Fill in a Valid Netspend Dispute Form

Common PDF Forms

Medicare Abn Form Pdf - This form is crucial for managing beneficiaries’ expectations regarding reimbursement for care.

When engaging in the sale of an RV, it is crucial to utilize a properly formatted Texas RV Bill of Sale to ensure a smooth transaction. This document not only establishes clear ownership transfer but also serves as a legal safeguard for both the buyer and seller. For more information on how to create or download this essential form, visit OnlineLawDocs.com.

Employer's Quarterly Federal Tax Return - The IRS provides guidelines for filing, ensuring employers can navigate the process efficiently.

Panel Schedule - Assists in ensuring balanced load distribution across circuits.

Misconceptions

Understanding the Netspend Dispute form is crucial for cardholders who wish to address unauthorized transactions effectively. However, several misconceptions can lead to confusion and delays in resolving disputes. Here are eight common misconceptions:

- The form must be submitted immediately. While it is important to act quickly, you have up to 60 days from the transaction date to submit the form.

- All unauthorized transactions are automatically credited. A decision will be made within 10 business days, but not all disputes guarantee a credit.

- You can dispute more than five transactions on one form. The form allows for the submission of up to five transactions at a time; exceeding this limit requires additional forms.

- Providing supporting documentation is optional. While not strictly required, including documentation can significantly assist in the determination of your dispute.

- You will not be liable for any unauthorized transactions. If your card was lost or stolen, you may still be liable for transactions made before you reported the loss.

- Contacting the merchant is unnecessary. You must indicate whether you have contacted the merchant, as this information is relevant to the dispute process.

- Resetting your PIN is not important. It is highly recommended to reset your PIN after reporting your card as lost or stolen to prevent further unauthorized use.

- Filing a police report is not required. While it is not mandatory, submitting a police report can strengthen your case and provide additional evidence.

Being aware of these misconceptions can help you navigate the dispute process more effectively. Take the time to understand the requirements and act promptly to protect your financial interests.

Documents used along the form

When you’re dealing with a dispute regarding unauthorized transactions on your Netspend card, the Dispute Notification Form is just the beginning. A few other important documents can help strengthen your case and ensure a smoother process. Here’s a look at some forms and documents that often accompany the Dispute Notification Form.

- Police Report: If your card was lost or stolen, filing a police report is crucial. This document serves as official proof of the incident and can significantly support your dispute claim.

- Transaction Receipts: Keeping copies of receipts for your transactions can help verify your claims. If you have receipts for the disputed transactions, include them to clarify your case.

- Email Correspondence: Any emails exchanged with merchants regarding the disputed transactions can provide valuable context. This documentation can show attempts to resolve the issue directly with the merchant.

- Vehicle Purchase Agreement: For those looking to secure their vehicle transactions, our official Vehicle Purchase Agreement template provides essential documentation for clarity and compliance.

- Shipping or Tracking Information: If the dispute involves a purchase that was never received, include shipping or tracking information. This can help substantiate your claim that the transaction was unauthorized.

- Cancellation Confirmation: If you canceled a service or order related to the disputed transaction, include any confirmation of that cancellation. It can strengthen your argument that you did not authorize the charge.

- Identity Theft Report: If you suspect that your identity has been compromised, filing an identity theft report can be beneficial. This document provides evidence of unauthorized use and can assist in your dispute process.

- Affidavit of Fraud: In some cases, you may be asked to complete an affidavit declaring that the transaction was fraudulent. This sworn statement can be an important part of your documentation.

By gathering these documents and submitting them alongside your Dispute Notification Form, you can create a comprehensive case that may expedite the resolution process. Remember, thorough documentation not only aids in your dispute but also provides peace of mind during what can be a stressful situation.

Steps to Filling Out Netspend Dispute

After completing the Netspend Dispute form, you will submit it to initiate the process of disputing unauthorized transactions. It’s important to act quickly, as you have a limited time frame to submit your request. Once Netspend receives your form, they will review it and typically make a decision within ten business days.

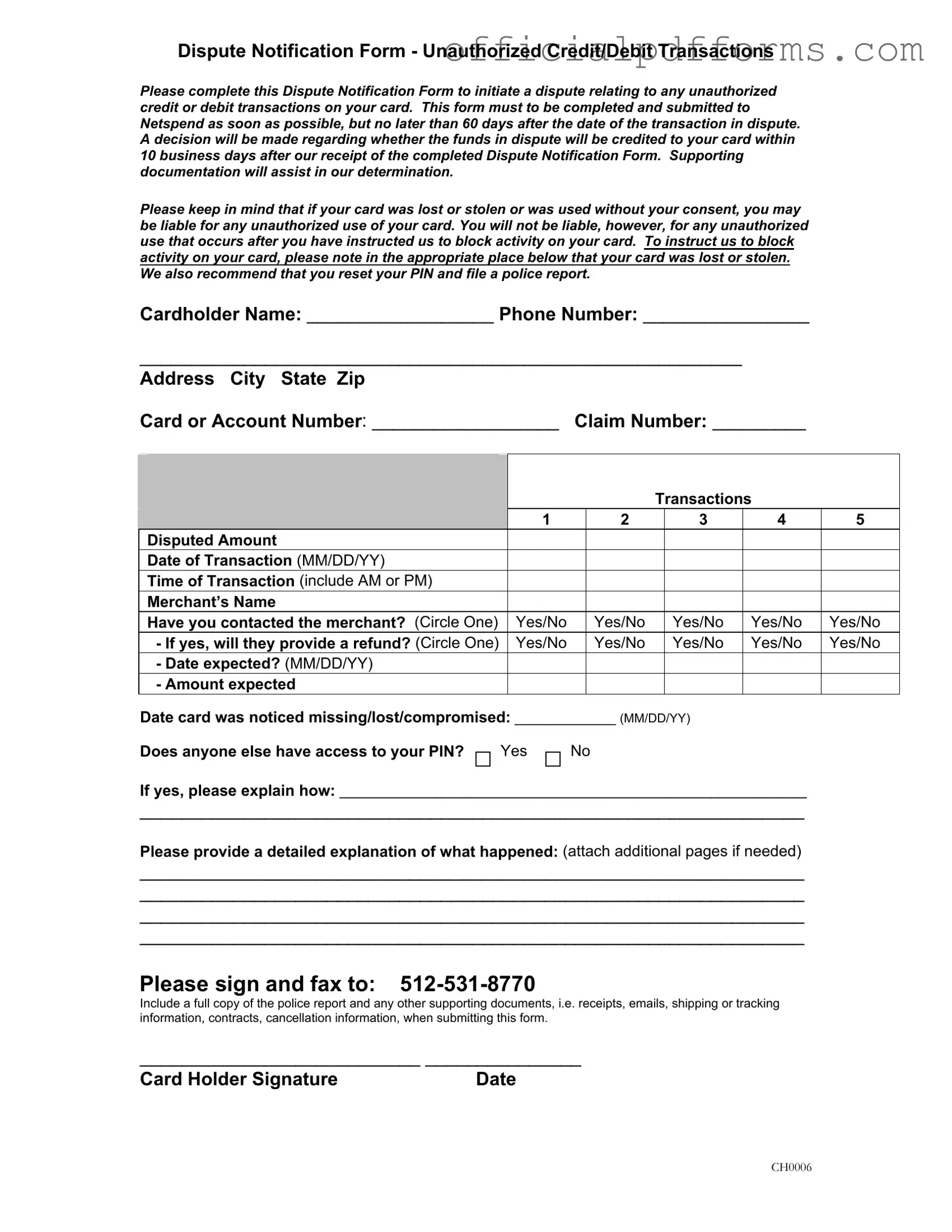

- Begin by entering your Cardholder Name in the designated space.

- Provide your Phone Number for contact purposes.

- Fill in your Address, including City, State, and Zip Code.

- Enter your Card or Account Number in the appropriate field.

- Write your Claim Number, if applicable.

- For each transaction you are disputing (up to five), fill out the following details:

- Disputed Amount

- Date of Transaction (format MM/DD/YY)

- Time of Transaction (include AM or PM)

- Merchant’s Name

- Have you contacted the merchant? (Circle Yes or No)

- If yes, will they provide a refund? (Circle Yes or No)

- Date expected? (if applicable, format MM/DD/YY)

- Amount expected

- Indicate the Date you noticed your card was missing, lost, or compromised (format MM/DD/YY).

- Answer whether anyone else has access to your PIN by selecting Yes or No.

- If you answered Yes, provide an explanation of how they have access.

- Write a detailed explanation of what happened regarding the unauthorized transactions. Attach additional pages if necessary.

- Sign the form and include the Date of your signature.

- Fax the completed form to 512-531-8770.

- Include a full copy of the police report and any supporting documents, such as receipts or emails, when submitting the form.

Common mistakes

-

Not Submitting Within the Time Limit: One of the most common mistakes is failing to submit the dispute form within 60 days of the transaction date. If you wait too long, you risk losing your chance to have the issue resolved.

-

Incomplete Information: Leaving out essential details can delay the processing of your dispute. Ensure that you fill in all required fields, including your contact information, card number, and a detailed explanation of the transaction.

-

Neglecting Supporting Documentation: Many people forget to attach necessary documents. Including receipts, emails, or police reports can strengthen your case and expedite the review process.

-

Failing to Contact the Merchant: Not reaching out to the merchant before filing a dispute is a mistake. If the merchant is willing to issue a refund, it may resolve the issue without needing to go through the dispute process.

-

Ignoring PIN Access Issues: If someone else has access to your PIN, it's crucial to disclose this information. Failing to mention this can complicate your case and may lead to liability for unauthorized transactions.

Get Clarifications on Netspend Dispute

What is the purpose of the Netspend Dispute Notification Form?

The Netspend Dispute Notification Form is designed for cardholders to report unauthorized credit or debit transactions. If you notice any charges on your account that you did not authorize, completing this form is the first step in disputing those transactions. It is essential to submit the form as soon as possible, ideally within 60 days of the transaction date.

How long does it take to resolve a dispute after submitting the form?

Once you submit the completed Dispute Notification Form, Netspend will review your claim. You can expect a decision regarding the disputed funds within 10 business days. This timeframe may vary depending on the complexity of the dispute and the availability of supporting documentation.

What happens if my card was lost or stolen?

If your card has been lost or stolen, it’s crucial to indicate this on the form. Doing so allows Netspend to block any further transactions on your card. You should also reset your PIN and consider filing a police report. You will not be held liable for unauthorized transactions that occur after you report the loss and request to block your card.

What supporting documents should I include with my dispute?

To strengthen your case, it’s advisable to include any relevant supporting documents with your Dispute Notification Form. This can include:

- A full copy of the police report (if applicable)

- Receipts related to the disputed transactions

- Emails or correspondence with the merchant

- Shipping or tracking information

- Contracts or cancellation information

Providing these documents can help expedite the resolution process.

Can I dispute multiple transactions on one form?

Yes, you can dispute up to five transactions on a single Dispute Notification Form. For each transaction, you will need to provide specific details, including the disputed amount, date and time of the transaction, and the merchant’s name. Make sure to answer any related questions for each transaction to ensure a thorough review.