Valid Investment Letter of Intent Document

Consider More Types of Investment Letter of Intent Documents

How to Write a Letter of Intent for Commercial Lease - It can help establish goodwill between the landlord and tenant during discussions.

Loi Meaning in Job - It can also be used to gauge candidate interest before going forward.

Letter of Intent to Purchase - It allows the seller to assess the buyer's seriousness before committing to a deal.

Misconceptions

Understanding the Investment Letter of Intent (LOI) can be challenging, and misconceptions often arise. Here are ten common misunderstandings about this important document.

- It is a legally binding contract. Many people believe that an LOI is a contract that legally binds the parties involved. In reality, it typically outlines intentions and expectations, but it is not usually enforceable as a contract.

- All terms are finalized in the LOI. Some assume that the LOI finalizes all terms of the investment. However, it serves as a starting point for negotiations and does not lock in every detail.

- It is only necessary for large investments. Many think that LOIs are only for significant financial transactions. In truth, they can be useful for investments of any size, helping clarify intentions regardless of the amount.

- LOIs are only for private investments. Some believe that LOIs are exclusive to private transactions. However, they can also be used in public investment scenarios to outline preliminary agreements.

- Signing an LOI means the deal is done. There is a misconception that signing an LOI means the investment deal is complete. In fact, it often indicates that both parties are willing to move forward with discussions.

- LOIs are unnecessary if you have a verbal agreement. Many think that a verbal agreement is enough to proceed. However, having an LOI in writing can help clarify expectations and prevent misunderstandings later.

- Only investors need to sign the LOI. Some believe that only the investor's signature is required. In reality, both parties typically sign the LOI to show mutual agreement on the outlined intentions.

- LOIs are standard and do not require customization. There is a notion that LOIs are one-size-fits-all documents. However, each investment is unique, and LOIs should be tailored to reflect the specific terms and conditions of the deal.

- Once signed, the LOI cannot be changed. Many think that an LOI is set in stone once signed. In fact, it can be amended if both parties agree to the changes.

- LOIs are only for financial investments. Some assume that LOIs are limited to financial transactions. However, they can also be used in various contexts, such as partnerships or joint ventures, to outline mutual intentions.

Addressing these misconceptions can help individuals better understand the purpose and function of the Investment Letter of Intent, making the investment process smoother and more transparent.

Documents used along the form

The Investment Letter of Intent (LOI) is a critical document in the investment process, outlining the preliminary understanding between parties before a formal agreement is reached. Along with the LOI, several other forms and documents are commonly utilized to facilitate the investment process. Below are four such documents.

- Confidentiality Agreement: This document ensures that sensitive information shared between parties remains confidential. It protects proprietary data and trade secrets during negotiations and discussions.

- Due Diligence Checklist: This list serves as a guide for investors to evaluate the potential risks and benefits of an investment. It typically includes financial, legal, and operational aspects that need to be reviewed before finalizing any deal.

- Term Sheet: A term sheet outlines the key terms and conditions of the proposed investment. It serves as a summary of the agreement and helps both parties understand the fundamental aspects of the deal before drafting a more detailed contract.

- Subscription Agreement: This document is used when an investor agrees to purchase shares or units in a company. It details the terms of the investment and the rights and obligations of both the investor and the company.

Understanding these accompanying documents can enhance clarity and ensure a smoother investment process. Each plays a vital role in protecting the interests of all parties involved, ultimately contributing to a successful investment transaction.

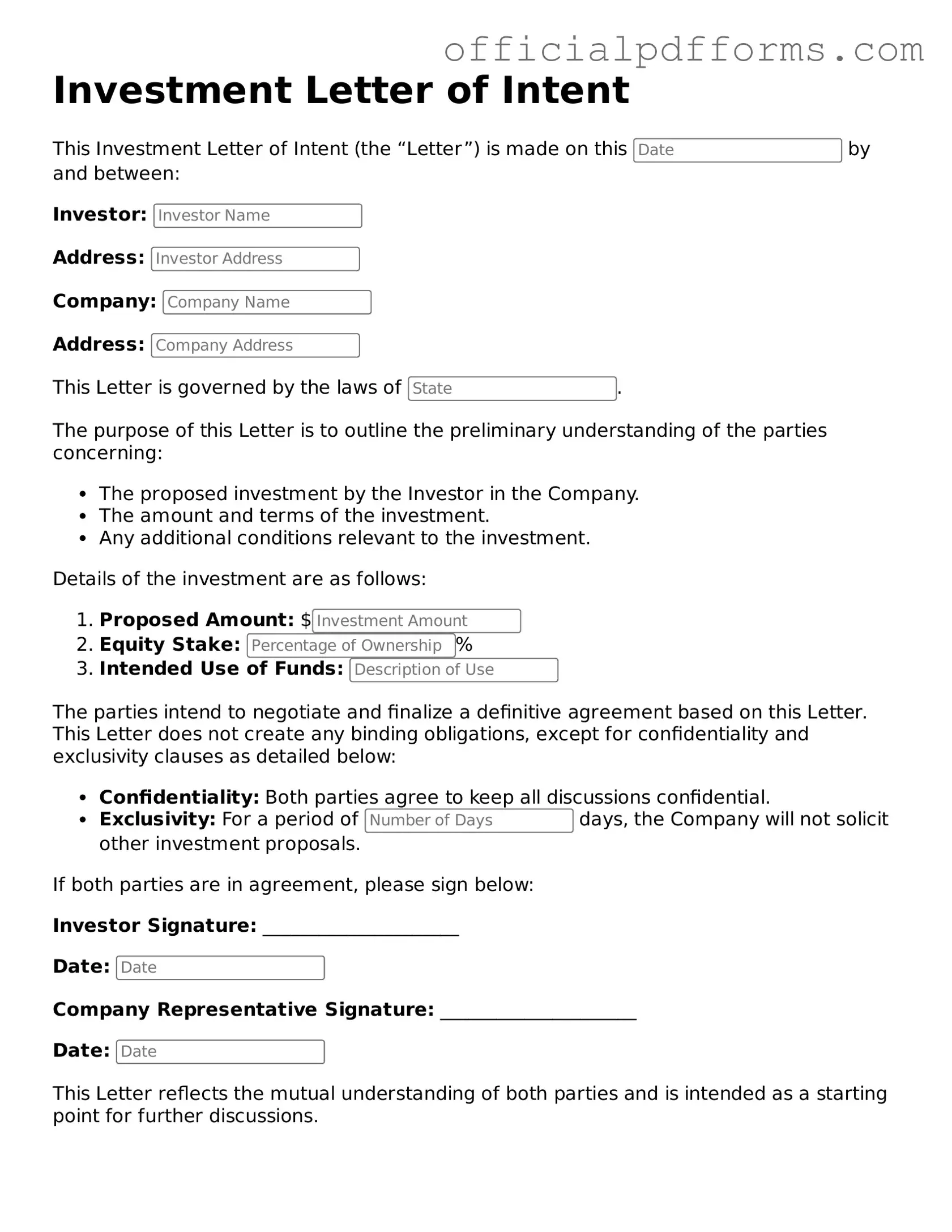

Steps to Filling Out Investment Letter of Intent

After obtaining the Investment Letter of Intent form, ensure you have all necessary information at hand. This includes personal details, investment amounts, and any relevant financial information. Completing the form accurately is essential for clarity and future reference.

- Begin by entering your full name in the designated section at the top of the form.

- Provide your current address, including city, state, and zip code.

- Fill in your contact information, including your phone number and email address.

- Indicate the date on which you are completing the form.

- In the investment amount section, clearly state the total amount you intend to invest.

- Include any specific terms or conditions related to your investment, if applicable.

- Review all entered information for accuracy and completeness.

- Sign and date the form at the bottom to validate your intent.

- Make a copy of the completed form for your records before submission.

Common mistakes

-

Incomplete Information: Many individuals forget to fill out all required fields. Leaving sections blank can delay the process or lead to rejection.

-

Incorrect Contact Details: Providing outdated or incorrect phone numbers and email addresses can hinder communication. Always double-check this information.

-

Missing Signatures: A common oversight is neglecting to sign the form. Without a signature, the document is not valid.

-

Inaccurate Financial Information: Entering wrong figures or misrepresenting financial status can lead to serious consequences. Accuracy is crucial.

-

Ignoring Instructions: Each form comes with specific guidelines. Failing to follow these can result in a form that is not accepted.

-

Not Keeping Copies: Individuals often forget to make copies of the completed form. Retaining a copy is essential for your records.

-

Submitting Late: Some people miss deadlines. Timely submission is important to ensure consideration of your investment.

-

Overlooking Additional Documentation: Sometimes, the form requires supporting documents. Not including these can lead to delays or denials.

Get Clarifications on Investment Letter of Intent

What is an Investment Letter of Intent?

An Investment Letter of Intent (LOI) is a document that outlines the preliminary understanding between parties who intend to enter into an investment agreement. It serves as a roadmap for negotiations and indicates the seriousness of the parties involved. While it is not legally binding, it sets the stage for further discussions and may include key terms such as investment amounts, timelines, and conditions that must be met before finalizing the agreement.

Who should use the Investment Letter of Intent form?

This form is primarily designed for individuals or entities looking to make an investment in a business or project. Entrepreneurs seeking funding, investors evaluating potential opportunities, and financial advisors assisting clients can all benefit from using this document. It helps clarify intentions and expectations, which can lead to more efficient negotiations and better outcomes for all parties involved.

What key components should be included in the Investment Letter of Intent?

When completing the Investment Letter of Intent, consider including the following components:

- Parties Involved: Clearly identify all parties entering the agreement.

- Investment Amount: Specify the total amount of investment being proposed.

- Purpose of Investment: Describe what the investment will be used for, such as business expansion or product development.

- Timeline: Outline important dates, including when the investment is expected to be made and any deadlines for negotiations.

- Conditions: List any conditions that must be met before the investment is finalized.

Is the Investment Letter of Intent legally binding?

The Investment Letter of Intent is generally not a legally binding document. However, certain sections may create binding obligations, depending on how they are worded. For example, confidentiality clauses or exclusivity agreements can be enforceable. It’s crucial to clearly state which parts of the LOI are intended to be binding and which are not. Always consult with a legal professional to ensure clarity and compliance with relevant laws.