Valid LLC Share Purchase Agreement Document

Fill out Popular Documents

Photobooth Rental Contract - The agreement highlights the refund policy for any unused services.

When Do You Need a Photo Release Form - This document outlines permissible image usage scenarios.

To ensure a smooth transaction, it is important for sellers and buyers to utilize a General Bill of Sale form, which you can find detailed information about at https://toptemplates.info/bill-of-sale/general-bill-of-sale/, as it provides essential proof of ownership transfer and protects both parties involved.

How to Set Up an Operating Agreement for Llc - It serves as a foundational document for legal protection of the business structure.

Misconceptions

When it comes to the LLC Share Purchase Agreement, several misconceptions can lead to confusion for those involved in business transactions. Here are six common misunderstandings:

-

All LLC Share Purchase Agreements are the same.

Many people believe that all agreements are interchangeable. In reality, each agreement should be tailored to the specific needs and circumstances of the parties involved.

-

Only lawyers can draft these agreements.

While having legal expertise is beneficial, business owners can draft an agreement. However, it is advisable to have a lawyer review it to ensure compliance with state laws.

-

Once signed, the agreement cannot be changed.

This is not true. Parties can negotiate amendments or modifications to the agreement after it has been signed, provided both sides agree.

-

All terms in the agreement are negotiable.

While many terms can be negotiated, some elements may be non-negotiable due to legal requirements or company policies.

-

The agreement only protects the buyer.

This misconception overlooks the fact that a well-drafted agreement protects both the buyer and the seller by clearly outlining rights and obligations.

-

Signing the agreement means the sale is final.

Although signing indicates intent, the sale may still depend on conditions being met, such as financing or regulatory approvals.

Understanding these misconceptions can help parties navigate the complexities of LLC Share Purchase Agreements more effectively.

Documents used along the form

When engaging in the purchase of shares in a Limited Liability Company (LLC), several other documents are often utilized alongside the LLC Share Purchase Agreement. Each of these documents plays a crucial role in ensuring a smooth transaction and protecting the interests of all parties involved.

- Operating Agreement: This document outlines the management structure and operating procedures of the LLC. It details the rights and responsibilities of members, including how profits and losses are distributed.

- Membership Interest Transfer Agreement: This agreement facilitates the transfer of ownership interests in the LLC. It specifies the terms under which the member's interest is sold or transferred to another party.

- Vehicle Release of Liability: This form is vital for indicating that the seller relinquishes responsibility for the vehicle once the transaction is completed. For more information, visit smarttemplates.net.

- Disclosure Statement: This document provides potential buyers with essential information about the LLC's financial status, operations, and any potential liabilities. Transparency is key to building trust in the transaction.

- Due Diligence Checklist: This is a tool used to ensure that all necessary information is gathered and reviewed before completing the purchase. It typically includes financial records, contracts, and compliance documents.

- Escrow Agreement: This agreement outlines the terms under which funds or documents are held by a third party until the conditions of the sale are met. It helps protect both the buyer and seller during the transaction process.

- Tax Clearance Certificate: This document confirms that the LLC has settled all tax obligations. Buyers often require this certificate to ensure there are no outstanding liabilities that could affect their investment.

In summary, these documents collectively support the transaction process and ensure that both buyers and sellers are adequately protected. Understanding each document's purpose can facilitate a smoother negotiation and closing process.

Steps to Filling Out LLC Share Purchase Agreement

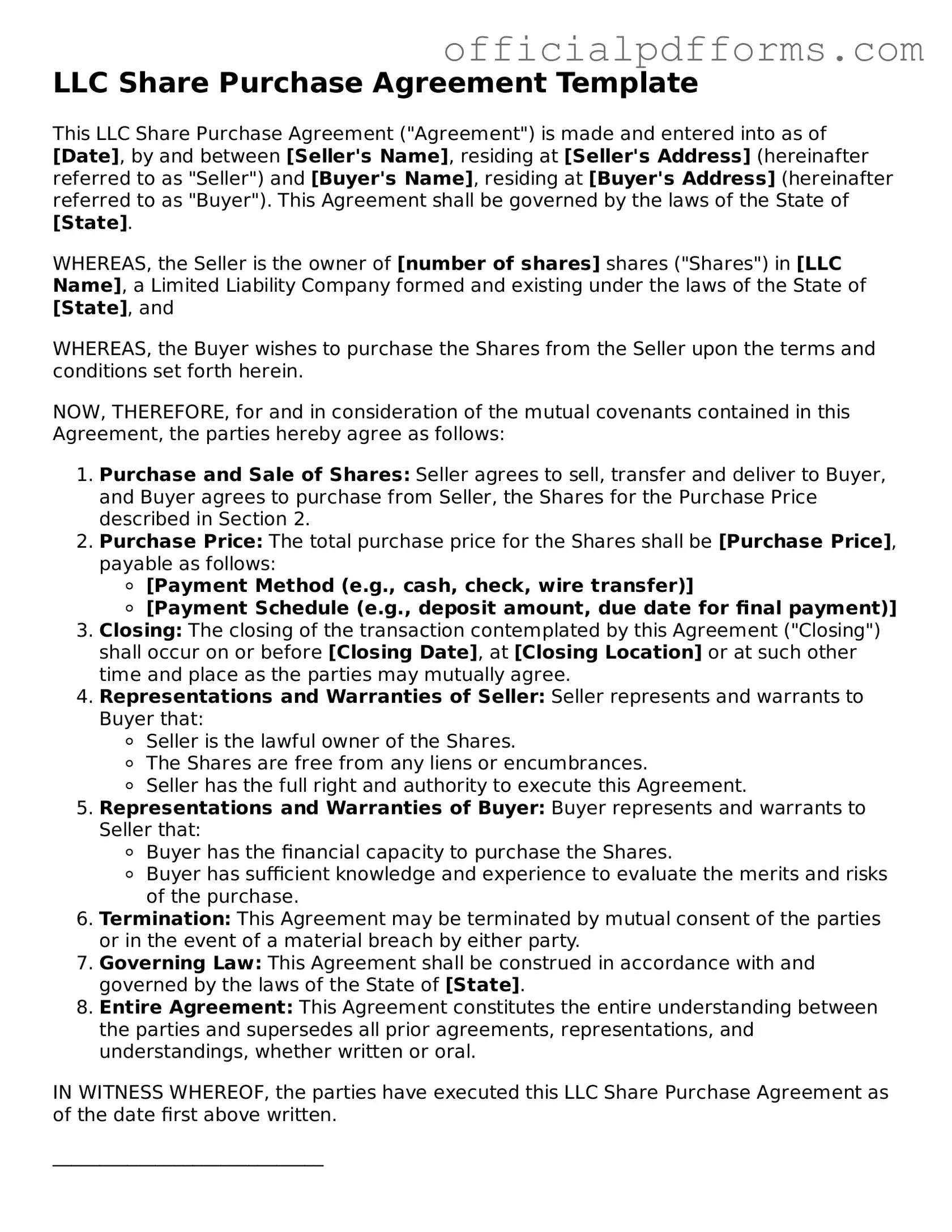

Filling out the LLC Share Purchase Agreement form is an important step in the process of transferring ownership of shares in a limited liability company. This form outlines the terms of the sale and protects both the buyer and seller by clearly defining their rights and responsibilities. Below are the steps to complete the form accurately.

- Begin by entering the date at the top of the form.

- Provide the full legal names of the buyer and seller. Ensure that the names match the names on their respective identification documents.

- Include the address of the buyer and seller. This should be their current residential or business address.

- Specify the number of shares being purchased. Clearly state the quantity and type of shares involved in the transaction.

- Indicate the purchase price for the shares. This should be a clear and specific amount, typically stated in U.S. dollars.

- Outline the payment method. Whether it’s a bank transfer, check, or another method, be specific about how the payment will be made.

- Include any conditions or contingencies related to the sale. If there are specific terms that must be met before the sale can be finalized, detail them here.

- Both parties should sign and date the agreement. Ensure that signatures are legible and that the date reflects when the agreement was signed.

- Consider having the agreement notarized. While not always necessary, notarization can add an extra layer of authenticity to the document.

Once the form is completed, both parties should retain a copy for their records. This document serves as a formal record of the transaction and can be referenced in the future if needed. Properly completing this agreement helps ensure a smooth transfer of ownership.

Common mistakes

-

Failing to include all parties involved in the agreement. Each member's name and role should be clearly stated.

-

Not specifying the purchase price. Clearly stating the amount is essential to avoid future disputes.

-

Omitting the payment terms. Details regarding how and when the payment will be made should be included.

-

Neglecting to outline the conditions of the sale. This includes any contingencies that must be met before the sale is finalized.

-

Using vague language. Clarity is crucial; ambiguous terms can lead to misunderstandings.

-

Not addressing potential liabilities. It is important to specify how liabilities will be handled post-sale.

-

Failing to include a confidentiality clause. Protecting sensitive information is vital for all parties involved.

-

Not having the agreement reviewed by a legal professional. A legal review can help identify potential issues before signing.

-

Neglecting to date the agreement. An undated document can create confusion regarding the timeline of the agreement.

Get Clarifications on LLC Share Purchase Agreement

What is an LLC Share Purchase Agreement?

An LLC Share Purchase Agreement is a legal document that outlines the terms and conditions under which an individual or entity agrees to buy shares in a Limited Liability Company (LLC). This agreement protects both the buyer and the seller by clearly defining the rights and obligations of each party. It typically includes details such as the purchase price, payment terms, and any representations or warranties made by the seller.

Why is an LLC Share Purchase Agreement important?

This agreement is crucial for several reasons:

- Clarity: It provides a clear understanding of the transaction, reducing the potential for disputes.

- Legal Protection: It serves as a legally binding contract that can be enforced in court if necessary.

- Due Diligence: It often includes provisions that require the seller to disclose important information about the LLC, allowing the buyer to make an informed decision.

What key elements should be included in the agreement?

A comprehensive LLC Share Purchase Agreement should include the following elements:

- Parties Involved: Clearly identify the buyer and seller.

- Purchase Price: Specify the amount the buyer will pay for the shares.

- Payment Terms: Outline how and when the payment will be made.

- Representations and Warranties: Include any guarantees made by the seller regarding the LLC's financial status and operations.

- Conditions Precedent: List any conditions that must be met before the sale can be finalized.

How can I ensure the agreement is valid and enforceable?

To ensure the LLC Share Purchase Agreement is valid and enforceable, consider the following steps:

- Consult a Professional: Engage a legal expert to review the agreement and ensure compliance with state laws.

- Signatures: Make sure both parties sign the agreement. This indicates acceptance of the terms.

- Witnesses or Notarization: Depending on your state, having the agreement witnessed or notarized may add an extra layer of validity.