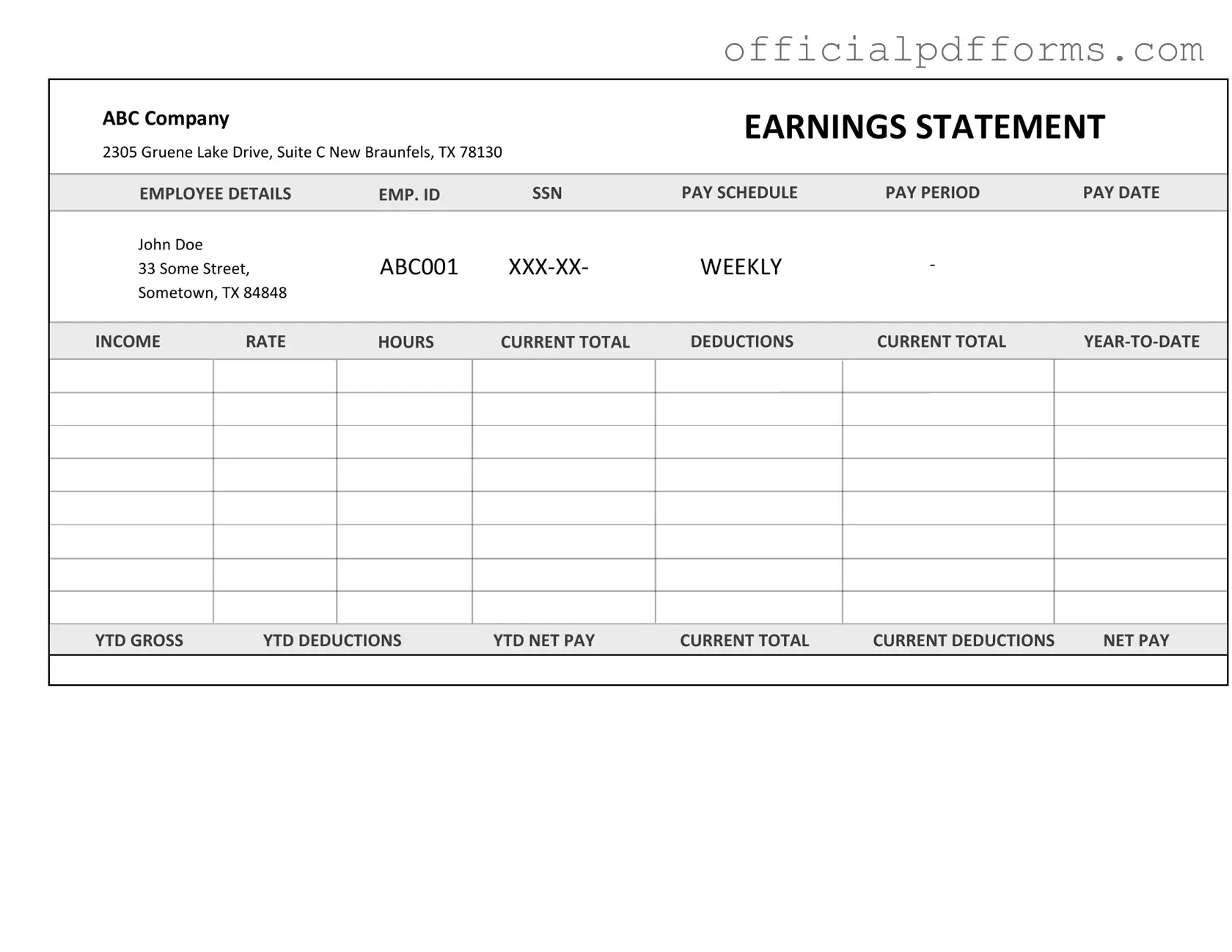

Fill in a Valid Independent Contractor Pay Stub Form

Common PDF Forms

Free Printable D1 Form - Secure delivery options for identity documents are available for applicant convenience.

Ms Word Chart Assignment - Details: Summary of the company’s strategic initiatives and goals.

For individuals interested in the legal transfer of ownership, a thorough understanding of the essential steps in an RV Bill of Sale process is important. This document serves as a vital record for buyers and sellers alike, ensuring a smooth transaction and peace of mind. Explore more about the RV Bill of Sale form to streamline your transaction.

Direct Deposit Forms - Ensure your financial institution supports direct deposit before submitting the form.

Misconceptions

Understanding the Independent Contractor Pay Stub form can be challenging. Here are four common misconceptions that people often have about this document:

- Independent contractors do not need pay stubs. Many believe that pay stubs are only necessary for employees. However, independent contractors can benefit from having pay stubs as they provide a clear record of earnings, which can be useful for tax purposes and financial planning.

- All independent contractors must use the same pay stub format. Some think there is a universal format for pay stubs. In reality, independent contractors can create pay stubs that suit their needs, as long as they include essential information like payment amounts, dates, and services rendered.

- Pay stubs are only for tracking payments. While tracking payments is a primary function, pay stubs also serve as a way to document work history and earnings over time. This can be important when applying for loans or other financial services.

- Independent contractors do not have to report their income. There is a misconception that independent contractors can avoid reporting their income. In truth, all income earned must be reported to the IRS, and having a pay stub can help ensure accurate reporting.

Documents used along the form

When working with independent contractors, it is essential to have a variety of documents that support the payment process and clarify the terms of the working relationship. Alongside the Independent Contractor Pay Stub form, several other forms and documents are commonly utilized. Below is a list of these important documents, each serving a unique purpose.

- Independent Contractor Agreement: This document outlines the terms and conditions of the working relationship between the contractor and the hiring party. It typically includes details about the scope of work, payment terms, and deadlines.

- W-9 Form: This form is used to collect the contractor's taxpayer identification number. It ensures that the hiring party has the necessary information for tax reporting purposes at the end of the year.

- Texas Motor Vehicle Power of Attorney: This document allows a vehicle owner to delegate responsibility for vehicle-related tasks to another individual. For more details, you can visit OnlineLawDocs.com.

- Invoice: An invoice is submitted by the contractor to request payment for services rendered. It details the work completed, the amount due, and any applicable payment terms.

- 1099-MISC Form: This tax form is issued by the hiring party to report payments made to the contractor throughout the year. It is crucial for the contractor’s tax filing and ensures compliance with IRS regulations.

Having these documents organized and readily available can streamline the process of working with independent contractors. They help clarify expectations and ensure that both parties are on the same page regarding payments and responsibilities.

Steps to Filling Out Independent Contractor Pay Stub

Filling out the Independent Contractor Pay Stub form is a straightforward process that requires careful attention to detail. This form is essential for documenting the payments made to independent contractors. Below are the steps to guide you through the completion of the form.

- Begin by entering the contractor's name at the top of the form.

- Next, provide the contractor's address, including street, city, state, and zip code.

- Fill in the contractor's Social Security Number or Tax Identification Number.

- Specify the pay period by entering the start and end dates.

- Indicate the total amount paid to the contractor during that pay period.

- List any deductions that apply, such as taxes or fees, if applicable.

- Finally, sign and date the form to certify the information provided is accurate.

Once you have completed the form, ensure that all information is correct before submitting it. Keep a copy for your records as well.

Common mistakes

-

Inaccurate personal information. Many individuals fail to provide correct details such as their name, address, or Social Security number. This can lead to delays in processing payments.

-

Incorrect payment calculations. Contractors sometimes miscalculate their earnings or fail to account for deductions. This can result in receiving less than the expected amount.

-

Omitting necessary documentation. It is common for individuals to forget to attach required documents, such as invoices or receipts, which are essential for verifying the services provided.

-

Failure to sign the form. Some contractors neglect to sign the pay stub, which is a crucial step in the submission process. Without a signature, the form may be considered incomplete.

-

Not keeping copies. Individuals often do not retain copies of their submitted forms. This can create difficulties if there are disputes or questions regarding payment in the future.

Get Clarifications on Independent Contractor Pay Stub

What is an Independent Contractor Pay Stub?

An Independent Contractor Pay Stub is a document that outlines the earnings and deductions for an independent contractor. It serves as a record of payment and can be used for tax purposes. This form provides transparency in financial transactions between the contractor and the hiring entity.

Why do I need a Pay Stub as an Independent Contractor?

Having a pay stub is essential for several reasons:

- It helps you keep track of your earnings and any deductions.

- You can use it to verify your income when applying for loans or mortgages.

- It provides a clear record for tax reporting purposes.

What information is included on a Pay Stub?

A typical Independent Contractor Pay Stub includes the following information:

- Your name and contact information.

- The name and contact information of the hiring entity.

- The payment period covered by the stub.

- Your total earnings for that period.

- Any deductions, such as taxes or fees.

- The net amount you received.

How often should I receive a Pay Stub?

The frequency of pay stub issuance depends on your agreement with the hiring entity. Common practices include weekly, bi-weekly, or monthly pay stubs. Ensure that your contract specifies how and when you will receive payment information.

Can I create my own Pay Stub?

Yes, you can create your own pay stub. However, it must accurately reflect your earnings and deductions. There are various templates available online that can help you generate a professional-looking pay stub. Ensure that all information is correct and complies with any applicable laws.

What should I do if my Pay Stub is incorrect?

If you find an error on your pay stub, contact the hiring entity immediately. Provide them with the details of the discrepancy. They should issue a corrected pay stub as soon as possible. Keeping clear communication is crucial to resolving any issues efficiently.

Do I need to keep my Pay Stubs?

Yes, it is advisable to keep all your pay stubs. They serve as important documentation for your income and can be useful during tax season. Store them in a safe place, either physically or digitally, for easy access when needed.

Are there any legal requirements for issuing Pay Stubs?

While independent contractors are not always entitled to pay stubs, many states require employers to provide some form of payment documentation. Check your state’s regulations to ensure compliance. Even if it’s not legally required, providing a pay stub is a good practice for transparency.

What if I am working for multiple clients?

If you are working for multiple clients, it’s important to keep separate pay stubs for each client. This will help you manage your income and simplify your tax reporting. Each client should provide a pay stub based on the work performed for them.

How do I report income from my Pay Stub on my taxes?

To report income from your pay stub on your taxes, you will need to include the total earnings listed on the stub in your income tax return. Keep track of all pay stubs throughout the year to ensure accurate reporting. Consider consulting a tax professional for guidance on deductions and reporting requirements.