Printable Illinois Last Will and Testament Template

Find Other Popular Last Will and Testament Templates for Specific States

Is a Handwritten Will Legal in Nc - This document can also allow for the appointment of alternate beneficiaries, providing flexibility.

When considering the implications of small business taxation, it's vital to understand the role of the IRS 2553 form, which allows eligible businesses to elect S corporation status. By completing this form correctly, companies can enjoy the benefits of being taxed as pass-through entities, potentially resulting in significant tax savings. For those seeking more information about this process, resources like smarttemplates.net/fillable-irs-2553 can provide valuable assistance.

How to Create a Will in Pa - Used to appoint an executor to manage the estate and carry out the wishes of the deceased.

Misconceptions

Many people have misunderstandings about the Illinois Last Will and Testament form. Here are seven common misconceptions:

- A will only takes effect after death. Many believe that a will is effective while the person is still alive. In reality, a will only comes into play after the individual passes away.

- Only wealthy individuals need a will. Some think that wills are only for the rich. However, anyone with assets or dependents should consider having a will to ensure their wishes are honored.

- Handwritten wills are not valid. There is a belief that only typed wills are acceptable. In Illinois, handwritten wills can be valid if they meet certain requirements.

- Once a will is created, it cannot be changed. Many assume that a will is set in stone. In fact, a will can be updated or revoked at any time as long as the individual is competent.

- Wills avoid probate. Some think that having a will means their estate will bypass probate. In reality, wills typically must go through the probate process.

- All assets will go to the beneficiaries named in the will. It is a common misconception that all assets automatically transfer to the named beneficiaries. Certain assets, like those held in a trust or with designated beneficiaries, may not go through the will.

- It is unnecessary to have witnesses. Some believe that a will does not require witnesses. However, Illinois law mandates that a will must be signed by at least two witnesses to be valid.

Understanding these misconceptions can help ensure that your estate planning is effective and aligns with your wishes.

Documents used along the form

When preparing an estate plan in Illinois, the Last Will and Testament is a crucial document. However, it is often accompanied by other forms and documents that help ensure your wishes are honored and your estate is managed effectively. Below is a list of five essential documents that are commonly used alongside the Last Will and Testament.

- Living Will: This document outlines your preferences for medical treatment in situations where you are unable to communicate your wishes. It specifically addresses end-of-life care and can guide healthcare providers and family members in making decisions that align with your values.

- Durable Power of Attorney for Healthcare: This form allows you to appoint someone to make medical decisions on your behalf if you become incapacitated. This trusted individual will have the authority to ensure that your healthcare preferences, as outlined in your living will, are respected.

- Bill of Sale: This document is crucial when transferring ownership of personal property, such as vehicles or valuable items, and can be obtained through resources like OnlineLawDocs.com.

- Durable Power of Attorney for Finances: Similar to the healthcare power of attorney, this document designates someone to handle your financial affairs if you are unable to do so. This can include managing bank accounts, paying bills, and making investment decisions.

- Revocable Living Trust: A revocable living trust is a legal entity that holds your assets during your lifetime and specifies how they should be distributed after your death. This can help avoid probate and maintain privacy regarding your estate.

- Beneficiary Designation Forms: These forms are used to specify who will receive certain assets, such as life insurance policies and retirement accounts, upon your death. Properly designating beneficiaries can ensure that these assets are transferred directly to your chosen individuals, bypassing the probate process.

Incorporating these documents into your estate plan can provide clarity and direction for your loved ones. Each form serves a unique purpose, helping to ensure that your wishes are followed and your estate is managed according to your preferences. Consulting with a legal professional can help you navigate these options effectively.

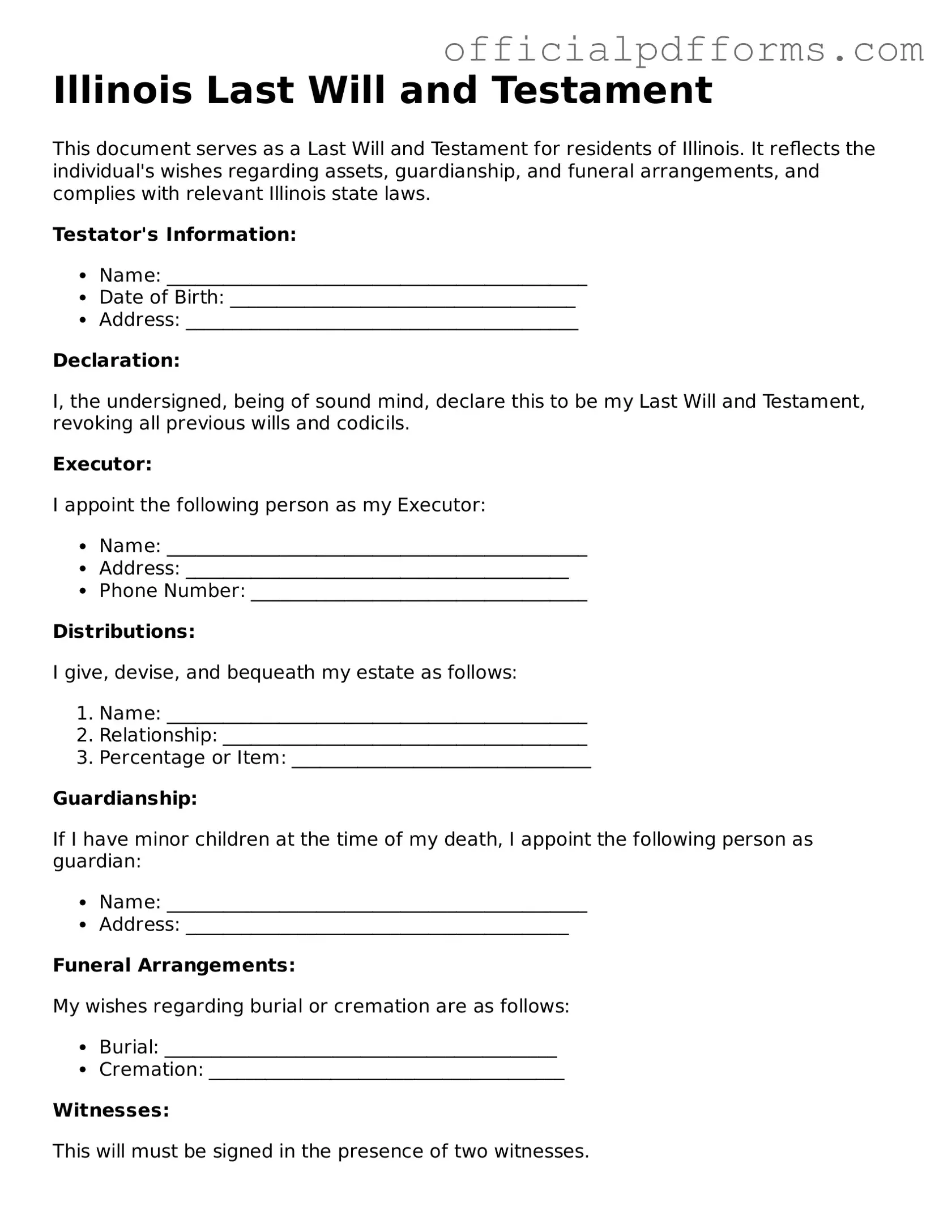

Steps to Filling Out Illinois Last Will and Testament

Completing the Illinois Last Will and Testament form is an important step in ensuring that your wishes regarding your estate are clearly documented. After filling out the form, it will need to be signed and witnessed according to state requirements to be considered valid.

- Begin by obtaining the Illinois Last Will and Testament form. You can find this form online or through legal stationery stores.

- Fill in your full name at the top of the form. Make sure it matches the name on your identification documents.

- Provide your current address. This should be the address where you reside at the time of filling out the will.

- Designate an executor. This is the person responsible for ensuring that your wishes are carried out. Include their full name and address.

- List your beneficiaries. These are the individuals or organizations that will inherit your assets. Be specific about what each beneficiary will receive.

- Include any specific bequests. If you want to leave certain items to specific people, detail those items and the intended recipients.

- Address any debts or expenses. Indicate how you would like your debts and final expenses to be handled after your passing.

- Sign the document in the presence of at least two witnesses. Make sure they are not beneficiaries of the will to avoid any conflicts of interest.

- Have the witnesses sign the will, including their full names and addresses.

- Store the completed will in a safe place, and inform your executor of its location.

Common mistakes

-

Not Clearly Identifying the Testator: It's essential to clearly state your full name and address at the beginning of the will. This helps avoid any confusion about who the will belongs to.

-

Failing to Name an Executor: An executor is responsible for carrying out the terms of your will. Without naming someone, your estate may face delays and complications during the probate process.

-

Omitting Witness Signatures: In Illinois, you need at least two witnesses to sign your will. If you skip this step, the will may be deemed invalid.

-

Not Dating the Document: Always include the date when you sign your will. This helps clarify which version of the will is the most current, especially if you make changes later.

-

Using Ambiguous Language: Be clear and specific about your wishes. Vague terms can lead to misunderstandings and disputes among heirs.

-

Forgetting to Update the Will: Life changes, such as marriage, divorce, or the birth of children, should prompt a review of your will. Failing to update it can lead to unintended consequences.

-

Not Considering Tax Implications: Some assets may have tax consequences for your heirs. Consulting with a financial advisor can help you plan accordingly.

-

Neglecting to Store the Will Safely: After creating your will, store it in a secure location, such as a safe or a bank safety deposit box. Inform your executor of its location to ensure it can be easily accessed when needed.

Get Clarifications on Illinois Last Will and Testament

What is a Last Will and Testament in Illinois?

A Last Will and Testament is a legal document that outlines how a person's assets and affairs should be handled after their death. In Illinois, this document allows individuals to specify who will inherit their property, name guardians for minor children, and appoint an executor to manage the estate. It is an essential tool for ensuring that one's wishes are respected and that loved ones are taken care of according to those wishes.

Who can create a Last Will and Testament in Illinois?

In Illinois, any individual who is at least 18 years old and of sound mind can create a Last Will and Testament. This means that the person must understand the nature of the document and the implications of their decisions. It is important to ensure that the will reflects the true intentions of the individual, as this will help avoid disputes among heirs later on.

What are the requirements for a valid Last Will and Testament in Illinois?

For a Last Will and Testament to be considered valid in Illinois, it must meet several key requirements:

- The document must be in writing.

- The person creating the will must sign it or have someone else sign it in their presence.

- The will must be witnessed by at least two individuals who are present at the same time.

These witnesses should not be beneficiaries of the will to avoid any potential conflicts of interest. Following these guidelines helps ensure that the will is legally enforceable.

Can I change or revoke my Last Will and Testament in Illinois?

Yes, individuals in Illinois can change or revoke their Last Will and Testament at any time while they are still alive and mentally competent. Changes can be made by creating a new will or by drafting a codicil, which is an amendment to the existing will. To revoke a will, one can destroy it or create a new will that explicitly states that the previous will is revoked. It is advisable to inform the executor and beneficiaries of any changes to avoid confusion in the future.

What happens if I die without a Last Will and Testament in Illinois?

If a person dies without a Last Will and Testament, they are said to have died "intestate." In this case, Illinois law dictates how their assets will be distributed. Generally, the estate will be divided among surviving relatives, such as spouses, children, or parents, according to a specific hierarchy established by state law. This process can lead to outcomes that may not align with the deceased's wishes, which is why having a will is strongly recommended.

Is it necessary to hire a lawyer to create a Last Will and Testament in Illinois?

While it is not legally required to hire a lawyer to create a Last Will and Testament in Illinois, doing so is often advisable. A lawyer can provide valuable guidance to ensure that the will meets all legal requirements and accurately reflects the individual's wishes. Additionally, a legal professional can help navigate complex family situations or significant assets, making the process smoother and more secure. However, individuals can also find templates and resources to create a will on their own if they feel confident in doing so.