Printable New Jersey Quitclaim Deed Template

Find Other Popular Quitclaim Deed Templates for Specific States

Quitclaim Deed Forms - Users should consult legal advice when uncertain about its implications.

Georgia Quit Claim Deed - They can be executed without the complexities of a traditional sale.

Ohio Quit Claim Deed - This deed is particularly effective for transferring small parcels of land between friends.

When engaging in the sale of a trailer in New York, utilizing the New York Trailer Bill of Sale form is crucial to avoid any ambiguities in the transaction. This important document not only acts as proof of purchase but also facilitates the registration process, ensuring a seamless and lawful transfer of ownership. For more information and access to the form, you can visit OnlineLawDocs.com.

Quit Claim Deed North Carolina - Although quick, the deed’s lack of assurances means trust is paramount.

Misconceptions

When dealing with real estate transactions in New Jersey, many individuals encounter the Quitclaim Deed form. However, several misconceptions can lead to confusion. Here are five common misunderstandings about this form:

- Quitclaim Deeds Transfer Ownership Without Guaranteeing Title: Many believe that a Quitclaim Deed guarantees clear title to the property. In reality, this type of deed transfers whatever interest the grantor has in the property, but it does not assure that the title is free of claims or encumbrances.

- Quitclaim Deeds Are Only for Family Transfers: While it’s true that Quitclaim Deeds are often used among family members, they are not limited to such transactions. They can be utilized in various situations, including sales between unrelated parties or in divorce settlements.

- Quitclaim Deeds Eliminate the Need for Title Insurance: Some assume that using a Quitclaim Deed means they do not need title insurance. However, title insurance is still advisable, as it protects against potential claims that may arise from previous ownership issues.

- All Parties Must Be Present for a Quitclaim Deed to Be Valid: There is a belief that all parties involved must be physically present when signing the deed. In New Jersey, as long as the deed is properly executed and notarized, it can be valid even if one party is absent.

- Quitclaim Deeds Can Only Be Used for Residential Properties: Another misconception is that Quitclaim Deeds are restricted to residential real estate. In fact, they can be used for any type of property, including commercial real estate and land.

Understanding these misconceptions can help individuals navigate the complexities of property transactions more effectively. Being informed is key to making sound decisions in real estate dealings.

Documents used along the form

When dealing with property transfers in New Jersey, the Quitclaim Deed is a crucial document. However, it often works in conjunction with other forms and documents that help facilitate the process. Here are four commonly used documents that accompany the Quitclaim Deed:

- Property Transfer Form (PTF): This form is required by the New Jersey Division of Taxation. It provides essential information about the property being transferred, including its value and the names of the parties involved. This helps ensure proper tax assessment and compliance.

- Affidavit of Title: This document serves as a sworn statement by the seller affirming that they hold clear title to the property. It can protect the buyer from potential claims or disputes regarding ownership, adding an extra layer of security to the transaction.

- Motor Vehicle Bill of Sale: This essential form records the transaction of a vehicle sale in Florida, serving as proof of purchase and assisting in the title transfer process. For more information, visit smarttemplates.net/fillable-florida-motor-vehicle-bill-of-sale/.

- Tax Clearance Certificate: Before finalizing a property transfer, this certificate confirms that all property taxes have been paid. It ensures that the buyer will not inherit any outstanding tax liabilities, providing peace of mind in the transaction.

- Closing Statement: Also known as the HUD-1 Settlement Statement, this document outlines the financial aspects of the transaction. It details all costs associated with the sale, including closing costs, taxes, and any adjustments. Both parties review this statement to ensure transparency and accuracy.

Understanding these accompanying documents is essential for a smooth property transfer process in New Jersey. Each plays a significant role in protecting the interests of both buyers and sellers, ensuring that the transaction is completed efficiently and legally.

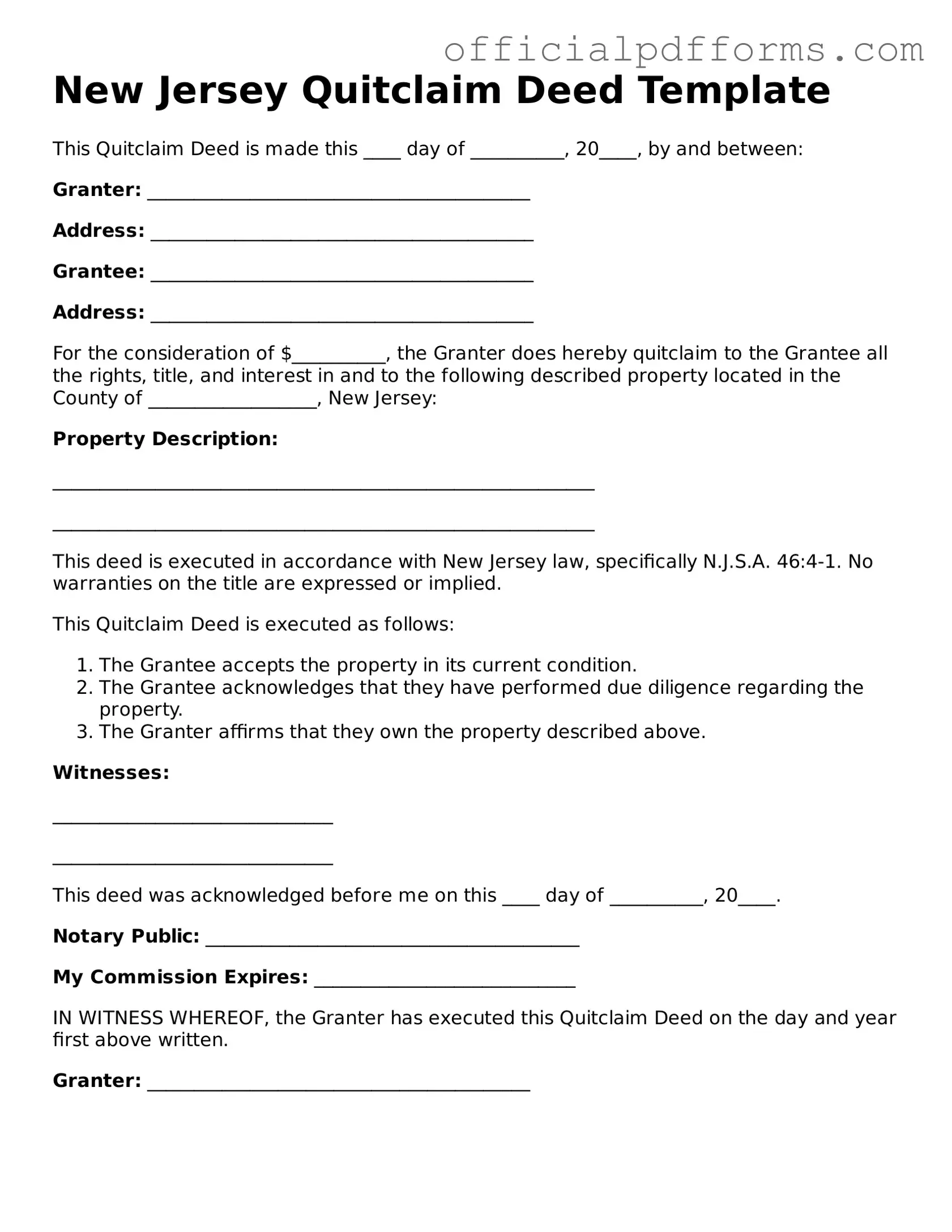

Steps to Filling Out New Jersey Quitclaim Deed

Once the New Jersey Quitclaim Deed form is completed, it must be signed and filed with the appropriate county clerk's office. This process ensures that the transfer of property ownership is officially recorded. Below are the steps to accurately fill out the form.

- Obtain the Form: Download or request a copy of the New Jersey Quitclaim Deed form from a reliable source.

- Identify the Grantor: Fill in the name and address of the person transferring the property (the grantor).

- Identify the Grantee: Enter the name and address of the person receiving the property (the grantee).

- Describe the Property: Provide a detailed description of the property being transferred. This includes the address and any relevant lot or block numbers.

- Consideration: Indicate the amount of consideration, if any, being exchanged for the property. If it is a gift, you may state "for no consideration."

- Signatures: Ensure that the grantor signs the form in the designated area. If there are multiple grantors, all must sign.

- Notarization: Have the signature(s) notarized by a licensed notary public. This step is essential for the form to be legally valid.

- File the Deed: Submit the completed and notarized form to the county clerk's office in the county where the property is located. Pay any required filing fees.

Common mistakes

-

Incorrect Names: One common mistake is misspelling the names of the grantor or grantee. Ensure that the names match the official identification documents.

-

Missing Signatures: Both the grantor and the grantee must sign the deed. Failing to obtain the necessary signatures can invalidate the document.

-

Improper Notarization: The deed must be notarized correctly. If the notary's signature or seal is missing or unclear, it may lead to complications.

-

Incorrect Property Description: The property description must be accurate and detailed. Omitting critical information can cause issues with the transfer of ownership.

-

Failure to Include Consideration: While a quitclaim deed may not always require consideration, failing to mention it can create confusion about the transaction's intent.

-

Not Filing with the County: After completing the deed, it must be filed with the appropriate county office. Neglecting this step means the deed is not officially recorded.

Get Clarifications on New Jersey Quitclaim Deed

What is a Quitclaim Deed?

A quitclaim deed is a legal document used to transfer ownership of real estate from one party to another. Unlike other types of deeds, a quitclaim deed does not guarantee that the person transferring the property has clear title. It simply conveys whatever interest the grantor has in the property, if any.

When should I use a Quitclaim Deed?

Quitclaim deeds are commonly used in specific situations, such as:

- Transferring property between family members, such as parents to children.

- Clearing up title issues, where a person wants to relinquish any claim they may have.

- In divorce settlements, where one spouse transfers their interest in the property to the other.

What information is required on a Quitclaim Deed?

A quitclaim deed typically requires the following information:

- The names of the grantor (the person transferring the property) and the grantee (the person receiving the property).

- A legal description of the property being transferred.

- The date of the transfer.

- The signature of the grantor, often requiring notarization.

Is a Quitclaim Deed the same as a Warranty Deed?

No, a quitclaim deed is not the same as a warranty deed. A warranty deed provides a guarantee that the grantor holds clear title to the property and has the right to sell it. In contrast, a quitclaim deed offers no such guarantees, making it a riskier option for the grantee.

Do I need to record a Quitclaim Deed?

While it is not legally required to record a quitclaim deed, it is highly recommended. Recording the deed with the county clerk or recorder’s office provides public notice of the ownership transfer and protects the grantee's rights against future claims. Failure to record may lead to disputes over property ownership.

Are there any taxes associated with a Quitclaim Deed?

Yes, there may be taxes associated with a quitclaim deed. In New Jersey, a realty transfer fee may apply, depending on the value of the property being transferred. Additionally, gift tax implications may arise if the transfer is between family members without monetary exchange.

Can I create a Quitclaim Deed without a lawyer?

While it is possible to create a quitclaim deed without a lawyer, it is advisable to seek legal assistance, especially if the property has complex title issues or if the transaction involves significant value. A lawyer can ensure that the deed is properly drafted and executed, reducing the risk of future disputes.