Printable Illinois Deed in Lieu of Foreclosure Template

Find Other Popular Deed in Lieu of Foreclosure Templates for Specific States

Deed in Lieu of Mortgage - Presents a practical solution in uncertain economic climates.

To ensure that your business operates smoothly and to avoid any potential disputes, it is essential to have a comprehensive New York Operating Agreement form, as detailed at OnlineLawDocs.com. This document not only establishes the guidelines for the management of your LLC but also clarifies the responsibilities and entitlements of all members involved.

Misconceptions

Many people have misunderstandings about the Illinois Deed in Lieu of Foreclosure form. Here are five common misconceptions:

- It eliminates all debt associated with the mortgage. Many believe that signing a deed in lieu of foreclosure wipes out all financial obligations. However, it may not eliminate secondary liens or other debts related to the property.

- It is a quick and easy solution. While a deed in lieu can be faster than foreclosure, the process still involves negotiations with the lender and may require time for approval. It is not an instant fix.

- It guarantees that the lender will accept the deed. Some homeowners think that simply offering a deed in lieu will be accepted. In reality, lenders have specific criteria and may reject the offer based on the property’s condition or market value.

- It has no impact on credit scores. Many assume that a deed in lieu of foreclosure will not affect their credit. In fact, it can still have a negative impact, though typically less severe than a foreclosure.

- It is the same as a short sale. Some people confuse a deed in lieu with a short sale. A short sale involves selling the property for less than the mortgage balance, while a deed in lieu transfers ownership back to the lender without a sale.

Understanding these misconceptions can help homeowners make informed decisions about their options in difficult financial situations.

Documents used along the form

When navigating the complexities of property transfer, especially in situations involving foreclosure, several documents are often utilized alongside the Illinois Deed in Lieu of Foreclosure form. Each of these forms plays a crucial role in ensuring a smooth and legally compliant process. Below is a list of commonly used documents.

- Notice of Default: This document formally informs the borrower that they have failed to meet their mortgage obligations. It outlines the specifics of the default and typically serves as a precursor to foreclosure proceedings.

- Loan Modification Agreement: This agreement modifies the terms of the original loan, often providing more favorable conditions for the borrower. It can include changes to the interest rate, payment schedule, or loan term to help the borrower avoid foreclosure.

- Release of Liability: This document releases the borrower from any further obligations related to the mortgage after the deed in lieu is executed. It ensures that the borrower is not held responsible for any remaining debt on the property.

- Property Inspection Report: Often required by lenders, this report assesses the condition of the property before the deed is transferred. It helps determine any necessary repairs or maintenance that may affect the property's value.

- Motorcycle Bill of Sale Form: When transferring ownership of a motorcycle in Texas, use the essential Motorcycle Bill of Sale document to ensure proper legal compliance and documentation.

- Settlement Statement: This document outlines all financial aspects of the transaction, including any fees, costs, and credits associated with the deed in lieu process. It provides transparency and clarity for both parties involved.

Understanding these documents can significantly ease the process of transferring property ownership, especially during challenging times. Each form serves a specific purpose, and being informed about them can help individuals navigate their options more effectively.

Steps to Filling Out Illinois Deed in Lieu of Foreclosure

After completing the Illinois Deed in Lieu of Foreclosure form, you will need to submit it to the appropriate parties. This typically includes your lender and may also involve local government offices. Ensure that you keep copies for your records.

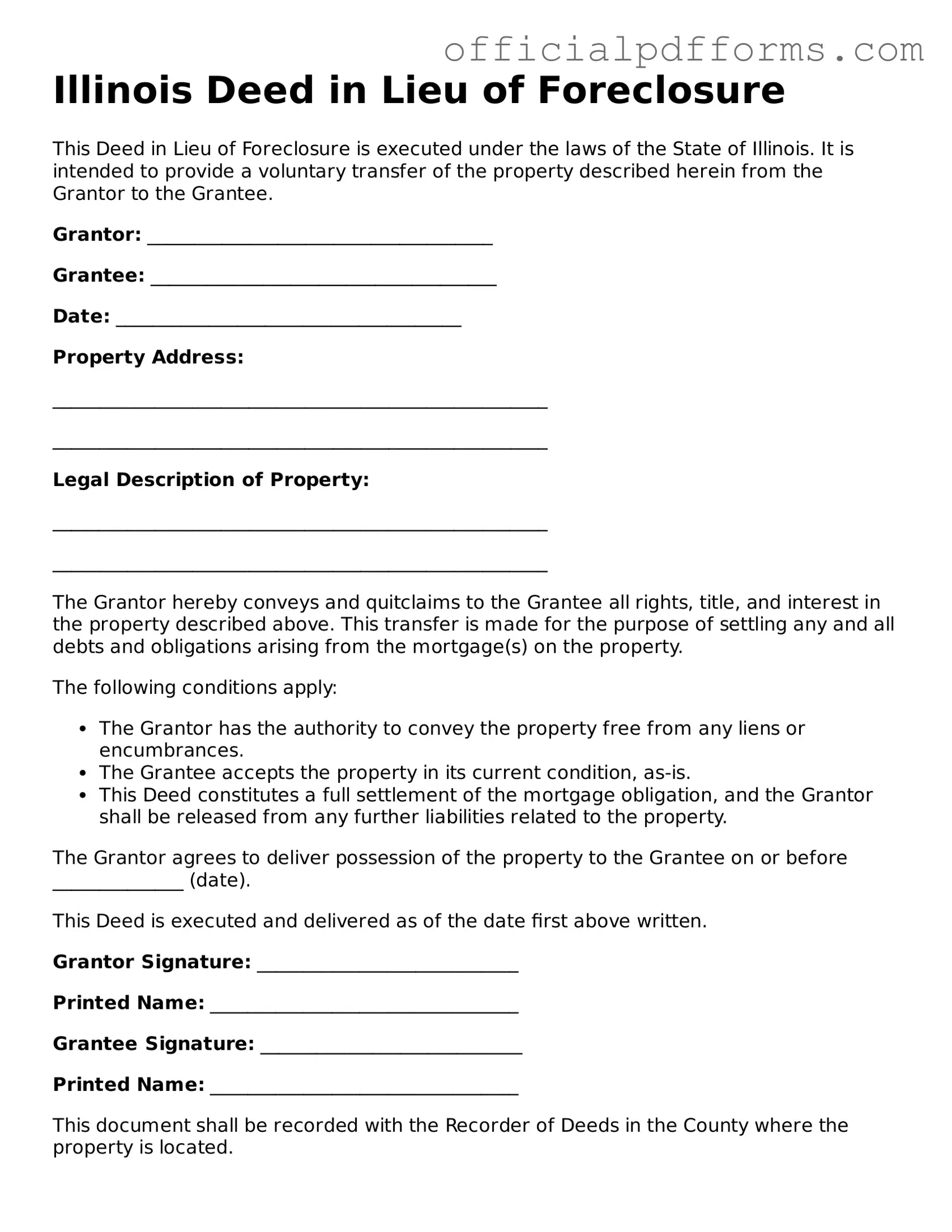

- Obtain the Illinois Deed in Lieu of Foreclosure form from a reliable source, such as your lender or an official website.

- Fill in the grantor's name, which is the name of the person or entity transferring the property.

- Provide the grantee's name, typically the lender or bank receiving the property.

- Include the property address and legal description of the property. This information can usually be found on your mortgage documents.

- State the date of the transfer. This is the date you are signing the form.

- Sign the document in the designated area. Ensure that your signature matches the name listed as the grantor.

- Have the form witnessed and notarized as required. This may vary, so check the specific requirements for your situation.

- Make copies of the completed form for your records before submitting it.

- Submit the signed and notarized form to your lender and any necessary local government offices.

Common mistakes

-

Not Understanding the Process: Many individuals fill out the Deed in Lieu of Foreclosure form without fully grasping what it entails. It's crucial to understand that this process involves voluntarily transferring ownership of the property to the lender to avoid foreclosure.

-

Incorrect Property Description: A common mistake is failing to provide an accurate legal description of the property. This description should match what is recorded in the county's property records to avoid complications.

-

Missing Signatures: All necessary parties must sign the document. Often, individuals forget to include the spouse or co-owner’s signature, which can invalidate the deed.

-

Not Including the Date: While it may seem minor, omitting the date can lead to confusion about when the deed takes effect. Always ensure the date is clearly marked.

-

Failure to Notarize: The form typically requires notarization. Skipping this step can render the document ineffective, as lenders often require a notarized deed for their records.

-

Ignoring Tax Implications: Some individuals overlook potential tax consequences associated with a Deed in Lieu of Foreclosure. Consulting a tax professional before proceeding can help avoid unexpected liabilities.

-

Not Communicating with the Lender: Failing to keep open lines of communication with the lender can lead to misunderstandings. It’s essential to confirm that the lender accepts the deed and understands the terms.

-

Assuming All Liabilities Are Cleared: Many believe that a Deed in Lieu of Foreclosure absolves them of all debts related to the property. This isn't always the case, especially if there are second mortgages or liens involved.

-

Not Seeking Legal Advice: Finally, many people attempt to navigate this process without legal assistance. Consulting with an attorney can provide clarity and ensure that all aspects are handled correctly.

Get Clarifications on Illinois Deed in Lieu of Foreclosure

What is a Deed in Lieu of Foreclosure?

A Deed in Lieu of Foreclosure is a legal process that allows a homeowner to transfer ownership of their property to the lender to avoid foreclosure. This option can be beneficial for both parties. The homeowner can avoid the lengthy and stressful foreclosure process, while the lender can take possession of the property without going through court. It is often seen as a last resort for homeowners who are unable to keep up with mortgage payments.

What are the benefits of a Deed in Lieu of Foreclosure?

There are several advantages to choosing a Deed in Lieu of Foreclosure:

- Avoiding Foreclosure: Homeowners can sidestep the negative impact of foreclosure on their credit score.

- Faster Process: The process is typically quicker than going through a formal foreclosure.

- Clear Title: The lender receives the property without any additional legal complications.

- Potential for Relocation Assistance: Some lenders may offer financial assistance for moving expenses.

What are the requirements to qualify for a Deed in Lieu of Foreclosure?

To qualify for a Deed in Lieu of Foreclosure, homeowners generally need to meet certain criteria, including:

- The property must be the homeowner's primary residence.

- The homeowner must be experiencing financial hardship that prevents them from making mortgage payments.

- The property must not have any outstanding liens or claims that would complicate the transfer.

- The homeowner must be willing to voluntarily transfer ownership to the lender.

How does the process of completing a Deed in Lieu of Foreclosure work?

The process typically involves several steps:

- Contact the Lender: The homeowner should reach out to their lender to discuss the possibility of a Deed in Lieu of Foreclosure.

- Submit Documentation: Homeowners will need to provide financial documents to demonstrate their hardship.

- Negotiate Terms: The lender and homeowner will negotiate the terms of the deed transfer.

- Complete the Deed: Once terms are agreed upon, the necessary legal documents will be prepared and signed.

- Transfer Ownership: The property ownership is officially transferred to the lender.