Printable Illinois Loan Agreement Template

Find Other Popular Loan Agreement Templates for Specific States

Promissory Note Georgia - The agreement may outline the rights of the lender in case of default.

In order to efficiently utilize the FedEx Bill of Lading form, shippers can explore the various features it offers through the guidance available at smarttemplates.net/fillable-fedex-bill-of-lading/, ensuring all necessary details are accurately captured and compliant with shipping requirements.

Misconceptions

Understanding the Illinois Loan Agreement form can be tricky, and there are several misconceptions that often arise. Here are seven common misunderstandings about this important document:

- It's only for large loans. Many believe that the Illinois Loan Agreement is only necessary for significant amounts of money. In reality, it is beneficial for loans of any size, providing clarity and protection for both parties.

- Verbal agreements are sufficient. Some people think that a verbal agreement is enough to secure a loan. However, having a written loan agreement helps prevent misunderstandings and provides a legal record of the terms.

- All loan agreements are the same. Many assume that all loan agreements follow a standard template. In truth, the Illinois Loan Agreement can be customized to fit specific needs, including interest rates and repayment terms.

- It's only necessary for personal loans. While personal loans often require a loan agreement, business loans and transactions between family members also benefit from this formal documentation.

- Once signed, it cannot be changed. Some individuals think that a loan agreement is set in stone once signed. However, parties can amend the agreement if both agree to the changes, as long as the amendments are documented in writing.

- Legal advice is not needed. Many people believe they can create a loan agreement without any legal guidance. Seeking advice from a legal professional can help ensure that the agreement is comprehensive and enforceable.

- It's only for lenders. Some think that only lenders benefit from a loan agreement. In fact, borrowers also gain protection by clearly understanding their obligations and rights under the agreement.

By addressing these misconceptions, individuals can better navigate the process of creating and signing an Illinois Loan Agreement, ensuring that both parties are protected and informed.

Documents used along the form

When entering into a loan agreement in Illinois, several other forms and documents may be necessary to ensure that all parties are adequately protected and informed. Each of these documents serves a specific purpose and can help clarify the terms of the loan, outline responsibilities, and provide legal protections.

- Promissory Note: This is a written promise from the borrower to repay the loan amount, detailing the repayment schedule, interest rate, and any penalties for late payments.

- Loan Disclosure Statement: This document provides borrowers with important information about the terms of the loan, including fees, interest rates, and the total cost of borrowing.

- Security Agreement: If the loan is secured by collateral, this agreement outlines the specific assets that back the loan and the lender's rights in case of default.

- Personal Guarantee: This document may be required if the borrower is a business entity, ensuring that an individual takes personal responsibility for the loan in case the business defaults.

- Credit Application: This form collects information about the borrower’s financial status and credit history to help the lender assess risk before approving the loan.

- Loan Modification Agreement: If changes to the original loan terms are necessary, this document outlines the new terms and conditions agreed upon by both parties.

- Operating Agreement: This document outlines the operating procedures and ownership structure of an LLC in New York, helping to avoid ambiguities and potential conflicts. For more information, visit OnlineLawDocs.com.

- Default Notice: This formal communication informs the borrower of a default on the loan, outlining the specific issues and any required actions to remedy the situation.

- Release of Lien: Once the loan is paid off, this document releases the lender's claim on the collateral, ensuring that the borrower owns the asset free and clear.

- Closing Statement: This document summarizes the financial transactions that occurred at the closing of the loan, including any fees, costs, and the final loan amount disbursed.

Understanding these documents can help borrowers navigate the loan process more effectively. Each form plays a crucial role in defining the relationship between the lender and borrower, ensuring transparency and legal compliance throughout the loan agreement's life cycle.

Steps to Filling Out Illinois Loan Agreement

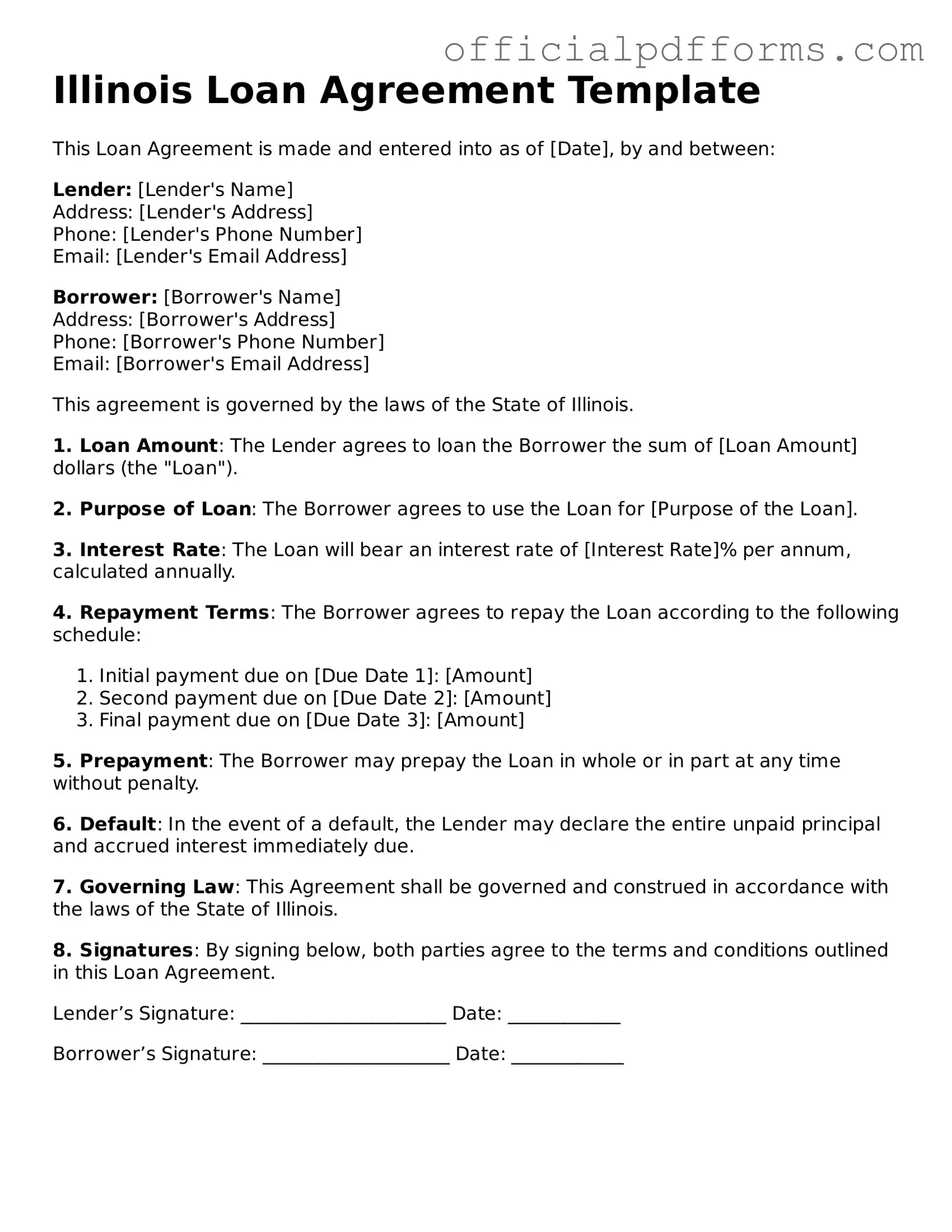

After gathering the necessary information, you are ready to fill out the Illinois Loan Agreement form. This document outlines the terms of the loan and protects both the lender and the borrower. Follow these steps carefully to ensure accuracy.

- Begin by entering the date at the top of the form. This should reflect the day you are completing the agreement.

- Provide the names and addresses of both the lender and the borrower. Make sure to include full legal names and current addresses.

- Specify the loan amount. Write the total sum being borrowed in both numerical and written form for clarity.

- Outline the interest rate. Indicate whether it is fixed or variable and provide the exact percentage.

- Detail the repayment terms. Include the schedule of payments, the due date for each payment, and the total duration of the loan.

- Include any fees associated with the loan. This could involve late fees, processing fees, or other costs.

- State any collateral, if applicable. If the loan is secured, describe the assets being used as collateral.

- Sign and date the form. Both parties must sign to validate the agreement. Ensure that each signature is dated correctly.

- Make copies of the completed agreement for both the lender and the borrower. Keep these copies in a safe place.

Common mistakes

-

Incomplete Information: Many individuals forget to fill out all required fields. This can lead to delays or even rejection of the loan application. Ensure that every section, especially personal identification details, is fully completed.

-

Incorrect Loan Amount: Borrowers often miscalculate the amount they need or fail to specify it correctly. Double-check the figures to avoid confusion and ensure that the requested amount aligns with your needs.

-

Missing Signatures: A common oversight is neglecting to sign the agreement. Without a signature, the document is not legally binding. Always review the form to ensure that all necessary signatures are present.

-

Ignoring Terms and Conditions: Some people skim through the terms and conditions, missing crucial details about interest rates and repayment schedules. Take the time to read and understand these elements to avoid future disputes.

-

Failing to Provide Supporting Documents: Applicants sometimes forget to include necessary documentation, such as proof of income or identification. Gather all required documents before submission to streamline the process.

Get Clarifications on Illinois Loan Agreement

What is the Illinois Loan Agreement form?

The Illinois Loan Agreement form is a legal document used to outline the terms and conditions of a loan between a lender and a borrower in the state of Illinois. This agreement serves to protect the interests of both parties by clearly stating the amount borrowed, repayment terms, interest rates, and any collateral involved.

Who should use the Illinois Loan Agreement form?

This form is suitable for individuals or businesses entering into a loan arrangement. Whether you are borrowing money for personal expenses, business purposes, or other financial needs, having a written agreement helps ensure clarity and accountability.

What key elements should be included in the Loan Agreement?

A comprehensive Loan Agreement should include the following key elements:

- Loan Amount: The total sum of money being borrowed.

- Interest Rate: The percentage charged on the loan, which can be fixed or variable.

- Repayment Schedule: Details on how and when the borrower will repay the loan, including the frequency of payments.

- Collateral: Any assets pledged by the borrower to secure the loan, if applicable.

- Default Conditions: Circumstances under which the borrower would be considered in default.

- Governing Law: A statement indicating that the agreement is governed by Illinois law.

Is it necessary to have a lawyer review the Loan Agreement?

While it is not legally required to have a lawyer review the Loan Agreement, doing so is highly recommended. A legal professional can help identify potential issues, ensure that the agreement complies with state laws, and provide guidance on any complex terms.

What happens if the borrower defaults on the loan?

If the borrower defaults on the loan, the lender may take specific actions as outlined in the agreement. These actions can include:

- Demanding immediate repayment of the outstanding balance.

- Seizing collateral, if any was pledged.

- Taking legal action to recover the owed amount.

It is crucial for both parties to understand these consequences before entering into the agreement.

Can the Loan Agreement be modified after it is signed?

Yes, the Loan Agreement can be modified after it is signed, but any changes must be documented in writing and signed by both parties. Verbal agreements or informal modifications may not be enforceable, so it is essential to maintain a clear record of any adjustments.

How long is the Loan Agreement valid?

The validity of the Loan Agreement depends on the terms specified within the document. Generally, the agreement remains in effect until the loan is fully repaid. However, if the borrower defaults, the lender may take action as outlined in the agreement, potentially terminating the contract sooner.

What should I do if I have disputes regarding the Loan Agreement?

If disputes arise regarding the Loan Agreement, it is advisable to first attempt to resolve the issue through communication between the lender and borrower. If this approach fails, mediation or arbitration may be considered as alternative dispute resolution methods. In some cases, legal action may be necessary, and consulting with an attorney can provide guidance on the best course of action.

Where can I obtain a copy of the Illinois Loan Agreement form?

Copies of the Illinois Loan Agreement form can typically be obtained through legal stationery stores, online legal document services, or state government websites. It is important to ensure that the form you are using is up-to-date and complies with current Illinois laws.