Fill in a Valid Intent To Lien Florida Form

Common PDF Forms

Lyft Inspection Form Sc - Check the engine oil level to maintain optimal vehicle performance.

Having a well-drafted Operating Agreement is essential for any LLC, as it prevents misunderstandings among members regarding their rights and responsibilities. This document can be created with the assistance of professionals, such as those at OnlineLawDocs.com, to ensure that it meets all legal requirements and effectively serves its purpose.

Player Evaluation Form Basketball - Assess 2-point range effectiveness to determine scoring potential.

Misconceptions

Understanding the Intent To Lien Florida form is crucial for both property owners and contractors. However, several misconceptions can lead to confusion. Here are seven common myths debunked:

- Myth 1: An Intent to Lien automatically means a lien has been filed.

- Myth 2: The form must be filed with the county clerk.

- Myth 3: You must wait 45 days after sending the notice to file a lien.

- Myth 4: Only contractors can file an Intent to Lien.

- Myth 5: Sending the Intent to Lien is the same as waiving your right to a lien.

- Myth 6: An Intent to Lien guarantees payment.

- Myth 7: You can ignore the Intent to Lien.

This is not true. The Intent to Lien is a notice that someone plans to file a lien if payment is not made. It serves as a warning, not a legal claim yet.

Actually, the Intent to Lien does not need to be filed with the county clerk. Instead, it should be served to the property owner and any relevant parties.

While the notice must be sent at least 45 days before filing, it can be filed sooner if payment is not received. The timeline can be flexible based on the situation.

This is a misconception. Subcontractors, suppliers, and even some professionals can use this form if they have not been paid for their services or materials.

Not at all! Sending the notice does not waive your right to file a lien later. It simply informs the property owner of your intent.

Unfortunately, it does not guarantee payment. It's a step in the process, but it does not ensure that the property owner will settle the debt.

Ignoring this notice can lead to serious consequences, including the potential for a lien to be filed against your property. It's best to address the matter promptly.

By understanding these misconceptions, both property owners and contractors can navigate the process more effectively and avoid unnecessary complications.

Documents used along the form

When dealing with property improvements and potential payment disputes in Florida, the Intent To Lien form is a crucial document. However, it is often accompanied by several other forms that help ensure clarity and compliance with state laws. Understanding these documents can empower property owners, contractors, and other stakeholders to navigate the lien process effectively.

- Claim of Lien: This document is filed after the Notice of Intent to File a Lien if payment is not received. It officially records the lien against the property, providing public notice of the claim. This action can lead to foreclosure if the debt remains unpaid.

- Notice of Non-Payment: This notice serves as a formal communication to the property owner, indicating that payment has not been received for services or materials provided. It often outlines the amount owed and the timeframe for payment before further action is taken.

- FedEx Release Form: This document allows recipients to authorize FedEx to leave packages at a specified location even if they are not home. For more details, visit smarttemplates.net/fillable-fedex-release.

- Waiver of Lien: This document can be used by contractors or suppliers to relinquish their right to file a lien against a property. It is typically signed once payment has been made and serves to protect the property owner from future claims related to the project.

- Release of Lien: Similar to a waiver, this document is filed after a lien has been recorded and payment has been received. It formally removes the lien from public records, clearing the property title and ensuring that the owner can sell or refinance the property without encumbrances.

Being familiar with these documents not only aids in managing financial responsibilities but also fosters better communication among all parties involved in property improvement projects. Taking proactive steps can help prevent misunderstandings and potential legal complications down the line.

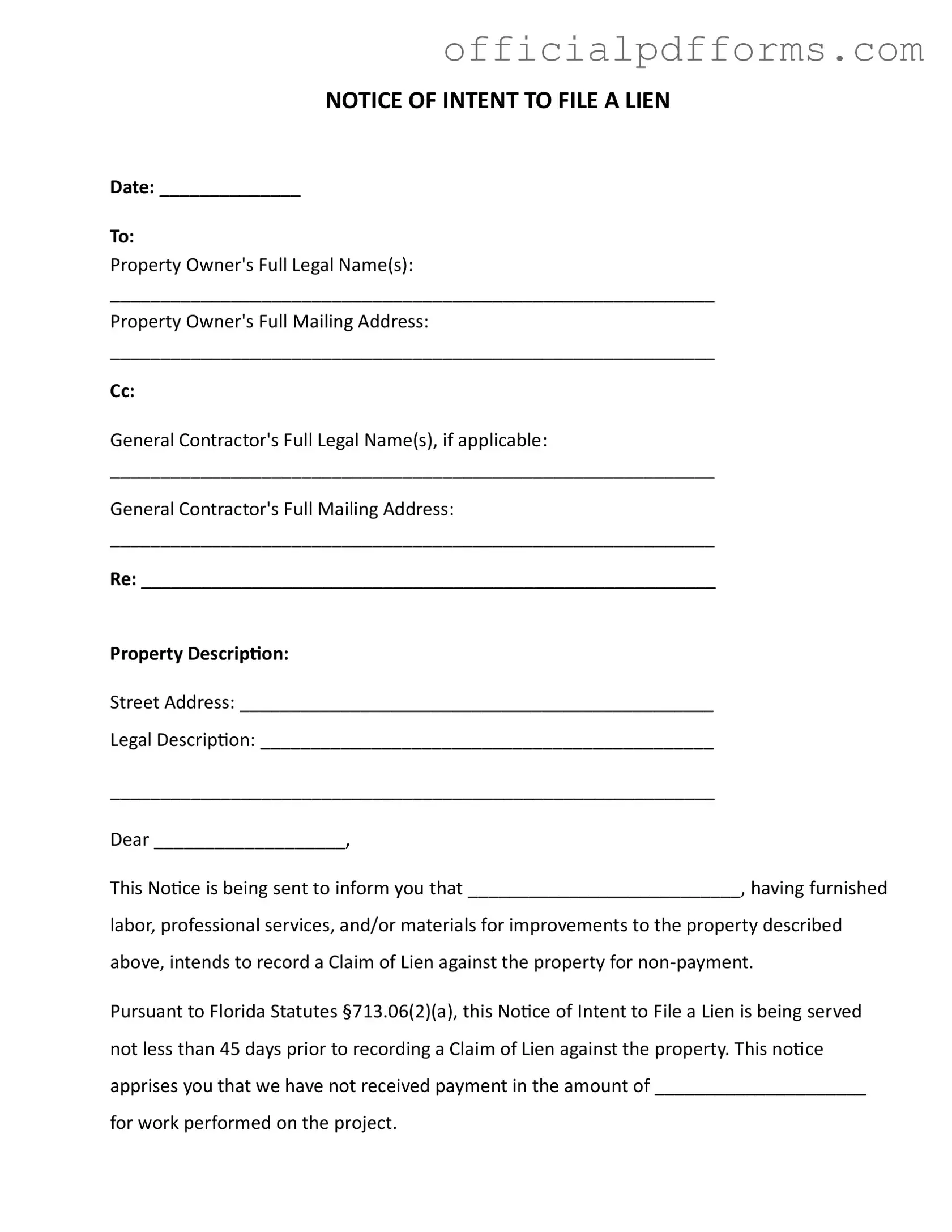

Steps to Filling Out Intent To Lien Florida

After completing the Intent to Lien Florida form, it is important to ensure that it is delivered to the appropriate parties in a timely manner. This will help to establish a record of your intent to file a lien should payment not be received. Follow the steps below to accurately fill out the form.

- Date: Enter the current date at the top of the form.

- Property Owner's Full Legal Name(s): Fill in the full legal name(s) of the property owner(s).

- Property Owner's Full Mailing Address: Provide the complete mailing address for the property owner(s).

- Cc: If applicable, enter the full legal name(s) of the general contractor.

- General Contractor's Full Mailing Address: Fill in the mailing address for the general contractor, if applicable.

- Re: Write a brief reference to the project or work performed.

- Property Description: Include the street address of the property.

- Legal Description: Provide the legal description of the property.

- Dear: Address the property owner(s) by their name(s).

- Statement of Intent: Indicate the name of the party intending to file the lien and mention that they have provided labor, services, or materials.

- Payment Amount: Specify the amount owed for the work performed.

- Request for Response: Clearly state the consequences of non-payment, including the potential for a lien and foreclosure.

- Contact Information: Include your name, title, phone number, and email address at the end of the letter.

- Certificate of Service: Fill in the date of service, recipient’s name, and address where the notice was served.

- Method of Service: Check the appropriate box for how the notice was delivered.

- Name and Signature: Sign the form and print your name below your signature.

Common mistakes

-

Incorrect or Incomplete Dates: Failing to fill in the date accurately can lead to confusion. Ensure that the date of the notice is clearly marked.

-

Property Owner Information Errors: Providing incorrect names or addresses for the property owner can invalidate the notice. Double-check this information for accuracy.

-

Missing Payment Amount: Not specifying the exact amount owed may create ambiguity. Clearly state the total due for the work performed.

-

Improper Service Method: Choosing an incorrect method for serving the notice can lead to legal complications. Follow the specified options for delivery carefully.

-

Neglecting to Sign the Document: Failing to sign the notice can render it ineffective. Ensure that the notice is signed by the appropriate individual.

-

Ignoring Follow-Up Requirements: Not understanding the timeline for responses can lead to missed opportunities. Be aware of the 30-day response window after sending the notice.

Get Clarifications on Intent To Lien Florida

What is the Intent To Lien Florida form?

The Intent To Lien Florida form is a legal document used to notify property owners of an impending lien due to non-payment for services rendered or materials supplied for improvements to a property. This notice serves as a formal warning that a claim of lien may be recorded if payment is not made within a specified timeframe.

Who should receive the Intent To Lien notice?

The notice should be sent to the property owner's full legal name and mailing address. Additionally, if there is a general contractor involved in the project, they should also receive a copy of the notice. This ensures that all parties are aware of the potential lien and the reasons behind it.

What information is required on the form?

The form requires several key pieces of information, including:

- Date of the notice

- Property owner's full legal name and mailing address

- General contractor's full legal name and mailing address, if applicable

- Description of the property, including street address and legal description

- Amount due for the work performed

Completing this information accurately is crucial for the validity of the notice.

What happens if payment is not made after the notice is sent?

If the property owner fails to make payment or provide a satisfactory response within 30 days of receiving the notice, the party sending the notice may proceed to record a claim of lien against the property. This action can lead to foreclosure proceedings, which may result in additional costs for the property owner, including attorney fees and court costs.

How long before a lien can be recorded after sending the notice?

What is the purpose of the Certificate of Service?

The Certificate of Service is a section of the form that confirms the notice was delivered to the appropriate parties. It includes details such as the date of service and the method of delivery, which can include certified mail, hand delivery, or other means. This certificate serves as proof that the notice was properly served, which is important in any potential legal proceedings.