Printable New Jersey Prenuptial Agreement Template

Find Other Popular Prenuptial Agreement Templates for Specific States

Pennsylvania Prenup - An effective prenuptial can create clarity regarding debts and liabilities.

Georgia Prenup - The contract should reflect each partner's interests and intentions clearly and fairly.

When seeking to create a strong endorsement for a candidate, utilizing a Recommendation Letter form can be crucial, providing a clear structure to highlight the individual's strengths. This can be particularly beneficial in competitive environments such as academic admissions or job applications. For those looking to craft an exceptional document, resources like OnlineLawDocs.com offer valuable guidance on how to convey personal experiences and observations effectively.

Ohio Prenup - Addresses issues such as spousal debt and personal debt allocation.

Illinois Prenup - This form serves as a critical legal safeguard for both partners.

Misconceptions

Many people hold misconceptions about prenuptial agreements in New Jersey. Understanding these misconceptions can help couples make informed decisions. Here are nine common misunderstandings:

-

Prenuptial agreements are only for the wealthy.

This is not true. Anyone can benefit from a prenuptial agreement, regardless of financial status. It can help clarify financial responsibilities and expectations for both partners.

-

Prenuptial agreements are only for divorce situations.

While they do address what happens in case of divorce, prenuptial agreements can also outline financial arrangements during the marriage. They can help couples avoid disputes over finances.

-

Prenuptial agreements are not enforceable.

In New Jersey, prenuptial agreements can be enforceable if they meet certain legal standards. This includes being in writing and signed by both parties.

-

Prenuptial agreements are complicated and expensive.

-

Prenuptial agreements are only for couples planning to divorce.

Many couples use them to clarify their financial situation before marriage. This can lead to open discussions about finances and expectations.

-

Prenuptial agreements can cover anything.

There are limits to what can be included. For example, agreements cannot dictate child custody or support arrangements, as these are determined based on the child's best interests.

-

Prenuptial agreements are unfair to one partner.

If both parties are involved in the creation of the agreement, it can be fair and beneficial. Transparency and communication are key in this process.

-

Prenuptial agreements are only for first marriages.

People entering second or subsequent marriages can also benefit from prenuptial agreements. They can protect existing assets and clarify financial responsibilities.

-

Prenuptial agreements can’t be changed once signed.

Couples can modify their prenuptial agreements if both parties agree. It is advisable to consult legal counsel to ensure any changes are valid and enforceable.

Understanding these misconceptions can help couples approach prenuptial agreements with a clearer perspective. Open communication and legal guidance are essential in this process.

Documents used along the form

A prenuptial agreement is an important document for couples planning to marry, outlining how assets will be divided in the event of a divorce. Along with this agreement, several other forms and documents can help clarify financial arrangements and protect individual interests. Here are five commonly used documents that complement a New Jersey prenuptial agreement.

- Financial Disclosure Statement: This document provides a detailed account of each party's assets, debts, income, and expenses. Transparency in financial matters is crucial for a fair prenuptial agreement.

- Postnuptial Agreement: Similar to a prenuptial agreement, this document is created after marriage. It can address changes in circumstances or clarify financial arrangements that may have evolved since the wedding.

- Marital Settlement Agreement: This agreement outlines the terms of asset division, spousal support, and other matters in the event of divorce. It is often used in conjunction with prenuptial agreements to ensure clarity.

- Invoice Documentation: For couples engaged in business together, maintaining clear financial records can be crucial. Utilizing tools like smarttemplates.net/fillable-free-and-invoice-pdf can provide structured invoices that detail transactions and strengthen transparency in financial dealings.

- Power of Attorney: This legal document grants one spouse the authority to make financial or medical decisions on behalf of the other in case of incapacity. It can be an essential part of a comprehensive financial plan.

- Will: A will specifies how an individual's assets will be distributed upon their death. Including a will in estate planning ensures that both parties' wishes are respected and can prevent disputes in the future.

Incorporating these documents alongside a prenuptial agreement can provide a solid foundation for financial planning and protection. Each serves a unique purpose, addressing various aspects of a couple's financial and legal relationship. Taking the time to prepare these documents can lead to a more secure and harmonious partnership.

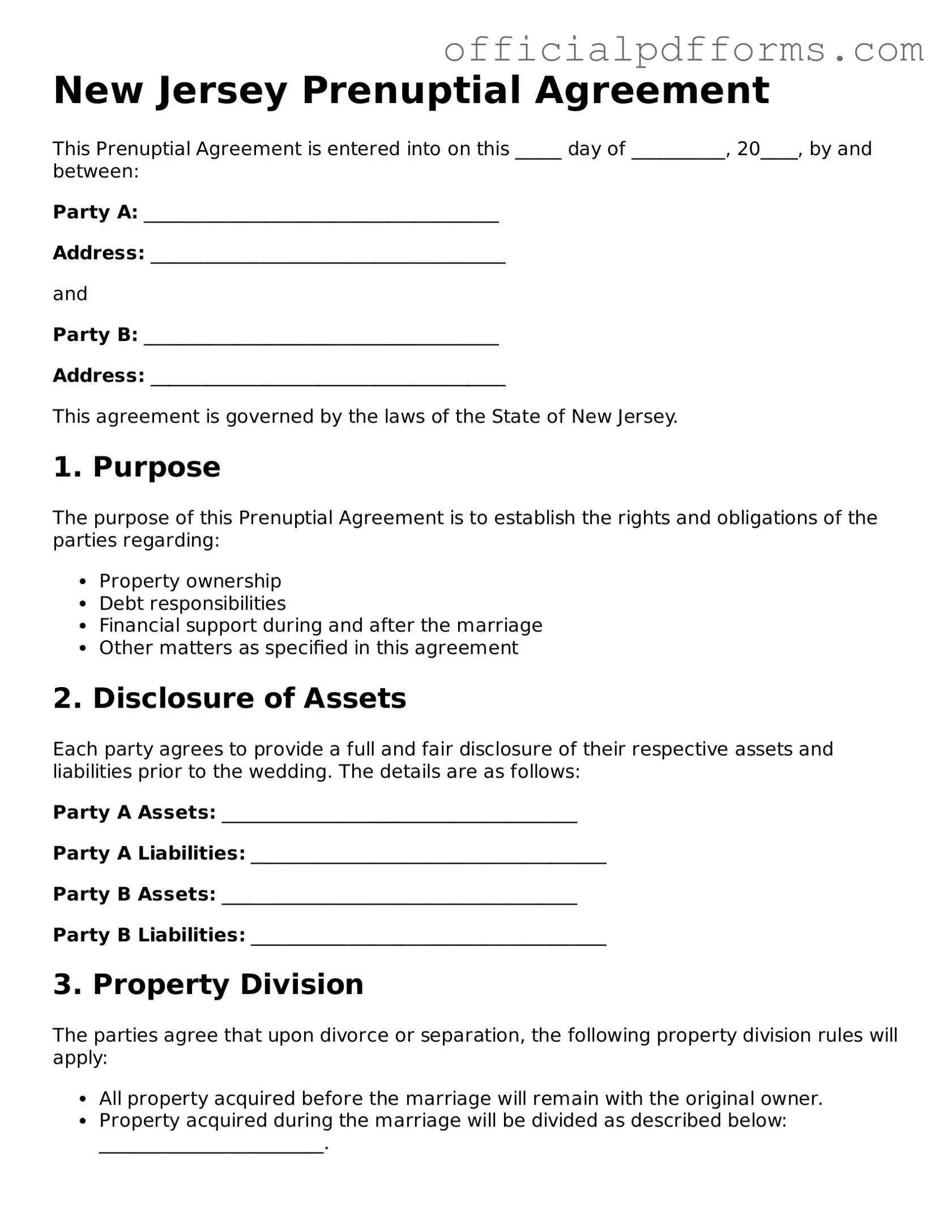

Steps to Filling Out New Jersey Prenuptial Agreement

Filling out a prenuptial agreement form in New Jersey is an important step for couples who want to outline their financial rights and responsibilities before marriage. This process can seem daunting, but with a clear understanding of the steps involved, it becomes much more manageable. Here’s a straightforward guide to help you through the process.

- Begin by gathering all necessary personal information. This includes full names, addresses, and contact details for both parties.

- Next, outline the assets and debts each person brings into the marriage. Be as detailed as possible, including bank accounts, real estate, and any other significant financial interests.

- Discuss and agree upon how you want to handle future earnings and assets. This can include income from jobs, investments, and any inheritances.

- Decide on how you want to approach debt during the marriage. Will each person be responsible for their own debts, or will they share responsibility for joint debts?

- Consider including provisions for spousal support or alimony in case of divorce. Discuss what you both feel is fair and reasonable.

- Once all details are agreed upon, write everything down clearly. Use simple language to ensure both parties understand the terms.

- Review the document together. Make sure both parties are comfortable with every aspect of the agreement.

- Consult with a legal professional. It’s wise to have an attorney review the agreement to ensure it meets New Jersey laws and protects both parties.

- Finally, both parties should sign the agreement in the presence of a notary public to make it legally binding.

By following these steps, you can create a comprehensive prenuptial agreement that reflects your mutual understanding and protects your interests. Taking the time to discuss these matters openly will contribute to a stronger foundation for your marriage.

Common mistakes

-

Not Disclosing All Assets: One of the most common mistakes is failing to fully disclose all assets and liabilities. Transparency is key in a prenuptial agreement. If one party hides assets, it can lead to significant legal issues later on.

-

Using Vague Language: Ambiguity can create confusion. It's essential to use clear and precise language when outlining terms. Vague terms can lead to different interpretations, which can complicate enforcement.

-

Not Considering Future Changes: Life circumstances change. Failing to account for potential changes in income, property, or family dynamics can render a prenuptial agreement less effective. It’s wise to include provisions for future adjustments.

-

Forgetting to Review State Laws: Each state has its own laws regarding prenuptial agreements. Ignoring New Jersey's specific requirements can invalidate the agreement. Familiarity with local laws ensures that the agreement is enforceable.

-

Not Seeking Legal Advice: Attempting to draft a prenuptial agreement without professional guidance can lead to serious oversights. Consulting with a lawyer who specializes in family law can provide clarity and ensure that both parties' interests are protected.

Get Clarifications on New Jersey Prenuptial Agreement

What is a prenuptial agreement in New Jersey?

A prenuptial agreement, often referred to as a "prenup," is a legal document created by two individuals before they get married. It outlines how assets and debts will be divided in the event of a divorce or separation. In New Jersey, these agreements can also cover issues like spousal support and property rights, providing clarity and security for both parties.

Why should couples consider a prenuptial agreement?

Couples may choose to create a prenuptial agreement for several reasons:

- To protect individual assets acquired before marriage.

- To clarify financial responsibilities during the marriage.

- To avoid lengthy and costly disputes in the event of a divorce.

- To ensure that family heirlooms or businesses remain within a specific family.

What are the requirements for a valid prenuptial agreement in New Jersey?

For a prenuptial agreement to be considered valid in New Jersey, it must meet several criteria:

- It should be in writing and signed by both parties.

- Both parties must fully disclose their assets and debts.

- The agreement should be entered into voluntarily, without coercion.

- It must be fair and reasonable at the time of signing.

Can a prenuptial agreement be modified after marriage?

Yes, a prenuptial agreement can be modified or revoked after marriage. Both parties must agree to the changes, and it's best to document any modifications in writing. This ensures that both individuals are on the same page and helps prevent misunderstandings in the future.

What happens if a prenuptial agreement is challenged in court?

If a prenuptial agreement is challenged in court, the judge will evaluate its validity based on several factors, including:

- Whether both parties had independent legal representation.

- Whether there was full disclosure of assets.

- Whether the agreement was signed voluntarily.

- Whether the terms are unconscionable or unfair.

Ultimately, the court will decide whether to uphold or invalidate the agreement based on these considerations.

How do you create a prenuptial agreement in New Jersey?

Creating a prenuptial agreement involves several steps:

- Discuss your financial situation openly with your partner.

- Draft the agreement, outlining the terms you both agree upon.

- Consult with separate legal professionals to ensure fairness and legality.

- Sign the agreement well in advance of the wedding to avoid any claims of coercion.

Is a prenuptial agreement only for wealthy individuals?

No, prenuptial agreements are not solely for wealthy individuals. They can benefit anyone who wants to clarify financial matters before marriage. Regardless of income or asset levels, having a prenup can provide peace of mind and help avoid potential conflicts down the road.

How long does it take to create a prenuptial agreement?

The time it takes to create a prenuptial agreement can vary. Generally, it may take a few weeks to a couple of months, depending on the complexity of the assets involved and the willingness of both parties to communicate openly. Starting the process early is advisable to ensure that both individuals feel comfortable and informed.

What is the cost of a prenuptial agreement in New Jersey?

The cost of a prenuptial agreement can vary widely based on factors such as the complexity of the agreement and the attorneys involved. On average, couples may spend anywhere from a few hundred to several thousand dollars. Investing in a well-drafted agreement can save both parties significant time and money in the future.