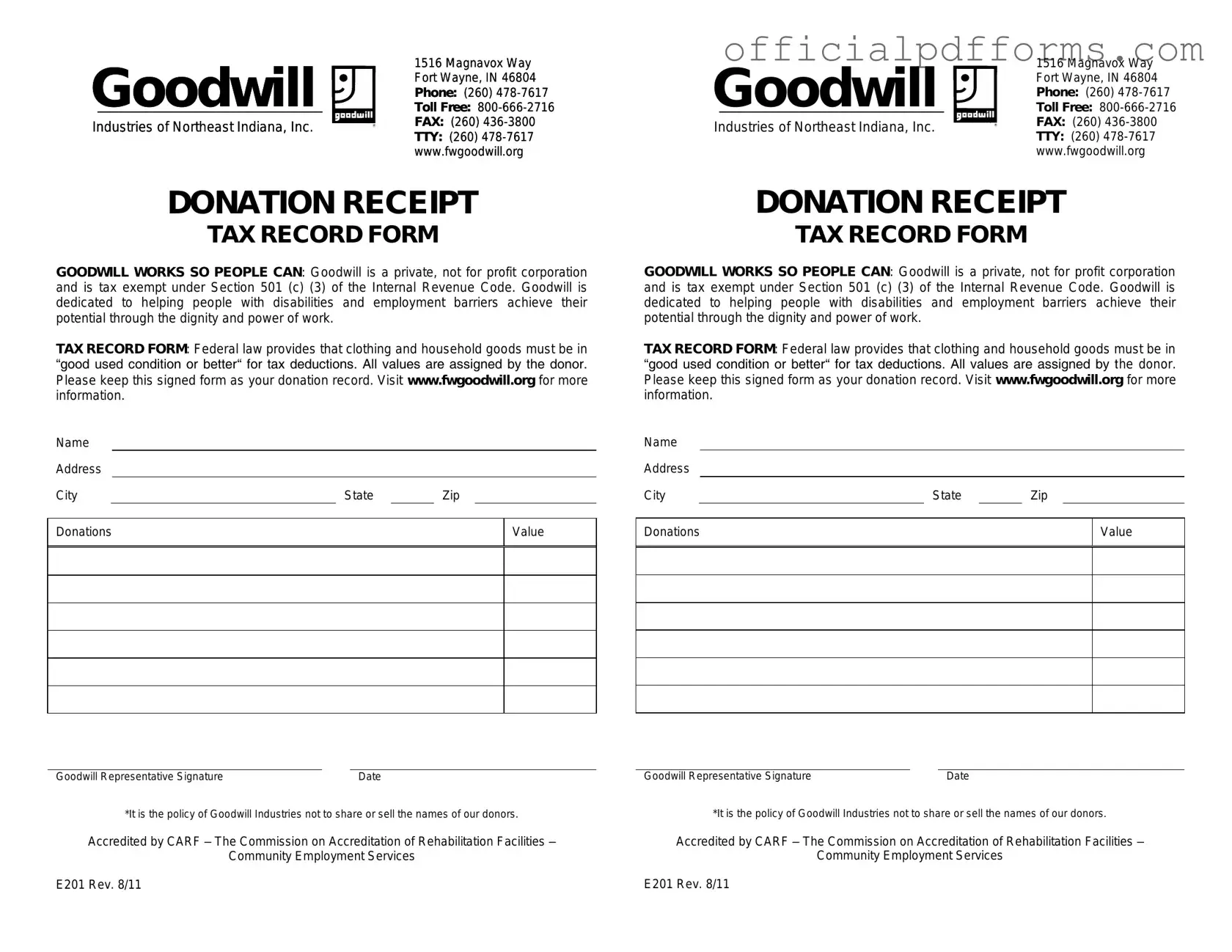

Fill in a Valid Goodwill donation receipt Form

Common PDF Forms

Voided Check Citibank Online - Filling out the Citibank Direct Deposit form improves your financial peace of mind.

1098s - You need to be aware of the current amount due to avoid foreclosure risks.

When seeking to present a comprehensive view of an individual, utilizing a Recommendation Letter form can significantly enhance the endorsement process, making it essential for various applications. This form not only highlights the candidate's skills and character but also provides a structured approach that allows referees to share their insights effectively. For those looking for a reliable template to create such letters, OnlineLawDocs.com offers valuable resources to ensure a polished and professional presentation.

Aircraft Bill of Sale - It is advisable to consult with legal or aviation professionals when drafting the form.

Misconceptions

When it comes to donating items to Goodwill, many people have questions about the donation receipt form. Unfortunately, several misconceptions can lead to confusion. Here are four common misunderstandings:

- The receipt is only for tax purposes. While it's true that many people use the receipt to claim tax deductions, the form serves other purposes as well. It acts as a record of your donation, helping you keep track of what you've given and when.

- All donations are valued the same. This is not accurate. The receipt does not assign a specific value to your items. Instead, it provides a space for you to estimate the fair market value of your donated goods. This value can vary based on condition and demand.

- You need to itemize every single item donated. While it’s helpful to list items for your records, you are not required to itemize every single piece on the receipt. You can group similar items together, which simplifies the process.

- Goodwill will automatically provide a receipt. This is a common misunderstanding. While Goodwill staff will give you a receipt upon request, it’s important to ask for one when you drop off your donations. Always ensure you receive it for your records.

Understanding these misconceptions can help make the donation process smoother and more beneficial for both you and Goodwill.

Documents used along the form

When donating items to Goodwill or similar organizations, various forms and documents may accompany the Goodwill donation receipt. Each of these documents serves a specific purpose, ensuring that both the donor and the organization maintain clear records of the transaction. Below is a list of common forms and documents that are often used alongside the Goodwill donation receipt.

- Donation Inventory List: This document allows donors to itemize the goods they are donating. It provides a detailed record of each item, which can be helpful for tax purposes and for the donor's personal records.

- Operating Agreement Form: To ensure smooth operations for your LLC, refer to the detailed Operating Agreement form guide for clear governance and compliance.

- Tax Deduction Worksheet: This worksheet helps donors calculate the estimated value of their donated items. It can guide them in determining the appropriate deduction to claim on their tax returns.

- Donation Agreement: In some cases, a donation agreement may be used to outline the terms of the donation. This document can clarify the expectations and responsibilities of both the donor and the organization.

- Charity Registration Certificate: This certificate verifies that the organization is a registered charity. Donors may want to keep this document for their records to confirm that their contributions are going to a legitimate nonprofit.

- Appraisal Report: For valuable items, such as antiques or collectibles, an appraisal report may be necessary. This document provides a professional evaluation of the item's worth, which can be essential for tax deductions.

- Thank You Letter: After receiving a donation, organizations often send a thank you letter to the donor. This letter not only expresses gratitude but also serves as a formal acknowledgment of the donation for tax purposes.

- IRS Form 8283: If a donor's total contributions exceed $500, they must complete this IRS form. It provides additional information about noncash charitable contributions and is necessary for tax reporting.

Understanding these documents can streamline the donation process and ensure that donors are well-prepared for tax season. Keeping accurate records helps both the donor and the organization maintain transparency and accountability in charitable giving.

Steps to Filling Out Goodwill donation receipt

After gathering your items for donation, you will need to complete the Goodwill donation receipt form to document your contribution. This form serves as a record for both you and Goodwill, ensuring that your donation is acknowledged and can be used for tax purposes.

- Begin by locating the Goodwill donation receipt form. This may be available at your local Goodwill location or online.

- Fill in your name in the designated field. Ensure that the spelling is correct for proper acknowledgment.

- Provide your address, including city, state, and zip code. This information helps in processing your donation.

- Enter the date of the donation. This is typically the date when you drop off your items.

- List the items you are donating. Be specific and include details such as quantity and condition of each item.

- Estimate the fair market value of each item. This is important for tax purposes, so consider using a valuation guide if necessary.

- Sign and date the form at the bottom. Your signature confirms that the information provided is accurate.

- Keep a copy of the completed form for your records. This will serve as proof of your donation for tax deductions.

Common mistakes

-

Incomplete Information: Many donors forget to fill out all required fields. Ensure that names, addresses, and contact information are complete.

-

Incorrect Valuation: Donors often underestimate or overestimate the value of their items. It's important to use fair market value for accurate reporting.

-

Missing Signatures: Some people neglect to sign the receipt. A signature is necessary for the receipt to be valid.

-

Not Keeping a Copy: Failing to keep a copy of the receipt can lead to issues when filing taxes. Always retain a copy for your records.

-

Incorrect Date: Donors sometimes forget to date the receipt. The date of the donation is crucial for tax purposes.

-

Overlooking Item Descriptions: Some individuals skip detailing the items donated. Providing a clear description helps with valuation and record-keeping.

Get Clarifications on Goodwill donation receipt

What is a Goodwill donation receipt form?

A Goodwill donation receipt form is a document provided to individuals who donate items to Goodwill Industries. This form serves as proof of the donation for tax purposes. It typically includes details such as the donor's name, the date of the donation, a description of the items donated, and an estimated value of those items. Having this receipt can be beneficial when filing taxes, as it may allow donors to claim a charitable deduction.

How do I obtain a Goodwill donation receipt?

When you make a donation to Goodwill, you will receive a donation receipt at the time of your contribution. This can occur at a physical Goodwill store or donation center. Simply ask an employee for the receipt, and they will provide you with one. If you forget to ask for it, you can also check the Goodwill website or contact your local Goodwill location for guidance on how to obtain a duplicate receipt.

Can I claim a tax deduction for my Goodwill donations?

Yes, you can claim a tax deduction for your Goodwill donations, provided you itemize your deductions on your tax return. To do this, you must have a valid receipt, which details the items donated and their estimated value. Keep in mind that the IRS requires you to have documentation for any donations over a certain amount. For donations exceeding $500, additional forms and documentation may be necessary, such as a qualified appraisal for high-value items.

What items can I donate to Goodwill?

Goodwill accepts a wide variety of items, including:

- Clothing and shoes

- Household goods and small appliances

- Furniture

- Toys and games

- Books and media

However, there are some restrictions. Goodwill does not accept items that are damaged, broken, or heavily soiled. Additionally, hazardous materials, such as paint or chemicals, are also prohibited. It’s always best to check with your local Goodwill for specific guidelines regarding acceptable donations.