Printable Illinois Promissory Note Template

Find Other Popular Promissory Note Templates for Specific States

Loan Note Template - They help establish a formal record of the loan agreement, reducing misunderstandings.

Understanding the significance of a Release of Liability form is essential for anyone participating in high-risk activities, as it offers a safeguard against unforeseen incidents. By using such a document, individuals acknowledge the potential dangers involved, thus minimizing legal repercussions for the organizing parties. For more detailed information on crafting effective legal documents, you can visit https://toptemplates.info.

Promissory Note Template Georgia - By signing a Promissory Note, the borrower acknowledges the debt owed.

Misconceptions

Understanding the Illinois Promissory Note form is crucial for anyone involved in lending or borrowing money. However, several misconceptions can lead to confusion. Here are nine common misunderstandings:

- It's only for large loans. Many believe that promissory notes are only necessary for significant amounts. In reality, they can be used for any loan amount, big or small.

- Verbal agreements are enough. Some think that a handshake or a verbal promise suffices. However, a written promissory note provides legal protection and clarity for both parties.

- It doesn't need to be notarized. While notarization is not always required, having a notary can enhance the document's credibility and help avoid disputes.

- All promissory notes are the same. Each state may have specific requirements. The Illinois Promissory Note form has unique elements that must be included to be enforceable in Illinois.

- Only lenders need to sign. Both the borrower and the lender should sign the note. This ensures that both parties acknowledge the terms and conditions.

- Interest rates are optional. While you can choose not to charge interest, if you do, the rate must be clearly stated in the note to avoid confusion.

- It's only for personal loans. Promissory notes are not limited to personal loans. They are also used in business transactions and other financial agreements.

- Once signed, it can't be changed. Amendments can be made, but both parties must agree to the changes and document them properly.

- Defaulting on a promissory note has no consequences. Defaulting can lead to serious repercussions, including legal action and damage to credit scores.

By clearing up these misconceptions, you can better navigate the complexities of promissory notes in Illinois.

Documents used along the form

When entering into a financial agreement in Illinois, a Promissory Note is often accompanied by several other important documents. These documents help clarify the terms of the loan, establish security, and provide legal protection for both parties involved. Below are some commonly used forms that complement the Illinois Promissory Note.

- Loan Agreement: This document outlines the specific terms of the loan, including the amount borrowed, interest rate, repayment schedule, and any fees associated with the loan. It serves as a more detailed contract that governs the relationship between the lender and borrower.

- Notice to Quit: To initiate the eviction process appropriately, landlords can use this formal Notice to Quit template for tenants to ensure compliance with legal requirements.

- Security Agreement: If the loan is secured by collateral, a Security Agreement is necessary. This document specifies the collateral being used to secure the loan and outlines the lender's rights in case of default.

- Disclosure Statement: This statement provides essential information about the loan, such as the total cost of the loan, the annual percentage rate (APR), and any potential fees. It ensures transparency and helps borrowers understand the financial implications of their agreement.

- UCC Financing Statement: If the loan involves collateral, a UCC Financing Statement may be filed to publicly declare the lender's interest in the collateral. This document protects the lender's rights and establishes priority over other creditors in case of default.

These documents, alongside the Illinois Promissory Note, create a comprehensive framework for the lending process. They help ensure that both parties are aware of their rights and obligations, ultimately fostering a clearer and more secure lending relationship.

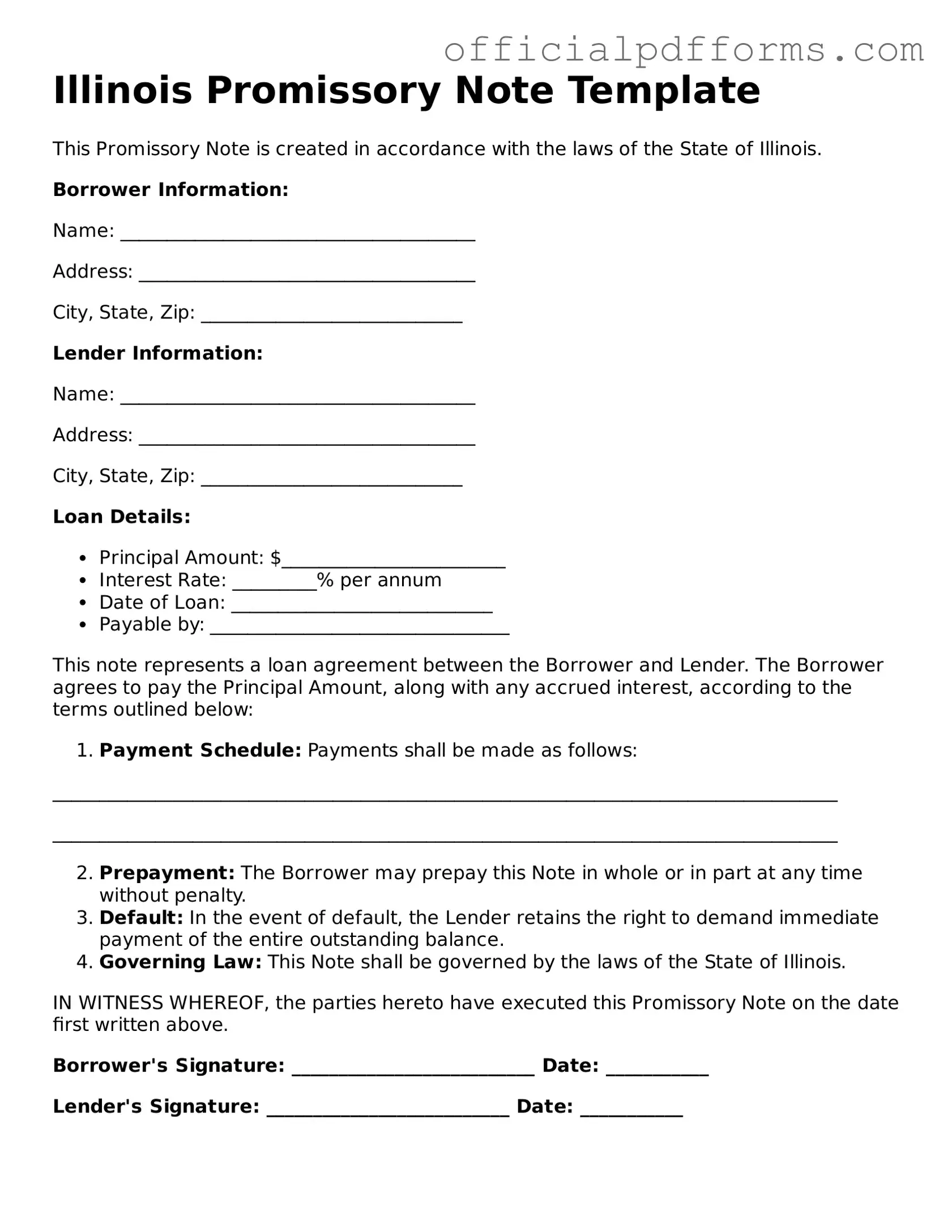

Steps to Filling Out Illinois Promissory Note

Completing the Illinois Promissory Note form is an important step in documenting a loan agreement. After filling out the form, it is advisable to keep copies for both parties involved. This ensures that all terms are clear and can be referenced in the future.

- Begin by entering the date at the top of the form. This should be the date when the note is created.

- Fill in the name and address of the borrower. Ensure that all details are accurate to avoid any confusion later.

- Next, provide the name and address of the lender. This identifies who is providing the loan.

- State the principal amount of the loan clearly. This is the total amount borrowed by the borrower.

- Specify the interest rate, if applicable. This should be written as a percentage.

- Indicate the repayment terms, including the due date for repayment. Be specific about whether payments are due monthly, quarterly, or on another schedule.

- Include any late fees or penalties for missed payments, if relevant.

- Sign the form where indicated. Both the borrower and lender should sign to acknowledge the agreement.

- Finally, provide the date of each signature. This helps to confirm when the agreement was finalized.

Common mistakes

-

Not including all necessary details: Many people forget to fill in crucial information such as the names of the borrower and lender, the loan amount, and the interest rate. Each detail matters for clarity and legal standing.

-

Incorrectly stating the repayment terms: Some individuals write vague or confusing repayment terms. It's important to specify when payments are due and the total duration of the loan.

-

Neglecting to include interest rates: Failing to mention an interest rate can lead to misunderstandings. If there is no interest, it should be clearly stated as "0% interest."

-

Not signing the document: A common oversight is forgetting to sign the promissory note. Without a signature, the note lacks legal validity.

-

Omitting the date: Leaving out the date of the agreement can create confusion about when the loan starts. Always include the date to ensure clarity.

-

Using unclear language: Some people use complex terms or jargon that can lead to misinterpretation. Keep the language simple and straightforward.

-

Failing to make copies: After filling out the form, it’s essential to make copies for both the lender and borrower. This ensures that both parties have a record of the agreement.

-

Not considering state laws: Ignoring Illinois-specific laws regarding promissory notes can lead to issues. Familiarize yourself with local regulations to avoid complications.

-

Not seeking legal advice: Some individuals fill out the form without consulting a lawyer. Getting professional guidance can help avoid mistakes that could affect the enforceability of the note.

Get Clarifications on Illinois Promissory Note

What is a Promissory Note in Illinois?

A Promissory Note is a written promise to pay a specified amount of money to a designated person or entity at a future date or on demand. In Illinois, this document serves as a legal instrument that outlines the terms of the loan, including the principal amount, interest rate, payment schedule, and any penalties for late payments.

Who can create a Promissory Note?

Any individual or business can create a Promissory Note in Illinois. The parties involved must be legally competent, meaning they have the mental capacity to understand the terms of the agreement. This includes adults and, in some cases, minors who are legally permitted to enter into contracts.

What information is typically included in a Promissory Note?

A typical Promissory Note includes the following information:

- The names and addresses of the borrower and lender.

- The principal amount being borrowed.

- The interest rate, if applicable.

- The payment schedule (e.g., monthly, quarterly).

- The maturity date when the loan must be repaid.

- Any collateral securing the loan, if applicable.

- Default terms and penalties for late payments.

Is a Promissory Note legally binding?

Yes, a properly executed Promissory Note is legally binding in Illinois. Once signed by both parties, it creates an enforceable obligation. If the borrower fails to repay the loan as agreed, the lender can take legal action to recover the owed amount.

Do I need a lawyer to create a Promissory Note?

While it is not legally required to have a lawyer draft a Promissory Note, it is often advisable. A legal professional can ensure that the document complies with Illinois laws and meets the specific needs of both parties. This can help prevent misunderstandings or disputes in the future.

Can a Promissory Note be modified?

Yes, a Promissory Note can be modified if both parties agree to the changes. It is essential to document any modifications in writing and have both parties sign the amended note to maintain clarity and enforceability.

What happens if the borrower defaults on the Promissory Note?

If the borrower defaults, the lender has several options. They may pursue legal action to collect the debt, which could involve filing a lawsuit. The lender may also seek to enforce any collateral listed in the note. Defaulting on a Promissory Note can negatively impact the borrower’s credit score.

How is a Promissory Note different from a loan agreement?

A Promissory Note is a simpler document that primarily focuses on the promise to repay a loan. In contrast, a loan agreement is more comprehensive and may include additional terms, conditions, and obligations of both parties. While a Promissory Note can stand alone, a loan agreement often encompasses a wider range of legal considerations.