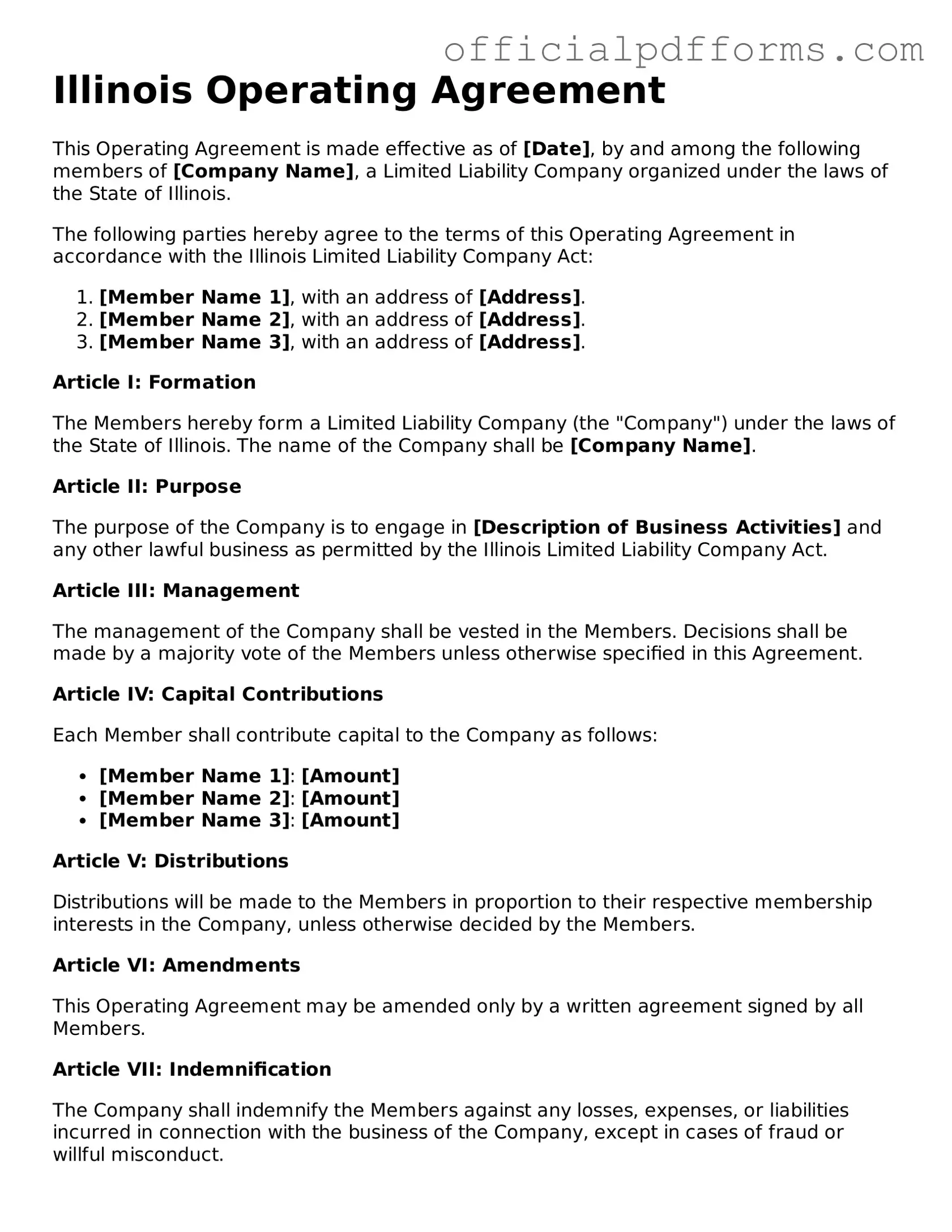

Printable Illinois Operating Agreement Template

Find Other Popular Operating Agreement Templates for Specific States

Llc Operating Agreement Georgia - This document helps to solidify the commitment of members to the success of the LLC.

For those navigating the complexities of a property transaction, a detailed understanding of the Real Estate Purchase Agreement requirements is crucial. This document lays out the obligations of all parties involved and provides clarity during the buying or selling process. To learn more about drafting this important agreement, visit our guide to the Real Estate Purchase Agreement essentials.

Ohio Llc Operating Agreement Template - An Operating Agreement outlines the management structure of an LLC.

Misconceptions

Misconceptions about the Illinois Operating Agreement form can lead to confusion for business owners and partners. Understanding these misconceptions is crucial for effective business management. Below is a list of seven common misconceptions.

- The Operating Agreement is optional. Many believe that an Operating Agreement is not necessary for an LLC in Illinois. However, while it is not required by law, having one is highly advisable for clarifying roles and responsibilities.

- All members must sign the Operating Agreement. Some think that every member of the LLC must sign the agreement for it to be valid. In reality, it is important for all members to agree to its terms, but not all need to sign it for the agreement to be enforceable.

- The Operating Agreement can only be created at formation. There is a misconception that the Operating Agreement must be drafted at the time of LLC formation. In fact, it can be created or amended at any time as the business evolves.

- It only addresses financial matters. Many assume that the Operating Agreement only covers financial aspects of the LLC. In truth, it also outlines management structure, member duties, and procedures for decision-making.

- State law governs all provisions in the Operating Agreement. Some believe that state law dictates every aspect of the Operating Agreement. While state law provides a framework, members have the freedom to customize many provisions within the bounds of the law.

- The Operating Agreement is the same as the Articles of Organization. There is a common misunderstanding that these two documents are interchangeable. However, the Articles of Organization serve to officially establish the LLC, while the Operating Agreement details its internal operations.

- Once created, the Operating Agreement cannot be changed. Many think that an Operating Agreement is set in stone once drafted. In reality, it can be amended as needed, provided that the process for amendments is followed as outlined in the agreement itself.

Addressing these misconceptions can help ensure that LLC members are better informed about their rights and responsibilities under Illinois law. It is essential to approach the Operating Agreement with the seriousness it deserves.

Documents used along the form

When forming a limited liability company (LLC) in Illinois, several important documents complement the Illinois Operating Agreement. Each of these documents serves a specific purpose in establishing the framework and operational guidelines for the LLC. Below is a list of essential forms and documents that are often used in conjunction with the Operating Agreement.

- Articles of Organization: This document is filed with the state to officially create the LLC. It includes basic information such as the company name, address, and the names of the members.

- IRS 2553 Form: This essential document allows small businesses to elect S corporation status for tax purposes, enabling them to be taxed as pass-through entities. For more information, visit https://smarttemplates.net/fillable-irs-2553/.

- Member Resolutions: These are formal documents that record decisions made by the members of the LLC. They can cover a range of topics, including approval of major business actions or changes in management.

- Membership Certificates: These certificates serve as proof of ownership for each member in the LLC. They outline the percentage of ownership and can be important for legal and financial purposes.

- Bylaws: While not always required, bylaws provide additional rules governing the internal management of the LLC. They can outline voting procedures, meeting requirements, and other operational guidelines.

- Operating Procedures: This document details the day-to-day operational procedures of the LLC. It can include guidelines for handling finances, member responsibilities, and conflict resolution processes.

- Tax Identification Number (TIN) Application: This form is used to apply for an Employer Identification Number (EIN) from the IRS. The EIN is necessary for tax purposes and to open a business bank account.

Having these documents prepared and organized can help ensure that the LLC operates smoothly and in compliance with state laws. Each document plays a vital role in defining the structure, responsibilities, and operational standards of the business.

Steps to Filling Out Illinois Operating Agreement

Filling out the Illinois Operating Agreement form is an essential step for anyone looking to establish a Limited Liability Company (LLC) in Illinois. The form requires specific information about your business structure and the roles of its members. Completing it accurately will help ensure that your LLC operates smoothly and in compliance with state regulations.

- Gather Information: Collect all necessary details about your LLC, including the name, address, and purpose of the business, as well as the names and addresses of the members.

- Title the Document: At the top of the form, clearly label it as the "Operating Agreement" for your LLC.

- Insert LLC Name: Write the official name of your LLC as it appears on your Articles of Organization.

- Provide Principal Office Address: Enter the primary address where your LLC will conduct business.

- Define Purpose: Describe the purpose of your LLC in a few sentences. This can be a general statement about the business activities.

- List Members: Include the names and addresses of all members involved in the LLC. Make sure this information is accurate.

- Outline Management Structure: Indicate whether the LLC will be managed by its members or by appointed managers. Specify the roles and responsibilities if applicable.

- Detail Financial Contributions: Specify the initial capital contributions of each member and how profits and losses will be distributed.

- Include Voting Rights: Define how voting rights will be allocated among members. This could be based on ownership percentage or another method.

- Set Terms for Adding Members: Outline the process for adding new members to the LLC in the future.

- Sign and Date: Ensure that all members sign and date the document to make it official. Consider having it notarized for added security.

Common mistakes

-

Not Including All Members: One common mistake is failing to list all members of the LLC. Each member’s name and address should be included to ensure clarity and legal validity.

-

Inaccurate Information: Providing incorrect details, such as wrong addresses or misspelled names, can lead to complications later. Double-check all information before submission.

-

Ignoring State Requirements: Each state has specific requirements for operating agreements. Some people overlook these, thinking a generic template will suffice. Make sure to understand what Illinois requires.

-

Vague Terms: Using unclear language can create confusion. Be precise in defining roles, responsibilities, and profit-sharing. Ambiguity can lead to disputes among members.

-

Not Addressing Changes: Failing to include procedures for adding or removing members can cause issues down the line. It’s important to outline how changes will be handled.

-

Overlooking Signatures: Lastly, neglecting to have all members sign the agreement can render it ineffective. Ensure that everyone involved provides their signature to validate the document.

Get Clarifications on Illinois Operating Agreement

What is an Illinois Operating Agreement?

An Illinois Operating Agreement is a legal document that outlines the management structure and operating procedures of a Limited Liability Company (LLC) in Illinois. It serves as an internal guideline for the members of the LLC, detailing how the business will be run, how profits and losses will be distributed, and the roles and responsibilities of each member.

Why is an Operating Agreement important?

Having an Operating Agreement is crucial for several reasons:

- It helps clarify the rights and responsibilities of each member.

- It can prevent misunderstandings and disputes among members.

- It provides a framework for making decisions and resolving conflicts.

- In the event of legal issues, it can serve as evidence of the company’s structure and operations.

Is an Operating Agreement required in Illinois?

While Illinois law does not mandate that LLCs have an Operating Agreement, it is highly recommended. Without one, the LLC will default to the state’s rules, which may not align with the members’ intentions or business needs. Having a written agreement can provide clarity and protection for all members involved.

What should be included in an Operating Agreement?

An effective Operating Agreement typically includes:

- The name and purpose of the LLC.

- The names and addresses of the members.

- Details on how profits and losses will be allocated.

- The management structure (member-managed or manager-managed).

- Voting rights and decision-making processes.

- Procedures for adding or removing members.

- How disputes will be resolved.

Can the Operating Agreement be changed after it is created?

Yes, the Operating Agreement can be amended after it has been created. Members can agree to changes through a formal process outlined in the agreement itself. It is important to document any amendments in writing and ensure that all members consent to the changes to avoid future disputes.

How do I create an Operating Agreement for my LLC?

Creating an Operating Agreement can be straightforward. Here are the steps to follow:

- Gather all members and discuss the key elements you want to include.

- Draft the agreement, ensuring it reflects the members' intentions.

- Review the document together and make necessary adjustments.

- Once everyone agrees, have all members sign the document.

- Store the signed agreement in a safe place, along with other important company documents.

Where can I find a template for an Illinois Operating Agreement?

Templates for Illinois Operating Agreements can be found online through various legal websites and resources. Many offer free or paid templates that can be customized to fit your LLC’s specific needs. Additionally, consulting with a legal professional can ensure that your agreement complies with state laws and adequately protects your interests.