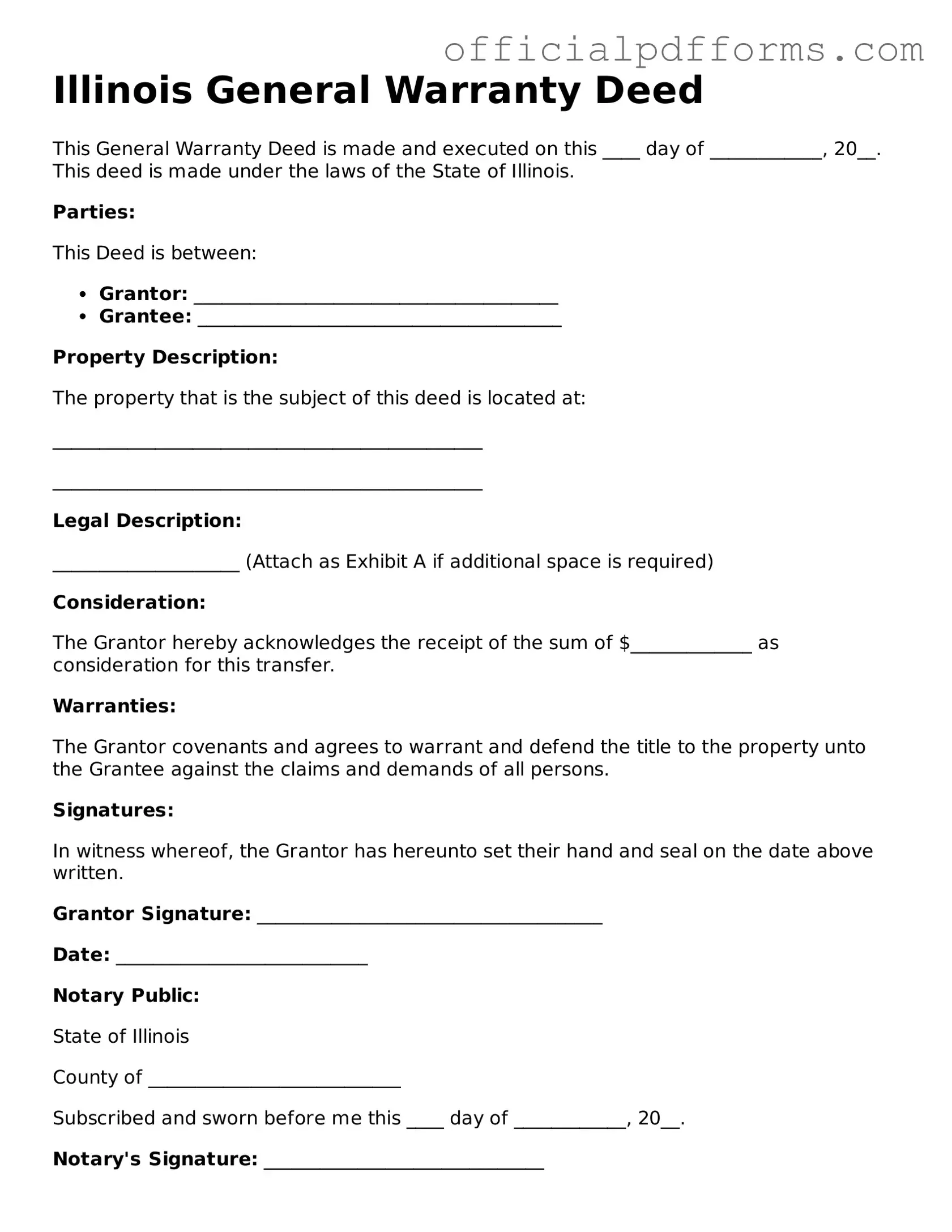

Printable Illinois Deed Template

Find Other Popular Deed Templates for Specific States

Discharge of Mortgage Form Nj - Deeds can be used in various circumstances, including sales, transfers, and leases.

The New York Trailer Bill of Sale form is a document that records the transfer of ownership of a trailer from the seller to the buyer. It serves as a proof of purchase and is essential for the registration process in New York. This form contains important details of the transaction, ensuring a clear and legal transfer of ownership. For more information or to obtain the form, visit OnlineLawDocs.com.

Nc Deed Transfer Form - A Deed establishes a formal agreement on ownership between parties.

Misconceptions

Understanding the Illinois Deed form is crucial for anyone involved in real estate transactions. However, several misconceptions can lead to confusion. Here are nine common misunderstandings about this important legal document:

- All deeds are the same. Many people believe that all deed forms are identical. In reality, there are different types of deeds, such as warranty deeds and quitclaim deeds, each serving distinct purposes and offering varying levels of protection.

- A deed must be notarized to be valid. While notarization is highly recommended and often required, the validity of a deed can depend on state laws. In Illinois, certain deeds may not require notarization to be legally binding, but it is advisable to have one.

- Once a deed is signed, it cannot be changed. Some assume that a signed deed is final and unchangeable. However, it is possible to modify or revoke a deed through proper legal channels, depending on the circumstances.

- Only attorneys can prepare a deed. While legal expertise is beneficial, it is not mandatory for an attorney to draft a deed. Individuals can prepare their own deeds, but they must ensure that all legal requirements are met.

- Deeds do not need to be recorded. Many people think that recording a deed is optional. In Illinois, recording a deed is essential for establishing public notice and protecting ownership rights against future claims.

- All property transfers require a new deed. Some believe that every transfer of property ownership necessitates a new deed. However, certain transactions, like those involving joint tenants, may not require a new deed if the property is already jointly owned.

- Deeds are only necessary for selling property. A common misconception is that deeds are only required in sales transactions. In fact, deeds are also needed for gifts, inheritances, and other forms of property transfer.

- Once recorded, a deed cannot be disputed. Many assume that recording a deed protects it from all disputes. However, even recorded deeds can be challenged in court, particularly if there are claims of fraud or errors in the deed's execution.

- Property taxes are automatically transferred with the deed. Some individuals think that when a deed is transferred, property taxes automatically follow. In Illinois, the new owner must ensure that property taxes are updated to reflect the change in ownership.

By understanding these misconceptions, individuals can navigate the complexities of property transactions with greater confidence and clarity. It is always wise to seek professional guidance when dealing with legal documents to ensure compliance with all applicable laws and regulations.

Documents used along the form

When handling property transactions in Illinois, several forms and documents accompany the Illinois Deed form. Each of these documents serves a specific purpose and helps ensure a smooth transfer of ownership. Below is a list of commonly used forms that you may encounter.

- Title Insurance Policy: This document protects the buyer and lender from potential disputes over property ownership. It ensures that the title is clear and free of liens or other claims.

- Property Transfer Tax Declaration: This form is required by the state to report the transfer of property and assess any applicable taxes. It provides details about the transaction, including the sale price.

- Affidavit of Title: This sworn statement confirms the seller's ownership of the property and discloses any potential issues, such as outstanding liens or encumbrances.

- Closing Statement: Also known as a HUD-1, this document outlines all costs associated with the property transaction. It details the financial aspects, including fees and adjustments.

- Bill of Sale: This document officially records the sale of a vehicle, similar to the Florida Motor Vehicle Bill of Sale form available at smarttemplates.net/fillable-florida-motor-vehicle-bill-of-sale, providing proof of transaction between the buyer and the seller.

- Power of Attorney: If a party cannot be present at closing, this document allows someone else to act on their behalf. It grants authority to sign documents related to the transaction.

- Bill of Sale: This document transfers ownership of personal property associated with the real estate, such as appliances or fixtures. It provides clarity on what is included in the sale.

- Warranty Deed: This form guarantees that the seller holds clear title to the property and has the right to sell it. It also provides protection to the buyer against future claims.

Understanding these documents can help streamline the property transfer process. Each plays a vital role in ensuring that both buyers and sellers are protected and informed throughout the transaction.

Steps to Filling Out Illinois Deed

Once you have the Illinois Deed form ready, you will need to fill it out accurately to ensure it meets all requirements for recording. Follow these steps carefully to complete the form correctly.

- Begin with the title of the form at the top. Clearly state "Deed" as the title.

- Provide the date of the transaction. Write the full date in the designated area.

- Enter the name of the grantor (the person transferring the property). Include the full legal name and address.

- List the name of the grantee (the person receiving the property). Again, provide the full legal name and address.

- Describe the property being transferred. Include the complete address and any relevant legal descriptions, such as lot numbers or parcel numbers.

- Indicate the consideration amount. This is the monetary value exchanged for the property.

- Sign the form. The grantor must sign and date the document in the appropriate section.

- Have the signature notarized. A notary public must witness the signing and provide their seal.

- Review the completed form for accuracy. Ensure all information is correct and legible.

- Make copies of the completed deed for your records before submitting it for recording.

After filling out the form, you will need to submit it to the appropriate county recorder's office for official recording. Be sure to check local requirements for any additional documents or fees that may be needed.

Common mistakes

-

Not providing complete names of all parties involved. It's essential to include the full legal names of the grantor (seller) and grantee (buyer). Missing or incorrect names can lead to disputes.

-

Failing to include the correct legal description of the property. The description should be specific and accurate, detailing the property's boundaries and location.

-

Omitting the signature of the grantor. Without a signature, the deed is not valid. Ensure that the grantor signs the document in the appropriate place.

-

Not having the deed notarized. In Illinois, a deed must be notarized to be legally binding. This step is crucial for the document's acceptance.

-

Using outdated or incorrect forms. Always check to ensure you have the most current version of the deed form. Using an outdated form can cause issues during the filing process.

-

Neglecting to fill in the date of the transaction. The date is important for legal purposes and helps establish the timeline of ownership.

-

Forgetting to include any necessary tax information. Depending on the transaction, there may be specific tax forms or disclosures required.

-

Not providing contact information for all parties. Including phone numbers or addresses can facilitate communication and help resolve any issues that may arise.

-

Leaving out the consideration amount. This is the price paid for the property and should be clearly stated in the deed.

-

Failing to double-check for typos or errors. Even small mistakes can lead to significant problems later. Review the entire document carefully before submitting.

Get Clarifications on Illinois Deed

What is an Illinois Deed form?

An Illinois Deed form is a legal document used to transfer ownership of real property from one party to another within the state of Illinois. This form outlines the details of the transaction, including the names of the parties involved, a description of the property, and any conditions related to the transfer. There are different types of deeds, such as warranty deeds and quitclaim deeds, each serving a specific purpose in property transfer.

What information is required to complete an Illinois Deed form?

To complete an Illinois Deed form, you will need to provide several key pieces of information:

- The full names and addresses of the grantor (the seller) and grantee (the buyer).

- A legal description of the property being transferred, which can often be found in previous deeds or property tax documents.

- The date of the transaction.

- The consideration amount, which is the price paid for the property.

Additionally, the form must be signed by the grantor in the presence of a notary public.

Do I need a lawyer to prepare an Illinois Deed form?

While it is not legally required to have a lawyer prepare an Illinois Deed form, consulting with one is often advisable. A lawyer can ensure that the deed is properly drafted, meets all legal requirements, and protects your interests. If you choose to prepare the deed yourself, make sure to follow all guidelines and double-check the information for accuracy.

How do I record an Illinois Deed after it is completed?

Once the Illinois Deed form is completed and signed, it must be recorded with the local county recorder's office where the property is located. To do this, follow these steps:

- Visit the county recorder's office in person or check their website for online recording options.

- Submit the completed deed along with any required fees.

- Request a copy of the recorded deed for your records.

Recording the deed provides public notice of the property transfer and helps protect your ownership rights.

What happens if an Illinois Deed form is not recorded?

If an Illinois Deed form is not recorded, the transfer of ownership may not be recognized by third parties. This can lead to complications, such as disputes over property ownership or issues when trying to sell the property in the future. Recording the deed is crucial for establishing a clear and legally recognized chain of title, which is essential for property transactions.