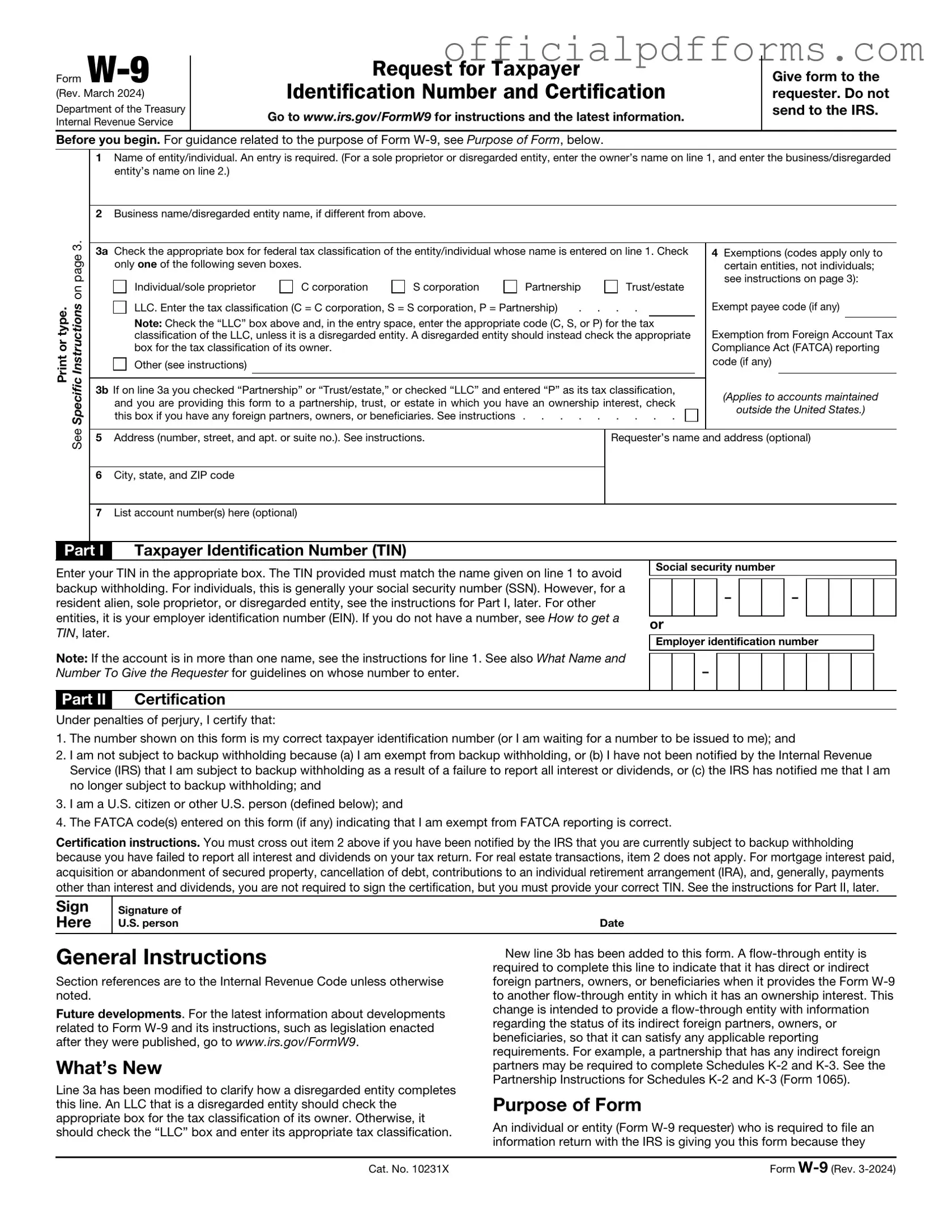

Fill in a Valid IRS W-9 Form

Common PDF Forms

Place of Birth Passport Application - All required documents must be submitted at the time of application.

To simplify the process of transferring ownership, utilize a user-friendly Alabama bill of sale form that provides essential documentation for both parties involved. For more information, visit the complete Bill of Sale guide.

Erc Forms - The analysis reinforces the broker’s expertise in the market.

Misconceptions

The IRS W-9 form is often misunderstood, leading to confusion among taxpayers and businesses alike. Here are seven common misconceptions about the W-9 form, along with clarifications to help demystify its purpose and use.

- Misconception 1: The W-9 form is only for independent contractors.

- Misconception 2: Submitting a W-9 means you will be audited.

- Misconception 3: The W-9 form is a tax return.

- Misconception 4: You must submit a W-9 every year.

- Misconception 5: The W-9 form is only for U.S. citizens.

- Misconception 6: The information on the W-9 is confidential and cannot be shared.

- Misconception 7: Completing a W-9 guarantees you will receive a 1099 form.

While independent contractors frequently use the W-9 form to provide their taxpayer identification information to clients, it is also applicable to other entities, including corporations and partnerships. Any business or individual receiving payments may need to complete this form.

Providing a W-9 does not trigger an audit. The form is simply a means for businesses to collect necessary information for tax reporting purposes. Audits are based on various factors unrelated to the submission of a W-9.

The W-9 is not a tax return. Instead, it is a request for your taxpayer identification number and certification of your tax status. It helps businesses report payments made to you on forms like the 1099.

Generally, you only need to submit a W-9 when requested by a payer or when your information changes. If your name, address, or taxpayer identification number changes, then you should complete a new W-9.

Non-U.S. residents can also complete a W-9 form if they have a U.S. taxpayer identification number. However, non-residents typically use the W-8 form for tax purposes instead.

While the W-9 contains personal information, businesses are required to protect this information. However, they may share it with the IRS or other relevant tax authorities as part of their reporting obligations.

Filling out a W-9 does not guarantee that you will receive a 1099 form. A 1099 is issued only if you meet certain payment thresholds and criteria established by the IRS. If your payments fall below these thresholds, you may not receive a 1099.

Documents used along the form

The IRS W-9 form is essential for individuals and businesses that need to provide their taxpayer identification information to others. This form is often accompanied by various other documents to ensure compliance with tax regulations and to facilitate accurate reporting. Below is a list of some common forms and documents that are frequently used alongside the W-9 form.

- Form 1099-MISC: This form is used to report miscellaneous income paid to individuals or businesses. If you receive payments that meet certain thresholds, the payer will issue a 1099-MISC, which requires your W-9 information.

- Form 1099-NEC: Similar to the 1099-MISC, this form specifically reports non-employee compensation. It is commonly used by independent contractors and freelancers.

- Form 1040: This is the standard individual income tax return form. If you receive income reported on a 1099 form, you will need to include that income when filing your 1040.

- Form 8821: This form allows you to authorize someone else to receive your tax information from the IRS. It may be used if you have a tax professional handling your affairs.

- Form SS-4: This form is used to apply for an Employer Identification Number (EIN). If you are a business entity, you will need an EIN for tax purposes, and the W-9 will require this number.

- Form W-8BEN: This form is for foreign individuals or entities to certify their foreign status. It is used in situations where a foreign party needs to provide their tax information instead of a W-9.

- Form 941: This is the Employer's Quarterly Federal Tax Return, which reports income taxes, Social Security tax, and Medicare tax withheld from employee wages. Businesses often use this form in conjunction with the W-9 for proper tax reporting.

- Arizona ATV Bill of Sale: This legal document is essential for recording the transfer of ownership of an all-terrain vehicle in Arizona and can be filled out conveniently through Top Document Templates.

- Form 1096: This is a summary form used to transmit paper Forms 1099 to the IRS. If you are submitting multiple 1099 forms, you will need to include a 1096 form along with them.

Understanding these forms and their relationships to the W-9 can help ensure that you are compliant with tax regulations. Proper documentation is key to avoiding issues with the IRS and ensuring that all income is reported accurately. If you have questions about these forms, consider consulting a tax professional for guidance.

Steps to Filling Out IRS W-9

After you complete the IRS W-9 form, you will typically provide it to the requester, such as an employer or a financial institution. This form helps them obtain your taxpayer identification information for reporting purposes. Follow these steps to fill it out correctly.

- Download the IRS W-9 form from the official IRS website or obtain a physical copy.

- In the first section, enter your name as it appears on your tax return.

- If applicable, fill in your business name in the second line.

- Select the appropriate box to indicate your federal tax classification (individual, corporation, partnership, etc.).

- Provide your address, including the street address, city, state, and ZIP code.

- Enter your taxpayer identification number (TIN), which can be your Social Security Number (SSN) or Employer Identification Number (EIN).

- If you are exempt from backup withholding, indicate this in the appropriate box.

- Sign and date the form at the bottom. Make sure the date is current.

Once you have filled out the form, review it for accuracy before submitting it to the requester. Keep a copy for your records.

Common mistakes

-

Not providing the correct name. Individuals should use their legal name as it appears on their tax return. If it's a business, the name should match the IRS records.

-

Failing to check the correct tax classification. It's important to identify whether you are an individual, sole proprietor, corporation, or another type of entity.

-

Incorrectly entering the Social Security Number (SSN) or Employer Identification Number (EIN). Double-check these numbers to avoid errors that can lead to delays.

-

Leaving out the address. The IRS needs a current address to send any necessary documents or correspondence.

-

Not signing the form. A signature is required to certify that the information provided is accurate and complete.

-

Failing to date the form. The date indicates when the information was provided, which is important for record-keeping.

-

Using outdated forms. Always ensure you are using the most current version of the W-9 form, as regulations can change.

-

Not providing the correct information for foreign entities. If applicable, additional information may be required for foreign individuals or businesses.

-

Overlooking backup withholding requirements. If you are subject to backup withholding, you must indicate that on the form.

-

Not keeping a copy of the completed form. Retaining a copy is essential for your records and for any future reference.

Get Clarifications on IRS W-9

What is the purpose of the IRS W-9 form?

The IRS W-9 form is used to provide your taxpayer identification information to another party, typically a business or individual who is required to report payments made to you. This form helps the requester accurately report income paid to you to the IRS. It is commonly used by freelancers, contractors, and vendors.

Who needs to fill out a W-9 form?

Individuals or entities that receive income from a business or other payers may need to fill out a W-9 form. This includes:

- Freelancers and independent contractors

- Real estate transactions

- Corporations or partnerships receiving payments

- Any individual or business that is required to report income to the IRS

How do I fill out a W-9 form?

To complete the W-9 form, follow these steps:

- Provide your name as it appears on your tax return.

- Enter your business name if applicable.

- Select the appropriate tax classification (individual, corporation, etc.).

- Fill in your address, including city, state, and ZIP code.

- Provide your taxpayer identification number (Social Security Number or Employer Identification Number).

- Sign and date the form to certify that the information is correct.

When should I submit a W-9 form?

You should submit a W-9 form when requested by a business or individual that will be paying you. This is often done before any payments are made to ensure compliance with tax reporting requirements. It is advisable to submit the form as soon as possible to avoid delays in payment.

What happens to the information on the W-9 form?

The information you provide on the W-9 form is used by the requester to prepare tax documents, such as the 1099 form, which reports income paid to you to the IRS. It is important to keep your information secure, as the W-9 contains sensitive personal data.

Can I refuse to fill out a W-9 form?

While you can technically refuse to fill out a W-9 form, doing so may have consequences. If you do not provide the requested information, the payer may withhold taxes from your payments at a higher rate. Additionally, they may refuse to work with you or delay payments. It is generally in your best interest to complete the form if requested.