Valid Letter of Intent to Purchase Business Document

Consider More Types of Letter of Intent to Purchase Business Documents

Letter of Intent to Purchase - The Purchase Letter of Intent can identify possible roadblocks before they become formal deal-breakers.

The Alabama Homeschool Letter of Intent form is a document that parents must submit to officially notify the state of their decision to homeschool their children. This form serves as an essential step in the homeschooling process, ensuring compliance with Alabama's educational regulations. By submitting this letter, parents take an important step in shaping their children's educational journey, and they can find the form at hsintentletter.com/alabama-homeschool-letter-of-intent-form/.

Misconceptions

When considering a Letter of Intent (LOI) to purchase a business, several misconceptions can lead to confusion. Understanding these can help you navigate the process more smoothly.

- It is a legally binding contract. Many people believe that an LOI is a binding agreement. In reality, it often serves as a starting point for negotiations and may not be legally enforceable unless specified.

- All terms are set in stone. Some assume that once the LOI is signed, all terms are final. However, the LOI is typically a flexible document, allowing for adjustments as negotiations progress.

- It guarantees the sale. A common misconception is that signing an LOI guarantees the completion of the sale. In truth, it merely indicates intent and does not ensure that the deal will close.

- Only buyers need to sign it. Many think that only the buyer's signature is necessary. In fact, both parties often need to sign the LOI to show mutual interest and agreement on the proposed terms.

- It covers all aspects of the sale. Some believe that an LOI addresses every detail of the transaction. Instead, it typically outlines key points and leaves room for further discussion on finer details.

- It is not necessary. Some people feel that an LOI is an unnecessary step. However, it can be a useful tool to clarify intentions and outline the framework for negotiations.

Documents used along the form

When entering into negotiations for the purchase of a business, several key documents complement the Letter of Intent to Purchase Business. These documents help clarify the terms and intentions of both parties, ensuring a smoother transaction process. Below is a list of commonly used forms that accompany the Letter of Intent.

- Confidentiality Agreement: This document establishes a confidential relationship between the parties involved. It protects sensitive information shared during negotiations, ensuring that proprietary details about the business remain private.

- Purchase Agreement: Once negotiations are finalized, this comprehensive contract outlines the specific terms of the sale. It includes details such as the purchase price, payment terms, and any contingencies that must be met before the transaction can be completed.

- Due Diligence Checklist: This is a tool used to guide the buyer in assessing the business's financial, legal, and operational status. It typically includes a list of documents and information the buyer should review to make an informed decision about the purchase.

- Investment Letter of Intent: This essential document outlines the preliminary agreement between investors and a business regarding proposed investment terms, serving as a roadmap that details key components such as investment amounts, timeline expectations, and conditions that must be met before final agreements are executed. Understanding its importance can facilitate smoother negotiations and lay the groundwork for a successful investment relationship. For more details, visit Top Forms Online.

- Disclosure Statement: This document provides essential information about the business being sold. It includes details about its financial health, liabilities, and any potential risks, helping the buyer understand what they are acquiring.

Each of these documents plays a vital role in the purchasing process, providing clarity and protection for both the buyer and the seller. By understanding their purpose, parties can navigate the complexities of a business acquisition with greater confidence.

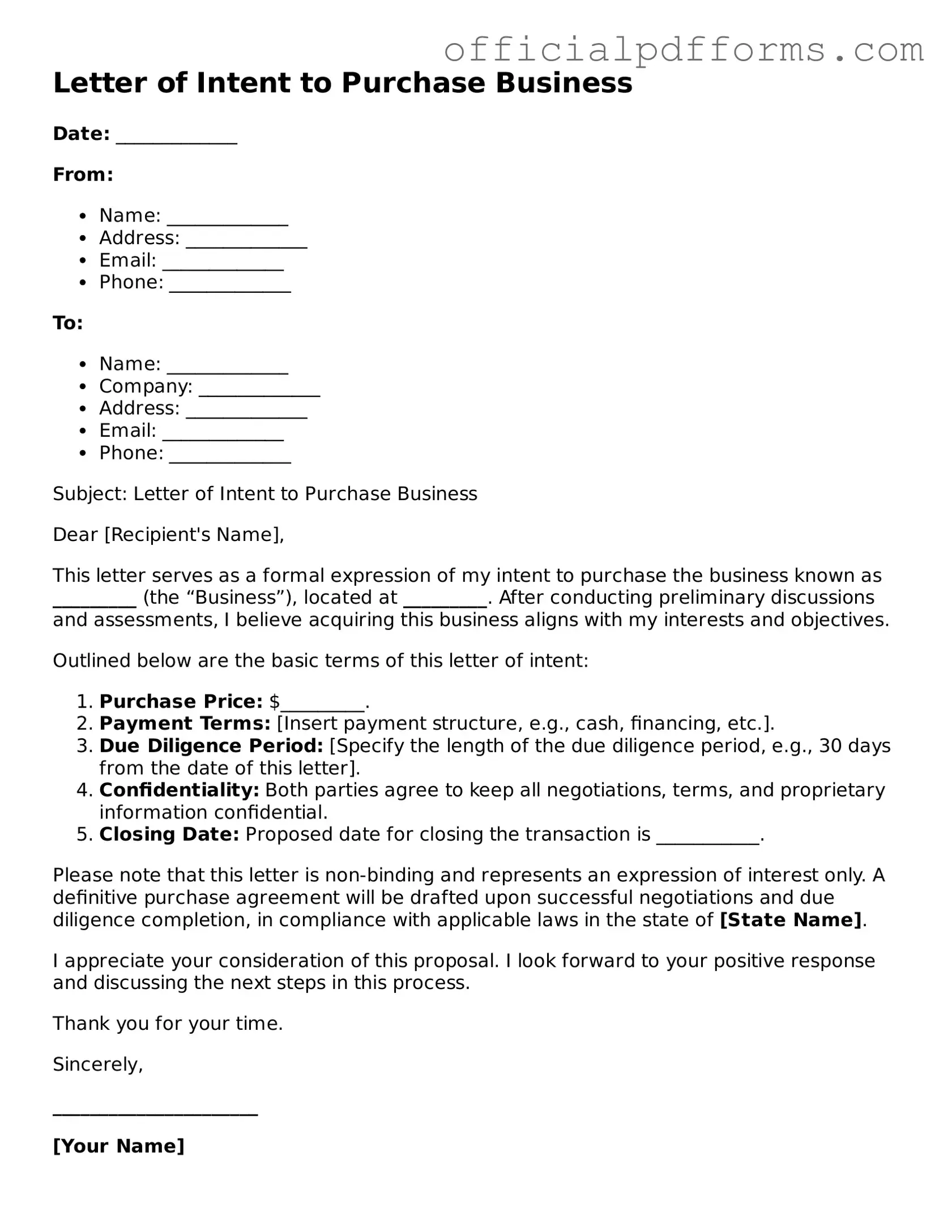

Steps to Filling Out Letter of Intent to Purchase Business

Completing the Letter of Intent to Purchase Business form is an important step in the process of acquiring a business. Once you have filled out the form, you will be able to move forward with negotiations and discussions regarding the purchase. It’s essential to ensure that all information is accurate and clearly presented to avoid any misunderstandings later on.

- Begin by entering the date at the top of the form. This establishes a timeline for your intent.

- Provide your full name and contact information. Include your address, phone number, and email address to ensure clear communication.

- Next, fill in the name of the business you intend to purchase. Be specific and include any relevant details, such as the business's location.

- Clearly state the purchase price you are proposing. This figure should be well-researched and reflect the value of the business.

- Outline any contingencies that may affect the purchase. This could include financing, inspections, or other conditions that must be met.

- Include a timeline for the purchase process. Specify key dates for negotiations, inspections, and closing.

- Sign the form to indicate your commitment. Your signature adds a personal touch and signifies your serious intent.

- Finally, make a copy of the completed form for your records. This will help you keep track of your intentions and any subsequent discussions.

Once you have completed these steps, review the form for accuracy. Ensure that all information is correct and that it reflects your intentions clearly. You are now ready to present this document to the seller and begin discussions about the purchase.

Common mistakes

-

Incomplete Information: One common mistake is failing to provide all required details. Essential information such as the names of the parties involved, the business name, and the purchase price should be clearly stated. Omitting any of these can lead to misunderstandings later.

-

Vague Language: Using ambiguous terms can create confusion. It is crucial to be specific about the terms of the purchase, including payment methods, contingencies, and timelines. Clear language helps ensure that both parties have a mutual understanding of the agreement.

-

Not Including Contingencies: Failing to outline contingencies can be detrimental. Buyers should consider including conditions that must be met before the sale is finalized, such as financing approval or satisfactory inspections. Without these, the buyer may find themselves in a difficult situation.

-

Ignoring Legal Requirements: Some individuals overlook the legal implications of the Letter of Intent. It is advisable to understand the local laws and regulations that may affect the purchase. Ignoring these requirements can lead to legal complications down the road.

-

Not Seeking Professional Advice: Many people attempt to fill out the form without consulting a lawyer or business advisor. Professional guidance can provide valuable insights and help avoid common pitfalls. Engaging with experts can enhance the quality of the document and protect the interests of both parties.

Get Clarifications on Letter of Intent to Purchase Business

What is a Letter of Intent to Purchase Business?

A Letter of Intent (LOI) to Purchase Business is a preliminary document that outlines the intention of one party to buy a business from another. It serves as a starting point for negotiations and establishes the framework for a potential sale. While it is not a legally binding contract, it demonstrates the buyer's serious interest and can include key terms such as the purchase price, payment structure, and any conditions that must be met before the sale can proceed.

What should be included in a Letter of Intent?

When drafting a Letter of Intent, several important elements should be included to ensure clarity and mutual understanding:

- Identification of Parties: Clearly state the names and addresses of both the buyer and the seller.

- Description of the Business: Provide a brief overview of the business being purchased, including its assets, liabilities, and any relevant operational details.

- Purchase Price: Specify the proposed purchase price and the payment terms, such as whether it will be paid in cash, through financing, or a combination of both.

- Due Diligence Period: Outline the timeframe for the buyer to conduct due diligence, which allows them to investigate the business’s financials, operations, and legal standing.

- Confidentiality Agreement: Include a clause that protects sensitive information shared during the negotiation process.

- Timeline: Set forth a timeline for the completion of the transaction, including any key milestones.

Is a Letter of Intent legally binding?

Generally, a Letter of Intent is not legally binding, meaning that it does not create a legal obligation for either party to complete the transaction. However, certain provisions within the LOI, such as confidentiality agreements or exclusivity clauses, may be binding. It is essential for both parties to understand which parts of the document are intended to be enforceable and to consult with legal counsel if there are any uncertainties.

Why is a Letter of Intent important?

A Letter of Intent plays a crucial role in the business acquisition process for several reasons:

- Clarifies Intentions: It helps clarify the intentions of both the buyer and seller, reducing misunderstandings.

- Framework for Negotiations: The LOI provides a framework for further negotiations, allowing both parties to discuss terms in a structured manner.

- Facilitates Due Diligence: By establishing a timeline and expectations, it aids in the due diligence process, ensuring that both parties have adequate time to evaluate the transaction.

- Builds Trust: A well-drafted LOI can foster trust between the parties, indicating that both are serious about the potential transaction.

How long does it take to draft a Letter of Intent?

The time required to draft a Letter of Intent can vary based on the complexity of the transaction and the readiness of both parties to agree on terms. Typically, it can take anywhere from a few days to a couple of weeks. Factors that influence this timeframe include the availability of information, the need for negotiation on specific terms, and the involvement of legal advisors. Open communication between both parties can expedite the process significantly.

Can a Letter of Intent be modified after it is signed?

Yes, a Letter of Intent can be modified after it is signed, but any changes should be documented in writing and agreed upon by both parties. It is advisable to clearly outline any amendments or additions to the original document to avoid confusion. Both parties should retain copies of the original and any modified versions for their records. Consulting with legal counsel during this process can help ensure that all modifications are properly executed and understood.