Printable New Jersey Durable Power of Attorney Template

Find Other Popular Durable Power of Attorney Templates for Specific States

General Power of Attorney Form Pennsylvania - It allows for seamless management of financial matters by a trusted individual of your choice.

When engaging in a transaction, it's essential to utilize a Texas Bill of Sale form to ensure clarity and legality in the sale and transfer of personal property. This document not only verifies the details between seller and buyer but also serves as a crucial piece of evidence for future reference. For more information on the specifics of creating a Bill of Sale, visit OnlineLawDocs.com.

Durable Power of Attorney Nc - Acknowledge the importance of having someone control your assets in case of incapacity.

How to Notarize a Power of Attorney in Ohio - It can empower someone you trust to step in when you can't manage your affairs.

Poa Financial Form - Properly executed, this form provides legal authority for your agent to act in your interest and welfare.

Misconceptions

Understanding the New Jersey Durable Power of Attorney (DPOA) form is essential for anyone looking to manage their financial and healthcare decisions effectively. However, there are several misconceptions surrounding this legal document. Here are ten common misunderstandings:

- It only applies to financial decisions. Many believe that a DPOA is limited to financial matters. In reality, it can also grant authority over healthcare decisions if specified.

- It becomes effective only when the principal is incapacitated. Some think that a DPOA is only activated when the principal is unable to make decisions. However, a DPOA can be effective immediately upon signing, depending on how it is drafted.

- Once created, it cannot be changed. This is not true. A principal can revoke or modify a DPOA at any time as long as they are mentally competent.

- It is the same as a regular Power of Attorney. A DPOA differs from a regular Power of Attorney because it remains effective even if the principal becomes incapacitated.

- All agents have the same powers. The powers granted to an agent can vary widely. The principal can specify what decisions the agent is authorized to make.

- It must be notarized to be valid. While notarization is recommended for added validity, a DPOA can still be legally binding without it, provided it meets state requirements.

- It can be used indefinitely. A DPOA does not last forever. It typically ends upon the principal's death or if the principal revokes it.

- Anyone can be appointed as an agent. While many people can serve as agents, there are restrictions. For example, an agent must be at least 18 years old and mentally competent.

- It is only necessary for the elderly. This misconception overlooks that anyone, regardless of age, can benefit from having a DPOA in place for unexpected situations.

- It is a one-size-fits-all document. A DPOA can be customized to fit individual needs and circumstances. It is important to tailor the document to reflect the specific wishes of the principal.

By clarifying these misconceptions, individuals can make more informed decisions about their legal and financial planning in New Jersey.

Documents used along the form

When creating a New Jersey Durable Power of Attorney, it’s essential to consider other related documents that can complement or enhance its effectiveness. These forms help ensure that your wishes are respected and that your affairs are managed according to your preferences. Below is a list of commonly used documents that often accompany a Durable Power of Attorney.

- Advance Healthcare Directive: This document outlines your medical treatment preferences in case you become unable to communicate your wishes. It can include decisions about life-sustaining treatments and appoints a healthcare proxy to make decisions on your behalf.

- Living Will: A living will specifies your wishes regarding medical care at the end of life. It provides guidance to healthcare providers and loved ones about the type of medical interventions you want or do not want.

- Real Estate Purchase Agreement: For those engaging in property transactions, the necessary Real Estate Purchase Agreement essentials ensure that the terms of the sale are clearly outlined and legally binding.

- Last Will and Testament: This legal document details how you want your assets distributed after your death. It can also appoint guardians for minor children and name an executor to manage your estate.

- Trust Agreement: A trust can hold your assets during your lifetime and dictate how they are managed and distributed after your passing. This can help avoid probate and provide more control over your estate.

- HIPAA Authorization: This authorization allows designated individuals to access your medical records. It ensures that your healthcare proxy or family members can obtain necessary information to make informed decisions about your care.

- Financial Power of Attorney: While similar to a Durable Power of Attorney, this document specifically focuses on financial matters. It grants someone authority to handle your financial affairs, such as paying bills and managing investments, especially if you become incapacitated.

Understanding these documents can significantly enhance your planning efforts. By ensuring that your preferences are clearly articulated and legally documented, you can provide peace of mind for yourself and your loved ones.

Steps to Filling Out New Jersey Durable Power of Attorney

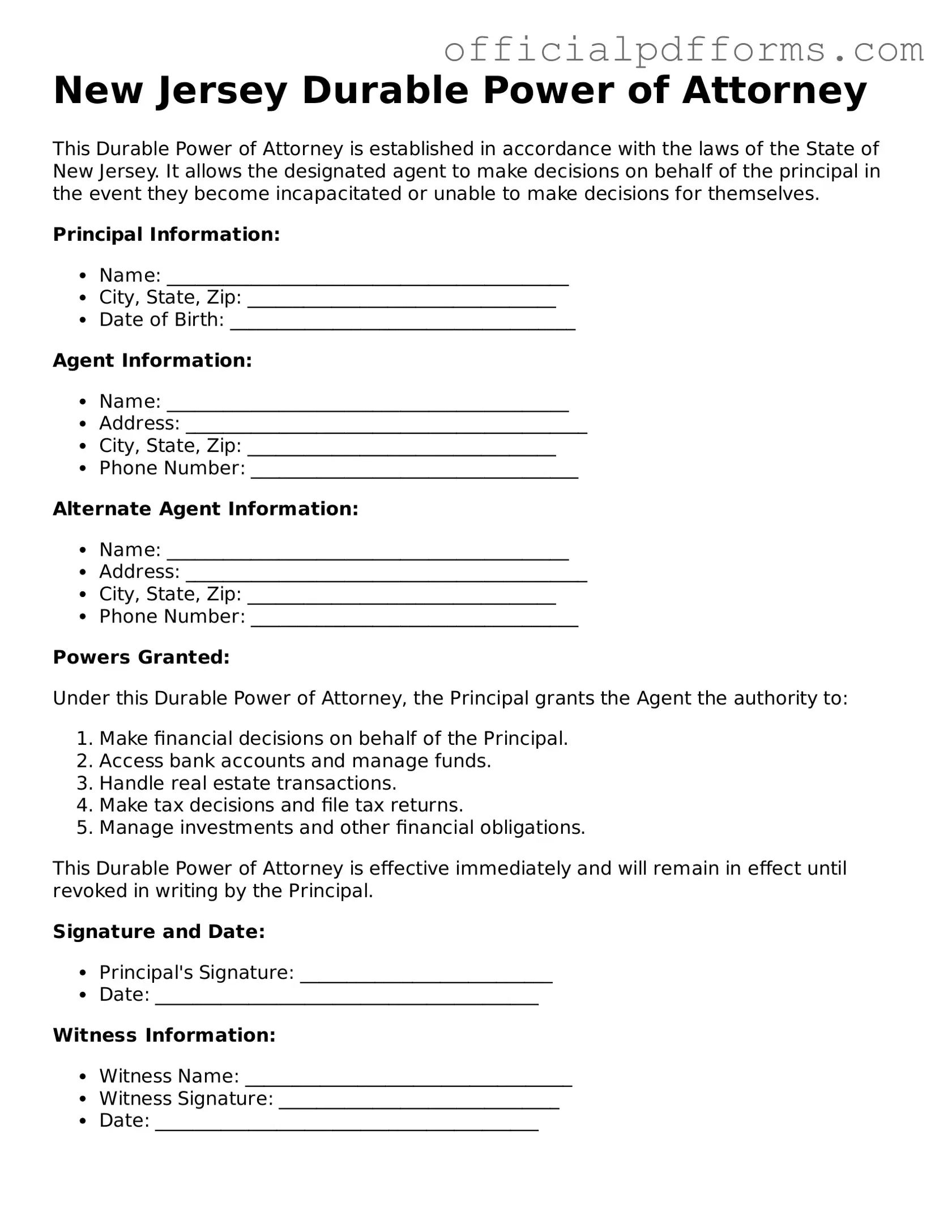

Filling out the New Jersey Durable Power of Attorney form is an important step in designating someone to make decisions on your behalf. Once you have completed the form, it will need to be signed and witnessed to ensure it is valid. Below are the steps to guide you through the process of filling out the form correctly.

- Obtain a copy of the New Jersey Durable Power of Attorney form. This can typically be found online or through legal offices.

- Begin by entering your full name and address at the top of the form. Ensure that this information is accurate.

- Next, identify the person you wish to designate as your agent. Write their full name and address in the designated section.

- Specify the powers you want to grant your agent. This may include financial decisions, healthcare choices, or other specific powers. Be clear and detailed.

- Indicate whether the powers granted will be effective immediately or only in the event of your incapacitation.

- Review the form for any additional provisions or specific instructions you may want to include. This could be limitations on the agent's authority or specific wishes regarding your care.

- Sign and date the form in the presence of a notary public or witnesses, as required by New Jersey law.

- Provide copies of the completed and signed form to your agent and any relevant institutions, such as banks or healthcare providers.

Common mistakes

-

Not naming an alternate agent. Many people forget to choose a backup agent. If the primary agent is unavailable or unable to act, having an alternate ensures that your wishes are still carried out.

-

Failing to specify powers. Some individuals leave the powers too vague. Clearly outlining what your agent can and cannot do helps prevent confusion and misuse.

-

Not signing in front of a notary. The form must be notarized to be valid. Skipping this step can lead to the document being rejected.

-

Ignoring state requirements. Each state has specific rules. Make sure you understand New Jersey’s requirements to avoid complications.

-

Overlooking witness signatures. In New Jersey, you may need witnesses to sign the document. Not including them can invalidate the form.

-

Not keeping copies. Failing to make copies of the signed document can lead to issues later. Always keep a copy for yourself and provide one to your agent.

-

Neglecting to review the document regularly. Life changes, and so do your needs. Regularly reviewing your Durable Power of Attorney ensures it reflects your current wishes.

Get Clarifications on New Jersey Durable Power of Attorney

What is a Durable Power of Attorney in New Jersey?

A Durable Power of Attorney (DPOA) in New Jersey is a legal document that allows you to appoint someone to make decisions on your behalf if you become unable to do so yourself. This document remains effective even if you become incapacitated. It can cover a wide range of decisions, including financial matters, healthcare decisions, and other personal affairs.

Who can be appointed as my agent under a Durable Power of Attorney?

You can choose almost anyone to be your agent, as long as they are at least 18 years old and capable of making decisions. Common choices include family members, trusted friends, or professionals such as attorneys or financial advisors. It’s essential to select someone you trust completely, as they will have significant authority over your affairs.

What powers can I grant to my agent in a Durable Power of Attorney?

In New Jersey, you can grant your agent a variety of powers, which may include:

- Managing your bank accounts and finances

- Buying or selling property

- Making healthcare decisions

- Handling tax matters

- Managing investments

It’s crucial to clearly outline the powers you wish to grant in the document. You can choose to give broad authority or limit it to specific areas.

Do I need to have my Durable Power of Attorney notarized?

Yes, in New Jersey, your Durable Power of Attorney must be signed in the presence of a notary public to be valid. Additionally, it is recommended to have one or two witnesses present during the signing. This ensures that the document meets legal requirements and helps prevent any potential disputes in the future.

Can I revoke my Durable Power of Attorney once it is created?

Absolutely. You have the right to revoke your Durable Power of Attorney at any time, as long as you are mentally competent. To do so, you should create a written revocation document and notify your agent and any relevant institutions, such as banks or healthcare providers, that you have revoked the authority granted to your agent.