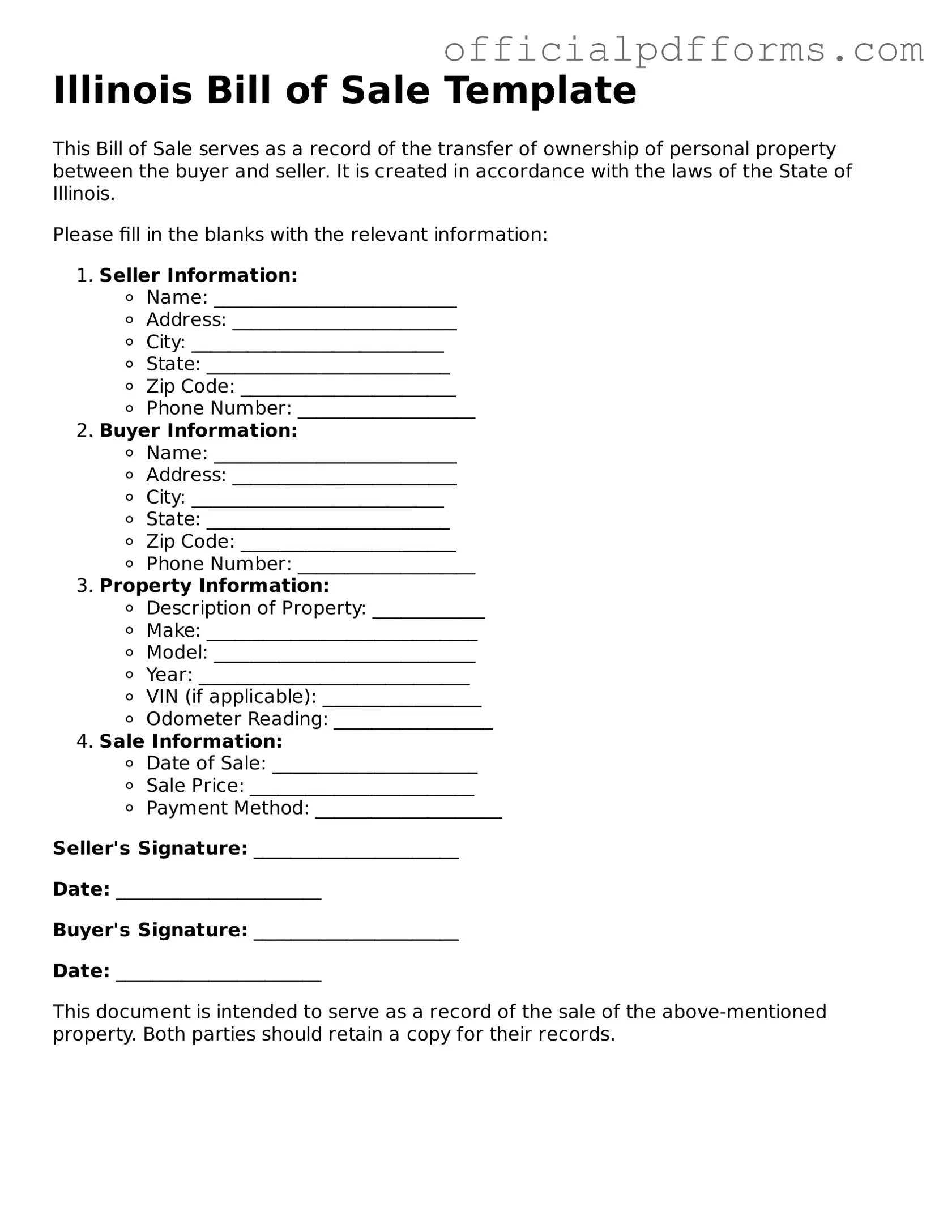

Printable Illinois Bill of Sale Template

Find Other Popular Bill of Sale Templates for Specific States

Vehicle Bill of Sale Template - It's a straightforward way to formalize a sale, making it clear who owns what after the transaction.

Understanding the significance of the ADP Pay Stub form can significantly enhance your financial management skills, helping you to track your earnings and deductions effectively.

Ohio Bill of Sale Word Template - A Bill of Sale is a practical tool that promotes fair dealings in sales transactions.

Misconceptions

Understanding the Illinois Bill of Sale form is crucial for anyone involved in buying or selling personal property. However, several misconceptions can lead to confusion. Here are nine common misconceptions about the Illinois Bill of Sale form:

- A Bill of Sale is not legally required. Many people believe that a Bill of Sale is optional for private sales. While it may not be legally mandated for every transaction, having one provides proof of the sale and protects both parties.

- All Bill of Sale forms are the same. Some assume that any Bill of Sale form will suffice for any transaction. In reality, the form should be tailored to the specific item being sold and the laws of Illinois.

- A Bill of Sale guarantees ownership. A common misconception is that a Bill of Sale automatically transfers ownership. While it documents the sale, ownership transfer may require additional steps, such as title transfer for vehicles.

- Only vehicles require a Bill of Sale. Many believe that Bills of Sale are only necessary for vehicle transactions. However, they are useful for any sale of personal property, including furniture, electronics, and more.

- Verbal agreements are sufficient. Some think that a verbal agreement is enough for a sale. In practice, having a written Bill of Sale is advisable to avoid disputes and misunderstandings later on.

- A Bill of Sale is only for buyers. It's a misconception that only buyers need a Bill of Sale. Sellers also benefit, as it provides them with a record of the transaction and can protect them from future claims.

- Notarization is always required. Many assume that a Bill of Sale must be notarized. In Illinois, notarization is not a requirement for most transactions, but it can add an extra layer of security.

- All Bills of Sale need to be filed with the state. Some people think that they must file their Bill of Sale with a government office. In Illinois, this is generally unnecessary unless it pertains to a vehicle title transfer.

- A Bill of Sale cannot be modified. Lastly, there's a belief that once a Bill of Sale is created, it cannot be changed. In reality, parties can amend the document as long as both agree to the changes and sign the updated version.

By understanding these misconceptions, individuals can better navigate the process of buying and selling personal property in Illinois.

Documents used along the form

The Illinois Bill of Sale form serves as a crucial document for the transfer of ownership of personal property. However, several other forms and documents may accompany it to ensure a smooth transaction. Below is a list of these documents, each playing a significant role in the process.

- Title Transfer Document: This document officially transfers the title of a vehicle from the seller to the buyer. It is often required for the registration of the vehicle in the new owner's name.

- Odometer Disclosure Statement: Required for vehicle sales, this statement records the mileage on the vehicle at the time of sale. It helps prevent odometer fraud.

- Sales Tax Form: Buyers may need to fill out this form to calculate and report the sales tax due on the purchase. This ensures compliance with state tax regulations.

- Vehicle Registration Application: This application is submitted to the state to register the vehicle in the new owner's name. It typically requires the bill of sale and title transfer document.

- Asurion F-017-08 MEN Form: This form is vital for managing administrative interactions within Asurion's framework. For more information, you can access Free Business Forms that provide further details on its application and importance.

- Affidavit of Identity: In some cases, this document may be needed to verify the identity of the buyer or seller, especially if there are discrepancies in the provided identification.

- Power of Attorney: If a party cannot be present to sign the bill of sale or other documents, a power of attorney may be used to authorize someone else to act on their behalf.

- Inspection Certificate: For certain transactions, particularly with vehicles, an inspection certificate may be required to confirm the condition of the item being sold.

- Warranty Deed: In real estate transactions, a warranty deed may accompany the bill of sale to guarantee that the seller has the right to sell the property and that it is free of liens.

- Receipt of Payment: This document provides proof of payment made by the buyer to the seller. It is important for both parties to maintain records of the transaction.

Utilizing these documents alongside the Illinois Bill of Sale can streamline the transfer process and protect the interests of both the buyer and seller. Proper documentation is essential for ensuring compliance with state laws and facilitating a transparent transaction.

Steps to Filling Out Illinois Bill of Sale

Once you have gathered the necessary information, you are ready to fill out the Illinois Bill of Sale form. This document serves as a record of the transaction between the seller and the buyer. It is essential to ensure that all details are accurate and complete, as this form may be needed for future reference or legal purposes.

- Begin by locating the Illinois Bill of Sale form. You can find this form online or at your local government office.

- At the top of the form, enter the date of the transaction. This should reflect the day the sale takes place.

- Next, fill in the seller's information. This includes the seller's full name, address, and contact number. Ensure that all details are correct to avoid any confusion later.

- Following the seller's information, provide the buyer's details. Similar to the seller's section, include the buyer's full name, address, and contact number.

- In the next section, describe the item being sold. Include important details such as the make, model, year, and any identifying numbers like a Vehicle Identification Number (VIN) if applicable.

- Specify the purchase price of the item. Clearly state the amount in both numbers and words to prevent any misunderstandings.

- If applicable, indicate whether there are any warranties or guarantees associated with the item. Clearly state the terms of these warranties if they exist.

- Both the seller and the buyer must sign the form. Ensure that both parties sign and date the document to validate the transaction.

- Finally, make copies of the completed Bill of Sale for both the seller and the buyer. This will serve as a record of the transaction for both parties.

Common mistakes

-

Incorrect Date: Failing to write the correct date of the transaction can lead to confusion. Ensure that the date reflects when the sale actually occurred.

-

Incomplete Seller Information: Omitting essential details about the seller, such as full name and address, can invalidate the document. Always provide complete and accurate information.

-

Missing Buyer Information: Just like the seller, the buyer's full name and address are crucial. Incomplete information can cause issues in ownership transfer.

-

Failure to Describe the Item: Not providing a detailed description of the item being sold can lead to disputes. Include make, model, year, and any identifying numbers.

-

Omitting Purchase Price: Leaving out the purchase price can create ambiguity. Clearly state the amount agreed upon to avoid future misunderstandings.

-

Not Signing the Document: A Bill of Sale is not legally binding without signatures. Both parties must sign the document to validate the transaction.

-

Not Including Witness or Notary Information: Depending on the type of sale, having a witness or notary may be required. Check local regulations to ensure compliance.

-

Using Inconsistent Terms: Using different terms for the same item can create confusion. Stick to one description throughout the document.

-

Not Keeping Copies: Failing to make copies for both the buyer and seller can lead to issues later on. Always retain a copy for your records.

Get Clarifications on Illinois Bill of Sale

What is an Illinois Bill of Sale?

An Illinois Bill of Sale is a legal document that serves as proof of a transaction between a buyer and a seller. It details the sale of personal property, which can include vehicles, furniture, or equipment. This document helps protect both parties by providing a record of the transaction and specifying the terms agreed upon.

When do I need a Bill of Sale in Illinois?

A Bill of Sale is typically needed in several situations, including:

- When buying or selling a vehicle, as it is often required for registration purposes.

- For transferring ownership of valuable personal property, such as boats or trailers.

- In private sales where no other documentation is available.

While not always legally required for smaller transactions, having a Bill of Sale is a good practice to ensure clarity and protect your interests.

What information should be included in the Bill of Sale?

To create a comprehensive Bill of Sale, include the following details:

- The names and addresses of both the buyer and the seller.

- A description of the item being sold, including make, model, year, and any identifying numbers.

- The sale price and payment method.

- The date of the transaction.

- Any warranties or guarantees provided by the seller.

Including these elements will help ensure that both parties understand the terms of the sale.

Is a Bill of Sale required to register a vehicle in Illinois?

Yes, when registering a vehicle in Illinois, a Bill of Sale is typically required. It serves as proof of ownership transfer and is necessary for the Illinois Secretary of State's office. Along with the Bill of Sale, you may also need to provide the vehicle title and proof of insurance. Always check with local authorities to confirm specific requirements.

Can I create my own Bill of Sale, or do I need a lawyer?

You can create your own Bill of Sale without the assistance of a lawyer. Many templates are available online that can guide you through the process. However, if the transaction involves a significant amount of money or complex terms, consulting a legal professional might be beneficial. They can ensure that your document meets all legal requirements and protects your interests.

What happens if there is a dispute after the sale?

If a dispute arises after the sale, the Bill of Sale can serve as a crucial piece of evidence. It outlines the agreed-upon terms and can help resolve misunderstandings. In cases where the matter escalates, having a well-documented Bill of Sale can strengthen your position. It’s always advisable to keep a copy of the document for your records.