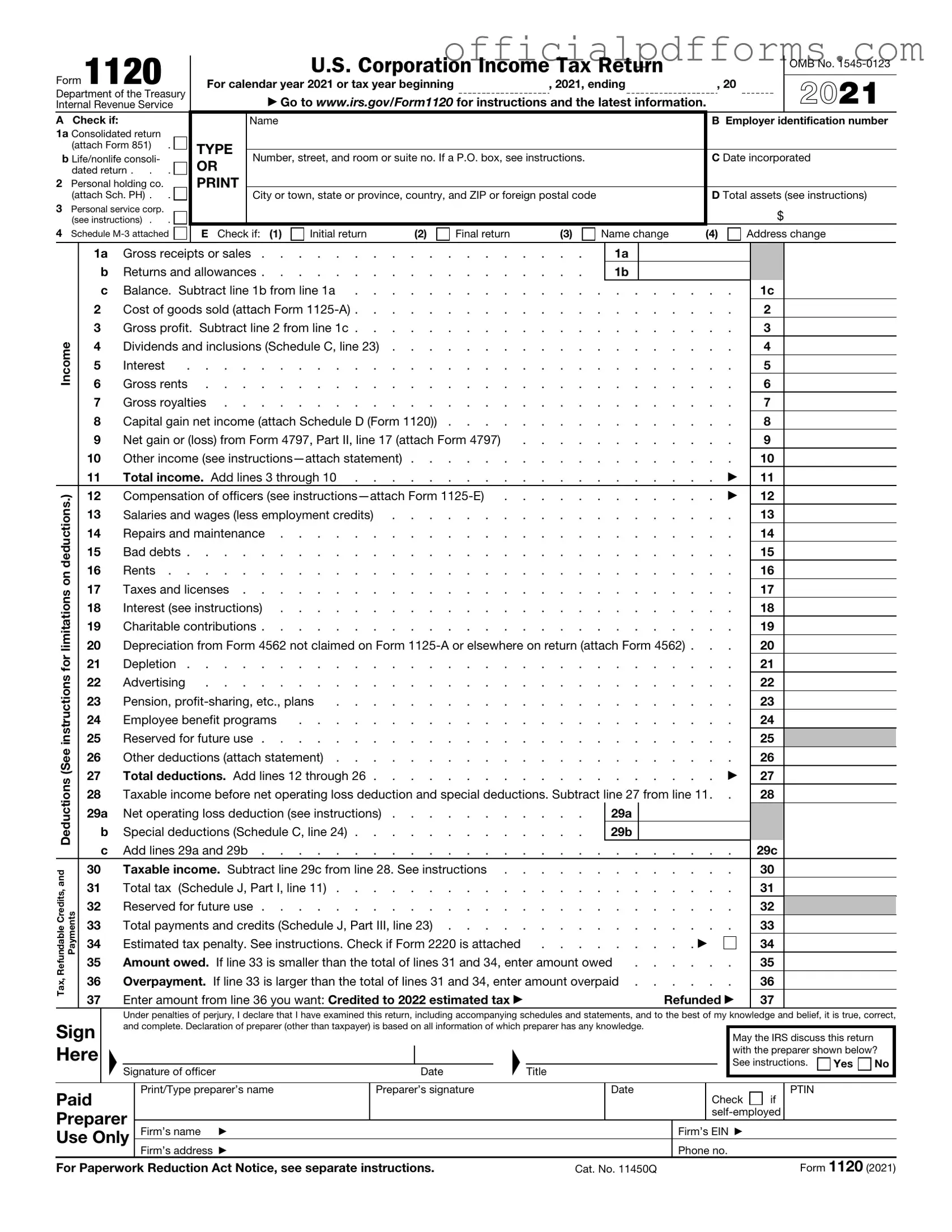

Fill in a Valid IRS 1120 Form

Common PDF Forms

Facial Consent Form Template - The form outlines potential side effects of facial treatments.

T47 Affidavit - The T-47 is a relatively simple document but critical in affirming property ownership details.

To efficiently manage vehicle-related transactions from a distance, it's advisable to use the essential Motor Vehicle Power of Attorney document, which empowers another individual to act on your behalf regarding registration and titling matters.

Written Estimate for Auto Repair - Clarify the cost implications of various repair options.

Misconceptions

The IRS Form 1120 is essential for corporations filing their income tax returns. However, several misconceptions exist regarding this form. Here are six common misunderstandings:

- Only large corporations need to file Form 1120. Many believe that only large corporations are required to file this form. In reality, any corporation, regardless of size, must file Form 1120 if it is recognized as a corporation for tax purposes.

- Form 1120 is only for C corporations. While Form 1120 is primarily associated with C corporations, S corporations also use a similar form, known as Form 1120S. It is crucial to understand the distinction between these forms based on the corporation's tax status.

- Filing Form 1120 guarantees a refund. Some individuals mistakenly believe that submitting Form 1120 will automatically result in a tax refund. Refunds depend on the corporation's tax liability and overpayment, not merely on filing the form.

- Form 1120 is due on April 15th. The misconception that Form 1120 shares the same due date as individual tax returns is common. In fact, Form 1120 is typically due on the 15th day of the fourth month after the end of the corporation's tax year.

- All income must be reported on Form 1120. Some believe that only income generated within the United States needs to be reported. However, corporations must report worldwide income, including foreign income, on Form 1120.

- Filing Form 1120 is a one-time obligation. Many assume that once they file Form 1120, they do not need to file again. Corporations must file Form 1120 annually for each tax year, regardless of whether they have taxable income.

Understanding these misconceptions can help corporations navigate their tax obligations more effectively and ensure compliance with IRS requirements.

Documents used along the form

The IRS Form 1120 is used by corporations to report their income, gains, losses, deductions, and credits. When filing this form, several other documents may also be required to ensure compliance with tax laws. Below is a list of related forms and documents that are commonly used alongside the IRS Form 1120.

- Schedule C: This schedule is used to report the corporation's income and expenses. It provides a detailed account of the company's profit or loss from business activities.

- Form 941: Employers use this form to report income taxes, Social Security tax, and Medicare tax withheld from employee's paychecks. It is filed quarterly.

- New York Mobile Home Bill of Sale: This form is crucial for outlining the sale and transfer of ownership of a mobile home, ensuring both parties have a reliable record of the transaction. For more information, visit OnlineLawDocs.com.

- Form 1125-A: This form is necessary for corporations that have cost of goods sold. It helps to calculate the cost associated with producing the goods sold during the tax year.

- Form 1125-E: This form is used to report compensation of officers. Corporations must disclose the salaries and bonuses paid to their top executives.

- Schedule G: This schedule is used to report information on certain shareholders and stock ownership. It provides transparency regarding the ownership structure of the corporation.

- Form 4562: Corporations use this form to claim depreciation and amortization on their assets. It helps in calculating the deduction for the wear and tear on business property.

These documents collectively support the information reported on Form 1120 and ensure accurate reporting of a corporation's financial activities. It is important to review each form's requirements carefully to maintain compliance with tax regulations.

Steps to Filling Out IRS 1120

Completing the IRS Form 1120 is an important task for corporations to report their income, gains, losses, deductions, and credits. By following the steps below, you can ensure that you fill out the form accurately and completely, which is essential for compliance with federal tax regulations.

- Gather necessary documents, including financial statements, income records, and expense receipts.

- Download the IRS Form 1120 from the official IRS website or obtain a physical copy.

- Fill out the corporation's name, address, and Employer Identification Number (EIN) at the top of the form.

- Enter the date of incorporation and the total assets of the corporation at the end of the tax year.

- Report the corporation's income by completing the appropriate lines in Section I, which includes gross receipts or sales, returns and allowances, and other income.

- Deduct any allowable expenses in Section II, including cost of goods sold, salaries and wages, and other deductions.

- Calculate the taxable income by subtracting total deductions from total income in Section III.

- Determine the tax liability based on the taxable income and fill in the appropriate tax amount in Section IV.

- Complete any additional schedules or forms as required, such as Schedule C for dividends and Schedule J for tax computation.

- Review the form for accuracy, ensuring all calculations are correct and all necessary information is included.

- Sign and date the form, ensuring that the person signing is authorized to do so on behalf of the corporation.

- Submit the completed Form 1120 to the IRS by the due date, either electronically or by mail.

Common mistakes

-

Incorrect Business Information: Many individuals fail to provide accurate details about their business. This includes the legal name, address, and Employer Identification Number (EIN). Inaccuracies can lead to processing delays or rejection of the form.

-

Omitting Income: Some filers overlook reporting all sources of income. Every dollar earned must be accounted for, including sales, dividends, and interest. Missing income can result in penalties and interest charges.

-

Misclassifying Expenses: Proper categorization of expenses is crucial. Common mistakes include misclassifying personal expenses as business expenses or failing to differentiate between capital expenditures and ordinary expenses. This can lead to incorrect deductions.

-

Neglecting to Sign the Form: A surprising number of taxpayers forget to sign the IRS 1120 form. An unsigned form is considered incomplete and can delay processing, leading to potential fines or penalties.

-

Missing Deadlines: Filing the IRS 1120 form late can incur penalties. It's essential to be aware of the due dates and plan ahead to avoid unnecessary fees. Extensions are available, but they must be requested in advance.

Get Clarifications on IRS 1120

What is the IRS Form 1120?

The IRS Form 1120 is the U.S. Corporation Income Tax Return. Corporations use this form to report their income, gains, losses, deductions, and credits, as well as to calculate their tax liability. It is essential for corporations to file this form annually to comply with federal tax regulations.

Who needs to file Form 1120?

Any corporation that is recognized as a separate legal entity for tax purposes must file Form 1120. This includes:

- C corporations

- Foreign corporations engaged in a trade or business in the U.S.

However, S corporations, partnerships, and sole proprietorships do not file this form.

When is Form 1120 due?

Form 1120 is typically due on the 15th day of the fourth month following the end of the corporation's tax year. For corporations that operate on a calendar year, this means the form is due by April 15. If the due date falls on a weekend or holiday, the deadline is extended to the next business day.

What information is required to complete Form 1120?

To complete Form 1120, corporations need to provide various pieces of information, including:

- The corporation's name, address, and Employer Identification Number (EIN)

- Income details, including gross receipts and other income sources

- Deductions, such as salaries, rent, and other business expenses

- Tax credits and any other relevant financial information

Accurate record-keeping throughout the year will make this process smoother.

Can Form 1120 be filed electronically?

Yes, corporations can file Form 1120 electronically using the IRS e-file system. E-filing is often faster and more efficient, and it can reduce the likelihood of errors. It also allows for quicker processing of any refunds that may be due.

What happens if a corporation fails to file Form 1120?

Failing to file Form 1120 can result in significant penalties. The IRS may impose a failure-to-file penalty, which is typically based on the amount of unpaid tax and the length of time the return is late. Additionally, interest may accrue on any unpaid tax. It's crucial for corporations to file on time to avoid these consequences.

Is there a penalty for filing Form 1120 late?

Yes, there is a penalty for late filing. The penalty can be substantial, generally calculated as a percentage of the unpaid tax for each month the return is late, up to a maximum amount. If a corporation owes taxes and fails to file on time, the penalties can add up quickly.

Can a corporation request an extension for filing Form 1120?

Yes, a corporation can request an extension by filing Form 7004. This form allows for an automatic six-month extension to file the return. However, it is important to note that this extension does not extend the time to pay any taxes owed. Corporations should estimate their tax liability and pay any amount due by the original due date to avoid penalties.

Where can I find instructions for completing Form 1120?

The IRS provides detailed instructions for Form 1120 on its official website. These instructions include information on how to fill out the form, what documentation is needed, and tips for ensuring accuracy. It is advisable to review these instructions thoroughly before starting the filing process.

What resources are available for assistance with Form 1120?

Corporations can seek assistance from various resources, including:

- Tax professionals or accountants who specialize in corporate tax filings

- The IRS website, which offers guidance and FAQs

- Local IRS offices that may provide in-person assistance

Utilizing these resources can help ensure compliance and accuracy when filing Form 1120.