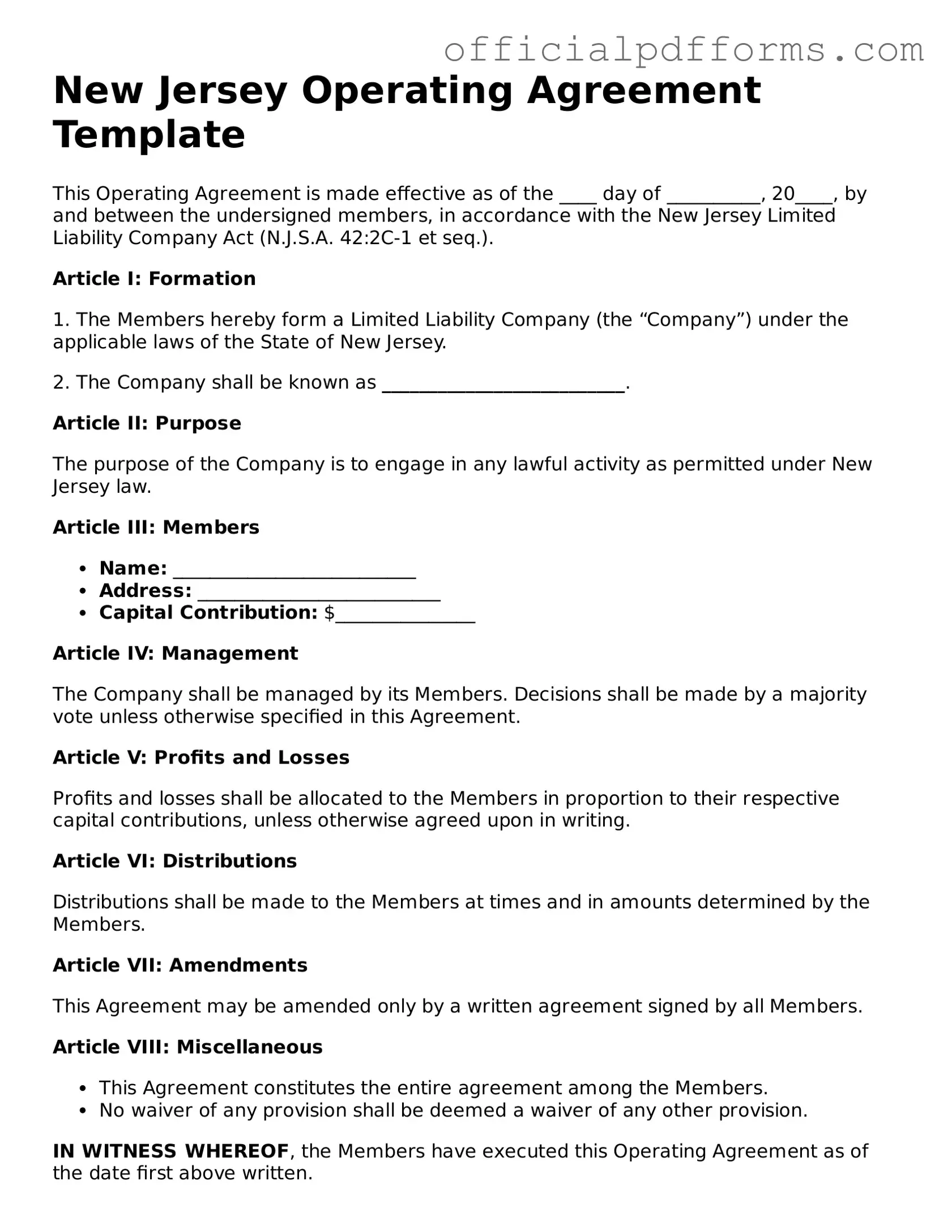

Printable New Jersey Operating Agreement Template

Find Other Popular Operating Agreement Templates for Specific States

Llc Operating Agreement Georgia - The Operating Agreement can also cover the roles of third-party advisors, like accountants or lawyers.

In addition to serving as a crucial legal record, a Texas Motorcycle Bill of Sale form can be easily obtained through various online platforms, one of which is OnlineLawDocs.com, providing a convenient way for both buyers and sellers to ensure they have the necessary documentation for their motorcycle transactions.

Operating Agreement Llc Pa - It is an essential document that lays the groundwork for the business's future.

Misconceptions

Understanding the New Jersey Operating Agreement form is essential for anyone involved in a limited liability company (LLC). However, there are several misconceptions that can lead to confusion. Here are eight common misconceptions:

-

It is not necessary to have an Operating Agreement.

Many people believe that an Operating Agreement is optional for LLCs in New Jersey. However, having one is crucial as it outlines the management structure and operational procedures of the company, helping to prevent disputes among members.

-

All members must be involved in drafting the Operating Agreement.

While it is beneficial for all members to contribute, it is not a requirement. One or a few members can draft the agreement, but it should reflect the interests and agreements of all members.

-

Operating Agreements are only for large businesses.

This is not true. Even single-member LLCs benefit from having an Operating Agreement. It provides clarity and legal protection, regardless of the size of the business.

-

The state provides a standard Operating Agreement template.

New Jersey does not provide a one-size-fits-all template. Each Operating Agreement should be tailored to the specific needs and agreements of the members involved.

-

Once created, the Operating Agreement cannot be changed.

This misconception is false. An Operating Agreement can be amended as necessary, provided that all members agree to the changes and the process for amendments is outlined in the agreement itself.

-

Verbal agreements are sufficient in place of a written Operating Agreement.

While verbal agreements may seem convenient, they can lead to misunderstandings and disputes. A written Operating Agreement provides clear documentation of the terms agreed upon by all members.

-

The Operating Agreement must be filed with the state.

This is incorrect. New Jersey does not require the Operating Agreement to be filed with the state. It should be kept on record for internal purposes and to clarify the terms of the LLC.

-

Operating Agreements are only for new businesses.

This is a common misconception. Existing businesses can and should create or update their Operating Agreements to reflect changes in membership, management, or business structure.

By understanding these misconceptions, LLC members can better navigate the requirements and benefits of the New Jersey Operating Agreement form.

Documents used along the form

The New Jersey Operating Agreement is an essential document for limited liability companies (LLCs) as it outlines the management structure and operating procedures. However, it is often accompanied by other forms and documents that help establish and maintain the LLC's legal and operational framework. Below is a list of commonly used documents that complement the Operating Agreement.

- Articles of Organization: This document is filed with the state to officially create the LLC. It includes basic information such as the company name, address, and registered agent.

- Membership Certificates: These certificates serve as proof of ownership for members of the LLC. They detail each member's ownership interest and can be important for internal record-keeping.

- Trailer Bill of Sale Form: For those navigating trailer ownership transfers, utilize the detailed trailer bill of sale documentation to ensure compliance with state regulations.

- Bylaws: While not required for LLCs, bylaws outline the rules and procedures for the internal management of the company. They can cover aspects such as voting rights and meeting protocols.

- Operating Procedures: This document may detail specific processes for day-to-day operations, including financial management and member responsibilities. It provides clarity on how the LLC will function.

- Annual Reports: Many states, including New Jersey, require LLCs to file annual reports. These documents provide updated information about the company and help maintain good standing with the state.

These documents work together to ensure that an LLC operates smoothly and remains compliant with state regulations. Having a clear understanding of each form's purpose can significantly benefit members and managers alike.

Steps to Filling Out New Jersey Operating Agreement

After obtaining the New Jersey Operating Agreement form, you will need to carefully fill it out to ensure that all necessary information is accurately provided. This document is essential for outlining the management and operational procedures of your business entity.

- Begin by entering the name of your business at the top of the form. Make sure it matches the name registered with the state.

- Provide the principal office address of your business. This should be a physical address, not a P.O. Box.

- List the names and addresses of all members involved in the business. Include their ownership percentages if applicable.

- Detail the purpose of the business. This should be a brief description of what your business does.

- Specify the management structure. Indicate whether the business will be member-managed or manager-managed.

- Outline the voting rights of members. Clearly state how decisions will be made and what percentage of votes is needed for approval.

- Include provisions for profit and loss distribution. Explain how profits and losses will be allocated among members.

- Address the process for adding new members or removing existing ones. This should include any necessary approvals or conditions.

- Indicate the duration of the business. State whether it is intended to operate indefinitely or for a specified term.

- Finally, ensure all members sign and date the agreement. This formalizes the document and makes it legally binding.

Common mistakes

-

Not Including All Members: One common mistake is failing to list all members of the LLC. Every member should be identified in the agreement to avoid confusion later.

-

Ignoring Voting Rights: Some individuals overlook the importance of specifying voting rights. Each member's voting power should be clearly outlined to prevent disputes during decision-making.

-

Omitting Profit and Loss Distribution: It's crucial to detail how profits and losses will be shared among members. Not addressing this can lead to misunderstandings about financial expectations.

-

Neglecting to Update the Agreement: As the business evolves, so should the Operating Agreement. Failing to update the document after significant changes can create legal complications down the line.

Get Clarifications on New Jersey Operating Agreement

What is a New Jersey Operating Agreement?

A New Jersey Operating Agreement is a legal document that outlines the management structure and operational procedures of a limited liability company (LLC). It serves as a foundational guide for how the business will be run and details the rights and responsibilities of its members.

Is an Operating Agreement required in New Jersey?

While New Jersey does not legally require LLCs to have an Operating Agreement, it is highly recommended. Having one can help clarify the roles of members, protect personal assets, and establish rules for resolving disputes. Without it, state default laws may govern your LLC, which may not align with your intentions.

What should be included in the Operating Agreement?

An Operating Agreement should cover several key components, including:

- The LLC's name and principal address.

- The purpose of the LLC.

- The names and contributions of the members.

- The management structure (member-managed or manager-managed).

- Voting rights and procedures.

- Profit and loss distribution.

- Procedures for adding or removing members.

How do I create an Operating Agreement?

Creating an Operating Agreement can be done in a few steps:

- Gather all members and discuss the terms you want to include.

- Draft the document, ensuring it covers all essential elements.

- Review the draft with all members to ensure agreement.

- Make any necessary revisions.

- Have all members sign the final version to make it official.

Can I amend the Operating Agreement after it is created?

Yes, you can amend the Operating Agreement. It is essential to follow the procedures outlined in the original agreement for making amendments. Typically, this involves obtaining consent from a certain percentage of the members. Document any changes clearly and ensure all members sign the amended agreement.

What happens if there is no Operating Agreement?

If your LLC does not have an Operating Agreement, New Jersey's default laws will apply. This could lead to unintended consequences, such as disputes among members being resolved according to state rules rather than your preferences. Additionally, the lack of a formal agreement may expose members to personal liability in certain situations.

Where can I find a template for a New Jersey Operating Agreement?

Templates for New Jersey Operating Agreements can be found online through various legal websites and resources. It’s important to choose a template that is specifically tailored for New Jersey laws. However, consider consulting with a legal professional to ensure that the document meets your specific needs and complies with state regulations.