Fill in a Valid Louisiana act of donation Form

Common PDF Forms

Coat of Arm - An intricate design that tells the story of personal and cultural roots.

In situations where delivery is expected but the recipient is unavailable, the FedEx Release Form allows for a seamless process by authorizing FedEx to leave packages in designated safe locations. This ensures that deliveries are not delayed or missed, providing peace of mind to the recipient. For more detailed information and to access the form, you can visit https://smarttemplates.net/fillable-fedex-release, where each package can be securely managed with its own release document.

Affidavit of Support - For each person the sponsor is responsible for, a separate I-864 must be completed.

Misconceptions

The Louisiana act of donation form is a legal document that allows individuals to donate property or assets to another person. Despite its straightforward purpose, several misconceptions surround this form. Here are six common misunderstandings:

- 1. The act of donation is only for large assets. Many believe that only significant properties, like houses or large sums of money, can be donated. In reality, the act of donation can apply to any type of property, including personal items, vehicles, or smaller assets.

- 2. The form is only necessary for immediate family members. Some think that the act of donation can only be used between family members. However, anyone can donate to anyone else, regardless of their relationship.

- 3. Donations are not taxable. There is a misconception that all donations are free from taxes. While many donations may not incur immediate taxes, there are potential tax implications, such as gift taxes, that donors should be aware of.

- 4. The act of donation is irrevocable. Many assume that once a donation is made, it cannot be taken back. While donations are generally considered final, there are specific circumstances under which a donor may reclaim the property, such as if the recipient fails to meet certain conditions.

- 5. A notary is not required for the act of donation. Some individuals believe that the form can be completed without a notary. In Louisiana, a notary is typically required to validate the act of donation, ensuring that it is legally binding.

- 6. The act of donation does not require any formalities. There is a misconception that the process is informal and can be done verbally. In fact, the act of donation must follow specific legal requirements to be enforceable, including the use of the proper form and notarization.

Understanding these misconceptions can help individuals navigate the process of donating property more effectively and ensure compliance with Louisiana law.

Documents used along the form

The Louisiana Act of Donation is a legal document that allows an individual to transfer ownership of property to another person without any expectation of payment. This form is often accompanied by several other documents that help clarify the terms of the donation, ensure compliance with state laws, and protect the interests of both the donor and the recipient. Below is a list of common forms and documents that are frequently used alongside the Louisiana Act of Donation.

- Donation Agreement: This document outlines the specific terms and conditions of the donation. It includes details such as the description of the property being donated, the intent of the donor, and any conditions that may apply to the donation.

- Title Transfer Document: This is essential for transferring ownership of real property. It serves as evidence that the donor has relinquished their rights to the property and that the recipient has accepted ownership.

- Affidavit of Identity: This affidavit verifies the identities of both the donor and the recipient. It may be required to prevent fraud and ensure that the parties involved are who they claim to be.

- Property Appraisal: An appraisal may be necessary to establish the fair market value of the property being donated. This information can be crucial for tax purposes and helps both parties understand the value of the transaction.

- Tax Exemption Form: If the donation qualifies for any tax exemptions, this form must be completed and submitted to the appropriate tax authority. It helps ensure that the recipient does not incur unexpected tax liabilities.

- Notarization Certificate: A notarization certificate may be required to validate the signatures on the Act of Donation and other related documents. This adds an extra layer of authenticity to the transaction.

- Witness Statements: In some cases, having witnesses sign the donation documents can provide additional verification of the transaction. These statements can help confirm that the donation was made voluntarily and without coercion.

- Release of Liability Form: Essential for protecting parties involved in hazardous activities, this form helps relinquish the right to sue for injuries sustained during such events, providing peace of mind; more details can be found at https://toptemplates.info.

- Power of Attorney: If the donor is unable to sign the Act of Donation personally, a Power of Attorney document may be necessary. This allows another individual to act on the donor's behalf, ensuring the donation can still proceed.

Each of these documents plays a vital role in the donation process, ensuring that all legal requirements are met and that the interests of both the donor and the recipient are protected. Understanding these forms can significantly streamline the donation process and help avoid potential disputes in the future.

Steps to Filling Out Louisiana act of donation

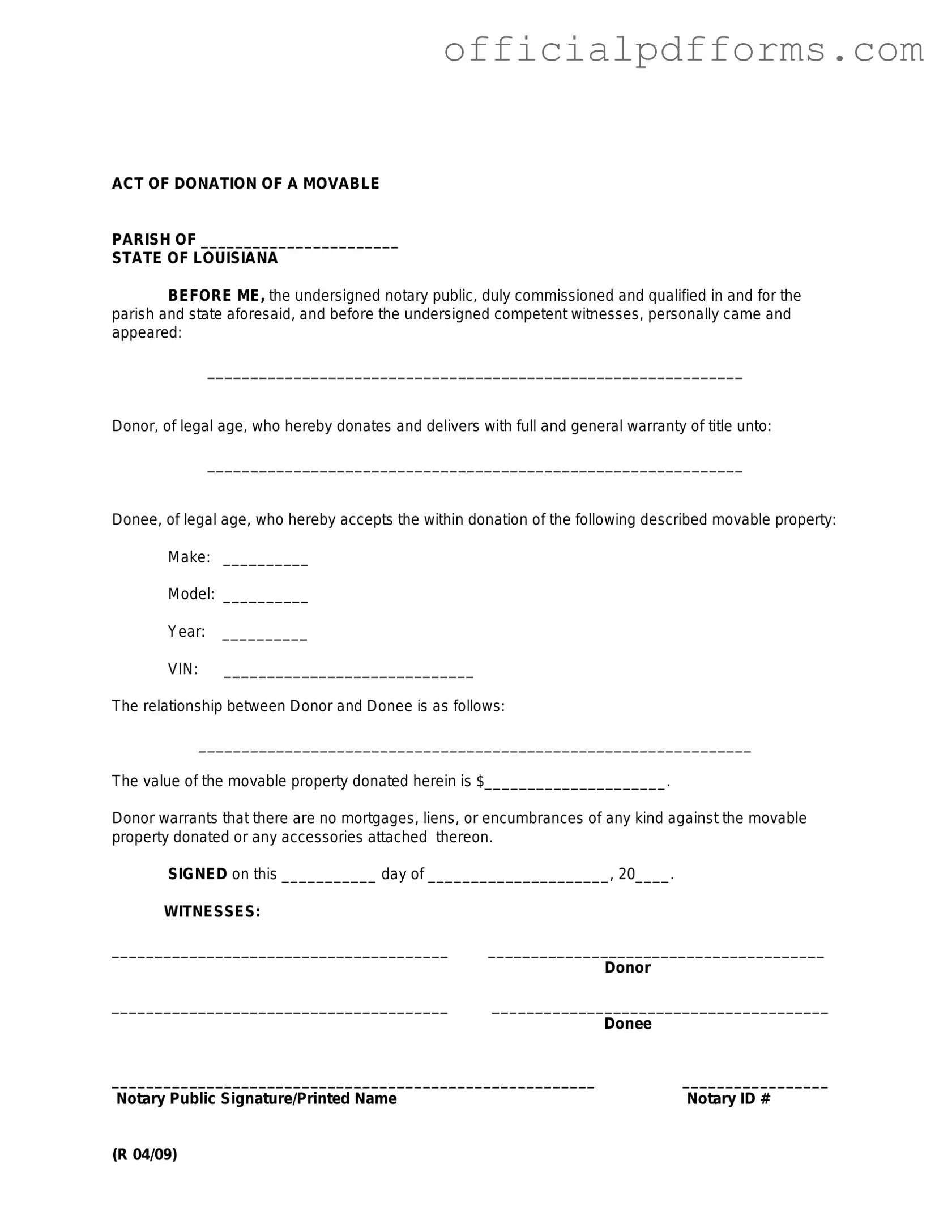

Filling out the Louisiana Act of Donation form is an important step for those wishing to formally donate property or assets. Completing this form accurately ensures that the donation is legally recognized and properly documented. Below are the steps to guide you through the process of filling out the form.

- Begin by obtaining the Louisiana Act of Donation form. You can find it online or at your local courthouse.

- Read through the entire form carefully to understand the requirements and sections that need to be completed.

- In the first section, provide the names and addresses of both the donor and the donee. Ensure that the information is accurate and up-to-date.

- Next, describe the property or assets being donated. Include details such as the type of property, its location, and any relevant identification numbers.

- Indicate the date of the donation. This is typically the date on which the form is signed.

- Sign the form in the designated area. Donors should also print their names below their signatures for clarity.

- Have the form notarized. This step is essential to validate the document legally. Find a notary public who can witness the signing.

- Once notarized, make copies of the completed form for your records and for the donee.

- Submit the original form to the appropriate local government office, if required, to finalize the donation process.

Common mistakes

-

Incomplete Information: Many individuals fail to provide all required details. Ensure every section is filled out, including names, addresses, and property descriptions.

-

Incorrect Signatures: Signatures must match the names on the form. If multiple parties are involved, all must sign. Missing signatures can invalidate the document.

-

Improper Witnessing: The act of donation typically requires witnesses. Not having the correct number of witnesses, or failing to have them sign, can lead to complications.

-

Ignoring Notarization Requirements: Some forms require notarization. Failing to have the document notarized when necessary may render it unenforceable.

-

Incorrect Property Descriptions: Clearly describe the property being donated. Vague or inaccurate descriptions can cause disputes or legal issues later.

-

Failing to Understand Tax Implications: Donors often overlook potential tax consequences. Consulting a tax professional before completing the form can help avoid unexpected liabilities.

Get Clarifications on Louisiana act of donation

What is a Louisiana Act of Donation Form?

The Louisiana Act of Donation Form is a legal document used to transfer ownership of property from one person to another as a gift. This form is particularly important in Louisiana, where the law has specific requirements for donations, especially when it involves immovable property like real estate. The act formalizes the gift and ensures that both parties understand the terms of the donation.

Who can use the Act of Donation Form?

Anyone who wishes to donate property, whether it be real estate, personal belongings, or other assets, can use the Act of Donation Form. However, both the donor (the person giving the gift) and the donee (the person receiving the gift) must be legally competent to enter into a contract. This means they should be of sound mind and at least 18 years old, unless they are legally emancipated minors.

What are the requirements for completing the form?

To complete the Louisiana Act of Donation Form, the following requirements must be met:

- The donor must clearly identify themselves and the donee.

- A detailed description of the property being donated should be included.

- Both parties must sign the document, and it is advisable to have it notarized to ensure legal validity.

- If the donation involves real estate, it may also need to be recorded with the appropriate parish office.

Is the Act of Donation Form legally binding?

Yes, once properly executed, the Act of Donation Form is legally binding. This means that the donor cannot later reclaim the property without the donee's consent. It is essential to ensure that all aspects of the donation are clear and agreed upon to avoid any future disputes.

Can the donation be revoked after the form is signed?

Generally, once the Louisiana Act of Donation Form is signed and delivered, the donation is irrevocable. However, there are certain circumstances under which a donation might be contested or revoked, such as if the donor was not of sound mind at the time of signing or if there was fraud involved. If you are considering revoking a donation, it is advisable to consult with a legal professional.

Do I need a lawyer to complete the Act of Donation Form?

While it is not strictly necessary to have a lawyer to complete the Louisiana Act of Donation Form, it is highly recommended. A legal professional can help ensure that the document is filled out correctly and complies with all state laws. They can also provide guidance on any tax implications or other legal considerations related to the donation.