Printable Illinois Quitclaim Deed Template

Find Other Popular Quitclaim Deed Templates for Specific States

New Jersey Deed Transfer Form - A Quitclaim Deed does not involve a third-party guarantee.

Georgia Quit Claim Deed - These deeds are often accompanied by other estate planning documents.

The IRS 2553 form is a critical document used by small businesses to elect S corporation status for tax purposes. This form allows eligible corporations or entities to be taxed as pass-through entities, potentially leading to tax savings. Understanding and correctly filing Form 2553 is essential for businesses seeking to benefit from S corporation status, and for more information, you can visit https://smarttemplates.net/fillable-irs-2553/.

Quit Claim Deed North Carolina - The document must be signed, typically requiring notarization to be valid.

Misconceptions

When it comes to the Illinois Quitclaim Deed, there are several misconceptions that can lead to confusion. Here are four common misunderstandings:

- Misconception 1: A quitclaim deed transfers ownership of the property without any warranties.

- Misconception 2: A quitclaim deed is only used between family members.

- Misconception 3: A quitclaim deed eliminates the need for a title search.

- Misconception 4: A quitclaim deed is the same as a warranty deed.

This is true, but it often leads people to think they are getting less security. A quitclaim deed simply transfers whatever interest the grantor has in the property. If there are issues with the title, the new owner may face challenges.

While it is common for family transfers, quitclaim deeds can be used in various situations. They are often used in divorces, property settlements, or even among friends.

Many believe that using a quitclaim deed means they don’t need to check the title. However, a title search is still important to uncover any potential issues or claims against the property.

This is not correct. A warranty deed provides guarantees about the title, while a quitclaim deed does not. This difference is crucial when it comes to ensuring clear ownership.

Documents used along the form

When transferring property in Illinois, the Quitclaim Deed is a vital document, but it's often accompanied by other forms to ensure a smooth and legally sound transaction. Here’s a list of common documents that you may encounter during this process.

- Property Transfer Tax Declaration: This form is required to report the sale price of the property and calculate any transfer taxes owed to the state or local government.

- Affidavit of Title: This document confirms that the seller holds clear title to the property and outlines any potential claims or encumbrances that may exist.

- Title Insurance Policy: A title insurance policy protects the buyer from any future claims against the title that may arise after the purchase, ensuring peace of mind.

- Motor Vehicle Bill of Sale: When buying or selling a motor vehicle, this document is essential to verify the transaction and protect both parties. For more details, you can visit OnlineLawDocs.com.

- Settlement Statement (HUD-1): This form details all financial transactions involved in the sale, including fees, taxes, and any credits or debits that apply.

- Illinois Real Estate Transfer Declaration (PTAX-203): This form is filed with the county assessor to report the transfer of real estate and is used to assess property taxes.

- Power of Attorney: If the seller cannot be present for the transaction, a Power of Attorney allows another person to act on their behalf, signing documents and making decisions.

- Notice of Sale: This document informs interested parties, such as tenants or lienholders, that the property has been sold, providing them with necessary information about the new owner.

- Certificate of Compliance: This form may be required to confirm that the property meets local building codes and regulations, ensuring that it is safe and habitable.

Understanding these documents can help streamline the property transfer process and protect the interests of all parties involved. Always consult with a legal professional to ensure that you have the correct forms and that they are completed properly.

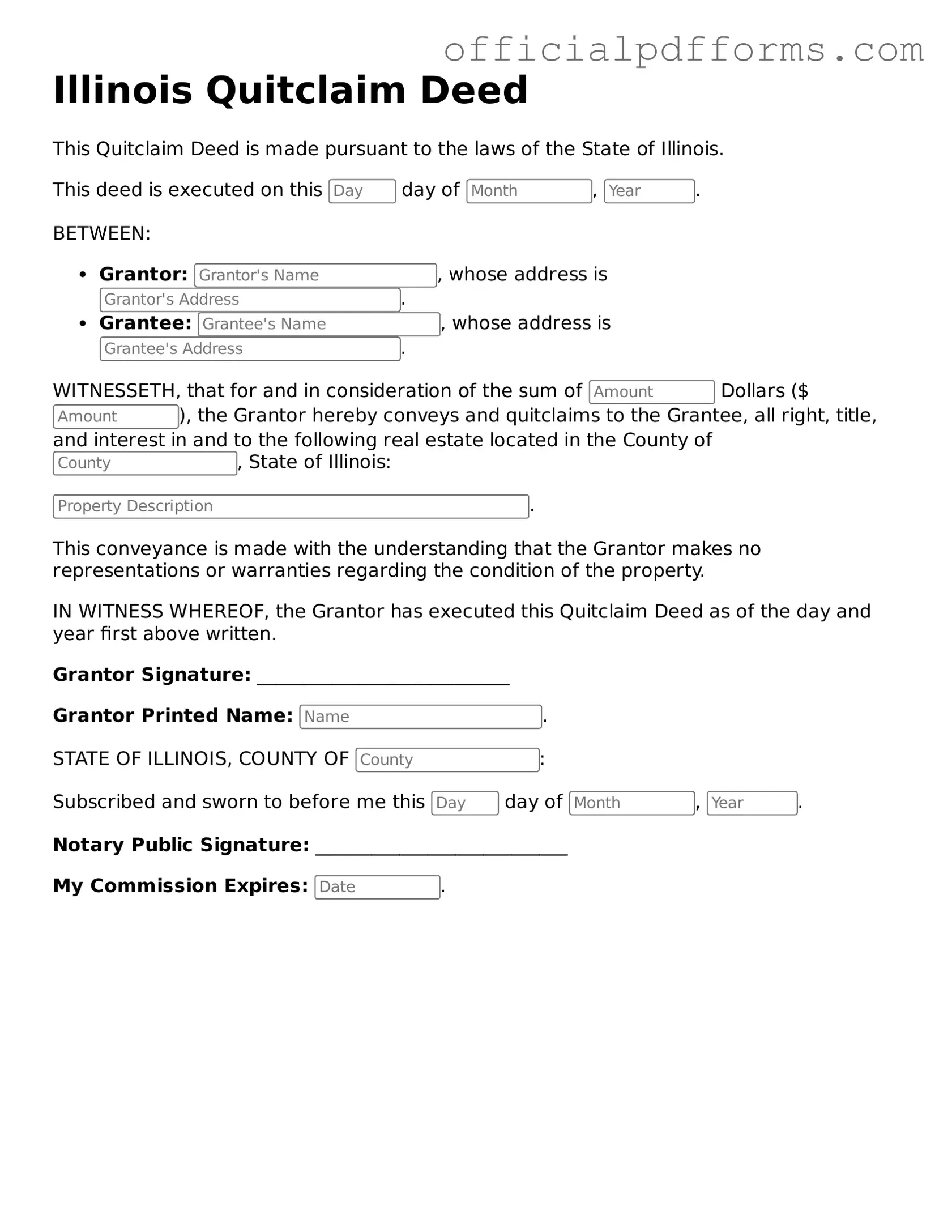

Steps to Filling Out Illinois Quitclaim Deed

After you have gathered the necessary information and documents, you are ready to fill out the Illinois Quitclaim Deed form. This form is essential for transferring property ownership, and completing it accurately is crucial. Follow these steps carefully to ensure everything is filled out correctly.

- Obtain the Form: You can find the Illinois Quitclaim Deed form online or at your local county recorder's office. Make sure you have the most current version.

- Identify the Grantor: In the designated section, write the full name and address of the person transferring the property. This individual is known as the grantor.

- Identify the Grantee: Next, provide the full name and address of the person receiving the property. This person is referred to as the grantee.

- Describe the Property: Clearly describe the property being transferred. Include the address, legal description, and any relevant parcel numbers to avoid confusion.

- Consideration: Indicate the amount of money or value exchanged for the property. If the transfer is a gift, you can write "love and affection" or simply state "no consideration."

- Sign the Document: The grantor must sign the form in the presence of a notary public. Ensure that the signature matches the name provided earlier.

- Notarization: The notary public will complete their section, verifying the identity of the grantor and witnessing the signature.

- Submit the Form: Take the completed and notarized Quitclaim Deed to the local county recorder’s office for filing. There may be a small fee for this service.

Once the Quitclaim Deed is submitted and recorded, it becomes part of the public record. The new owner can then enjoy their property rights, knowing the transfer has been officially documented. Always keep a copy for your records as well.

Common mistakes

-

Failing to include all necessary parties. All individuals involved in the transaction must be clearly listed as grantors and grantees.

-

Not providing a legal description of the property. A vague or incomplete description can lead to issues with the transfer of ownership.

-

Neglecting to sign the document. Both the grantor and grantee must sign the Quitclaim Deed for it to be valid.

-

Using incorrect names. It is essential that the names of all parties are spelled correctly and match their legal identification.

-

Inadequate notarization. The Quitclaim Deed must be notarized by a licensed notary public to ensure its legitimacy.

-

Forgetting to check local requirements. Different counties may have specific regulations regarding the filing of Quitclaim Deeds.

-

Omitting the date of execution. The date on which the deed is signed must be included to establish the timeline of the transfer.

-

Not recording the deed. After completion, the Quitclaim Deed should be filed with the appropriate county office to make the transfer official.

Get Clarifications on Illinois Quitclaim Deed

What is a Quitclaim Deed in Illinois?

A Quitclaim Deed is a legal document used to transfer ownership of real estate from one party to another without making any guarantees about the property title. In Illinois, this type of deed allows the grantor (the person transferring the property) to relinquish their interest in the property to the grantee (the person receiving the property). It is often used in situations such as transferring property between family members or in divorce settlements.

When should I use a Quitclaim Deed?

A Quitclaim Deed is typically used in specific situations, including:

- Transferring property between family members.

- Transferring property as part of a divorce settlement.

- Clearing up title issues, such as adding or removing a name from the title.

- Transferring property to a trust or business entity.

However, it is important to note that a Quitclaim Deed does not provide any warranty or guarantee regarding the title, so it should not be used when buying or selling property in a traditional real estate transaction.

What information is required on the Illinois Quitclaim Deed form?

The Illinois Quitclaim Deed form requires several key pieces of information, including:

- The names and addresses of the grantor and grantee.

- A legal description of the property being transferred.

- The date of the transfer.

- The signature of the grantor, which must be notarized.

Additional details, such as the property’s tax identification number, may also be included for clarity.

How do I complete the Quitclaim Deed form?

To complete the Quitclaim Deed form, follow these steps:

- Gather the necessary information about the property and the parties involved.

- Fill out the form, ensuring all required fields are completed accurately.

- Have the grantor sign the document in the presence of a notary public.

- File the completed deed with the appropriate county recorder’s office.

Double-check the form for any errors before submitting it, as inaccuracies can cause delays or complications.

Is a Quitclaim Deed legally binding?

Yes, a properly executed Quitclaim Deed is legally binding once it is signed by the grantor and notarized. However, it must also be recorded with the local county recorder’s office to provide public notice of the transfer. Recording the deed helps protect the rights of the grantee and establishes a public record of ownership.

Are there any fees associated with filing a Quitclaim Deed in Illinois?

Yes, there are typically fees associated with filing a Quitclaim Deed in Illinois. These fees can vary by county and may include recording fees and, in some cases, transfer taxes. It is advisable to check with the local county recorder’s office for the specific fees applicable to your situation.

Can a Quitclaim Deed be revoked?

Once a Quitclaim Deed is executed and recorded, it cannot be revoked unilaterally. However, if both parties agree, they can execute a new deed to reverse the transfer. This process may involve creating another Quitclaim Deed to transfer the property back to the original grantor or to a new grantee.

Do I need an attorney to prepare a Quitclaim Deed?

While it is not legally required to have an attorney prepare a Quitclaim Deed, it is often advisable. An attorney can ensure that the deed is completed correctly and complies with all legal requirements. They can also provide guidance on any potential implications of the transfer and help address any specific concerns you may have.

Where can I obtain an Illinois Quitclaim Deed form?

Illinois Quitclaim Deed forms can be obtained from various sources, including:

- Local county recorder’s office websites, which may provide downloadable forms.

- Legal stationery stores that sell real estate forms.

- Online legal form providers that offer customizable Quitclaim Deed templates.

Make sure to use a form that complies with Illinois state laws to ensure its validity.