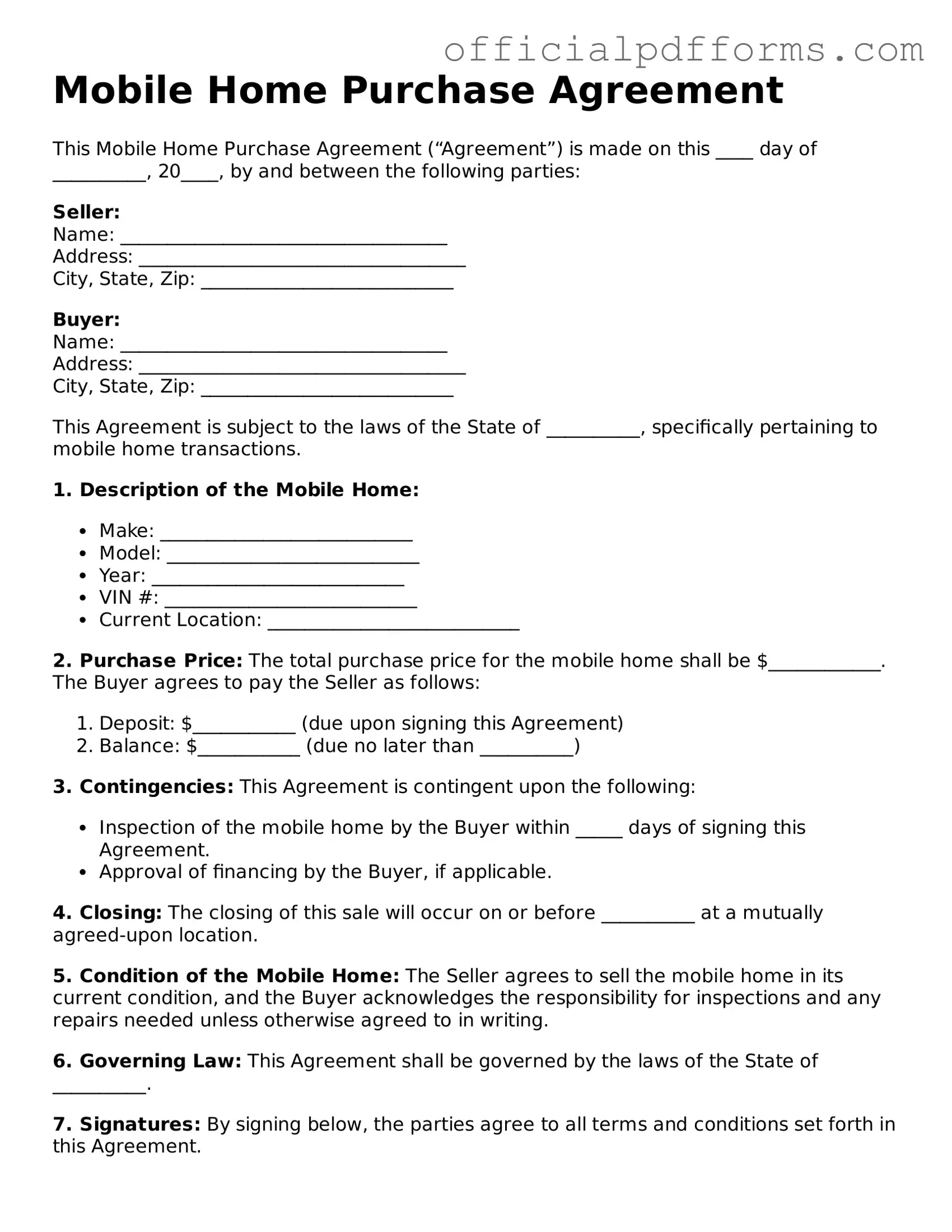

Valid Mobile Home Purchase Agreement Document

Fill out Popular Documents

Medication Administration Record Printable - It serves as a reliable resource for parents and guardians wishing to understand their loved ones' treatment.

Understanding the importance of the Vehicle Release of Liability form can help safeguard your interests during a vehicle sale, ensuring that both parties are clear about their responsibilities. For more information and access to templates, you can visit https://smarttemplates.net, which provides resources to create a comprehensive release document that protects against future claims.

Aircraft Bill of Sale - In some cases, a notarized signature may enhance the document's validity.

Misconceptions

When it comes to purchasing a mobile home, many people hold misconceptions about the Mobile Home Purchase Agreement form. Understanding the truth behind these misunderstandings can help buyers navigate the process more effectively. Here are nine common misconceptions:

- 1. The form is not legally binding. Many believe that a Mobile Home Purchase Agreement is just a casual document. In reality, once signed, it serves as a legally binding contract between the buyer and seller.

- 2. It only covers the price of the mobile home. Some assume the agreement solely addresses the purchase price. However, it often includes terms related to financing, warranties, and other important conditions.

- 3. The form is the same in every state. Many think that the Mobile Home Purchase Agreement is standardized across the country. In truth, requirements can vary significantly by state, reflecting local laws and regulations.

- 4. You don’t need to read it thoroughly. Some buyers skim the document, believing it’s straightforward. It’s essential to read every detail, as misunderstandings can lead to disputes later.

- 5. It can be easily modified after signing. Many people think changes can be made post-signature without consequences. In fact, altering the agreement usually requires consent from both parties and could complicate matters.

- 6. The seller is responsible for all repairs. Some buyers assume that the seller must handle any repairs before the sale. The agreement should specify who is responsible for repairs, and this can vary widely.

- 7. You don’t need a lawyer to review it. Many believe that they can navigate the agreement without legal help. Consulting a lawyer can provide valuable insights and help prevent potential pitfalls.

- 8. It’s only necessary if financing is involved. Some think that the agreement is only needed for financed purchases. Regardless of payment method, having a formal agreement protects both parties.

- 9. The agreement is only for the buyer's protection. Some people believe it only benefits the buyer. In reality, it protects the interests of both the buyer and the seller, ensuring clarity in the transaction.

By addressing these misconceptions, potential buyers can approach the Mobile Home Purchase Agreement with a clearer understanding, leading to a smoother transaction process.

Documents used along the form

When purchasing a mobile home, several important documents accompany the Mobile Home Purchase Agreement to ensure a smooth transaction. These documents provide additional details and protections for both the buyer and seller, making the process clearer and more secure.

- Bill of Sale: This document serves as proof of the sale and transfer of ownership from the seller to the buyer. It typically includes details about the mobile home, such as its make, model, and vehicle identification number (VIN).

- General Bill of Sale: A General Bill of Sale form serves as a legal document that records the transfer of ownership of personal property from a seller to a buyer. It acts as proof of purchase and indicates that the seller has transferred all rights to the property to the buyer. For more information, visit TopTemplates.info.

- Title Transfer Document: This form is crucial for officially transferring the title of the mobile home. It must be filed with the appropriate state department to ensure the buyer is recognized as the new owner.

- Inspection Report: An inspection report outlines the condition of the mobile home. It can help buyers understand any potential issues that may need addressing before finalizing the purchase.

- Financing Agreement: If the buyer is financing the mobile home, this document details the terms of the loan, including interest rates, repayment schedules, and any other conditions agreed upon by the lender and borrower.

Each of these documents plays a vital role in the mobile home buying process. Having them prepared and reviewed can help prevent misunderstandings and ensure that both parties are protected throughout the transaction.

Steps to Filling Out Mobile Home Purchase Agreement

Filling out the Mobile Home Purchase Agreement form is an important step in the process of buying a mobile home. Accurate completion ensures that all parties understand the terms of the sale. Follow these steps to fill out the form correctly.

- Start with the date: Write the date when you are filling out the form at the top.

- Seller Information: Enter the full name and contact details of the seller. Include their address and phone number.

- Buyer Information: Provide your full name and contact details. Include your address and phone number.

- Mobile Home Details: Fill in the make, model, year, and Vehicle Identification Number (VIN) of the mobile home.

- Purchase Price: Clearly state the total purchase price of the mobile home.

- Deposit Amount: Indicate the amount of the deposit, if applicable, and the due date for this payment.

- Financing Terms: If applicable, describe any financing arrangements, including loan details and terms.

- Closing Date: Specify the proposed closing date for the sale.

- Signatures: Both the buyer and seller must sign and date the agreement at the bottom of the form.

Common mistakes

-

Not reading the entire agreement. Many buyers skip sections or gloss over details, which can lead to misunderstandings later.

-

Failing to provide accurate information. Incorrect names, addresses, or other personal details can cause delays or complications in the purchase process.

-

Ignoring the terms of payment. Buyers often overlook how and when payments should be made, which can lead to disputes down the line.

-

Not checking for additional fees. Many agreements include hidden costs such as taxes, maintenance fees, or transfer fees that buyers may not initially notice.

-

Skipping the inspection clause. Failing to include a clause for a home inspection can result in unexpected repairs and expenses after the purchase.

-

Overlooking the warranty details. Buyers may miss important information regarding warranties on the home or appliances, leading to potential issues later.

-

Not understanding the cancellation policy. Many people do not clarify the terms for canceling the agreement, which can lead to financial loss if they change their minds.

-

Neglecting to sign and date the document. This might seem minor, but without signatures, the agreement is not legally binding.

Get Clarifications on Mobile Home Purchase Agreement

What is a Mobile Home Purchase Agreement?

A Mobile Home Purchase Agreement is a legal document that outlines the terms and conditions under which a mobile home is bought and sold. This agreement serves as a binding contract between the buyer and the seller, detailing important aspects of the transaction, such as the purchase price, payment terms, and any contingencies that may apply.

Why do I need a Mobile Home Purchase Agreement?

This agreement is essential for several reasons:

- It protects both the buyer and seller by clearly stating the terms of the sale.

- It helps prevent misunderstandings or disputes regarding the transaction.

- It provides a written record of the agreement, which can be referenced if any issues arise.

What key elements should be included in the agreement?

When drafting a Mobile Home Purchase Agreement, consider including the following key elements:

- Parties Involved: Clearly identify the buyer and seller.

- Property Description: Provide details about the mobile home, including make, model, year, and identification numbers.

- Purchase Price: State the total amount to be paid for the mobile home.

- Payment Terms: Outline how and when payments will be made, including any deposit requirements.

- Contingencies: Include any conditions that must be met for the sale to proceed, such as inspections or financing approval.

- Closing Date: Specify when the transaction will be finalized.

Can I customize the Mobile Home Purchase Agreement?

Yes, the Mobile Home Purchase Agreement can be customized to fit the specific needs of the transaction. While there are standard elements that should be included, parties can add additional clauses or modify existing ones to address unique circumstances. However, it is advisable to ensure that any changes comply with local laws and regulations.

What happens if one party does not fulfill their obligations?

If one party fails to meet the terms outlined in the Mobile Home Purchase Agreement, the other party may have legal options to enforce the agreement. This could involve seeking damages or specific performance, which means compelling the non-compliant party to fulfill their obligations. It is often beneficial to consult with a legal professional if issues arise.

Is it necessary to have the agreement notarized?

Notarization is not always required for a Mobile Home Purchase Agreement, but it can add an extra layer of protection. Having the agreement notarized can help verify the identities of the parties involved and ensure that they signed the document willingly. Some states may have specific requirements regarding notarization, so it is important to check local laws.