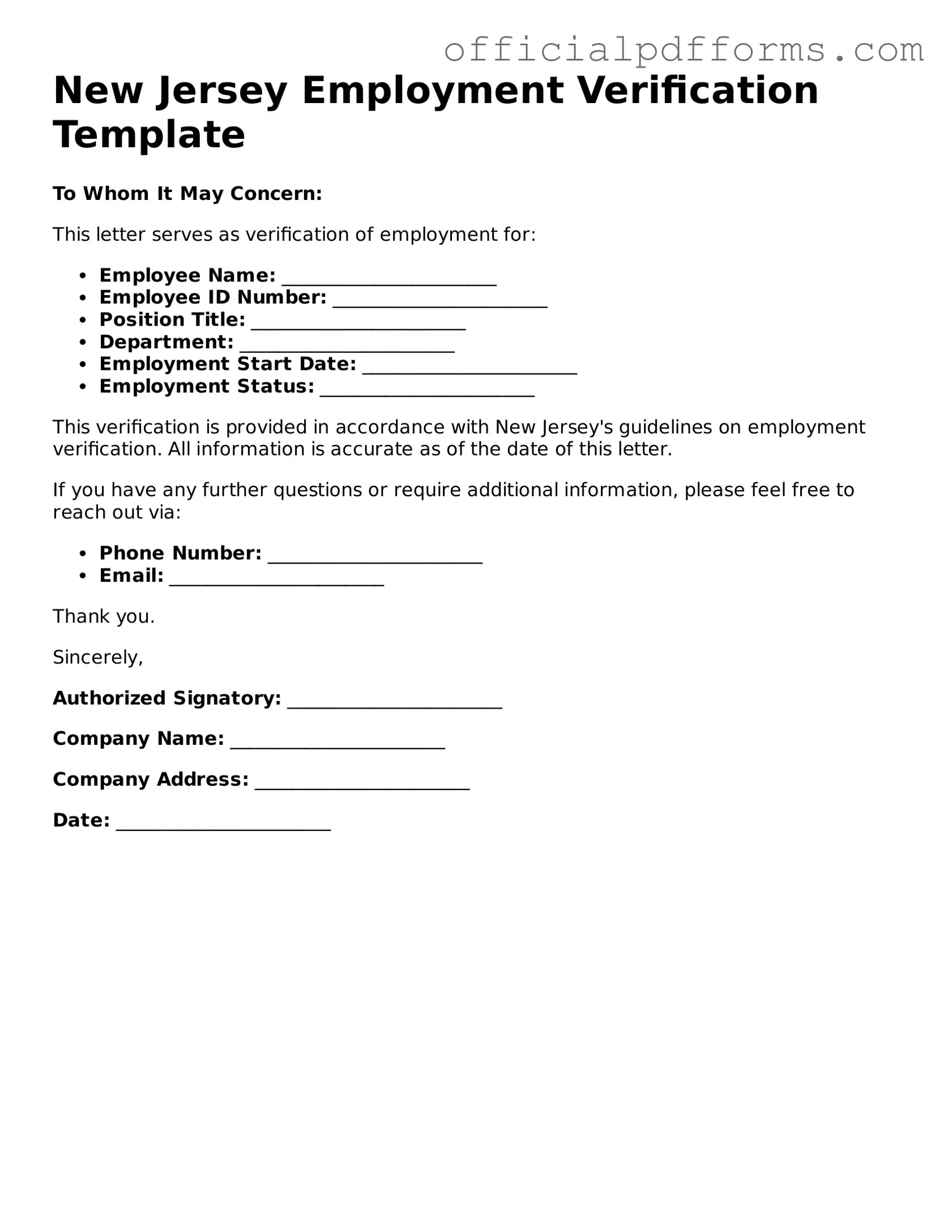

Printable New Jersey Employment Verification Template

Find Other Popular Employment Verification Templates for Specific States

State of Ohio Employment Verification - Helps maintain transparency in the hiring process.

For those navigating the complexities of vehicle transactions, understanding the importance of a necessary Motor Vehicle Bill of Sale form is essential to ensure legal protection and clarity in the sale process.

Peachcare for Kids Income - This document may be required by rental agencies for tenant screening.

Misconceptions

The New Jersey Employment Verification form is an important document for both employers and employees. However, several misconceptions surround its purpose and use. Understanding these misconceptions can help clarify the process and ensure compliance with the law.

-

Misconception 1: The form is only necessary for new hires.

This is not true. The Employment Verification form may be required for various situations, including promotions, transfers, or even when an employee requests verification for a loan or mortgage application.

-

Misconception 2: Only full-time employees need to complete the form.

Part-time employees are also subject to employment verification. Regardless of hours worked, the form is applicable to all employees.

-

Misconception 3: The form is only for state employees.

In reality, this form is used by both public and private sector employers in New Jersey.

-

Misconception 4: Employers can fill out the form without employee consent.

Consent is essential. Employees must be informed and agree to the completion of the form, as it contains personal information.

-

Misconception 5: The form is optional for employers.

Employers are required to complete this form under specific circumstances, particularly when requested by the employee or for certain legal purposes.

-

Misconception 6: The Employment Verification form is the same as a W-2 form.

While both documents serve different purposes, they are not interchangeable. The W-2 form reports wages and taxes, whereas the Employment Verification form confirms employment status.

-

Misconception 7: The form can be submitted without any supporting documents.

Supporting documentation may be necessary to validate the information provided on the Employment Verification form. This can include pay stubs or employment contracts.

-

Misconception 8: Once submitted, the form cannot be updated.

In fact, employers can and should update the form as necessary, particularly if there are changes in the employee's status or information.

-

Misconception 9: The form guarantees employment verification will be accepted by third parties.

While the form serves as a reliable source of information, acceptance ultimately depends on the policies of the third party requesting verification.

By addressing these misconceptions, both employers and employees can better navigate the Employment Verification process in New Jersey, ensuring that all parties are informed and compliant.

Documents used along the form

The New Jersey Employment Verification form is an essential document for confirming an individual's employment status and details. When completing this form, you may also encounter several other documents that can support the verification process. Below is a list of commonly used forms that often accompany the Employment Verification form.

- W-2 Form: This tax document summarizes an employee's annual wages and the taxes withheld from their paycheck. Employers issue it at the end of each tax year, making it a reliable proof of income and employment history.

- Vehicle Purchase Agreement: A OnlineLawDocs.com offers a Texas Vehicle Purchase Agreement form that details the transaction between a buyer and seller, ensuring transparency and minimizing disputes.

- Pay Stubs: These are regular statements provided by employers that detail an employee's earnings for each pay period. Pay stubs typically include information such as gross pay, deductions, and net pay, serving as ongoing verification of employment and income.

- Offer Letter: This document outlines the terms of employment, including job title, salary, and start date. An offer letter can be useful for verifying employment details and confirming the agreement between the employer and employee.

- Employment Contract: A formal agreement between the employer and employee that specifies job duties, compensation, and other terms of employment. This contract serves as a comprehensive record of the employment relationship and can clarify any ambiguities during verification.

In summary, while the New Jersey Employment Verification form is crucial for confirming employment status, these additional documents can provide further clarity and support in the verification process. Collecting and presenting these forms together can enhance the accuracy and reliability of employment verification.

Steps to Filling Out New Jersey Employment Verification

Completing the New Jersey Employment Verification form is an important step in ensuring that your employment details are accurately recorded. Follow the steps below to fill out the form correctly.

- Begin by entering your full name in the designated field. Make sure to use your legal name as it appears on official documents.

- Provide your current address. Include the street number, street name, city, state, and zip code.

- Next, fill in your date of birth. Use the format MM/DD/YYYY to avoid any confusion.

- Indicate your Social Security number. This is crucial for verification purposes.

- List your employer's name. Ensure that you spell it correctly to avoid any issues.

- Provide the employer's address, including street, city, state, and zip code.

- Enter your job title. This should reflect your current position within the company.

- Fill in the start date of your employment. Use the same format as your date of birth.

- If applicable, include your end date of employment. If you are still employed, you can leave this blank.

- Review all the information you have entered for accuracy. Double-check for any spelling errors or incorrect dates.

- Finally, sign and date the form at the bottom. Your signature confirms that the information provided is true and accurate.

Common mistakes

-

Incomplete Information: One common mistake is failing to fill out all required fields. Each section of the form must be completed to ensure it is valid. Omitting even a single detail can delay the verification process.

-

Incorrect Dates: People often make errors when entering employment dates. It’s crucial to double-check these dates for accuracy, as discrepancies can lead to confusion or complications.

-

Wrong Employer Information: Listing the wrong employer or providing outdated contact information can hinder the verification process. Ensure that the employer’s name and address are current and correctly spelled.

-

Signature Issues: Some individuals forget to sign the form or provide an illegible signature. A clear and proper signature is essential for the form to be accepted.

-

Misunderstanding Employment Status: Misclassifying employment status, such as indicating full-time when part-time applies, can lead to inaccuracies. Be honest and precise about your employment situation.

-

Failure to Provide Supporting Documents: Often, people neglect to include necessary supporting documents, such as pay stubs or tax forms. These documents can provide additional context and verification of employment.

-

Not Keeping a Copy: After submitting the form, some forget to keep a copy for their records. Retaining a copy can be helpful for future reference or in case of discrepancies.

-

Ignoring Instructions: Lastly, not reading or following the provided instructions can lead to mistakes. Each form may have specific guidelines that must be adhered to for successful completion.

Get Clarifications on New Jersey Employment Verification

What is the New Jersey Employment Verification form?

The New Jersey Employment Verification form is a document used to confirm an individual's employment status. It is often required by various agencies, including government entities and financial institutions, to verify a person's job title, length of employment, and salary. This form serves as an official record that can help individuals in various situations, such as applying for loans, housing, or government assistance.

Who needs to complete the Employment Verification form?

Typically, the form needs to be completed by employers on behalf of their employees. If you are an employee seeking verification, you may request your employer to fill out the form. In certain cases, employees may also need to provide additional documentation, such as pay stubs or tax forms, to support the verification process.

What information is required on the form?

The Employment Verification form usually requires the following information:

- Employee's full name

- Job title and description

- Dates of employment, including start and end dates if applicable

- Salary or hourly wage

- Employer's contact information

Providing accurate information is crucial, as any discrepancies can lead to delays or complications in the verification process.

How can I obtain the Employment Verification form?

You can obtain the New Jersey Employment Verification form from several sources. Most employers have their own version of the form, which may be available through your human resources department. Additionally, you can find templates online or request a copy from state agencies that may require the verification.

What should I do if my employer refuses to complete the form?

If your employer is unwilling to complete the Employment Verification form, it is important to communicate your needs clearly. You can explain the purpose of the verification and how it may benefit both you and the employer. If they still refuse, consider the following options:

- Request alternative documentation that proves your employment, such as a pay stub or tax return.

- Consult your HR department to understand your rights and the company's policies regarding employment verification.

- Seek legal advice if you believe your employer is violating any laws regarding employment verification.

Remember, open and respectful communication often leads to the best outcomes.