Printable New Jersey Deed Template

Find Other Popular Deed Templates for Specific States

How to Obtain the Deed to My House - A Deed can enhance the marketability of a property by providing clear title to new owners.

In California, the Release of Liability form is essential for individuals engaging in activities that may involve risks, as it legally protects one party from lawsuits regarding any injuries or damages. It is important to understand how to properly execute this document to ensure its effectiveness, and more information can be found at https://toptemplates.info.

Nc Deed Transfer Form - A Deed can also be used in divorce settlements involving property.

Misconceptions

Understanding the New Jersey Deed form is essential for anyone involved in real estate transactions in the state. However, several misconceptions can lead to confusion. Here are seven common misconceptions about the New Jersey Deed form:

- All Deeds are the Same: Many people believe that all deeds serve the same purpose. In reality, there are different types of deeds (such as warranty deeds and quitclaim deeds) that offer varying levels of protection and rights to the buyer.

- Only a Lawyer Can Prepare a Deed: While legal assistance can be beneficial, it is not mandatory. Homeowners can prepare their own deeds, provided they follow the state's requirements.

- A Deed Must Be Notarized: It is a common belief that notarization is required for all deeds. In New Jersey, notarization is not necessary for the deed to be valid, but it is highly recommended for clarity and to avoid disputes.

- Deeds Are Only Needed for Sales: Some think that deeds are only relevant during the sale of property. However, deeds are also used in transfers between family members, estate planning, and other situations.

- Once a Deed is Filed, It Cannot Be Changed: Many assume that a filed deed is permanent. While it is true that changing a deed can be complex, it is possible to amend or create a new deed to correct errors or update ownership.

- All Deeds Are Recorded Automatically: There is a misconception that once a deed is signed, it is automatically recorded with the county. In reality, the property owner is responsible for ensuring that the deed is filed with the appropriate county office.

- Property Taxes Are Not Affected by Deeds: Some believe that changing a deed does not impact property taxes. In fact, transferring ownership can trigger reassessment and potentially change the tax obligations.

By understanding these misconceptions, individuals can navigate the New Jersey Deed form process more effectively and avoid potential pitfalls.

Documents used along the form

When engaging in real estate transactions in New Jersey, the Deed form is a critical document that facilitates the transfer of property ownership. However, it is often accompanied by several other forms and documents that help ensure a smooth and legally sound process. Below is a list of common documents that may be used alongside the New Jersey Deed form.

- Property Transfer Tax Form: This form is required to report the transfer of property and calculate any applicable taxes due at the time of sale.

- Affidavit of Title: This document serves as a sworn statement by the seller, affirming their legal ownership of the property and disclosing any liens or claims against it.

- Title Insurance Policy: This policy protects the buyer and lender from potential disputes over property ownership and ensures that the title is clear of any encumbrances.

- Lease Agreement: This document is essential for establishing clear terms between landlord and tenant regarding rental conditions. For more details, access the form here.

- Sales Contract: A legally binding agreement between the buyer and seller that outlines the terms of the sale, including price, contingencies, and closing date.

- Mortgage Documents: If financing is involved, these documents outline the terms of the loan, including the amount borrowed, interest rate, and repayment schedule.

- Settlement Statement: Also known as a HUD-1, this document provides a detailed breakdown of all costs and fees associated with the closing of the property sale.

- Power of Attorney: In some cases, a seller may authorize another individual to act on their behalf in the transaction, which is formalized through this document.

- Notice of Settlement: This is a notification sent to relevant parties to inform them of the impending closing date and to confirm the details of the transaction.

Each of these documents plays a vital role in the real estate process, ensuring that both buyers and sellers are protected and informed throughout the transaction. Understanding these forms can empower individuals to navigate property transfers with confidence and clarity.

Steps to Filling Out New Jersey Deed

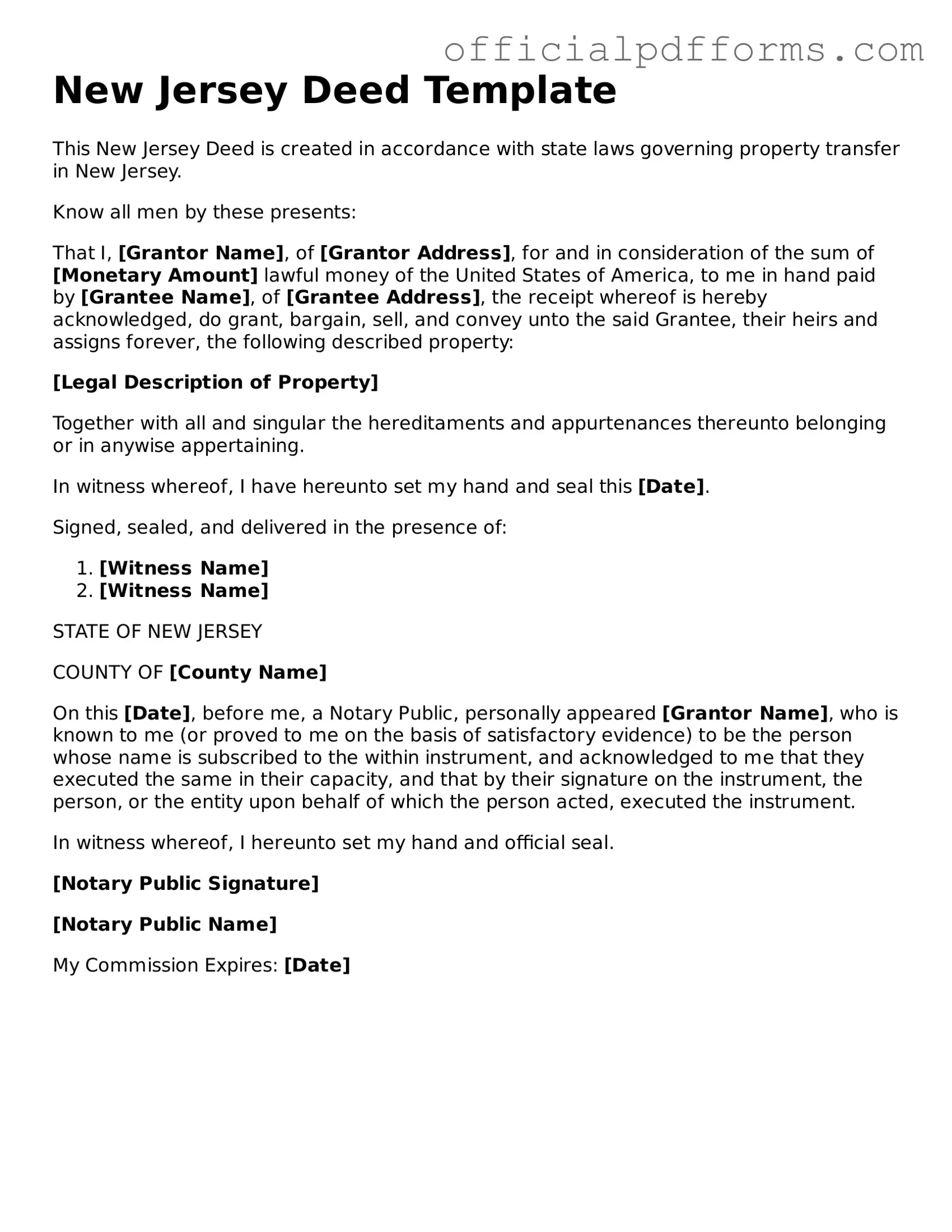

After obtaining the New Jersey Deed form, you will need to fill it out accurately to ensure proper transfer of property ownership. It is important to have all necessary information ready before starting the process. Follow these steps to complete the form.

- Begin by entering the name of the grantor, the person transferring the property. Ensure the name is spelled correctly.

- Next, provide the address of the grantor. Include the street address, city, and zip code.

- Now, fill in the name of the grantee, the person receiving the property. Again, check for correct spelling.

- Include the grantee's address, similar to how you entered the grantor's address.

- In the next section, describe the property being transferred. This may include the lot number, block number, and any other identifying information.

- Indicate the date of the transfer. This is the date when the ownership will officially change hands.

- Sign the form where indicated. The grantor must sign in the presence of a notary public.

- Have the document notarized. The notary will confirm the identity of the grantor and witness the signing.

- Finally, submit the completed form to the appropriate county office for recording. Check if there are any fees associated with this process.

Common mistakes

-

Incorrect Property Description: One common mistake is failing to accurately describe the property being transferred. This includes not providing the correct lot number, block number, or failing to include the street address. A vague or incomplete description can lead to confusion and potential legal issues.

-

Omitting Signatures: Another frequent error is neglecting to obtain the necessary signatures. All parties involved in the transaction must sign the deed. Without the required signatures, the deed may not be considered valid, which can complicate ownership transfer.

-

Not Notarizing the Document: Many people overlook the importance of having the deed notarized. In New Jersey, a deed typically must be notarized to be legally binding. Failing to do so can render the document ineffective, making it crucial to seek a notary's assistance.

-

Ignoring Tax Implications: Individuals often forget to consider the tax consequences of transferring property. New Jersey has specific tax requirements that must be met when completing a deed. Not addressing these can lead to unexpected financial obligations later on.

-

Filing the Deed Incorrectly: Finally, misfiling the deed is a common mistake. After completing the deed, it must be filed with the appropriate county office. Failing to file it correctly, or at all, can cause complications in proving ownership and may result in additional fees.

Get Clarifications on New Jersey Deed

What is a New Jersey Deed form?

A New Jersey Deed form is a legal document used to transfer ownership of real estate from one party to another. This document outlines the details of the property being transferred, including its legal description and the names of both the seller (grantor) and the buyer (grantee). It serves as proof of ownership and is essential for recording the transaction with the county clerk's office.

What types of Deed forms are available in New Jersey?

New Jersey offers several types of Deed forms, each serving different purposes. The most common types include:

- Warranty Deed: This type guarantees that the grantor holds clear title to the property and has the right to sell it.

- Quitclaim Deed: This form transfers whatever interest the grantor has in the property without any guarantees. It is often used among family members or in divorce settlements.

- Special Warranty Deed: This provides a limited warranty, covering only the time the grantor owned the property.

- Deed in Lieu of Foreclosure: This is used when a homeowner voluntarily transfers the property to the lender to avoid foreclosure.

How do I complete a New Jersey Deed form?

Completing a New Jersey Deed form involves several steps:

- Gather necessary information, including the names of the grantor and grantee, the property description, and any relevant legal details.

- Choose the appropriate type of deed based on your situation.

- Fill out the form accurately, ensuring all information is correct and complete.

- Sign the deed in the presence of a notary public. This step is crucial, as notarization validates the document.

- File the completed deed with the county clerk's office where the property is located to make the transfer official.

Are there any fees associated with filing a Deed in New Jersey?

Yes, there are fees associated with filing a Deed in New Jersey. These fees can vary depending on the county and the type of deed being filed. Typically, you may encounter the following costs:

- Recording fee: Charged by the county clerk for processing the deed.

- Transfer tax: A tax imposed on the transfer of property, which may vary based on the property's value.

- Notary fees: If you require a notary public to witness your signature, there may be a small fee for their services.

It’s advisable to check with your local county clerk's office for the most accurate and current fee schedule.