Printable New Jersey Real Estate Purchase Agreement Template

Find Other Popular Real Estate Purchase Agreement Templates for Specific States

North Carolina Purchase and Sale Agreement - Helps clarify any property liens or claims.

In the context of risk management, understanding the implications of a Release of Liability form is essential, especially for those involved in high-risk activities. This legal agreement, which ensures that one party will not hold the other accountable for potential injuries or damages, is crucial for safeguarding both individuals and organizations. For more information on how to effectively create and utilize such forms, visit https://toptemplates.info/.

Purchase Agreement Real Estate - This form plays a crucial role in moving the real estate transaction process forward.

Georgia Real Estate Contract - Buyers might include clauses for buyer's inspection to ensure the property's condition meets expectations.

Misconceptions

The New Jersey Real Estate Purchase Agreement is a critical document in real estate transactions. However, several misconceptions surround its use and implications. Below are seven common misunderstandings regarding this agreement.

- It is a binding contract immediately upon signing. Many believe that once both parties sign the agreement, it is automatically enforceable. In reality, certain conditions, such as the completion of inspections or financing, may need to be satisfied first.

- All terms are negotiable. While many aspects of the agreement can be negotiated, some terms are standard and may not be easily altered. Understanding which terms are flexible and which are not is essential.

- The agreement protects only the seller. This misconception suggests that the agreement favors the seller at the expense of the buyer. In truth, the document is designed to protect the interests of both parties, outlining rights and obligations clearly.

- It is the same as a lease agreement. Some individuals confuse a purchase agreement with a lease. However, a purchase agreement is intended for buying property, while a lease agreement pertains to renting it.

- Verbal agreements are sufficient. There is a belief that verbal agreements or informal discussions can replace the need for a written contract. This is misleading; a written agreement is crucial for clarity and enforceability.

- Once signed, it cannot be changed. Some think that any modifications to the agreement after signing are impossible. In fact, amendments can be made, provided both parties agree to the changes in writing.

- The form is standardized and does not require legal review. While the New Jersey Real Estate Purchase Agreement has standard elements, it is still advisable to have a legal professional review the document. Each transaction may have unique considerations that require attention.

Understanding these misconceptions can lead to more informed decisions when engaging in real estate transactions in New Jersey. Clarity in the purchase agreement fosters smoother negotiations and helps protect the interests of all parties involved.

Documents used along the form

In the context of real estate transactions in New Jersey, the Real Estate Purchase Agreement is a fundamental document that outlines the terms of the sale. However, several other forms and documents are commonly used alongside this agreement to ensure that all legal and procedural aspects of the transaction are adequately addressed. Below is a list of these essential documents.

- Property Disclosure Statement: This document provides information about the property's condition and any known issues. Sellers are typically required to disclose material defects to potential buyers.

- California Lease Agreement: The California Lease Agreement form is essential for tenants and landlords. For those looking to understand the terms of this document, you can access the form.

- Title Report: A title report is prepared by a title company and details the legal ownership of the property. It identifies any liens, easements, or other encumbrances that may affect the property.

- Mortgage Commitment Letter: This letter from a lender confirms that a buyer has been approved for a mortgage. It outlines the terms of the loan and is essential for securing financing for the purchase.

- Lead-Based Paint Disclosure: Required for homes built before 1978, this document informs buyers about the potential risks of lead-based paint and outlines the seller's obligations regarding disclosure.

- Closing Statement: Also known as a HUD-1 Settlement Statement, this document itemizes all the costs associated with the real estate transaction. It is presented at the closing and details the financial aspects of the sale.

- Deed: The deed is the legal document that transfers ownership of the property from the seller to the buyer. It must be executed and recorded to complete the transaction legally.

Each of these documents plays a crucial role in the real estate transaction process. They help protect the interests of both buyers and sellers and ensure compliance with state and federal regulations. Understanding these documents can facilitate a smoother transaction and mitigate potential disputes.

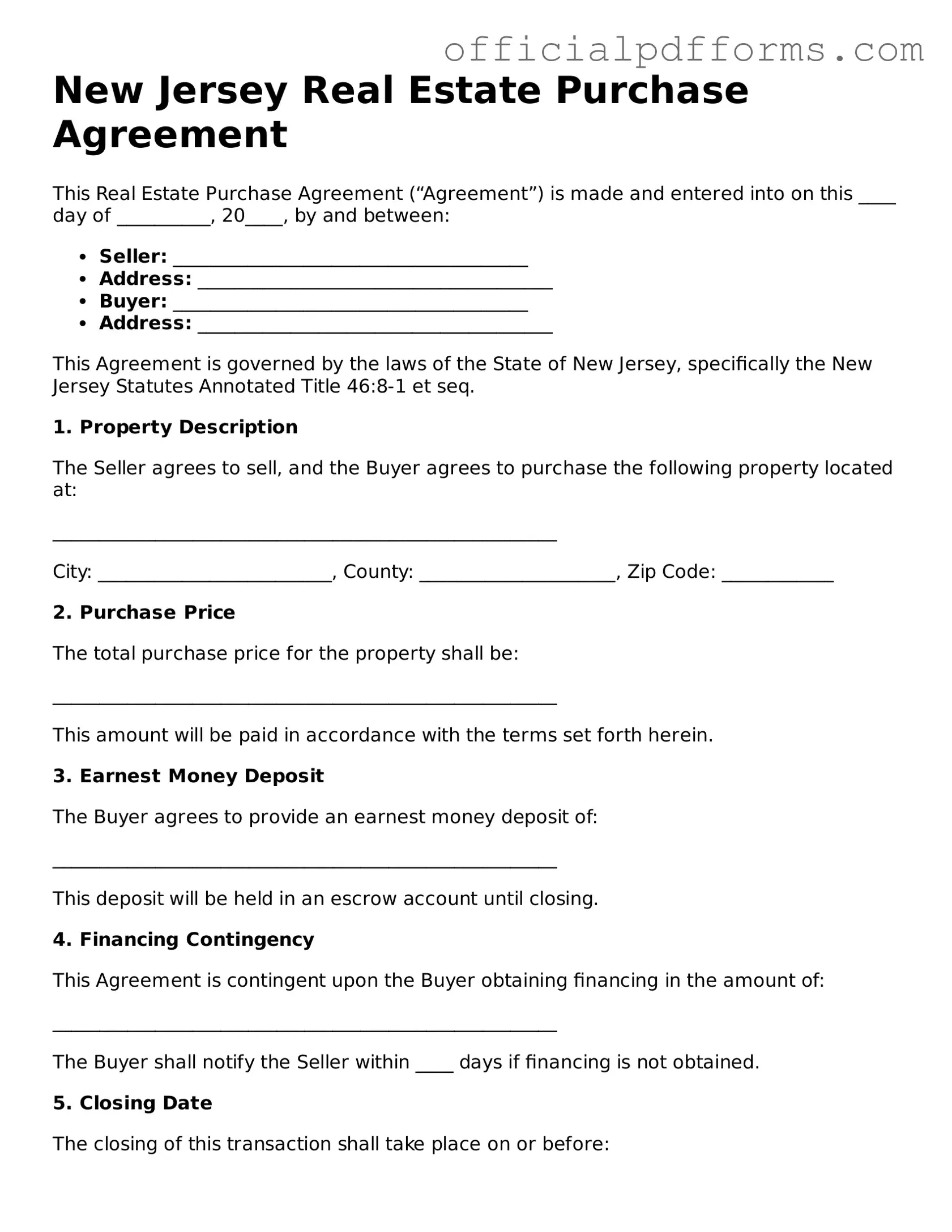

Steps to Filling Out New Jersey Real Estate Purchase Agreement

Filling out the New Jersey Real Estate Purchase Agreement form is an important step in the home buying process. Once you complete this form, you will be ready to move forward with negotiations and securing your new property.

- Begin by entering the date at the top of the form.

- Provide the names of the buyer(s) and seller(s). Make sure to include full legal names.

- Clearly state the property address, including the city, state, and ZIP code.

- Specify the purchase price of the property. This is the amount the buyer agrees to pay.

- Outline the deposit amount, which is typically a percentage of the purchase price.

- Indicate the closing date. This is when the sale will be finalized.

- Include any contingencies, such as financing or inspection requirements. Be specific about what conditions must be met.

- Detail any personal property included in the sale, such as appliances or fixtures.

- Provide information about the title company or attorney handling the closing.

- Sign and date the agreement. Ensure all parties involved sign the document.

After completing the form, review it carefully to confirm that all information is accurate. Once satisfied, you can present the agreement to the other party for their review and signature.

Common mistakes

-

Incorrect Property Description: Many people fail to provide a complete and accurate description of the property. This includes not specifying the correct address or omitting important details about the lot size or boundaries.

-

Missing Buyer and Seller Information: It is crucial to include full names and contact information for both the buyer and seller. Omitting this information can lead to confusion and delays.

-

Neglecting to Specify Purchase Price: Some individuals forget to clearly state the purchase price. This can create misunderstandings and disputes later in the process.

-

Not Including Contingencies: Buyers often overlook the importance of including contingencies, such as financing or inspection contingencies. These protect the buyer's interests and can prevent future issues.

-

Ignoring Closing Date: Failing to specify a closing date can lead to complications. Both parties should agree on a timeline to avoid unnecessary delays.

-

Omitting Earnest Money Details: The agreement should clearly state the amount of earnest money and how it will be handled. Not doing so can lead to disputes over the deposit.

-

Overlooking Signatures: Both parties must sign the agreement for it to be valid. Forgetting signatures can render the document unenforceable.

-

Not Reviewing Local Laws: Some individuals fail to consider local laws and regulations that may affect the transaction. Familiarity with these laws can prevent legal complications.

-

Rushing the Process: Taking the time to carefully fill out the form is essential. Rushing can lead to mistakes that might complicate the transaction.

Get Clarifications on New Jersey Real Estate Purchase Agreement

What is a New Jersey Real Estate Purchase Agreement?

The New Jersey Real Estate Purchase Agreement is a legal document that outlines the terms and conditions under which a buyer agrees to purchase a property from a seller. This agreement serves as a binding contract once both parties sign it. It typically includes essential details such as the purchase price, property description, closing date, and any contingencies that must be met before the sale can proceed.

What key components should be included in the agreement?

A comprehensive Real Estate Purchase Agreement in New Jersey should include several key components:

- Parties Involved: Names and addresses of the buyer and seller.

- Property Description: A detailed description of the property, including the address and any relevant parcel identification numbers.

- Purchase Price: The agreed-upon price for the property, along with details on the deposit and payment methods.

- Contingencies: Conditions that must be satisfied for the sale to proceed, such as financing, inspections, or the sale of another property.

- Closing Date: The date when the transaction will be finalized and ownership transferred.

Are there any contingencies that can be included in the agreement?

Yes, contingencies are an important aspect of the New Jersey Real Estate Purchase Agreement. They protect both the buyer and seller by allowing certain conditions to be met before the sale is finalized. Common contingencies include:

- Financing Contingency: This allows the buyer to back out if they cannot secure a mortgage.

- Home Inspection Contingency: This enables the buyer to conduct an inspection and negotiate repairs or withdraw from the agreement if significant issues are found.

- Appraisal Contingency: This protects the buyer if the property appraises for less than the purchase price.

Including these contingencies can provide peace of mind and ensure that the transaction proceeds smoothly.

What happens if one party wants to back out of the agreement?

If one party wishes to back out of the agreement, the consequences depend on the circumstances and whether any contingencies are in place. If a buyer decides to withdraw without a valid reason or without fulfilling a contingency, they may forfeit their earnest money deposit. Conversely, if the seller attempts to back out without justification, the buyer may have legal recourse, including the option to seek specific performance, which compels the seller to complete the sale. It's essential for both parties to understand their rights and obligations as outlined in the agreement to avoid potential disputes.