Printable New Jersey Promissory Note Template

Find Other Popular Promissory Note Templates for Specific States

Ohio Promissory Note Requirements - The note can include a confidentiality clause to protect the details of the loan.

Simple Promissory Note Template - Should disputes arise, the note serves as evidence of the agreement.

Promissory Note Template Georgia - This document can help protect both parties in a lending arrangement.

When entering into a rental arrangement, it is essential for both landlords and tenants to have a clear understanding of their obligations and rights, which is why the use of the California Room Rental Agreement form is recommended. This document not only delineates the specific terms of the rental, such as payment schedules and house rules, but it also helps prevent misunderstandings and potential disputes. For those in California looking for comprehensive forms to facilitate this process, you can refer to All California Forms.

Promissory Note Illinois - Signing a promissory note indicates the borrower's intention to repay the amount borrowed.

Misconceptions

Understanding the New Jersey Promissory Note form can be challenging due to various misconceptions. Here are ten common misunderstandings, along with clarifications to help you navigate this important financial document.

- All promissory notes are the same. Many believe that all promissory notes function identically. In reality, each state has specific requirements and formats, including New Jersey.

- A promissory note must be notarized. While notarization can add an extra layer of authenticity, it is not a legal requirement for a promissory note to be valid in New Jersey.

- Only banks can issue promissory notes. This is incorrect. Individuals and businesses can create promissory notes as well, provided they meet the legal criteria.

- Promissory notes are only for large loans. People often think these documents are reserved for significant transactions. However, they can be used for loans of any size.

- Once signed, a promissory note cannot be changed. Modifications can be made if both parties agree and document the changes properly.

- Interest rates must be included in the note. While many promissory notes do include interest rates, it is not a requirement. A note can specify a zero-interest loan.

- A promissory note guarantees repayment. A promissory note is a promise to repay, but it does not guarantee that the borrower will fulfill that promise.

- All promissory notes are legally enforceable. For a note to be enforceable, it must meet certain legal criteria, such as clarity of terms and mutual consent.

- Verbal agreements are sufficient. While verbal agreements can be binding, having a written promissory note provides clear evidence of the terms and conditions.

- Promissory notes are not necessary for personal loans. Even personal loans between friends or family can benefit from a written note to avoid misunderstandings.

By understanding these misconceptions, individuals can better navigate the process of creating and utilizing promissory notes in New Jersey.

Documents used along the form

When dealing with a New Jersey Promissory Note, several other documents may be needed to support the agreement and ensure all parties are protected. Below is a list of common forms and documents that are often used alongside the Promissory Note.

- Loan Agreement: This document outlines the terms of the loan, including the amount, interest rate, repayment schedule, and any conditions that must be met by the borrower.

- Dog Bill of Sale: This form, essential for dog transactions, ensures both buyer and seller have a clear and legal record of the sale, including critical details like the dog's description and price. For more information, visit https://onlinelawdocs.com.

- Security Agreement: If the loan is secured by collateral, this agreement details the collateral being used to back the loan and the rights of the lender in case of default.

- Personal Guarantee: A personal guarantee may be required from a third party, ensuring that they will be responsible for the loan if the borrower fails to repay.

- Disclosure Statement: This document provides important information about the loan, including fees, payment terms, and potential risks, helping the borrower understand their obligations.

- Amortization Schedule: This schedule breaks down the repayment of the loan into regular payments, showing how much of each payment goes toward interest and principal over time.

- Default Notice: In case of missed payments, this notice informs the borrower of their default status and outlines the steps the lender may take to recover the owed amount.

- Release of Liability: Once the loan is paid off, this document releases the borrower from any further obligations and confirms that the lender no longer has any claims against them.

- Modification Agreement: If the terms of the loan need to be changed, this agreement outlines the new terms and must be signed by both parties.

- Payment Receipt: This simple document serves as proof of payment made by the borrower, providing a record for both parties.

Each of these documents plays a crucial role in the loan process, ensuring clarity and protection for all involved. It is important to understand each document's purpose and how they work together with the Promissory Note.

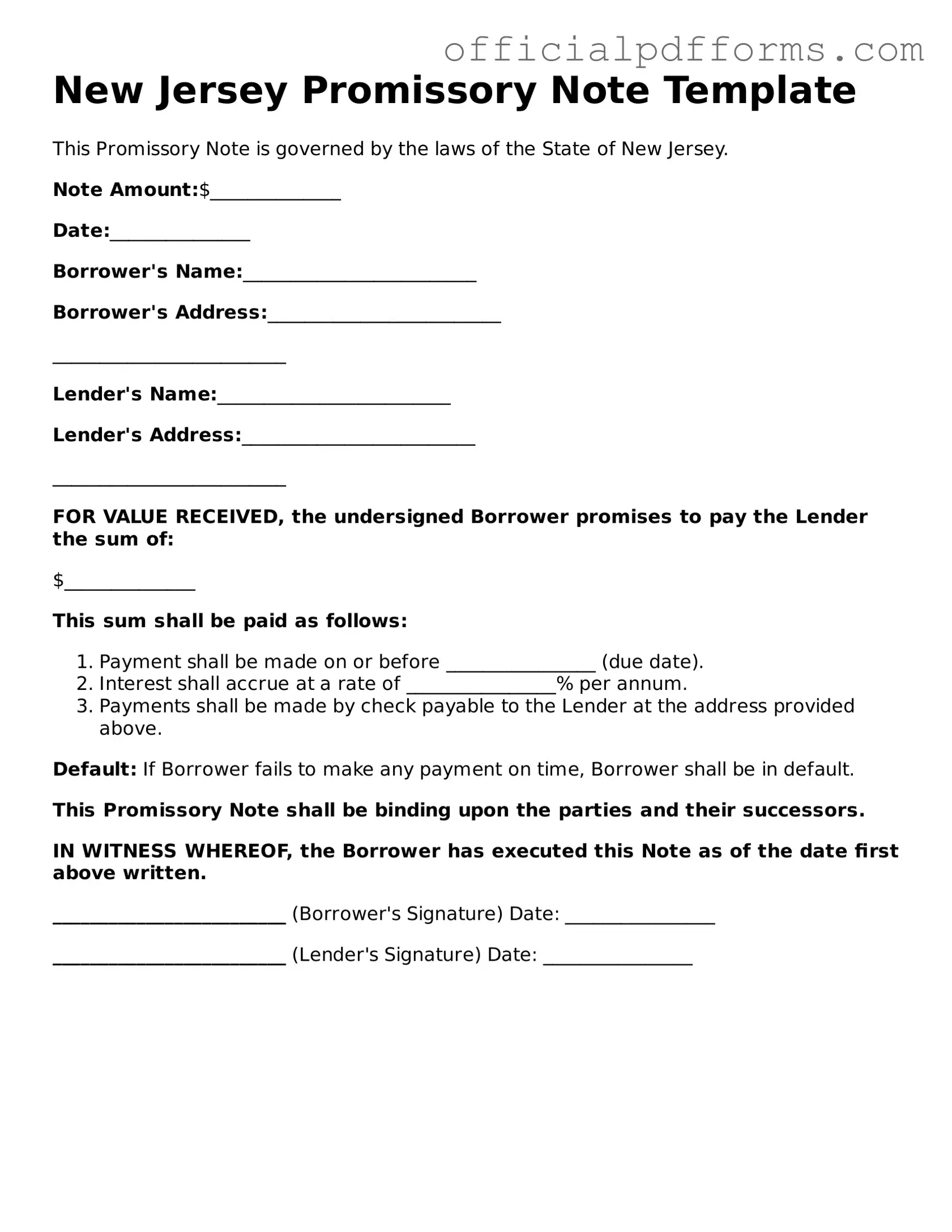

Steps to Filling Out New Jersey Promissory Note

Once you have the New Jersey Promissory Note form in hand, it’s time to fill it out accurately. This document will serve as a clear agreement between the lender and the borrower regarding the loan terms. Follow these steps carefully to ensure all necessary information is included.

- Start with the date: Write the date on which the note is being executed at the top of the form.

- Identify the parties: Clearly print the name and address of the borrower. Then, do the same for the lender.

- Specify the loan amount: Indicate the total amount being borrowed in both numbers and words to avoid any confusion.

- Detail the interest rate: If applicable, write the interest rate that will be charged on the loan.

- Outline the repayment terms: Specify how and when the borrower will repay the loan. Include details like monthly payments, due dates, and any grace periods.

- Include any late fees: If there are penalties for late payments, clearly state the amount and conditions.

- Signatures: Both the borrower and the lender must sign the document. Make sure to print their names below the signatures.

- Witness or notarization: Depending on your needs, consider having the document witnessed or notarized for added legal protection.

After completing the form, review it for accuracy. Make sure all sections are filled out completely. Once confirmed, both parties should keep a copy for their records. This ensures that everyone involved has a clear understanding of the loan agreement.

Common mistakes

-

Neglecting to Include All Parties' Names: One common mistake is failing to list the full names of all parties involved in the agreement. It’s crucial to include the names of both the borrower and the lender. Omitting a name can lead to confusion or disputes later on.

-

Incorrectly Stating the Loan Amount: Accuracy is key when specifying the loan amount. People sometimes write the number incorrectly or forget to include cents. Always double-check the numerical and written amounts to ensure they match.

-

Ignoring the Interest Rate: Some individuals overlook the interest rate, which is essential for understanding the total repayment obligation. Not clearly stating the interest rate can lead to misunderstandings about how much will ultimately be owed.

-

Failing to Specify Payment Terms: Payment terms, including the schedule and method of payment, should be clearly outlined. Without this information, borrowers may not know when or how to make payments, potentially leading to missed deadlines.

-

Not Signing the Document: Finally, one of the simplest yet most critical mistakes is forgetting to sign the document. A promissory note is not legally binding without the signatures of all parties involved. Ensure everyone signs and dates the form to validate the agreement.

Get Clarifications on New Jersey Promissory Note

What is a New Jersey Promissory Note?

A New Jersey Promissory Note is a legal document that outlines a borrower's promise to repay a specified amount of money to a lender under agreed-upon terms. This document serves as evidence of the debt and includes details such as the loan amount, interest rate, repayment schedule, and any collateral involved.

Who typically uses a Promissory Note in New Jersey?

Individuals and businesses often use Promissory Notes. Common scenarios include personal loans between friends or family members, business loans, and real estate transactions. Both lenders and borrowers benefit from having a clear, written agreement that outlines their obligations.

What are the key components of a New Jersey Promissory Note?

A well-drafted Promissory Note generally includes the following key components:

- Principal Amount: The total amount of money being borrowed.

- Interest Rate: The percentage charged on the principal amount.

- Repayment Schedule: The timeline for repayment, including due dates.

- Borrower and Lender Information: Names and addresses of both parties.

- Default Terms: Conditions under which the borrower would be considered in default.

- Governing Law: A statement indicating that New Jersey law governs the note.

Do I need a lawyer to create a Promissory Note?

While it is not legally required to have a lawyer draft a Promissory Note, consulting one can provide valuable insights. A lawyer can ensure that the document complies with New Jersey laws and adequately protects your interests. This is especially important for larger loans or complex agreements.

Can a Promissory Note be modified after it is signed?

Yes, a Promissory Note can be modified, but both parties must agree to the changes. It is advisable to document any modifications in writing and have both parties sign the revised agreement. This helps avoid misunderstandings in the future.

What happens if the borrower defaults on the Promissory Note?

If a borrower defaults, the lender has several options. They can pursue legal action to recover the owed amount, which may include filing a lawsuit. The specific remedies available will depend on the terms outlined in the Promissory Note and New Jersey law.

Is a Promissory Note the same as a loan agreement?

While both documents serve to outline the terms of a loan, they are not the same. A Promissory Note is a simpler document focused on the borrower's promise to repay. In contrast, a loan agreement is typically more comprehensive, covering additional terms such as covenants, representations, and warranties.

Do I need to notarize a Promissory Note in New Jersey?

Notarization is not required for a Promissory Note to be legally enforceable in New Jersey. However, having the document notarized can add an extra layer of authenticity and may be beneficial if disputes arise in the future.

Where can I find a New Jersey Promissory Note template?

Templates for New Jersey Promissory Notes can be found online through various legal websites or document preparation services. Ensure that any template you choose complies with New Jersey laws and is tailored to your specific needs.