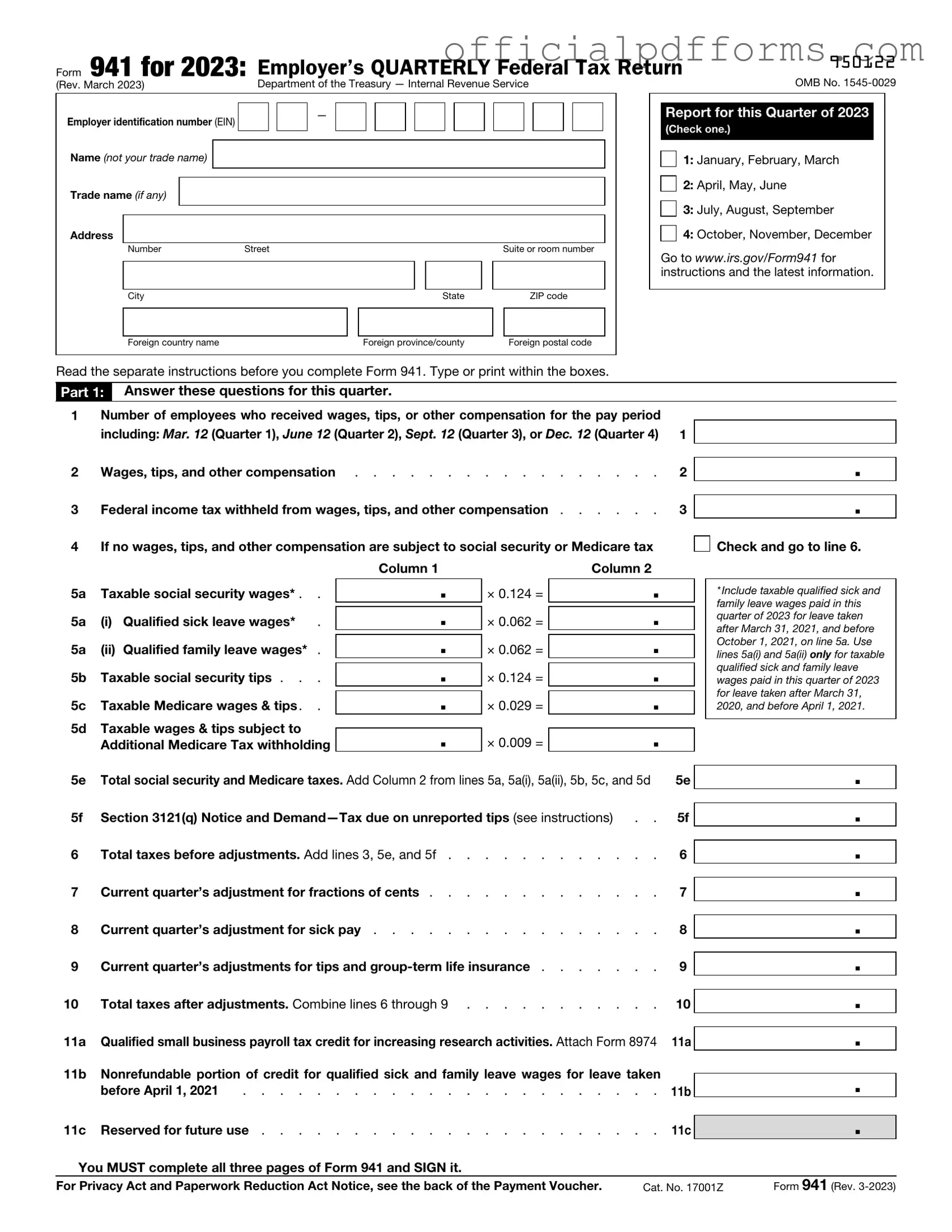

Fill in a Valid IRS 941 Form

Common PDF Forms

Is Geico Cheaper Than Progressive - Timely submission can speed up the review process from GEICO.

To further clarify the importance of a New York Motorcycle Bill of Sale, it serves not only as a record of the transaction but also as a safeguard for both buyer and seller, ensuring that all necessary details are documented accurately. For those seeking or needing assistance with this form, resources are readily available; one such helpful site is OnlineLawDocs.com, which provides comprehensive information on the bill of sale process.

Lyft Inspection Form Sc - Look for any fluids on the ground where the vehicle is parked that might indicate leaks.

Misconceptions

- Misconception 1: The IRS 941 form is only for large businesses.

- Misconception 2: The 941 form is filed only once a year.

- Misconception 3: Filing the 941 form is optional if no employees were paid during the quarter.

- Misconception 4: The 941 form only reports federal taxes.

This is not true. The IRS 941 form is required for all employers who withhold income tax, Social Security tax, or Medicare tax from employees' wages. Regardless of the size of the business, if you have employees, you need to file this form.

Many believe that the IRS 941 form is an annual requirement. In reality, it must be filed quarterly. Employers are responsible for reporting their payroll taxes every three months, ensuring that the IRS receives accurate and timely information about tax withholdings.

Some people think they can skip filing if they did not pay any employees. However, even if there are no wages to report, employers must still file a 941 form to indicate that there were no employees paid. This keeps the IRS informed and avoids potential penalties.

While the IRS 941 form primarily focuses on federal income tax, Social Security, and Medicare taxes, it also includes information that can affect state tax filings. Accurate reporting on the 941 can help ensure compliance with both federal and state tax obligations.

Documents used along the form

The IRS Form 941 is used by employers to report income taxes, Social Security tax, and Medicare tax withheld from employee wages. Several other forms and documents may accompany this form to ensure compliance with tax regulations. Below is a list of commonly used forms and documents related to the IRS 941 form.

- IRS Form 940: This form is used to report and calculate federal unemployment tax (FUTA) liability. Employers file this annually to report their unemployment tax obligations.

- IRS Form W-2: Employers use this form to report wages paid to employees and the taxes withheld from those wages. It is provided to employees and submitted to the Social Security Administration.

- Employment Verification Form: A key document to confirm an individual's employment status and income, vital for lenders and landlords. More information can be found at https://smarttemplates.net/fillable-employment-verification/.

- IRS Form W-3: This is a summary form that accompanies Form W-2. It is used to transmit W-2 forms to the Social Security Administration and includes totals for all W-2s issued by the employer.

- IRS Form 1099: This form reports various types of income other than wages, salaries, and tips. It is commonly used for independent contractors and freelancers.

- IRS Form 1040: This is the individual income tax return form used by taxpayers to report their annual income and calculate their tax liability. It may be relevant for employees filing their personal taxes.

- IRS Form 945: This form is used to report federal income tax withheld from nonpayroll payments, such as pensions and annuities. Employers must file it annually.

- IRS Form 8862: This form is used by taxpayers who have previously been denied the Earned Income Tax Credit (EITC) and wish to claim it again. It is relevant for employees who may qualify for this credit.

- IRS Form 941-X: This form is used to amend a previously filed Form 941. Employers use it to correct errors related to employment taxes.

- Payroll Records: These documents include detailed records of employee wages, hours worked, and tax withholdings. They are essential for accurate reporting and compliance with tax obligations.

Understanding these forms and documents can help employers manage their tax responsibilities effectively. Each form serves a specific purpose and contributes to the overall compliance with federal tax regulations.

Steps to Filling Out IRS 941

After completing the IRS Form 941, ensure that all information is accurate and that you have included any necessary attachments. This form is typically submitted quarterly, and it is essential to meet the filing deadlines to avoid penalties. Review the form carefully before submission.

- Obtain the latest version of IRS Form 941 from the IRS website.

- Fill in your business name, address, and Employer Identification Number (EIN) at the top of the form.

- Indicate the quarter for which you are filing by checking the appropriate box.

- Provide the total number of employees who received wages during the quarter.

- Report the total wages paid to employees during the quarter.

- Calculate and enter the total amount of federal income tax withheld from employees' wages.

- Complete the sections for Social Security and Medicare taxes, including any adjustments.

- Fill out the section for any tax credits claimed, if applicable.

- Sign and date the form, certifying that the information is accurate.

- Submit the completed form to the IRS by the designated deadline, either electronically or via mail.

Common mistakes

-

Incorrect Employer Identification Number (EIN): Failing to provide the correct EIN can lead to processing delays and potential penalties. Always double-check the number before submission.

-

Wrong Reporting Period: Each form must correspond to a specific quarter. Submitting for the wrong period can result in inaccurate tax filings and complications with the IRS.

-

Omitting Employee Information: Neglecting to include all required employee details, such as names and Social Security numbers, can cause issues with tax calculations and reporting.

-

Miscalculating Tax Liabilities: Errors in calculating the amount of taxes owed can lead to underpayment or overpayment, both of which can trigger penalties or delays in processing.

-

Failing to Sign the Form: Not signing the form can result in it being rejected. Ensure that the appropriate person signs and dates the form before submission.

-

Ignoring Instructions: Each form comes with specific instructions. Overlooking these can lead to mistakes that complicate the filing process.

-

Not Keeping Copies: Failing to keep a copy of the submitted form for your records can create difficulties in case of audits or discrepancies. Always retain a copy for your files.

Get Clarifications on IRS 941

What is the IRS Form 941?

IRS Form 941, also known as the Employer's Quarterly Federal Tax Return, is a form that employers use to report income taxes, Social Security tax, and Medicare tax withheld from employee wages. It is filed quarterly and helps the IRS track the taxes owed by employers and the amounts that have been paid.

Who needs to file Form 941?

Any employer who pays wages to employees must file Form 941. This includes businesses of all sizes, non-profits, and government entities. If you have employees and withhold taxes, you are required to submit this form quarterly.

When is Form 941 due?

Form 941 is due four times a year, specifically on the last day of the month following the end of each quarter. The deadlines are:

- For the first quarter (January - March): April 30

- For the second quarter (April - June): July 31

- For the third quarter (July - September): October 31

- For the fourth quarter (October - December): January 31

How do I file Form 941?

You can file Form 941 electronically or by mail. The IRS encourages electronic filing, which can be done through various tax software or through a tax professional. If you choose to file by mail, ensure that you send it to the correct address based on your location and whether you are including a payment.

What information do I need to complete Form 941?

To complete Form 941, you will need the following information:

- Your business name and address

- Your Employer Identification Number (EIN)

- The number of employees you had during the quarter

- Total wages paid to employees

- Amount of federal income tax withheld

- Social Security and Medicare taxes withheld

What if I made a mistake on Form 941?

If you realize that you made a mistake after filing Form 941, you can correct it by filing Form 941-X, Adjusted Employer’s QUARTERLY Federal Tax Return or Claim for Refund. This form allows you to amend your original filing and report any corrections needed.

What happens if I don’t file Form 941?

Failing to file Form 941 can lead to penalties and interest on any unpaid taxes. The IRS takes noncompliance seriously, and penalties can accumulate quickly. It is crucial to file on time to avoid these consequences.

Can I get an extension for filing Form 941?

Unfortunately, there is no formal extension for filing Form 941. However, if you are unable to pay the taxes owed, you can still file the form on time and request a payment plan with the IRS. This can help you avoid penalties for late filing.

How do I pay the taxes reported on Form 941?

You can pay the taxes owed on Form 941 through various methods. Options include electronic funds withdrawal, credit or debit card payments, or sending a check or money order with your form. Ensure that you include your EIN on any payments to avoid processing delays.

Where can I find more information about Form 941?

For more detailed information about Form 941, you can visit the IRS website. The site provides instructions, FAQs, and additional resources to help employers understand their filing responsibilities and stay compliant.