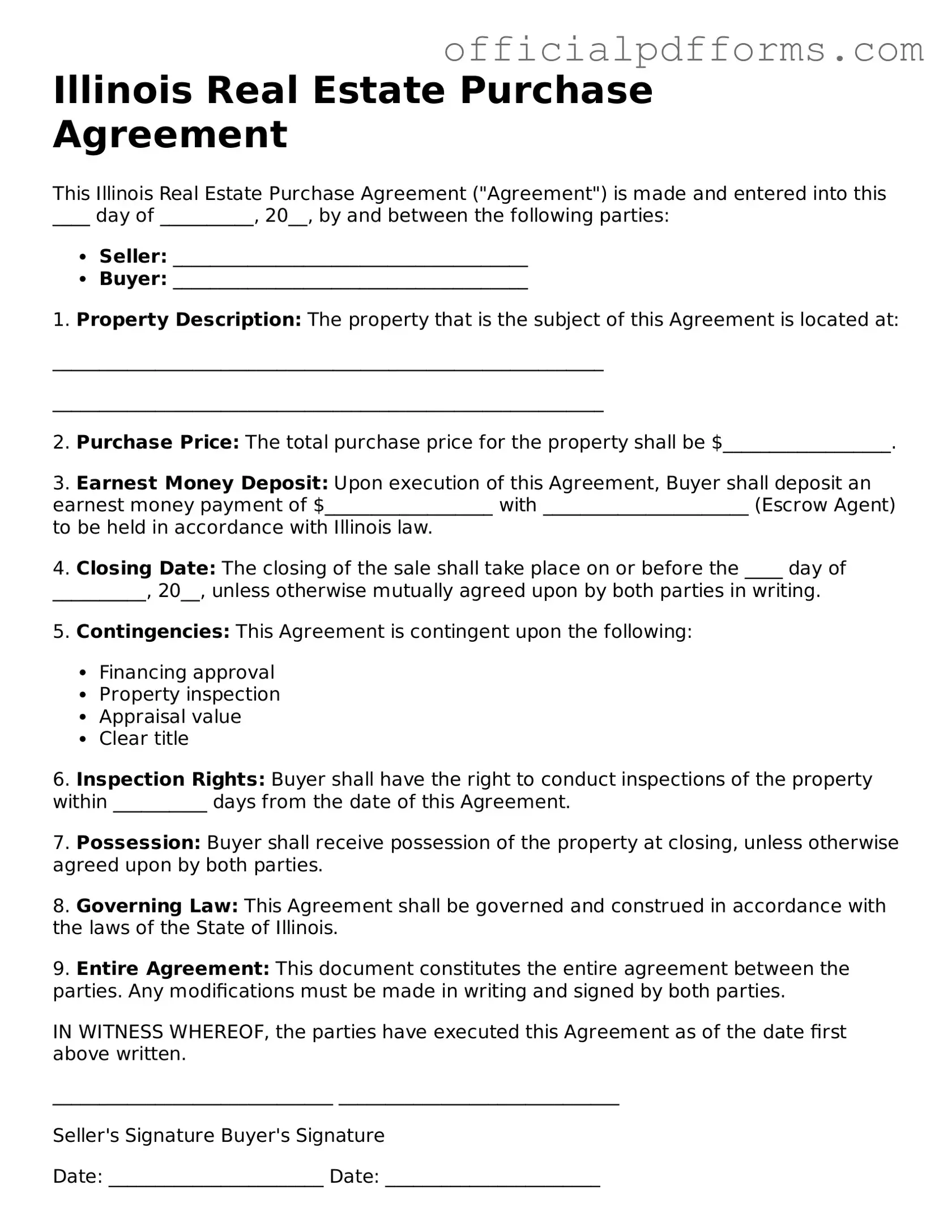

Printable Illinois Real Estate Purchase Agreement Template

Find Other Popular Real Estate Purchase Agreement Templates for Specific States

Midland Title Toledo - This document is often required by lenders when financing a property purchase.

To ensure a smooth property transfer, understanding the implications of a Quitclaim Deed for quick transactions is vital, especially when dealing with familial or informal agreements. This document facilitates an expeditious conveyance, streamlining the process for those needing to transfer property rights without extensive legal formalities.

Georgia Real Estate Contract - Contingencies, which are conditions that must be met for the sale to proceed, are outlined in this contract.

Misconceptions

Understanding the Illinois Real Estate Purchase Agreement form is crucial for anyone involved in a real estate transaction. However, several misconceptions can lead to confusion. Here’s a list of common misunderstandings:

- It's a standard form with no variations. Many believe the agreement is a one-size-fits-all document. In reality, it can be customized to fit the specific needs of the parties involved.

- Only real estate agents can fill it out. While agents often assist, buyers and sellers can complete the form themselves if they understand the requirements.

- Once signed, it cannot be changed. Some think the agreement is set in stone. Amendments can be made if both parties agree to the changes.

- It guarantees the sale will go through. Signing the agreement does not guarantee the transaction will be completed. Contingencies can lead to cancellation.

- All terms are negotiable. While many terms can be negotiated, some legal aspects must comply with Illinois law.

- It's only about the price. People often focus solely on the purchase price. However, the agreement includes many other important terms, such as contingencies and closing dates.

- It does not require legal review. Many think they can proceed without legal advice. Consulting an attorney can help clarify terms and protect interests.

- It’s only necessary for residential properties. This form is used for various types of real estate transactions, not just residential sales.

- It’s a simple document that doesn’t need careful reading. Some underestimate its complexity. Every clause should be understood before signing.

- Once accepted, the buyer has no obligations until closing. Buyers must fulfill any contingencies and conditions outlined in the agreement before closing.

Being informed about these misconceptions can help ensure a smoother real estate transaction. Always seek clarity and ask questions when in doubt.

Documents used along the form

When engaging in real estate transactions in Illinois, several important documents accompany the Illinois Real Estate Purchase Agreement. Each of these forms plays a crucial role in ensuring that both buyers and sellers are protected and that the transaction proceeds smoothly. Below is a list of commonly used documents that often accompany the purchase agreement.

- Disclosure Statement: This document provides vital information about the property's condition, including any known defects or issues. Sellers are required to disclose certain facts to potential buyers, ensuring transparency in the transaction.

- Lead-Based Paint Disclosure: For homes built before 1978, this form is essential. It informs buyers about the potential presence of lead-based paint, which can pose health risks, especially to children. Buyers must acknowledge receipt of this information.

- Title Commitment: This document outlines the terms of the title insurance policy that will be issued upon closing. It details any liens, encumbrances, or claims against the property, helping buyers understand their ownership rights.

- Bill of Sale: This document serves as proof of the transaction between the seller and buyer and is particularly important for the sale of personal property. For more information, visit OnlineLawDocs.com.

- Closing Statement: Also known as the HUD-1 Settlement Statement, this document summarizes all financial transactions involved in the sale, including the purchase price, closing costs, and any adjustments. It provides a clear overview of the final amounts due at closing.

- Property Inspection Report: Often conducted by a professional inspector, this report assesses the property's condition and identifies any necessary repairs. Buyers typically review this document to make informed decisions about the purchase.

Understanding these accompanying documents is vital for anyone involved in a real estate transaction. They not only facilitate a smoother process but also help ensure that all parties are aware of their rights and obligations. By being informed, buyers and sellers can navigate the complexities of real estate transactions with greater confidence.

Steps to Filling Out Illinois Real Estate Purchase Agreement

After gathering the necessary information, you can begin filling out the Illinois Real Estate Purchase Agreement form. This form is essential for documenting the terms of a real estate transaction. Follow these steps carefully to ensure accuracy.

- Start by entering the date at the top of the form.

- Identify the buyer and seller. Fill in their full names and addresses in the designated sections.

- Provide a description of the property being sold. This includes the address and any relevant details that identify the property.

- State the purchase price. Clearly write the total amount the buyer agrees to pay for the property.

- Outline the earnest money deposit. Indicate the amount and when it will be paid.

- Specify the closing date. This is the date when the transaction will be finalized.

- Include any contingencies. If there are conditions that must be met before the sale, list them here.

- Sign and date the form. Both the buyer and seller need to sign to make the agreement official.

Once you have completed the form, review it for any errors or missing information. It's important to ensure everything is accurate before submitting it to the relevant parties.

Common mistakes

-

Incomplete Information: Buyers and sellers often leave sections blank. Each party must provide their full legal names, addresses, and contact information.

-

Incorrect Property Description: Failing to accurately describe the property can lead to disputes. Always include the correct address and any relevant legal descriptions.

-

Missing Signatures: Both parties must sign the agreement. An unsigned document is not legally binding.

-

Not Specifying Contingencies: Buyers should clearly outline any contingencies, such as financing or inspections. Omitting these can jeopardize the deal.

-

Ignoring Deadlines: Dates for inspections, financing, and closing should be clearly stated. Missing these deadlines can lead to complications.

-

Failure to Disclose Issues: Sellers must disclose known issues with the property. Not doing so can lead to legal trouble later.

-

Neglecting to Include Earnest Money: The agreement should specify the amount of earnest money and the terms for its return. This shows good faith in the transaction.

-

Overlooking Legal Review: Many people skip having the agreement reviewed by a legal professional. This can result in misunderstandings and potential legal issues down the line.

Get Clarifications on Illinois Real Estate Purchase Agreement

What is the Illinois Real Estate Purchase Agreement form?

The Illinois Real Estate Purchase Agreement form is a legal document used when buying or selling real estate in Illinois. This form outlines the terms and conditions of the sale, including the purchase price, property description, and any contingencies. It serves as a binding contract between the buyer and seller once both parties have signed it.

What key information is included in the agreement?

The agreement includes several important details, such as:

- The names and contact information of the buyer and seller.

- A detailed description of the property being sold.

- The agreed-upon purchase price.

- Contingencies, which are conditions that must be met for the sale to proceed, such as financing or inspections.

- Closing date and any other relevant timelines.

Do I need a lawyer to complete this agreement?

What happens after the agreement is signed?

Once both parties have signed the agreement, it becomes a legally binding contract. The next steps typically include:

- Conducting any agreed-upon inspections or appraisals.

- Securing financing if necessary.

- Working towards the closing date, during which the final paperwork will be signed, and ownership will be transferred.

Both parties should stay in communication to ensure that all conditions are met in a timely manner.

Can the agreement be changed after it is signed?

Yes, changes can be made to the agreement after it is signed, but both parties must agree to the changes. Any modifications should be documented in writing and signed by both the buyer and seller to ensure that they are enforceable. It is advisable to consult with a lawyer when making changes to ensure that all parties understand the implications.