Printable Illinois Transfer-on-Death Deed Template

Find Other Popular Transfer-on-Death Deed Templates for Specific States

Problems With Transfer on Death Deeds in Indiana - The form can empower individuals to make estate decisions tailored to their wishes and family dynamics.

Understanding the importance of a Power of Attorney form is crucial for anyone looking to secure their wishes in case they cannot make decisions themselves; for more information on how to create and utilize this essential document, you can visit OnlineLawDocs.com.

Transfer on Death Deed Form Ohio - This deed is revocable; the owner can change beneficiaries at any time before death.

How to Gift a House to a Family Member - Beneficiaries take ownership precisely as indicated in the deed, avoiding disputes.

Misconceptions

Understanding the Illinois Transfer-on-Death Deed can be challenging, and several misconceptions often arise. Here are five common misunderstandings about this important legal tool:

- It automatically transfers property upon death. Many people believe that the Transfer-on-Death Deed allows for an immediate transfer of property upon the owner's death. In reality, the transfer only occurs after the owner's passing, provided the deed is properly executed and recorded.

- It eliminates the need for a will. Some assume that using a Transfer-on-Death Deed negates the necessity of having a will. However, a will is still important for addressing other assets and ensuring that your overall estate plan reflects your wishes.

- It can be used for all types of property. There is a misconception that the Transfer-on-Death Deed applies to all property types. In Illinois, this deed is only valid for residential real estate, not for personal property or other types of real estate, such as commercial properties.

- It can be revoked at any time without formalities. While it is true that a Transfer-on-Death Deed can be revoked, it must be done through a formal process. Simply deciding to revoke it verbally or informally will not suffice; a new deed must be executed and recorded.

- It avoids probate altogether. Many believe that a Transfer-on-Death Deed completely avoids probate. While it can simplify the transfer process and may reduce the complexity of probate for the property in question, it does not eliminate the probate process for the entire estate.

By understanding these misconceptions, individuals can make more informed decisions regarding their estate planning and ensure that their wishes are honored. Proper guidance can help navigate the complexities of property transfer and ensure that all legal documents are in order.

Documents used along the form

When planning for the transfer of property in Illinois, several forms and documents may be necessary alongside the Illinois Transfer-on-Death Deed. Each of these documents serves a unique purpose in ensuring that your wishes are carried out and that the transfer process is smooth. Below is a list of commonly used forms that you might consider.

- Will: A legal document that outlines how a person's assets will be distributed upon their death. It can specify guardianship for minors and address debts and taxes.

- Living Trust: This document allows a person to place assets into a trust during their lifetime, enabling smoother transfer to beneficiaries without going through probate.

- Power of Attorney: A legal form that designates an individual to make decisions on behalf of another, particularly regarding financial or medical matters, if they become incapacitated.

- Affidavit of Heirship: A sworn statement used to establish the heirs of a deceased person when there is no will, often used to transfer property without formal probate.

- Deed: A legal document that transfers ownership of property from one party to another. This is essential for formalizing property transfers.

- Probate Petition: A request filed with the court to begin the probate process, which validates a will and oversees the distribution of a deceased person's estate.

- Dog Bill of Sale: This essential document provides proof of the transaction between the buyer and seller of a dog in California, ensuring legal clarity in the transfer of ownership. For more information on necessary forms, visit All California Forms.

- Certificate of Trust: A document that verifies the existence of a trust and its terms, often used to prove the authority of a trustee without disclosing the entire trust document.

- Property Tax Exemption Application: A form submitted to claim exemptions on property taxes, which can benefit certain heirs or individuals under specific circumstances.

- Beneficiary Designation Form: This form allows individuals to designate beneficiaries for certain accounts or assets, ensuring they pass directly to the named parties upon death.

Understanding these forms and documents can significantly aid in the estate planning process. Each plays a vital role in ensuring that your property and wishes are handled according to your preferences. It's advisable to consult with a legal professional to determine which documents are best suited for your individual situation.

Steps to Filling Out Illinois Transfer-on-Death Deed

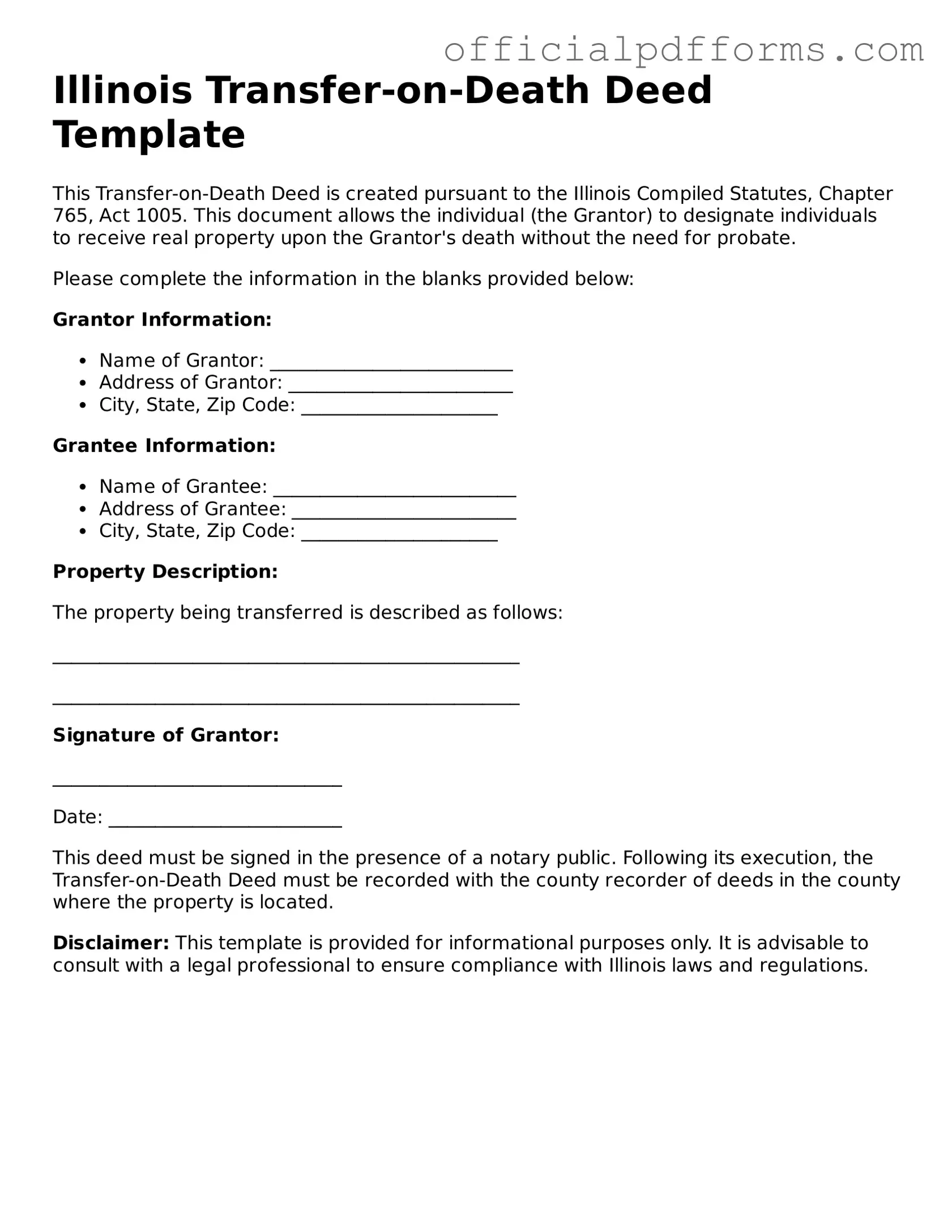

Once you have the Illinois Transfer-on-Death Deed form in hand, it’s time to fill it out carefully. This form allows you to designate a beneficiary for your property, ensuring a smooth transfer after your passing. Follow the steps below to complete the form accurately.

- Obtain the Form: Download the Illinois Transfer-on-Death Deed form from a reliable source or visit your local courthouse.

- Property Information: Write the full legal description of the property you wish to transfer. This includes the address and any parcel identification numbers.

- Owner Information: Fill in your name as the current owner of the property. Include any additional owners if applicable.

- Beneficiary Information: Clearly state the name(s) of the person(s) you wish to designate as the beneficiary. Make sure to include their relationship to you.

- Sign the Form: Sign the form in the presence of a notary public. Your signature must be notarized to validate the deed.

- File the Deed: Submit the completed form to the appropriate county recorder's office. Check for any filing fees that may apply.

After submitting the form, keep a copy for your records. This will ensure that you have proof of the transfer arrangement. It’s important to confirm that the deed is recorded correctly to avoid any issues in the future.

Common mistakes

-

Not understanding the purpose: Many individuals fill out the Transfer-on-Death Deed without fully grasping its intent. This deed allows property to pass directly to beneficiaries upon death, avoiding probate. Understanding this can prevent future complications.

-

Incorrect property description: A common mistake is failing to provide a clear and accurate description of the property. Without precise details, such as the property address and legal description, the deed may be deemed invalid.

-

Not naming beneficiaries: Some people forget to name beneficiaries altogether. This omission can lead to confusion and disputes among family members after the property owner’s death.

-

Using vague language: Using terms like "heirs" or "family" instead of naming specific individuals can create ambiguity. Clear identification of beneficiaries is essential to ensure that the property goes to the intended recipients.

-

Failing to sign the deed: A deed that is not signed is not legally binding. This mistake is surprisingly common and can invalidate the entire transfer process.

-

Not having witnesses: In Illinois, the Transfer-on-Death Deed must be signed in the presence of two witnesses. Failing to have witnesses present during signing can lead to legal challenges later on.

-

Neglecting to record the deed: After completing the deed, it must be recorded with the county recorder’s office. Many people overlook this step, which is crucial for the deed to take effect.

-

Not updating the deed: Life changes such as marriage, divorce, or the birth of a child may necessitate updates to the deed. Failing to revise the deed can result in unintended beneficiaries.

-

Assuming it replaces a will: Some individuals mistakenly believe that a Transfer-on-Death Deed replaces their will. In reality, it is a separate legal instrument that should complement, not replace, estate planning documents.

-

Ignoring tax implications: Property transfers can have tax consequences. Not consulting a tax professional can lead to unexpected financial burdens for beneficiaries.

Get Clarifications on Illinois Transfer-on-Death Deed

What is a Transfer-on-Death Deed in Illinois?

A Transfer-on-Death Deed (TOD Deed) is a legal document that allows a property owner in Illinois to transfer real estate to a designated beneficiary upon the owner's death. This deed does not require the property to go through probate, making the transfer process more straightforward and efficient. The property owner retains full control over the property during their lifetime and can sell or modify the property without any restrictions imposed by the deed.

How do I create a Transfer-on-Death Deed in Illinois?

To create a Transfer-on-Death Deed in Illinois, follow these steps:

- Obtain the official Transfer-on-Death Deed form, which can typically be found on the Illinois Secretary of State's website or through legal resources.

- Fill out the form with accurate information, including the name of the property owner, a description of the property, and the name of the beneficiary.

- Sign the deed in the presence of a notary public to ensure its validity.

- Record the signed deed with the county recorder's office where the property is located. This step is crucial for the deed to take effect.

Can I revoke a Transfer-on-Death Deed?

Yes, a Transfer-on-Death Deed can be revoked at any time before the property owner's death. To revoke the deed, the owner must execute a new deed that explicitly states the revocation or file a formal revocation document with the county recorder's office. It is advisable to follow the same recording procedures as the original deed to ensure that the revocation is properly documented and recognized.

What are the benefits of using a Transfer-on-Death Deed?

There are several benefits to using a Transfer-on-Death Deed in Illinois:

- Avoids Probate: The property transfers directly to the beneficiary upon the owner's death, bypassing the often lengthy and costly probate process.

- Retains Control: The property owner maintains full control of the property during their lifetime, allowing for the ability to sell, mortgage, or change the beneficiary if desired.

- Simplicity: The process of creating and executing a TOD Deed is relatively straightforward compared to other estate planning tools.

- Flexibility: Property owners can designate multiple beneficiaries or change beneficiaries as circumstances evolve.