Fill in a Valid Mortgage Statement Form

Common PDF Forms

Florida Realtors Commercial Contract Pdf - This comprehensive document aims to create a fair transaction environment for all parties involved in the commercial real estate industry.

For those in need of a reliable transfer document, a comprehensive Trailer Bill of Sale template can facilitate the process of purchasing or selling a trailer. Access the necessary format at this link to ensure you're fully equipped for the transaction.

Chickfila Jobs - Possesses a cheerful demeanor that enhances customer engagement.

Misconceptions

Understanding the Mortgage Statement form can be challenging. Here are five common misconceptions that often arise:

- All payments are applied immediately. Many believe that when they make a payment, it is applied right away. However, partial payments are held in a suspense account until the full amount is received.

- The late fee is a one-time charge. Some borrowers think that if they pay late once, they will only incur a single late fee. In reality, each month that payment is not received by the due date can result in additional fees.

- Escrow amounts are fixed and unchanging. It is a common assumption that the escrow portion of the payment remains constant. In fact, escrow amounts can fluctuate based on changes in property taxes and insurance premiums.

- All fees are clearly explained on the statement. While the statement does list fees, some borrowers may overlook additional charges that are not explicitly detailed. It is essential to review the transaction activity section for a complete understanding.

- Delinquency notices are only sent after several missed payments. Many assume they will receive a notice only after multiple late payments. However, a delinquency notice may be issued after just one missed payment, alerting borrowers to the potential consequences.

Being informed about these misconceptions can help borrowers manage their mortgage more effectively and avoid unnecessary fees.

Documents used along the form

The Mortgage Statement form is a crucial document for borrowers, providing detailed information about their mortgage account. Alongside this form, there are several other documents that are often utilized in the mortgage process. Each document serves a specific purpose and helps both borrowers and lenders manage the mortgage effectively.

- Loan Agreement: This document outlines the terms and conditions of the mortgage loan, including the loan amount, interest rate, repayment schedule, and any fees associated with the loan. It serves as the legal contract between the borrower and the lender.

- IRS W-9 Form: Completing the smarttemplates.net/fillable-irs-w-9 is essential for ensuring accurate reporting of your taxpayer identification number to those who will be paying you income, thus helping streamline the tax process.

- Truth in Lending Disclosure: This form provides borrowers with important information about the cost of borrowing. It includes details such as the annual percentage rate (APR), total finance charges, and the total amount financed, ensuring transparency in the lending process.

- Escrow Account Statement: This statement details the funds held in escrow for property taxes and homeowners insurance. It shows the amounts collected, disbursed, and any adjustments made, helping borrowers understand their escrow contributions.

- Payment History Report: This report provides a detailed account of all payments made on the mortgage. It includes dates, amounts, and whether payments were made on time, allowing borrowers to track their payment behavior over time.

- Delinquency Notice: If a borrower falls behind on payments, this notice informs them of their delinquent status. It outlines the amount overdue and warns of potential fees or foreclosure if the situation is not rectified.

- Mortgage Payoff Statement: This document indicates the total amount required to pay off the mortgage in full. It includes principal, interest, and any applicable fees, providing borrowers with clarity on their remaining balance.

Understanding these documents can help borrowers navigate their mortgage obligations more effectively. Each plays a vital role in ensuring that both parties are informed and protected throughout the mortgage process.

Steps to Filling Out Mortgage Statement

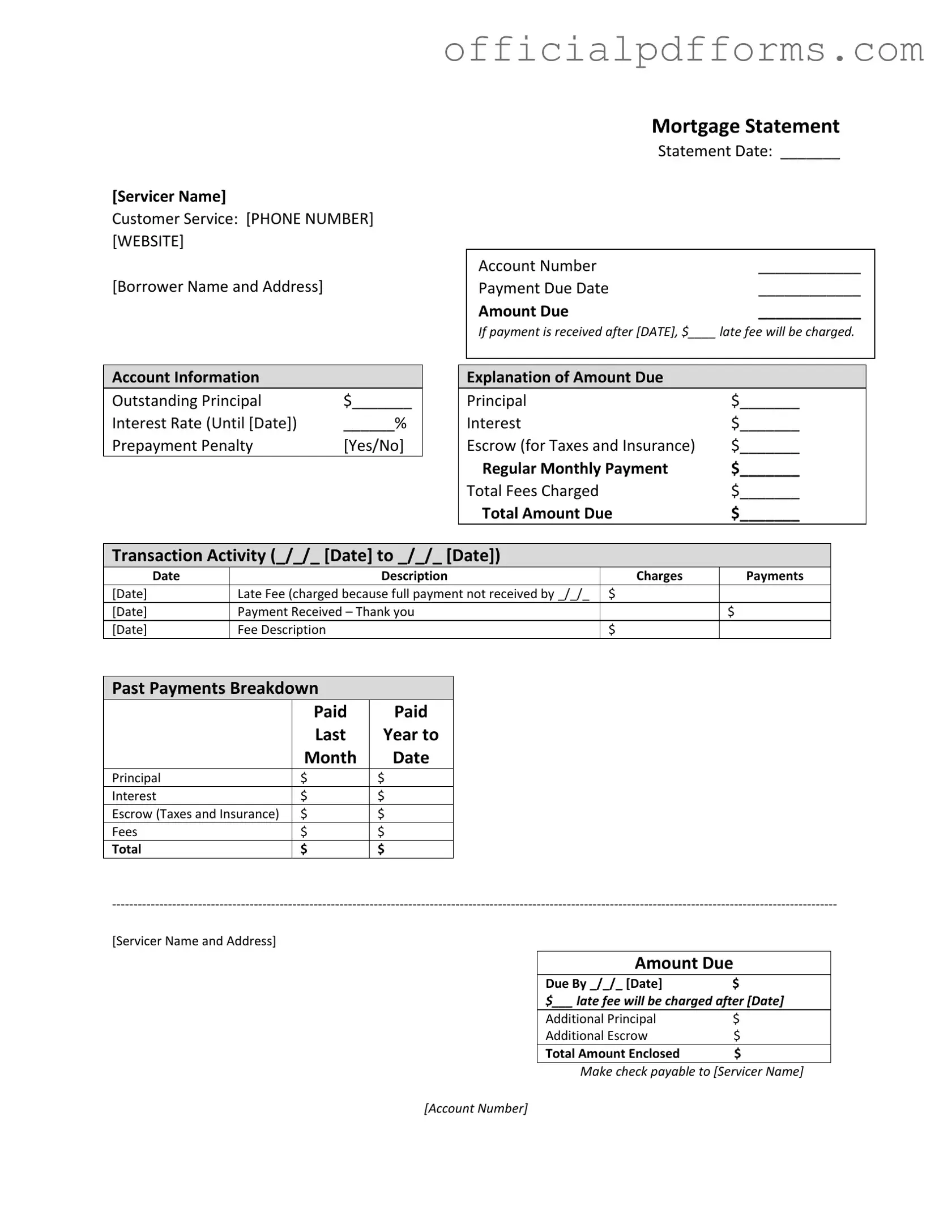

Completing the Mortgage Statement form accurately is essential for managing your mortgage account. This form provides critical information regarding your mortgage payments, outstanding balance, and any fees that may apply. Below are the steps to guide you through filling out the form.

- Servicer Information: At the top of the form, enter the name of the mortgage servicer. Include their customer service phone number and website for your reference.

- Borrower Details: Fill in your name and address as the borrower.

- Statement Date: Write the date of the statement in the designated space.

- Account Number: Enter your mortgage account number clearly.

- Payment Due Date: Specify the date by which your next payment is due.

- Amount Due: Indicate the total amount you owe for this payment period.

- Late Fee Information: If applicable, note the amount of the late fee that will be charged if payment is received after the specified date.

- Account Information: Fill in the outstanding principal balance, interest rate, and whether there is a prepayment penalty.

- Explanation of Amount Due: Break down the total amount due into principal, interest, escrow for taxes and insurance, regular monthly payment, total fees charged, and total amount due.

- Transaction Activity: Document any transactions within the specified date range, including charges, payments, and any late fees that were applied.

- Past Payments Breakdown: Record details of past payments made, including amounts paid towards principal, interest, escrow, and fees.

- Amount Due: Reiterate the amount due and the date by which it must be paid to avoid late fees.

- Payment Instructions: If sending a check, ensure it is made payable to the servicer and include your account number on it.

- Important Messages: Review the important messages section for information on partial payments and delinquency notices.

Once you have filled out the form, review all entries for accuracy. Keeping a copy of the completed form for your records can be beneficial. If you have any questions about specific sections, consider reaching out to the servicer's customer service for assistance.

Common mistakes

-

Incomplete Information: Failing to fill in all required fields, such as the account number or payment due date, can lead to processing delays. Every section of the form must be completed to ensure accurate record-keeping.

-

Incorrect Contact Details: Providing an incorrect phone number or website for customer service can hinder communication. Make sure the information is accurate so you can receive assistance when needed.

-

Missing Signature: Forgetting to sign the form can result in rejection. Always double-check that your signature is included before submitting.

-

Improper Payment Amount: Submitting an incorrect payment amount can lead to additional fees or complications. Be sure to verify the total amount due, including any late fees, before making a payment.

-

Ignoring Late Fees: Not acknowledging the late fee policy may lead to unexpected charges. Understand the terms regarding late payments and ensure that payments are made on time to avoid these fees.

-

Overlooking Escrow Information: Failing to account for escrow amounts for taxes and insurance can result in underpayment. Always include this in your calculations to avoid issues with your mortgage.

-

Neglecting to Review Transaction History: Not checking past payments can lead to confusion regarding your current balance. Review this section to ensure accuracy in your records.

-

Forgetting to Include Additional Payments: If you are making additional principal or escrow payments, be sure to list them. This can help reduce your overall loan balance more quickly.

-

Not Seeking Help When Needed: If you are experiencing financial difficulties, failing to reach out for assistance can exacerbate the situation. Utilize available resources for mortgage counseling to avoid further complications.

Get Clarifications on Mortgage Statement

What is a Mortgage Statement?

A mortgage statement is a document provided by your mortgage servicer. It details your loan account, including the amount you owe, payment due dates, and transaction history. This statement helps you keep track of your mortgage payments and any fees associated with your loan.

What information is included in the Mortgage Statement?

Your mortgage statement includes several key pieces of information:

- Account number

- Outstanding principal balance

- Interest rate

- Payment due date

- Amount due

- Transaction activity

- Recent account history

This information helps you understand your current mortgage status and any payments that need to be made.

What happens if I miss a payment?

If you miss a payment, a late fee will be charged. The amount of the late fee is specified on your mortgage statement. Additionally, missing payments can lead to further consequences, such as foreclosure. It’s important to stay current on your payments to avoid these issues.

What is a partial payment?

A partial payment is any amount less than your total monthly payment. If you make a partial payment, it will not be applied to your mortgage balance. Instead, it will be held in a suspense account until you pay the full amount due. Once you pay the remaining balance, those funds will then be applied to your mortgage.

What is an escrow account?

An escrow account is used to hold funds for property taxes and insurance. Your mortgage statement shows how much is allocated to escrow. This ensures that these important expenses are paid on time, helping you avoid penalties or lapses in coverage.

What is a prepayment penalty?

A prepayment penalty is a fee charged if you pay off your mortgage early. Not all loans have this penalty, so check your mortgage statement to see if it applies to your loan. Understanding this can help you make informed decisions about paying down your mortgage faster.

How can I contact my mortgage servicer?

Your mortgage statement provides contact information for your servicer, including a customer service phone number and website. If you have questions or need assistance, reach out to them directly. They can provide you with specific information related to your account.

What should I do if I'm experiencing financial difficulty?

If you're facing financial challenges, it's crucial to act quickly. Your mortgage statement often includes information about mortgage counseling or assistance programs. These resources can help you understand your options and potentially avoid foreclosure.