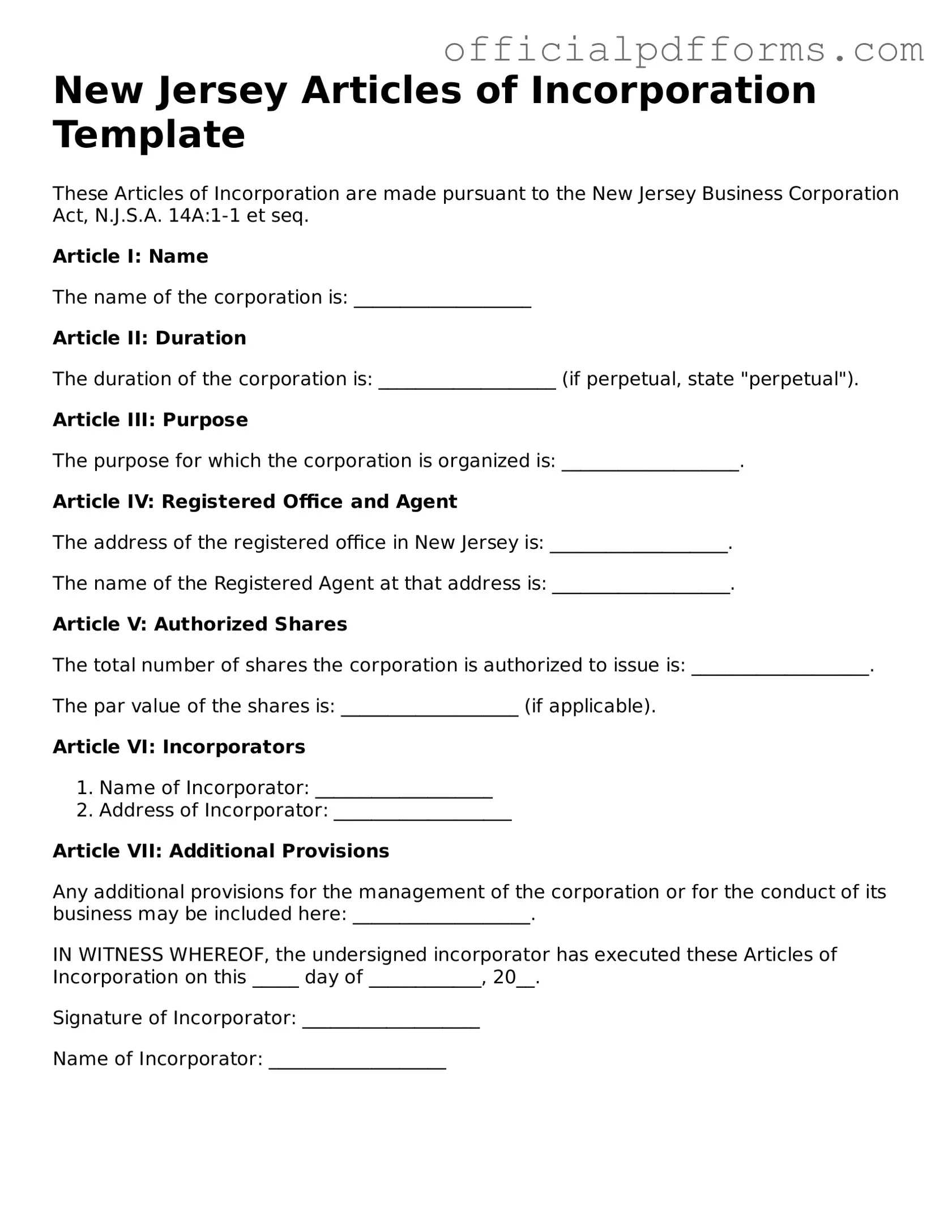

Printable New Jersey Articles of Incorporation Template

Find Other Popular Articles of Incorporation Templates for Specific States

Ga Corporation - This document is a key part of the legal framework that governs corporate actions.

When completing a transaction for a motorcycle, it's important to use a New York Motorcycle Bill of Sale to ensure clarity and security for both the buyer and seller. This essential document outlines the sale's specifics, including the motorcycle's details, the transaction date, and the price. Furthermore, resources like OnlineLawDocs.com can provide valuable assistance in obtaining or understanding this form, making the process smoother for all parties involved.

Ohio Business Central - Share structure is described, including types and number of shares authorized.

Misconceptions

Here are five common misconceptions about the New Jersey Articles of Incorporation form:

- All businesses must file Articles of Incorporation. Many people believe that every type of business entity needs to file this form. However, only corporations are required to submit Articles of Incorporation. Other business structures, like sole proprietorships and partnerships, do not need to file this form.

- The form is the same for all states. Some assume that Articles of Incorporation are uniform across the United States. In reality, each state has its own specific requirements and forms. New Jersey's form may differ significantly from those in other states.

- Filing Articles of Incorporation guarantees business success. While this form is essential for establishing a corporation, it does not ensure that the business will thrive. Success depends on various factors, including market demand, management, and financial planning.

- Once filed, Articles of Incorporation cannot be changed. There is a belief that the information in the Articles is permanent. In fact, corporations can amend their Articles of Incorporation if there are changes in the business structure or other important details.

- Legal assistance is mandatory to file the form. Some think that hiring a lawyer is necessary to complete the Articles of Incorporation. While legal advice can be helpful, many individuals successfully file the form on their own with the right resources and information.

Documents used along the form

When forming a corporation in New Jersey, the Articles of Incorporation is just the beginning. Several other documents may be necessary to ensure that your corporation is compliant with state laws and operates smoothly. Here’s a list of commonly used forms and documents that accompany the Articles of Incorporation.

- Bylaws: This document outlines the internal rules and procedures for managing the corporation. It typically includes information about the board of directors, meetings, and voting procedures.

- Initial Report: Some states require an initial report that provides basic information about the corporation, including its address and the names of its officers. This may need to be filed shortly after incorporation.

- Employer Identification Number (EIN): An EIN is essential for tax purposes. It is a unique number assigned by the IRS that allows your corporation to open a bank account, hire employees, and file taxes.

- State Business License: Depending on the nature of your business, you may need to obtain a state business license or permit to operate legally in New Jersey.

- Employment Verification Form: This document is crucial for confirming an individual's employment status and is often required by lenders, landlords, or future employers. For more information, visit smarttemplates.net/fillable-employment-verification/.

- Operating Agreement: While more common in LLCs, an operating agreement can also be beneficial for corporations. It details the management structure and operating procedures of the business.

- Meeting Minutes: Keeping records of meetings, especially the initial organizational meeting, is important. Minutes document decisions made and actions taken, ensuring transparency and accountability.

- Shareholder Agreements: If your corporation has multiple shareholders, a shareholder agreement can help define the rights and responsibilities of each shareholder, including how shares can be sold or transferred.

Understanding these documents and their purposes can help you navigate the incorporation process more effectively. Properly completing and filing these forms will set a strong foundation for your new corporation, ensuring compliance and promoting successful operation in the future.

Steps to Filling Out New Jersey Articles of Incorporation

After you complete the New Jersey Articles of Incorporation form, you will need to submit it to the appropriate state office along with the required filing fee. This step is crucial for officially establishing your corporation in New Jersey.

- Obtain the New Jersey Articles of Incorporation form from the New Jersey Division of Revenue and Enterprise Services website or your local office.

- Fill in the name of your corporation. Ensure it complies with New Jersey naming requirements.

- Provide the principal address of the corporation. This should be a physical address, not a P.O. Box.

- List the registered agent's name and address. This person or entity will receive legal documents on behalf of the corporation.

- Specify the purpose of the corporation. Be clear and concise about the business activities.

- Indicate the number of shares the corporation is authorized to issue. Include the par value of the shares if applicable.

- Provide the names and addresses of the incorporators. These are the individuals responsible for setting up the corporation.

- Sign and date the form. Ensure that the signature is from one of the incorporators.

- Prepare the filing fee. Check the New Jersey Division of Revenue and Enterprise Services website for the current fee amount.

- Submit the completed form and payment to the New Jersey Division of Revenue and Enterprise Services, either online or by mail.

Common mistakes

-

Not providing a clear name for the corporation. The name must be unique and distinguishable from other registered entities in New Jersey.

-

Forgetting to include the purpose of the corporation. A brief description of what the business will do is essential.

-

Neglecting to specify the registered agent. This person or business must be located in New Jersey and will receive legal documents on behalf of the corporation.

-

Failing to list the initial directors. The form requires the names and addresses of the individuals who will serve on the board of directors.

-

Omitting the duration of the corporation. Most corporations are set up to exist indefinitely, but this should be stated clearly.

-

Not providing the correct address for the principal office. This address must be a physical location and cannot be a P.O. Box.

-

Incorrectly calculating the filing fee. The fee varies based on the type of corporation, and it must be included with the submission.

-

Ignoring the requirement for signatures. The form must be signed by the incorporators, and missing signatures can delay the process.

-

Submitting the form without reviewing it for errors. Typos or missing information can lead to rejection or delays in processing.

Get Clarifications on New Jersey Articles of Incorporation

What is the New Jersey Articles of Incorporation form?

The New Jersey Articles of Incorporation form is a legal document that establishes a corporation in the state of New Jersey. By filing this form, you officially create a corporation, which is a separate legal entity from its owners. This means the corporation can enter contracts, own property, and be liable for its debts independently of its shareholders.

Who needs to file the Articles of Incorporation?

Anyone looking to start a corporation in New Jersey must file the Articles of Incorporation. This includes individuals or groups planning to operate a business, non-profit organizations, and professional corporations. If you want to limit personal liability and enjoy certain tax benefits, incorporating is a crucial step.

What information is required on the form?

When completing the Articles of Incorporation, you will need to provide several key pieces of information, including:

- The name of the corporation, which must be unique and not already in use.

- The purpose of the corporation, which can be general or specific.

- The registered agent's name and address, who will receive legal documents on behalf of the corporation.

- The number of shares the corporation is authorized to issue.

- The names and addresses of the initial directors.

How do I file the Articles of Incorporation?

Filing the Articles of Incorporation can be done online or by mail. To file online, visit the New Jersey Division of Revenue and Enterprise Services website. If you prefer to file by mail, download the form, complete it, and send it to the appropriate address along with the required filing fee. Ensure all information is accurate to avoid delays.

What is the filing fee for the Articles of Incorporation?

The filing fee for the Articles of Incorporation in New Jersey varies depending on the type of corporation you are forming. Generally, the fee ranges from $125 to $150. Be sure to check the latest fee schedule on the New Jersey Division of Revenue and Enterprise Services website, as fees may change.

How long does it take for the Articles of Incorporation to be processed?

Processing times for the Articles of Incorporation can vary. Typically, if you file online, you may receive confirmation within a few business days. Mail filings can take longer, often up to two weeks or more. For faster processing, consider opting for expedited services if available.