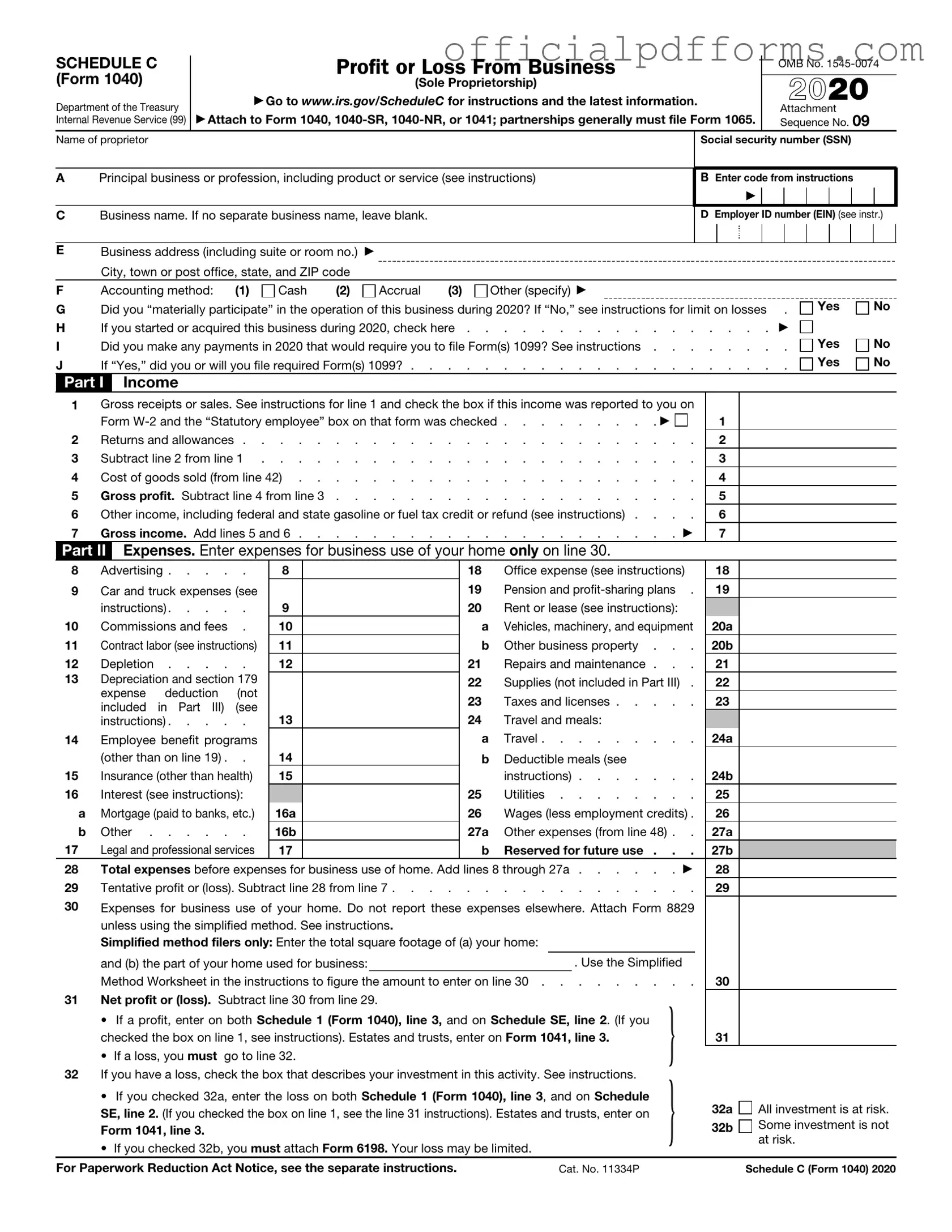

Fill in a Valid IRS Schedule C 1040 Form

Common PDF Forms

Contractor Proposal Form - A great way to showcase the project vision to clients.

For vehicle owners in Texas seeking assistance with their motor vehicle transactions, understanding the implications of the Texas Motor Vehicle Power of Attorney form is crucial. This document authorizes another individual to perform specific duties on behalf of the owner, such as registration, title acquisition, or selling the vehicle. For more information, you can visit OnlineLawDocs.com, which provides resources and guidance on this important form, ensuring that all transactions are handled smoothly and efficiently.

Puppy Health Record - Birth information helps document the puppy’s arrival, including time, date, and weight.

Misconceptions

The IRS Schedule C (Form 1040) is a crucial document for many self-employed individuals and small business owners. However, several misconceptions surround this form. Here are five common misunderstandings:

-

Schedule C is only for large businesses.

This is not true. Schedule C is designed for sole proprietors, which can include freelancers, independent contractors, and small business owners, regardless of the size of their business.

-

You can only deduct expenses if you have a profit.

Many believe that only profitable businesses can deduct expenses. In reality, you can still deduct legitimate business expenses even if your business operates at a loss. This can help reduce your overall tax liability.

-

All income must be reported on Schedule C.

While Schedule C is used to report business income, not all income must go on this form. For example, income from investments or rental properties should be reported on different forms.

-

Filing Schedule C is optional for self-employed individuals.

Some people think that filing Schedule C is optional if they are self-employed. However, if you earn income from self-employment, you are required to report it, and Schedule C is the appropriate form to do so.

-

You can only claim expenses that are directly related to your business.

While it’s true that business expenses must be ordinary and necessary, some may not realize that certain indirect expenses, such as a portion of home office costs, can also be deducted.

Understanding these misconceptions can help you navigate your tax responsibilities more effectively and ensure you take advantage of all available deductions.

Documents used along the form

The IRS Schedule C (Form 1040) is essential for self-employed individuals to report income and expenses from their business activities. However, it is often accompanied by several other forms and documents that help provide a complete financial picture. Below is a list of commonly used forms and documents that complement the Schedule C.

- Form 1040: This is the standard individual income tax return form. It serves as the main document for reporting personal income, including income from self-employment reported on Schedule C.

- Schedule SE: This form is used to calculate self-employment tax. If you earn income from self-employment, you will need to complete this form to determine your tax liability.

- Form 4562: This form is for reporting depreciation and amortization. If you have business assets that depreciate over time, you will need this form to claim those deductions.

- IRS Form 2553: This form is essential for small businesses to elect S corporation status for tax purposes, allowing certain corporations to be taxed as pass-through entities. For detailed guidance on filling out this form, visit smarttemplates.net/fillable-irs-2553/.

- Form 8829: This form is used to calculate expenses for business use of your home. If you operate your business from home, you may be eligible for certain deductions related to your home office.

- Form 1099-MISC: This form reports income received from clients or other businesses. If you earned $600 or more from a client, they are required to issue this form to you, which you will need to report on your Schedule C.

- Receipts and Invoices: Keeping detailed records of all business-related expenses is crucial. Receipts and invoices help substantiate the expenses you claim on your Schedule C.

Using these forms and documents in conjunction with the Schedule C can help ensure accurate reporting of your business income and expenses. Proper documentation not only aids in compliance with tax laws but also maximizes potential deductions, ultimately benefiting your financial situation.

Steps to Filling Out IRS Schedule C 1040

Filling out the IRS Schedule C (Form 1040) is an essential task for self-employed individuals. This form helps report income or loss from a business operated as a sole proprietorship. Completing it accurately is crucial for ensuring compliance with tax obligations. Follow these steps to fill out the form effectively.

- Gather your documents: Collect all necessary financial records, including income statements, receipts, and expense reports.

- Obtain the form: Download the Schedule C form from the IRS website or obtain a physical copy from a tax professional.

- Fill in your basic information: At the top of the form, enter your name, Social Security number, and the name of your business.

- Choose your accounting method: Indicate whether you use cash or accrual accounting for your business.

- Report your income: Enter your gross receipts or sales for the year. Include any returns and allowances to calculate your total income.

- List your expenses: Complete the expenses section by detailing costs such as advertising, car expenses, and utilities. Be sure to categorize each expense correctly.

- Calculate your net profit or loss: Subtract total expenses from total income to determine your net profit or loss for the year.

- Complete additional sections: If applicable, fill out any other sections, such as the cost of goods sold or information about your vehicle.

- Review your form: Double-check all entries for accuracy and ensure all necessary information is included.

- Sign and date the form: Don’t forget to sign and date your Schedule C before submitting it with your tax return.

Common mistakes

-

Incorrect Business Name: Failing to provide the correct legal name of the business can lead to confusion and potential issues with the IRS.

-

Missing or Wrong Employer Identification Number (EIN): Not including an EIN when required, or using an incorrect number, can delay processing and create complications.

-

Inaccurate Income Reporting: Underreporting or overreporting income can trigger audits or penalties. Ensure all income sources are accurately reflected.

-

Neglecting Business Expenses: Failing to list all eligible business expenses means missing out on potential deductions, which could increase tax liability.

-

Improper Classification of Expenses: Misclassifying expenses can lead to disallowed deductions. It's crucial to categorize expenses correctly.

-

Omitting Cost of Goods Sold (COGS): If applicable, not reporting COGS can result in inaccurate profit calculations and affect overall tax liability.

-

Ignoring Record Keeping: Not maintaining proper records to support income and expenses can lead to challenges during audits or disputes with the IRS.

-

Failure to Sign and Date the Form: An unsigned or undated form is considered incomplete and may be rejected by the IRS, delaying processing.

-

Not Seeking Professional Help: Attempting to fill out the form without understanding the requirements can lead to errors. Consulting a tax professional can help avoid mistakes.

Get Clarifications on IRS Schedule C 1040

What is IRS Schedule C, and who needs to file it?

IRS Schedule C, officially known as "Profit or Loss from Business," is a form used by sole proprietors to report income and expenses from their business activities. If you operate a business as a sole proprietorship, you are required to file this schedule along with your Form 1040 during tax season. This form captures various details about your business, including gross income, cost of goods sold, and various deductions related to business expenses.

What types of income should be reported on Schedule C?

On Schedule C, you must report all income earned from your business activities. This includes:

- Sales of products or services.

- Commissions or fees earned.

- Income from rental properties, if applicable.

- Any other income related to your business operations.

It's crucial to maintain accurate records of all income sources to ensure that your Schedule C reflects your true earnings. This documentation can also be beneficial if you are ever audited by the IRS.

What expenses can be deducted on Schedule C?

Schedule C allows for various deductions that can significantly reduce your taxable income. Common deductible expenses include:

- Cost of goods sold, if applicable.

- Business operating expenses, such as rent, utilities, and office supplies.

- Vehicle expenses related to business use, which can be calculated using either the standard mileage rate or actual expenses.

- Advertising and marketing costs.

- Professional fees, including legal and accounting services.

It's important to keep detailed records and receipts for these expenses, as they provide necessary proof in the event of an audit. Only expenses that are ordinary and necessary for your business can be deducted.

How does Schedule C affect my overall tax liability?

The information reported on Schedule C directly impacts your overall tax liability. The net profit or loss calculated on this form is transferred to your Form 1040 and is included in your total income. If your business generates a profit, it will increase your taxable income, which may result in a higher tax bill. Conversely, if your business incurs a loss, you may be able to offset other income, potentially lowering your overall tax liability. Understanding the implications of your Schedule C is essential for effective tax planning.