Valid Last Will and Testament Document

Last Will and Testament Forms for Individual US States

Last Will and Testament Document Subtypes

Fill out Popular Documents

Rv Bill of Sale - The form can help protect both parties in the event of future disputes.

For those looking to navigate the intricacies of transferring ownership, utilizing templates can simplify the process significantly; you can find a useful resource at Top Document Templates.

Deed in Lieu of Foreclosure Template - Streamlines the property relinquishment process, saving time and resources.

Misconceptions

When it comes to Last Wills and Testaments, many individuals harbor misconceptions that can lead to confusion and potential legal issues. Understanding these misconceptions is crucial for anyone considering how to manage their estate. Here are seven common misunderstandings:

- My will does not need to be in writing. Some people believe that verbal agreements are sufficient. In reality, most states require a will to be in writing to be legally valid.

- Only wealthy people need a will. This is a prevalent myth. Regardless of your financial situation, having a will can help ensure that your wishes are honored and that your loved ones are taken care of after your passing.

- I can write my will without any help. While it’s possible to create a will on your own, seeking legal advice can help you navigate complex issues and ensure that your document meets all legal requirements.

- Once I create a will, it cannot be changed. Many believe that a will is set in stone. In fact, you can modify or revoke your will at any time, as long as you are of sound mind.

- My spouse will automatically inherit everything. While many states have laws that favor spouses, this is not universally true. A will can override default inheritance laws, so it’s essential to specify your wishes clearly.

- Having a will avoids probate. This is a common misconception. A will typically must go through the probate process, which can be lengthy and costly. However, certain assets can bypass probate if designated properly.

- My will is valid as long as I sign it. Simply signing a will does not guarantee its validity. Most states require witnesses to sign the will as well, ensuring that the document is authentic and that you were of sound mind when you created it.

By addressing these misconceptions, individuals can better prepare for the future and ensure their wishes are respected. A well-crafted will can provide peace of mind and clarity for loved ones during a challenging time.

Documents used along the form

When planning for the future, a Last Will and Testament is an essential document. However, it often works best in conjunction with other forms and documents that help ensure your wishes are fully carried out. Here’s a look at five important documents that you might consider alongside your will.

- Power of Attorney: This document allows you to appoint someone to make financial or legal decisions on your behalf if you become unable to do so. It can be limited to specific tasks or be broad in scope.

- Asurion F-017-08 MEN Form: To assist with device protection claims, complete the Asurion F-017-08 MEN form for efficient reporting of any issues you may experience with your electronics.

- Healthcare Proxy: Also known as a medical power of attorney, this form designates someone to make healthcare decisions for you if you are incapacitated. It ensures your medical wishes are respected.

- Living Will: A living will outlines your preferences regarding medical treatment in situations where you are unable to communicate your wishes. It typically addresses end-of-life care and life-sustaining measures.

- Trust Document: A trust can hold assets for your beneficiaries and can be structured to provide for them over time. This document can help avoid probate and may offer tax benefits.

- Beneficiary Designations: For certain assets like life insurance policies or retirement accounts, you can specify beneficiaries directly. These designations can override what is stated in your will, so it’s important to keep them updated.

Incorporating these documents into your estate plan can provide clarity and peace of mind. By ensuring that all your wishes are documented and understood, you can help your loved ones navigate what can be a challenging time.

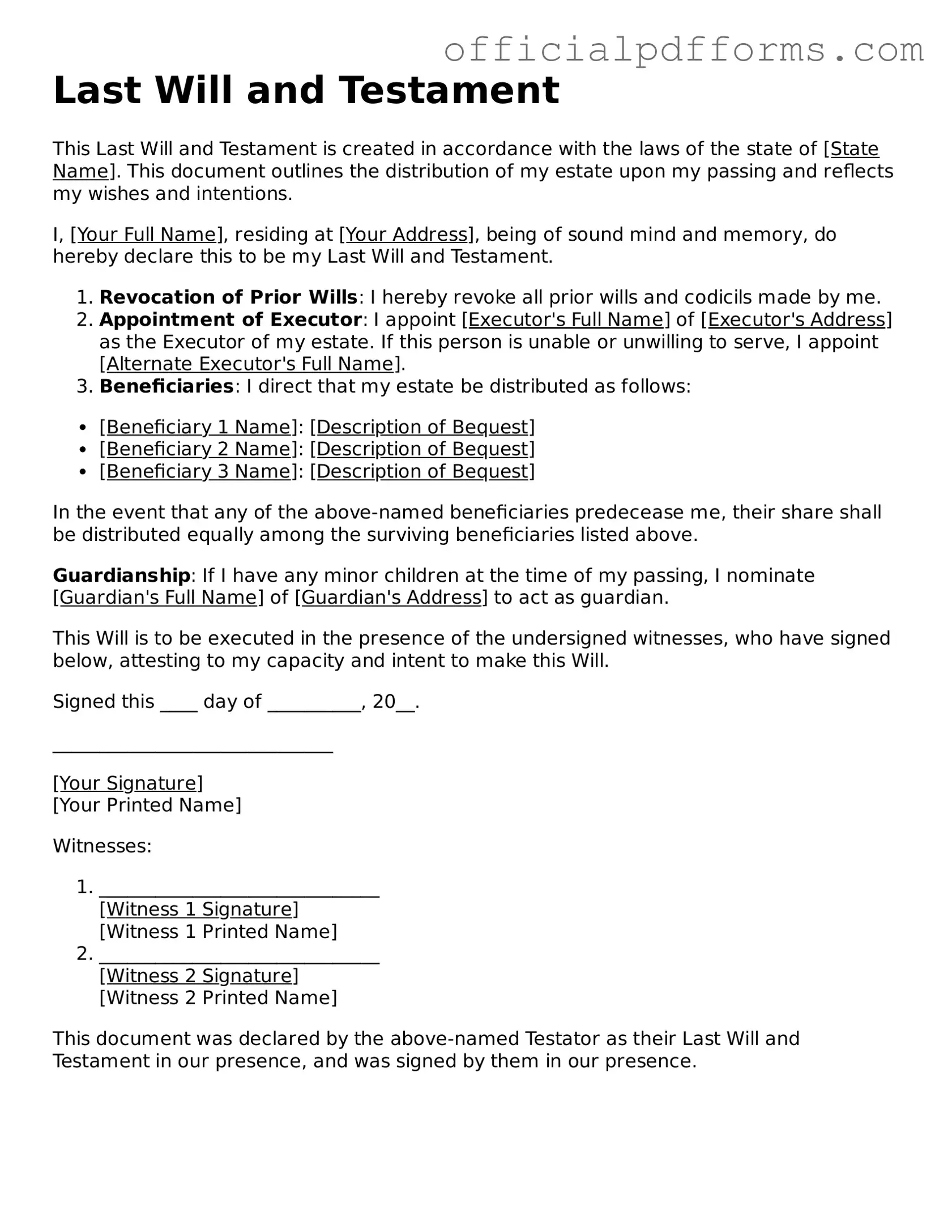

Steps to Filling Out Last Will and Testament

Completing a Last Will and Testament form is an important step in planning for the future. This document outlines your wishes regarding the distribution of your assets and the care of any dependents. After filling out the form, it is advisable to have it reviewed by a legal professional to ensure it meets all necessary requirements.

- Begin by clearly stating your full name and address at the top of the form.

- Identify yourself as the testator, confirming that you are of legal age and sound mind.

- Designate an executor who will be responsible for carrying out the terms of your will.

- List your beneficiaries, including their full names and relationships to you.

- Detail the specific assets you wish to leave to each beneficiary. Be as clear and specific as possible.

- Include provisions for any dependents, specifying guardianship arrangements if applicable.

- Sign and date the document in the presence of witnesses, following your state's requirements for valid signatures.

- Have the witnesses sign the document, including their names and addresses, as required.

- Store the completed will in a safe place and inform your executor of its location.

Common mistakes

-

Not Being Specific with Assets: Many individuals fail to clearly specify what assets they want to distribute. This can lead to confusion and disputes among heirs. It's crucial to list each item and its intended recipient.

-

Overlooking Witness Requirements: Some people forget that a will often needs to be witnessed. Most states require at least two witnesses who are not beneficiaries. Without proper witnesses, the will might not be valid.

-

Neglecting to Update the Will: Life changes, such as marriage, divorce, or the birth of a child, should prompt a review of the will. Failing to update it can result in unintended distributions.

-

Using Ambiguous Language: Vague terms can create uncertainty. Phrases like "my belongings" can lead to different interpretations. Clear and precise language is essential to ensure your wishes are understood.

-

Not Signing the Document Properly: A will must be signed according to state laws. Some individuals forget to sign or do so incorrectly, which can invalidate the entire document.

Get Clarifications on Last Will and Testament

What is a Last Will and Testament?

A Last Will and Testament is a legal document that outlines how an individual's assets and affairs should be handled after their death. It allows a person, known as the testator, to specify who will inherit their property, appoint guardians for minor children, and designate an executor to manage the estate. This document ensures that the testator's wishes are honored and can help prevent disputes among family members.

Who can create a Last Will and Testament?

Any adult who is of sound mind can create a Last Will and Testament. In most states, the individual must be at least 18 years old. It's crucial that the testator understands the implications of the document and is not under any undue influence when drafting it. Those with minor children, significant assets, or specific wishes for their estate should consider creating a will to ensure their desires are clearly communicated.

What happens if someone dies without a Last Will and Testament?

If an individual passes away without a Last Will and Testament, they are said to have died "intestate." In this case, state laws will determine how their assets are distributed. Typically, the estate will be divided among surviving relatives according to a predetermined formula. This can lead to outcomes that may not align with the deceased's wishes, potentially causing family disputes and delays in the distribution of assets.

How can I ensure my Last Will and Testament is valid?

To ensure the validity of a Last Will and Testament, consider the following steps:

- Follow state laws: Each state has specific requirements regarding the creation of a will, including how it must be signed and witnessed.

- Be clear and specific: Clearly outline your wishes to avoid confusion or misinterpretation.

- Update regularly: Review and update your will as life circumstances change, such as marriage, divorce, or the birth of children.

- Consult a professional: While it’s possible to create a will on your own, consulting with an attorney can help ensure that all legal requirements are met and your wishes are effectively communicated.