of these details can lead to confusion or disputes later on.

-

Incorrect Vehicle Identification Number (VIN): The VIN is crucial for identifying the tractor. Mistakes in this number can cause significant issues when registering the vehicle. Always double-check the VIN against the tractor’s title or registration documents.

-

Not Including Sale Price: Some individuals neglect to include the sale price of the tractor. This information is vital for tax purposes and can affect the buyer's ability to register the tractor. Ensure that the sale price is clearly stated on the form.

-

Failure to Sign the Document: Both parties must sign the bill of sale for it to be valid. Sometimes, one party forgets to sign, which can render the document unenforceable. Always check that both signatures are present before finalizing the transaction.

Get Clarifications on New Jersey Tractor Bill of Sale

-

What is a New Jersey Tractor Bill of Sale?

A New Jersey Tractor Bill of Sale is a legal document that records the sale of a tractor between a seller and a buyer. This form includes important details about the transaction, such as the identification of the tractor, the purchase price, and the names and addresses of both parties. It serves as proof of ownership transfer and can be used for registration purposes.

-

Why do I need a Bill of Sale for a tractor?

A Bill of Sale is crucial for several reasons. Firstly, it provides legal evidence of the transaction, protecting both the buyer and the seller. Secondly, it helps establish the buyer's ownership of the tractor, which is necessary for registration and insurance purposes. Lastly, it can assist in resolving any disputes that may arise regarding the sale.

-

What information is required on the Bill of Sale?

The Bill of Sale should include the following information:

- The names and addresses of the buyer and seller

- A detailed description of the tractor, including make, model, year, and Vehicle Identification Number (VIN)

- The purchase price of the tractor

- The date of the sale

- Signatures of both the buyer and seller

-

Is the Bill of Sale required by law in New Jersey?

While a Bill of Sale is not legally required for every transaction in New Jersey, it is highly recommended. Having this document can simplify the registration process and provide clarity in case of any disputes. For certain transactions, especially those involving vehicles, having a Bill of Sale may be necessary for proper documentation.

-

How do I fill out the Bill of Sale?

Filling out the Bill of Sale is straightforward. Start by entering the names and addresses of both parties at the top of the form. Next, provide a detailed description of the tractor, including its make, model, year, and VIN. After that, indicate the sale price and the date of the transaction. Finally, both parties should sign the document to validate the sale.

-

Can I create my own Bill of Sale?

Yes, you can create your own Bill of Sale, as long as it includes all the necessary information. However, using a template specifically designed for New Jersey can ensure that you cover all required elements and comply with state regulations. Templates are often available online and can simplify the process.

-

Do I need to have the Bill of Sale notarized?

In New Jersey, notarization of the Bill of Sale is not required. However, having the document notarized can provide an extra layer of security and authenticity. It can be especially beneficial in situations where there may be potential disputes regarding the sale.

-

What should I do with the Bill of Sale after the sale?

After the sale, both the buyer and seller should keep a copy of the Bill of Sale for their records. The buyer will need it for registration purposes with the New Jersey Motor Vehicle Commission (MVC). It’s advisable to store the document in a safe place, as it may be needed for future reference or in case of any issues that arise.

-

Where can I obtain a New Jersey Tractor Bill of Sale form?

You can obtain a New Jersey Tractor Bill of Sale form from various sources. Many legal websites offer free templates that you can download and fill out. Additionally, some local government offices or libraries may have copies available. Always ensure that the form you use is up to date and complies with New Jersey laws.

-

What if I lose my Bill of Sale?

If you lose your Bill of Sale, you can create a new one if you have the necessary information. Both parties should sign the new document to acknowledge the sale. If you need to prove ownership and cannot locate the Bill of Sale, you may need to provide additional documentation to the MVC to register the tractor.