Valid Lady Bird Deed Document

Lady Bird Deed Forms for Individual US States

Consider More Types of Lady Bird Deed Documents

Wuick Claim Deed - It does not alleviate the responsibility of existing mortgage obligations.

Additionally, utilizing resources like the OnlineLawDocs.com can enhance the quality of your Recommendation Letter form, ensuring it meets the necessary standards and effectively highlights the applicant's credentials and strengths.

Misconceptions

The Lady Bird Deed, also known as an enhanced life estate deed, is a powerful estate planning tool. However, several misconceptions surround its use. Below is a list of ten common misconceptions about the Lady Bird Deed, along with clarifications for each.

- It is only for elderly individuals. Many believe that the Lady Bird Deed is exclusively for seniors. In reality, anyone can use this deed as part of their estate planning, regardless of age.

- It avoids probate completely. While a Lady Bird Deed can help avoid probate for the property it covers, it does not eliminate probate for other assets. It’s important to consider the entire estate.

- It is irrevocable. Some think that once a Lady Bird Deed is executed, it cannot be changed. In fact, the grantor retains the right to revoke or alter the deed at any time during their lifetime.

- It automatically transfers ownership upon death. This is misleading. The property does not transfer until the death of the grantor, but it does avoid the need for probate.

- It can only be used for residential property. Many assume that the Lady Bird Deed is limited to homes. However, it can be used for various types of real estate, including land and commercial properties.

- It affects property taxes negatively. There is a belief that using a Lady Bird Deed will increase property taxes. In most cases, the property tax assessment remains unchanged until the property is sold.

- It is a complex legal document. Some view the Lady Bird Deed as overly complicated. In reality, it is a straightforward form that can be easily understood with the right guidance.

- It is only beneficial for Medicaid planning. While it can be advantageous for Medicaid purposes, its benefits extend beyond that, including general estate planning and asset protection.

- All states recognize the Lady Bird Deed. Not every state has adopted the Lady Bird Deed. It is crucial to verify its availability and legality in your specific state.

- Once the deed is executed, the grantor loses control of the property. This is a common misconception. The grantor maintains full control over the property during their lifetime, including the ability to sell or mortgage it.

Understanding these misconceptions is vital for effective estate planning. Proper guidance can help ensure that the Lady Bird Deed is used to its fullest potential.

Documents used along the form

A Lady Bird Deed is a useful tool for transferring property while retaining certain rights. It often works best when paired with other important documents. Here are some forms and documents that are commonly used alongside a Lady Bird Deed.

- Property Title Deed: This document shows who legally owns the property. It is essential to confirm ownership before making any transfers.

- Operating Agreement: To manage your business's legal structure effectively, utilize the detailed guidelines for your Operating Agreement to ensure all operational and financial aspects are clearly defined.

- Transfer on Death Deed (TOD): Similar to a Lady Bird Deed, this document allows property to pass directly to beneficiaries upon the owner's death, avoiding probate.

- Will: A legal document that outlines how a person wishes their assets to be distributed after death. It can complement a Lady Bird Deed by covering other assets.

- Power of Attorney: This document gives someone the authority to act on behalf of another person. It can be useful if the property owner is unable to manage their affairs.

- Affidavit of Heirship: This document is used to establish the heirs of a deceased person. It may be necessary if the property owner passes away without a will.

- Trust Agreement: This document creates a trust that holds property for the benefit of specific individuals. It can work in tandem with a Lady Bird Deed to manage assets effectively.

Using these documents together can help ensure a smooth transfer of property and provide clarity regarding ownership and rights. Each document plays a unique role in estate planning and property management.

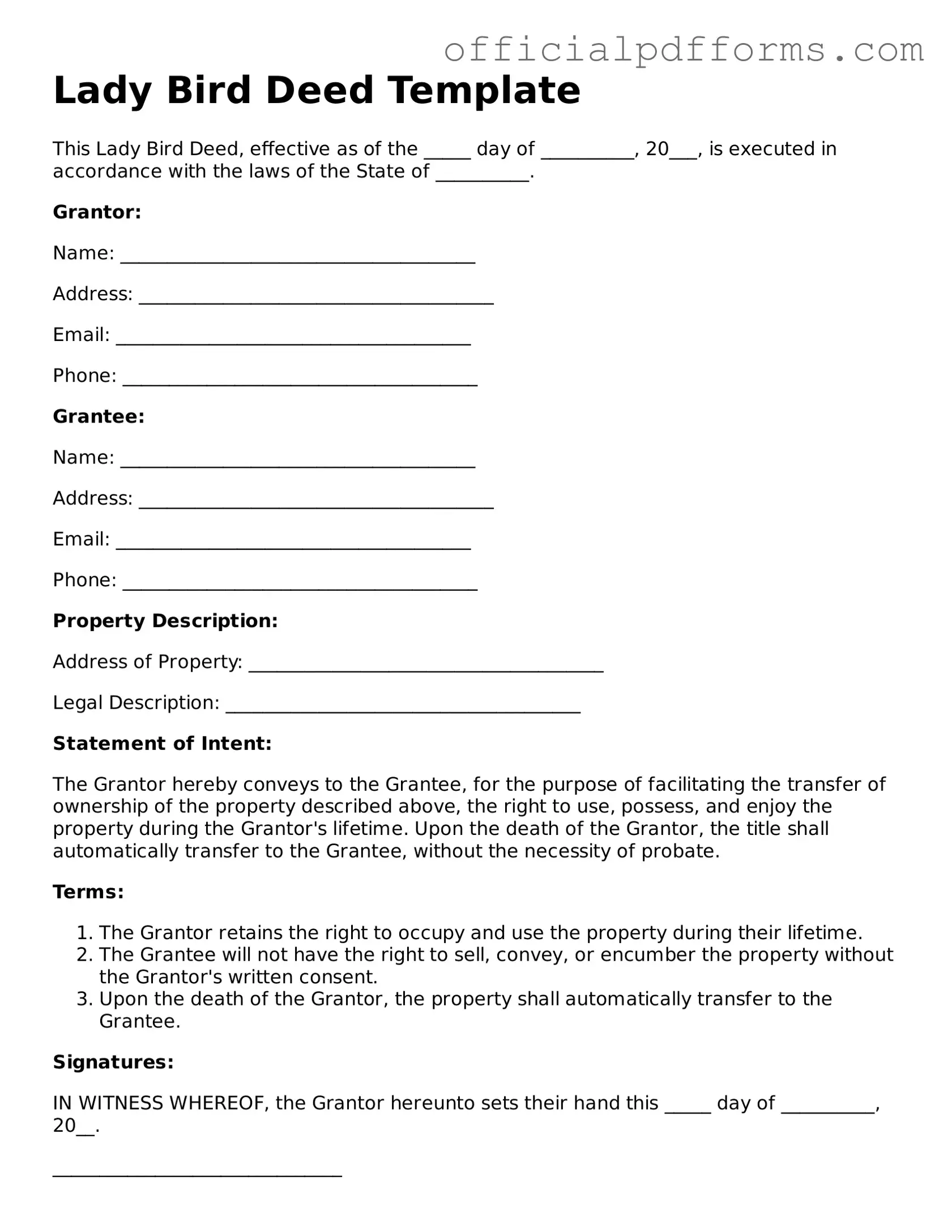

Steps to Filling Out Lady Bird Deed

After obtaining the Lady Bird Deed form, you will need to fill it out carefully. Make sure to have all necessary information on hand. This will ensure a smooth process as you prepare to finalize your deed.

- Begin by entering the name of the property owner at the top of the form.

- Provide the address of the property being transferred.

- List the names of the beneficiaries who will receive the property upon the owner’s passing.

- Indicate the relationship of each beneficiary to the property owner.

- Fill in the date of the deed’s execution.

- Sign the form in the designated area. Ensure that the signature is dated.

- Have the form notarized. A notary public must witness the signing.

- File the completed deed with the appropriate county clerk’s office. Be aware of any filing fees that may apply.

Once you have completed these steps, you will have a properly filled out Lady Bird Deed form ready for submission. Make sure to keep a copy for your records.

Common mistakes

-

Not including all owners: When filling out the Lady Bird Deed, it's crucial to list all current owners of the property. Omitting an owner can lead to disputes and complications in the future.

-

Incorrect property description: Ensure that the property is accurately described. This includes the correct address and legal description. An inaccurate description can cause the deed to be invalid.

-

Failing to sign and date: Both the grantor and any witnesses must sign and date the deed. Without these signatures, the deed may not be legally enforceable.

-

Not considering tax implications: Some individuals overlook potential tax consequences associated with transferring property. It's important to understand how this deed might affect taxes for both the grantor and the beneficiaries.

-

Neglecting to record the deed: After completing the form, it’s essential to record the deed with the appropriate county office. Failing to do so can result in issues with property ownership down the line.

Get Clarifications on Lady Bird Deed

What is a Lady Bird Deed?

A Lady Bird Deed is a legal document that allows a property owner to transfer their property to a beneficiary while retaining the right to live in and control the property during their lifetime. This type of deed helps avoid probate and can offer tax benefits. It is particularly useful for individuals looking to ensure their property passes directly to their heirs without complications.

Who can benefit from using a Lady Bird Deed?

Many people can benefit from a Lady Bird Deed, including:

- Homeowners who want to avoid probate for their property.

- Individuals concerned about Medicaid eligibility and asset protection.

- Those who want to retain control of their property while planning for the future.

- Families looking to simplify the transfer of property to heirs.

How does a Lady Bird Deed work?

The process involves the property owner executing the deed, which names the beneficiary who will receive the property upon the owner's death. The owner retains full rights to the property, including the ability to sell, rent, or modify it. Upon the owner’s passing, the property automatically transfers to the beneficiary without going through probate.

Are there any drawbacks to using a Lady Bird Deed?

While a Lady Bird Deed offers many advantages, there are some potential drawbacks to consider:

- It may not be recognized in all states, so it's important to check local laws.

- If not properly executed, it could lead to disputes among heirs.

- It does not protect the property from creditors after the owner's death.

How do I create a Lady Bird Deed?

Creating a Lady Bird Deed typically involves the following steps:

- Consult with a legal professional to ensure it meets your needs.

- Prepare the deed, including the property description and beneficiary information.

- Sign the deed in front of a notary public.

- Record the deed with the appropriate county office to make it official.

Taking these steps can help ensure a smooth transfer of property in the future.