Printable Illinois Rental Application Template

Find Other Popular Rental Application Templates for Specific States

Georgia Rental Application - Provide insights into your lifestyle and how it fits the property.

The quick guide to the Motor Vehicle Bill of Sale is vital for anyone involved in buying or selling a vehicle, as it ensures the proper documentation of ownership transfer. Filling out this form accurately can help avoid disputes and provide security in your transaction.

Rental Application Form Nc - Smoking Policy: Indicate whether you smoke and willingness to abide by the smoking policy.

Rental Application Form Nj - Please confirm whether you have ever been evicted from a property.

Rental Application Pa - Consider including a personal statement to support your application.

Misconceptions

When it comes to the Illinois Rental Application form, many people hold misconceptions that can lead to confusion and misunderstandings. Here are nine common misconceptions explained:

- Everyone must fill out a rental application. While it’s common for landlords to require applications, not every rental situation mandates it. Some landlords may choose to bypass this step based on their discretion or the nature of the rental agreement.

- Rental applications are the same for every landlord. This is not true. Different landlords may have their own specific forms and requirements. Always check with the landlord for their particular application process.

- Filling out an application guarantees you the rental. Submitting an application does not guarantee approval. Landlords will review applications and make decisions based on various factors, including credit history and rental references.

- There is a standard fee for rental applications. Fees can vary widely. Some landlords may charge an application fee, while others do not. It’s essential to inquire about any potential fees before applying.

- Your credit score is the only factor considered. While credit scores are important, landlords also look at rental history, income verification, and personal references. A holistic view is often taken when assessing applicants.

- All rental applications ask for the same personal information. Different applications may request varying amounts and types of personal information. Some may ask for employment history, while others may focus more on financial stability.

- Once you submit an application, you cannot withdraw it. You can withdraw your application at any time before approval. However, be aware that some landlords may not refund application fees if you choose to withdraw.

- Landlords must approve or deny applications within a specific timeframe. There is no legally mandated timeframe for landlords to respond to applications. Response times can vary based on the landlord's processes and workload.

- All rental applications are legally binding contracts. A rental application itself is not a lease or binding contract. It is merely a request for consideration to rent a property. A lease agreement is a separate document that outlines the terms of the rental.

Understanding these misconceptions can help potential renters navigate the application process more effectively and avoid unnecessary frustrations.

Documents used along the form

When renting a property in Illinois, several forms and documents are often used alongside the Illinois Rental Application. These documents help both landlords and tenants clarify their rights and responsibilities, ensuring a smoother rental process. Below is a list of common forms that may accompany the rental application.

- Lease Agreement: This is a legally binding contract between the landlord and tenant that outlines the terms of the rental, including the duration, rent amount, and rules for the property.

- Background Check Authorization: This form allows landlords to conduct a background check on potential tenants, which may include credit history, criminal records, and rental history.

- RV Bill of Sale Form: When finalizing your RV transactions, consider the comprehensive RV Bill of Sale documentation to ensure all legal requirements are met.

- Credit Report Authorization: Similar to the background check, this document gives landlords permission to obtain the tenant's credit report to assess their financial reliability.

- Move-In Inspection Checklist: This checklist is used to document the condition of the property before the tenant moves in, helping to prevent disputes over security deposits later.

- Pet Agreement: If pets are allowed, this document outlines the rules and responsibilities related to pet ownership in the rental property, including any additional fees.

- Security Deposit Receipt: This receipt serves as proof of the security deposit payment made by the tenant and outlines the terms for its return at the end of the lease.

- Notice of Rent Increase: If the landlord plans to raise the rent, this document provides formal notification to the tenant, detailing the new rent amount and effective date.

- Tenant’s Insurance Requirement: Some landlords require tenants to obtain renters insurance. This document outlines the coverage needed and may require proof of insurance.

- Termination Notice: This form is used when either party wishes to terminate the lease. It specifies the reason for termination and the notice period required.

Each of these documents plays a crucial role in the rental process, providing clarity and protection for both landlords and tenants. Understanding these forms can help ensure a positive rental experience.

Steps to Filling Out Illinois Rental Application

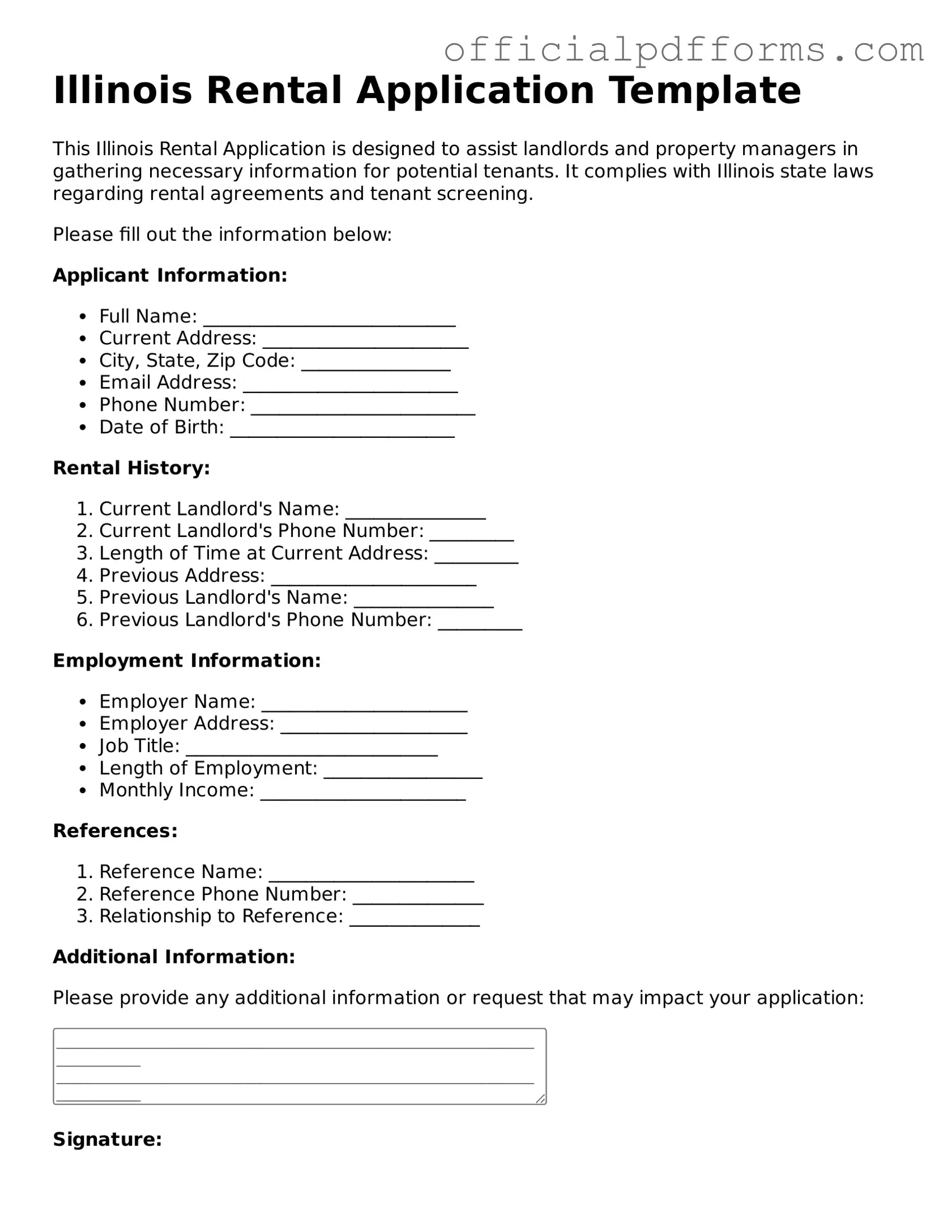

After obtaining the Illinois Rental Application form, you will need to provide specific information to complete it. This information is crucial for the landlord or property manager to assess your application. Follow the steps below to fill out the form accurately.

- Start with your personal information. Enter your full name, current address, and contact details, including phone number and email address.

- Provide your Social Security number and date of birth. This information is often required for background checks.

- Fill in your employment information. List your current employer, job title, and length of employment. Include your employer's address and phone number.

- Disclose your income. Indicate your monthly income and any additional sources of income.

- List previous rental history. Include addresses of past rentals, names of landlords, and the duration of each tenancy.

- Answer questions regarding your credit history. Be honest about any past issues, as this can affect your application.

- Provide references. Include names and contact information for personal or professional references who can vouch for your reliability.

- Review the application for accuracy. Make sure all information is complete and correct before submitting.

- Sign and date the application. Your signature confirms that all provided information is truthful.

Once you have completed the application, submit it to the landlord or property manager along with any required fees. Be prepared for a potential background check and to provide additional documentation if requested.

Common mistakes

-

Providing Incomplete Information: Many applicants fail to fill out all required sections. Leaving out details like employment history or previous addresses can raise red flags for landlords.

-

Using Incorrect or Outdated Contact Information: It's crucial to ensure that phone numbers and email addresses are current. If landlords can't reach you, it may hinder your chances of securing the rental.

-

Neglecting to Disclose Rental History: Omitting previous rental experiences can lead to distrust. Landlords appreciate transparency, so it's wise to include all relevant rental history, even if it wasn't perfect.

-

Failing to Provide References: Not including personal or professional references can weaken your application. References serve as endorsements of your character and reliability as a tenant.

-

Not Disclosing Income: Some applicants hesitate to share their income details. However, providing this information is vital, as landlords want to ensure you can afford the rent.

-

Ignoring the Application Fee: Some individuals forget to include the application fee. This fee is often non-refundable and is a standard part of the application process.

-

Rushing the Process: Taking your time to carefully review the application is essential. Mistakes made in haste can lead to delays or even disqualification from the rental process.

Get Clarifications on Illinois Rental Application

What is an Illinois Rental Application form?

The Illinois Rental Application form is a document used by landlords to collect information from potential tenants. It helps landlords assess the suitability of applicants based on various factors, such as credit history, rental history, and income. This form is essential for ensuring that landlords make informed decisions when selecting tenants for their properties.

What information do I need to provide on the application?

When filling out the application, you will typically need to provide:

- Your full name and contact information.

- Social Security number or other identification.

- Employment details, including your employer's name and contact information.

- Income information, such as pay stubs or tax returns.

- Rental history, including previous addresses and landlord contact information.

- References, which may include personal or professional contacts.

Be prepared to provide accurate and complete information, as this will help streamline the application process.

How is my information used?

Your information will be used primarily to evaluate your application. Landlords may conduct background checks, credit checks, and verify your rental history. This process helps them determine whether you are a reliable tenant. Your information is typically kept confidential, but it is always a good idea to ask the landlord how they will protect your data.

Is there an application fee?

Many landlords charge an application fee to cover the costs of processing your application. This fee can vary widely, so it's important to ask the landlord upfront. The fee is usually non-refundable, even if you are not approved for the rental. Be sure to clarify what the fee covers, such as background checks or credit reports.

How long does the application process take?

The application process can take anywhere from a few hours to several days, depending on the landlord's policies and how quickly they can verify your information. If you are in a competitive rental market, it's a good idea to submit your application as soon as possible. You can also follow up with the landlord to check on the status of your application.

What happens if my application is denied?

If your application is denied, the landlord is required to provide you with a reason. Common reasons for denial include poor credit history, insufficient income, or negative rental history. If you believe there was an error in the information used to evaluate your application, you can request a copy of your credit report and dispute any inaccuracies. It's also worth asking the landlord if they would consider a co-signer or a higher security deposit if you still want to pursue the rental.