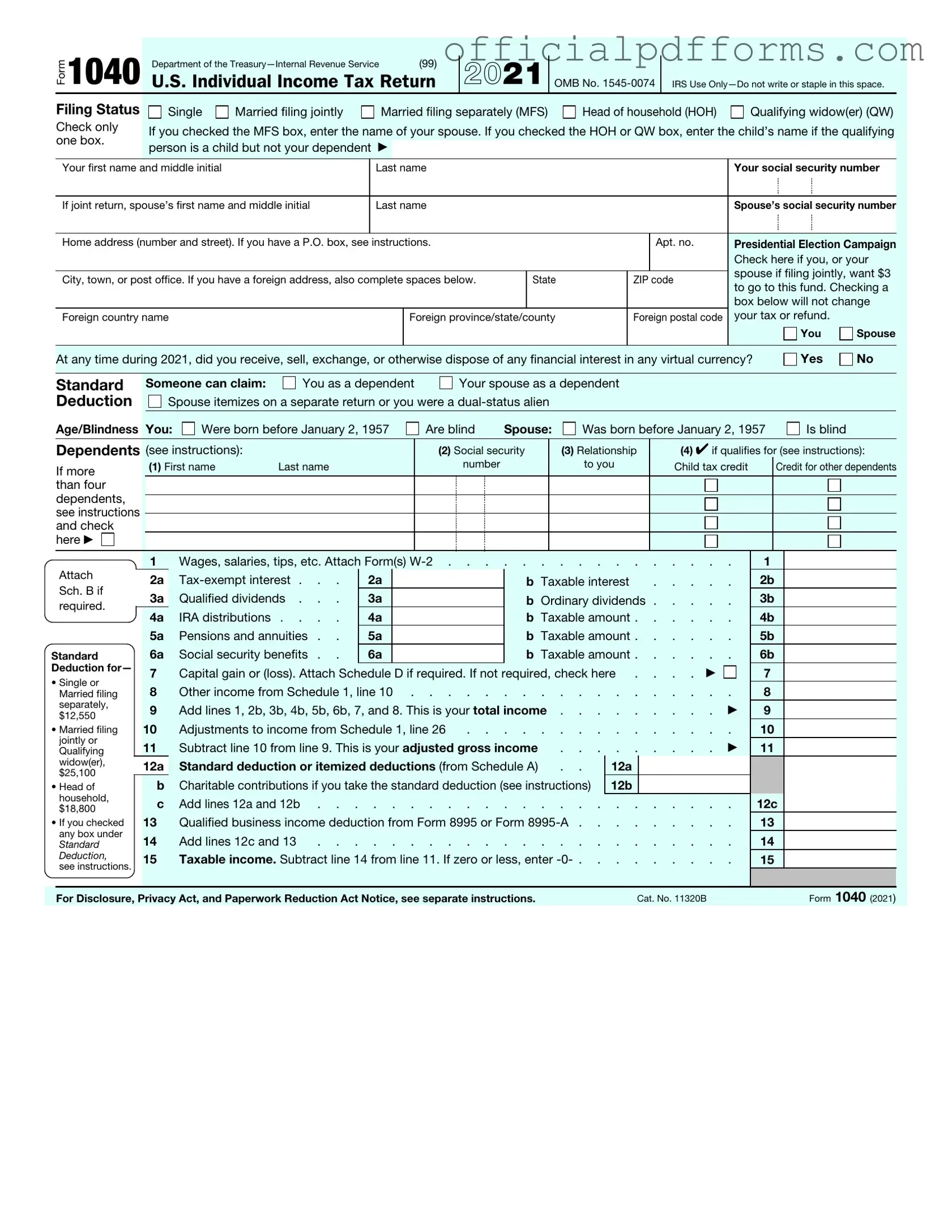

Fill in a Valid IRS 1040 Form

Common PDF Forms

Form 6059B Customs Declaration - The CBP 6059B allows customs authorities to efficiently process arriving passengers.

When planning your estate, understanding the significance of a Transfer-on-Death Deed can be invaluable. This legal tool simplifies the transfer of property to your designated heirs, eliminating the complications of probate. For more information, explore our guide on the straightforward options for utilizing a Transfer-on-Death Deed in your estate planning process to secure your assets effectively.

How to Get Title for Car After Payoff - The form’s clear acknowledgement of receipt of payment helps to mitigate disputes regarding work scope and cost.

Misconceptions

Understanding the IRS 1040 form can be challenging, and many misconceptions can lead to confusion during tax season. Here’s a list of ten common misunderstandings about the 1040 form, along with explanations to clarify them.

-

Everyone must file a 1040 form.

This is not true. While many individuals do need to file a 1040, some people may not meet the income thresholds that require them to file. Additionally, certain situations, such as being a dependent or having no taxable income, can exempt someone from filing.

-

The 1040 form is only for individuals.

While the 1040 form is primarily used by individual taxpayers, it can also be used by certain estates and trusts. Additionally, married couples can file jointly or separately using this form.

-

You can only use the 1040 form if you have a job.

This misconception overlooks other sources of income. People who earn income from investments, self-employment, or rental properties can also use the 1040 form to report their earnings.

-

Filing a 1040 guarantees a refund.

While many taxpayers do receive refunds, filing the 1040 does not guarantee one. Refunds depend on various factors, including total income, tax deductions, and credits claimed.

-

All taxpayers should itemize deductions.

Not everyone benefits from itemizing deductions. Many taxpayers find that taking the standard deduction is more advantageous, simplifying the filing process and often resulting in a lower tax liability.

-

You must file your 1040 by April 15 every year.

While April 15 is the typical deadline, it can vary. If it falls on a weekend or holiday, the deadline may be extended. Additionally, taxpayers can request an extension to file, although any taxes owed are still due by the original deadline.

-

The 1040 form is the same every year.

The IRS often updates the 1040 form and its accompanying schedules to reflect changes in tax laws and regulations. Taxpayers should review the current year's form to ensure they are using the correct version.

-

Filing a 1040 is always complicated.

While some taxpayers may have complex situations, many find the 1040 form straightforward. With clear instructions and available resources, filing can be manageable, especially for those with simple tax situations.

-

Once you file a 1040, you cannot make changes.

This is a common myth. If a mistake is discovered after filing, taxpayers can amend their return using Form 1040-X. It’s important to correct any errors to ensure accurate tax records.

-

Using tax software guarantees accuracy.

While tax software can help minimize errors, it does not guarantee accuracy. Taxpayers must input their information correctly and understand their tax situation to ensure the software produces an accurate return.

By addressing these misconceptions, individuals can approach their tax filing with greater confidence and clarity. Understanding the 1040 form is an essential step in managing personal finances effectively.

Documents used along the form

When filing your taxes, the IRS 1040 form is just one piece of the puzzle. Several other forms and documents may be required to ensure your tax return is complete and accurate. Here’s a list of common forms that often accompany the 1040.

- W-2 Form: This form is provided by your employer and reports your annual wages and the taxes withheld from your paycheck. It's essential for calculating your taxable income.

- 1099 Form: This form is used to report various types of income other than wages, salaries, or tips. There are several types of 1099 forms, such as 1099-MISC for freelance work and 1099-INT for interest income.

- Schedule A: If you plan to itemize your deductions instead of taking the standard deduction, you'll need this form. It lists eligible expenses like mortgage interest, state taxes, and charitable contributions.

- Schedule C: For those who are self-employed, this form reports income and expenses from a business. It helps determine your net profit or loss.

- Schedule D: This form is used to report capital gains and losses from the sale of investments. It helps calculate any tax owed on profits from these transactions.

- Form 8889: If you have a Health Savings Account (HSA), this form is required to report contributions and distributions. It’s important for managing tax benefits related to your HSA.

- Texas Real Estate Purchase Agreement: This document is essential for any property sale in Texas as it sets out the terms and conditions, including price and closing date. For more information, visit OnlineLawDocs.com.

- Form 8862: If you previously had your Earned Income Tax Credit (EITC) denied, this form is necessary to claim it again. It helps verify your eligibility for the credit.

Gathering these forms and documents ahead of time can make the tax filing process smoother. Each one plays a vital role in ensuring your return is accurate and compliant with IRS regulations.

Steps to Filling Out IRS 1040

Filling out the IRS 1040 form is an important step in reporting your income and calculating your tax liability. Once you complete the form, you will submit it to the IRS along with any necessary attachments. Here are the steps to guide you through the process of filling out the form.

- Gather all necessary documents, including W-2s, 1099s, and any other income statements.

- Obtain a copy of the IRS 1040 form, which can be downloaded from the IRS website or obtained at a local library or post office.

- Fill in your personal information at the top of the form, including your name, address, and Social Security number.

- Indicate your filing status by checking the appropriate box. Options include single, married filing jointly, married filing separately, head of household, or qualifying widow(er).

- Report your income in the designated section. Include wages, salaries, tips, and any other sources of income.

- Calculate your adjusted gross income (AGI) by subtracting any adjustments from your total income.

- Determine your taxable income by subtracting the standard deduction or itemized deductions from your AGI.

- Use the tax tables provided in the IRS instructions to find your tax liability based on your taxable income.

- Account for any tax credits you may qualify for, which can reduce your overall tax liability.

- Calculate any additional taxes owed, if applicable, and add them to your total tax liability.

- Determine your total payments, including any withholding and estimated tax payments made during the year.

- Subtract your total payments from your total tax liability to find out if you owe money or will receive a refund.

- Sign and date the form. If you are filing jointly, your spouse must also sign.

- Make a copy of the completed form for your records before submitting it to the IRS.

Common mistakes

-

Incorrect Personal Information: Many people fail to double-check their name, Social Security number, and address. Mistakes in this information can lead to delays in processing or even rejection of the return.

-

Filing Status Errors: Selecting the wrong filing status can significantly impact tax calculations. Individuals often misinterpret their eligibility for statuses such as "Single," "Married Filing Jointly," or "Head of Household."

-

Omitting Income: Some filers forget to report all sources of income. This includes wages, freelance work, and interest earned. Failing to report all income can lead to penalties and interest charges.

-

Math Errors: Simple arithmetic mistakes can occur when calculating total income, deductions, or tax owed. These errors can result in underpayment or overpayment of taxes.

-

Neglecting Signatures: A common oversight is forgetting to sign the form. An unsigned return is considered invalid, which can delay processing and any potential refund.

Get Clarifications on IRS 1040

What is the IRS 1040 form?

The IRS 1040 form is a standard individual income tax return form used by U.S. taxpayers to report their annual income. It allows individuals to calculate their taxable income and determine the amount of tax owed or the refund due. The form is essential for fulfilling federal tax obligations and is typically due on April 15 each year.

Who needs to file a 1040 form?

Most U.S. citizens and residents who earn income must file a 1040 form. This includes individuals who:

- Have a gross income that meets or exceeds the IRS filing threshold.

- Are self-employed or receive income from freelance work.

- Are claiming certain tax credits or deductions.

Even if your income is below the threshold, you may want to file to claim a refund or certain credits.

What are the different versions of the 1040 form?

The IRS offers several versions of the 1040 form to accommodate various taxpayer situations:

- Form 1040: The standard form for most taxpayers.

- Form 1040-SR: Designed for seniors aged 65 and older, featuring larger print and a simpler layout.

- Form 1040-NR: For non-resident aliens who earn income in the U.S.

Each version serves specific needs, so it is essential to choose the correct one based on your residency status and age.

What documents do I need to complete the 1040 form?

To complete the 1040 form, gather the following documents:

- W-2 forms from employers, showing wages and withheld taxes.

- 1099 forms for other income sources, such as freelance work or interest.

- Records of any deductions or credits, such as mortgage interest statements or education expenses.

- Social Security numbers for yourself and any dependents.

Having these documents ready will streamline the filing process and help ensure accuracy.

How do I file the 1040 form?

You can file the 1040 form in several ways:

- Electronically, using tax software or a tax professional.

- By mail, sending a paper form to the appropriate IRS address.

Filing electronically is often faster and can result in quicker refunds. If you choose to file by mail, ensure you send it to the correct address based on your state.

What if I owe taxes?

If you owe taxes, you must pay the amount due by the filing deadline to avoid penalties and interest. You have several options for payment:

- Pay online through the IRS website.

- Send a check or money order with your tax return.

- Set up an installment agreement if you cannot pay the full amount at once.

It is important to address any tax liability promptly to minimize additional charges.

What if I am due a refund?

If you are due a refund, the IRS typically processes it within 21 days if you file electronically. You can check the status of your refund online using the IRS "Where's My Refund?" tool. Make sure to provide accurate banking information if you choose direct deposit for a faster refund.

Can I amend my 1040 form after filing?

Yes, if you discover an error after filing, you can amend your 1040 form using Form 1040-X. This form allows you to correct mistakes or make changes to your filing status, income, or deductions. It is advisable to file the amendment as soon as you realize the error, especially if it may affect your tax liability.