Fill in a Valid IRS 2553 Form

Common PDF Forms

Formulario I-134 - Each supporter should keep copies of the submitted I-134 for their records.

The Asurion F-017-08 MEN form is pivotal in streamlining customer service operations; hence, understanding its implications in the overall management of service requests can be beneficial. For more details, you can refer to the necessary Asurion F-017-08 MEN documentation.

Acord 130 - Intricate details about business operations gathered in the Acord 130 assist insurers in providing the most suitable coverage options.

Misconceptions

The IRS Form 2553 is an important document for small business owners who wish to elect S Corporation status. However, several misconceptions surround this form. Below is a list of common misunderstandings:

- Form 2553 is only for new businesses. Many believe that only newly established companies can file this form. In reality, existing businesses can also elect S Corporation status by submitting Form 2553.

- Filing Form 2553 guarantees S Corporation status. Simply submitting the form does not automatically grant S Corporation status. The IRS must approve the election, and certain requirements must be met.

- All businesses can elect S Corporation status. This is not true. Only certain types of businesses, such as domestic corporations, can qualify for S Corporation status. Some businesses, like certain financial institutions and insurance companies, are excluded.

- There is no deadline for filing Form 2553. Some people think they can file the form at any time. However, there are specific deadlines. Generally, the form must be filed within 75 days of the start of the tax year in which the election is to take effect.

- Filing Form 2553 is a one-time process. Many assume that once they file, they never have to worry about it again. In fact, if a business changes its structure or if there are changes in ownership, it may need to refile or meet additional requirements.

- All shareholders must agree to elect S Corporation status. This is a common misunderstanding. While most shareholders must consent, there are exceptions depending on the ownership structure and specific circumstances.

- Tax benefits of S Corporations are automatic after filing. Some believe that simply electing S Corporation status will provide immediate tax benefits. In reality, businesses must comply with ongoing requirements to maintain these benefits.

- Form 2553 can be filed online. Many think they can submit Form 2553 electronically. Currently, the IRS requires this form to be filed by mail, which can lead to delays in processing.

- Filing Form 2553 is too complicated for small business owners. While the form may seem daunting, it is designed to be accessible. Many resources are available to assist business owners in completing it correctly.

Understanding these misconceptions can help business owners navigate the process of electing S Corporation status more effectively.

Documents used along the form

When filing the IRS Form 2553, which is used to elect S Corporation status, several other forms and documents may also be required to ensure compliance with tax regulations. Understanding these additional documents can help streamline the process and avoid any potential pitfalls.

- Form 1120S: This is the annual tax return for an S Corporation. Once the S Corporation status is approved, this form must be filed each year to report income, deductions, and credits.

- Schedule K-1 (Form 1120S): Each shareholder receives this document, which details their share of the corporation's income, deductions, and credits. It is essential for shareholders when they file their personal tax returns.

- Form SS-4: This form is used to apply for an Employer Identification Number (EIN). An EIN is necessary for tax reporting and is required when filing Form 2553.

- California ATV Bill of Sale Form: For a structured transfer of ownership, the necessary California ATV Bill of Sale document provides essential proof for buyers and sellers alike.

- State S Corporation Election Forms: Depending on the state, there may be additional forms required to elect S Corporation status at the state level. These forms vary by state, so it’s important to check local requirements.

Being aware of these documents and their purposes can facilitate a smoother transition to S Corporation status. Ensuring all necessary forms are completed accurately and submitted on time is crucial for maintaining compliance and maximizing the benefits of this election.

Steps to Filling Out IRS 2553

Filling out IRS Form 2553 is an important step for small businesses that wish to elect S Corporation status. This form must be completed accurately and submitted to the IRS in a timely manner to ensure that your business can benefit from the associated tax advantages. Below are the steps to guide you through the process of filling out the form.

- Begin by downloading IRS Form 2553 from the IRS website or obtain a physical copy from your local IRS office.

- At the top of the form, enter the name of your corporation as it appears on your Articles of Incorporation.

- Provide the corporation’s address, including the city, state, and zip code.

- Fill in the Employer Identification Number (EIN) assigned to your corporation. If you do not have an EIN, you must apply for one before completing this form.

- Indicate the date of incorporation in the appropriate section. This is the date when your corporation was legally formed.

- Choose the tax year you want to use for your S Corporation election. Most corporations use the calendar year, but you can select a different fiscal year if it suits your business.

- List the names, addresses, and Social Security Numbers (SSNs) of all shareholders. Ensure that each shareholder is aware of their ownership percentage.

- Specify the number of shares each shareholder owns. This is crucial for determining ownership percentages and voting rights.

- Sign and date the form. A corporate officer must sign the form, confirming that the information provided is accurate.

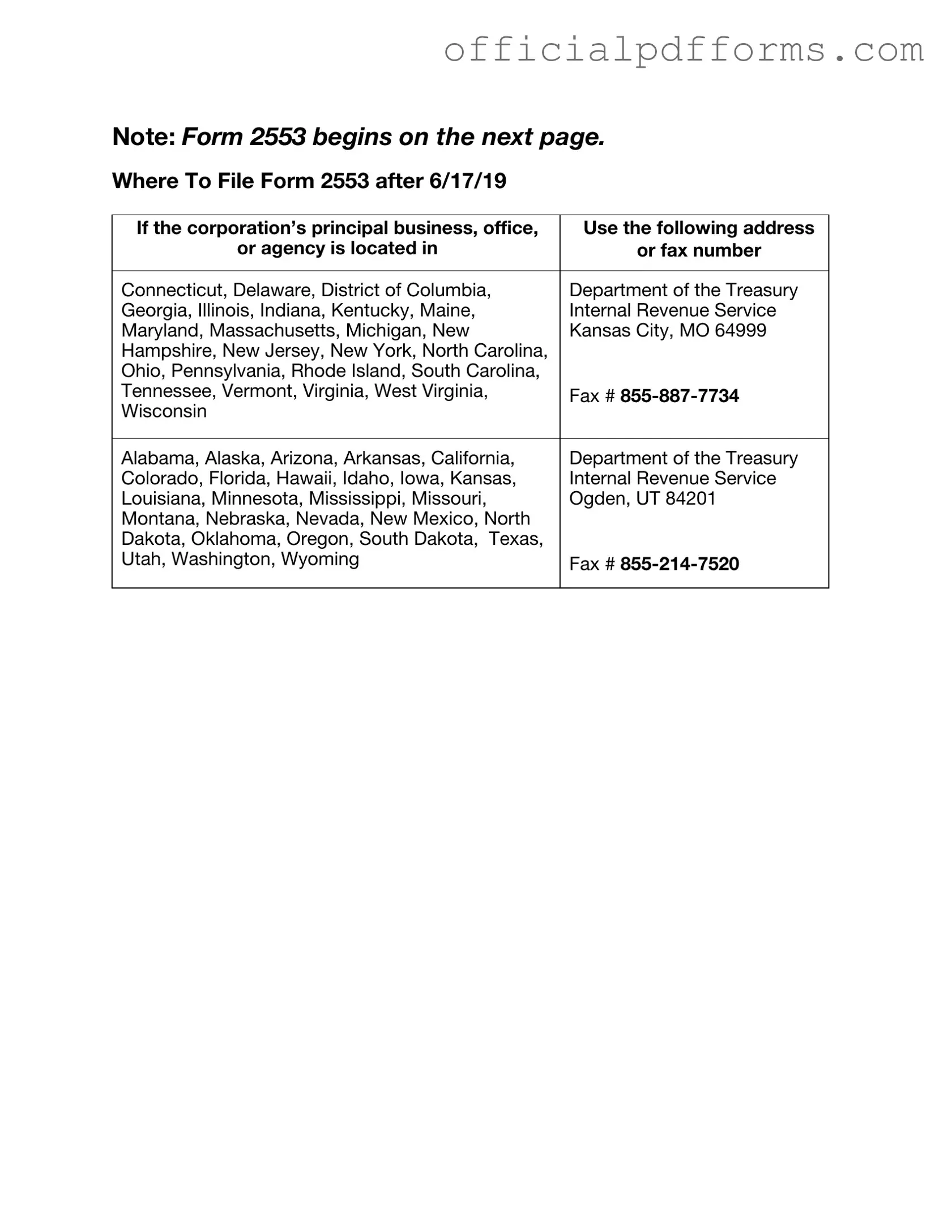

- Submit the completed form to the IRS. You can mail it to the address provided in the form’s instructions, or you may be able to file it electronically depending on your situation.

After submitting Form 2553, it is essential to keep a copy for your records. The IRS will review your application and send a confirmation once your election is approved. If there are any issues or additional information needed, they will contact you directly.

Common mistakes

-

Incorrect Election Year: One common mistake is failing to specify the correct tax year for the S Corporation election. The form should clearly indicate the year for which the election is intended, and any oversight can lead to delays or rejections.

-

Missing Signatures: All shareholders must sign the form. A frequent error is submitting the form without the necessary signatures, which can invalidate the election.

-

Improperly Identifying Shareholders: It's crucial to accurately list all shareholders. Omitting a shareholder or incorrectly identifying them can lead to complications in the election process.

-

Failure to Meet Deadline: The IRS requires the form to be filed within a specific timeframe. Missing this deadline can result in the loss of S Corporation status for the intended year.

-

Not Providing Complete Information: Incomplete information can lead to processing issues. Ensure that all required sections of the form are filled out thoroughly to avoid delays.

-

Ignoring State Requirements: Some states have additional requirements for S Corporation elections. Failing to check state-specific rules can result in complications, including potential noncompliance.

Get Clarifications on IRS 2553

What is the IRS Form 2553?

The IRS Form 2553 is a crucial document for small business owners who wish to elect S Corporation status for their corporation or limited liability company (LLC). By filing this form, a business can choose to be taxed as an S Corporation, which can provide certain tax benefits, including avoiding double taxation on corporate income.

Who is eligible to file Form 2553?

To be eligible to file Form 2553, a business must meet several requirements:

- The entity must be a domestic corporation or an eligible LLC.

- It must have no more than 100 shareholders.

- All shareholders must be individuals, certain trusts, or estates. Partnerships and corporations cannot be shareholders.

- The business must have only one class of stock.

If these criteria are met, the business can proceed with the election by submitting Form 2553 to the IRS.

When should Form 2553 be filed?

Form 2553 should generally be filed within two months and 15 days after the beginning of the tax year when the S Corporation election is to take effect. For new businesses, this often means filing the form shortly after incorporation. If the deadline is missed, the business may still be able to request late election relief under certain conditions.

What information is required on Form 2553?

Form 2553 requires several pieces of information, including:

- The name, address, and Employer Identification Number (EIN) of the corporation or LLC.

- The date of incorporation or formation.

- The tax year the business intends to use.

- Information about all shareholders, including their names, addresses, and Social Security numbers.

- A statement confirming that all shareholders consent to the S Corporation election.

Accurate and complete information is vital to avoid delays or issues with the election process.

What are the benefits of electing S Corporation status?

Electing S Corporation status can offer several advantages, including:

- Pass-through taxation, meaning that income is only taxed at the shareholder level, avoiding double taxation.

- Potential savings on self-employment taxes, as only salaries paid to shareholders are subject to these taxes.

- Increased credibility with customers and suppliers, as S Corporations often appear more established than sole proprietorships or partnerships.

These benefits can significantly enhance the financial health of a business.

What happens if Form 2553 is not approved?

If the IRS does not approve the S Corporation election, the business will be taxed as a C Corporation by default. This means the company will face double taxation on its profits—once at the corporate level and again at the individual level when dividends are distributed to shareholders. If there are issues with the form, the IRS will typically notify the business, allowing for corrections or further action.

Can Form 2553 be revoked?

Yes, a business can revoke its S Corporation election by filing a statement with the IRS. This revocation can be made at any time, but it is often effective for the tax year in which it is filed. Shareholders must also consent to the revocation. It’s important to consider the implications of revoking S Corporation status, as it may affect the business's tax situation moving forward.