Fill in a Valid Gift Letter Form

Common PDF Forms

How to Get Title for Car After Payoff - Timely completion of this waiver supports effective communication and trust among parties involved in construction work.

Advance Salary Application Form - This form helps to bridge the gap for employees facing unexpected expenses before payday.

To facilitate the sale, it is advisable for both parties to utilize a Texas Motorcycle Bill of Sale form which can be obtained through resources like OnlineLawDocs.com. This document not only details the transaction but also provides necessary legal protection for both the buyer and the seller.

What Does a Roof Warranty Cover - Understanding what is covered helps homeowners budget for potential out-of-pocket costs effectively.

Misconceptions

When it comes to the Gift Letter form, several misconceptions often arise. Understanding these can help clarify its purpose and use in financial transactions, especially in real estate. Here are five common misconceptions:

-

Gift Letters are only for first-time homebuyers.

This is not true. While first-time homebuyers frequently use gift letters to document financial assistance, anyone receiving a gift for a home purchase can use this form, regardless of their buying history.

-

A Gift Letter must be notarized.

Many believe that notarization is a requirement for a gift letter. In reality, notarization is not typically necessary. However, some lenders may request it for added verification.

-

Gift Letters can only be used for down payments.

This is a common misunderstanding. While gift letters are often associated with down payments, they can also be used for closing costs or other related expenses.

-

Only family members can provide gifts.

While family members are the most common source of gift funds, friends and other individuals can also provide financial assistance. It's essential to document the relationship in the gift letter.

-

Gift letters are the same as loans.

This misconception can lead to confusion. A gift is not a loan and should not be repaid. A gift letter explicitly states that the funds are a gift and do not require repayment.

By clearing up these misconceptions, you can better navigate the process of using a Gift Letter form and ensure a smoother transaction.

Documents used along the form

The Gift Letter form is commonly utilized in real estate transactions, particularly when a buyer receives financial assistance from a family member or friend for a home purchase. This document serves to confirm that the funds provided are indeed a gift and not a loan. In addition to the Gift Letter form, several other documents may be necessary to support the transaction. Below is a list of these documents, each with a brief description.

- Bank Statement: This document provides a record of the donor's financial account, showing that the funds are available and can be transferred without issue.

- Proof of Relationship: Documentation such as birth certificates or marriage licenses may be required to establish the relationship between the donor and the recipient, confirming the legitimacy of the gift.

- Trailer Bill of Sale Form: For those looking to document the transfer of trailer ownership, the essential Trailer Bill of Sale resources provide the necessary legal framework for this important transaction.

- Loan Application: If the recipient is obtaining a mortgage, the loan application outlines the details of the loan being requested, including the amount and terms.

- Purchase Agreement: This document details the terms of the sale, including the purchase price and conditions, and is essential for the transaction to proceed.

- Gift Tax Return: If the gift exceeds a certain amount, the donor may need to file a gift tax return to report the transaction to the IRS.

- Settlement Statement: Also known as a HUD-1, this document summarizes the financial aspects of the real estate transaction, including all costs and credits involved.

- Title Insurance Policy: This document protects the buyer and lender against potential disputes over property ownership and ensures that the title is clear of any encumbrances.

- Identification Documents: Valid identification, such as a driver’s license or passport, may be required from both the donor and the recipient to verify their identities during the transaction.

Each of these documents plays a crucial role in the home-buying process, ensuring transparency and compliance with legal requirements. Proper documentation not only facilitates a smooth transaction but also helps protect the interests of all parties involved.

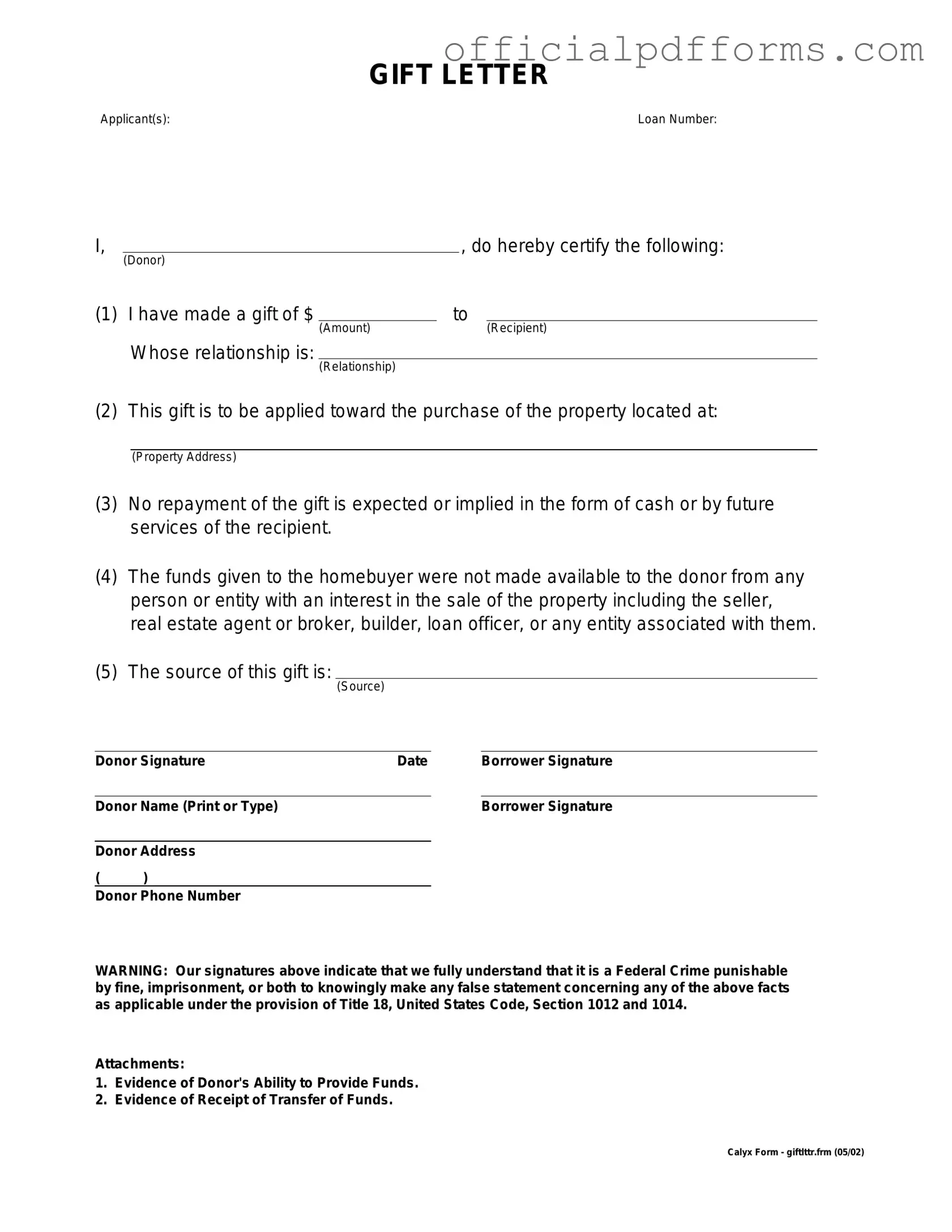

Steps to Filling Out Gift Letter

Filling out a Gift Letter form is a straightforward process. It’s important to provide accurate information to ensure everything goes smoothly. Follow these steps to complete the form correctly.

- Begin by entering the date at the top of the form. Use the format MM/DD/YYYY.

- Fill in the names of the donor and recipient. Make sure to include full legal names as they appear on official documents.

- Provide the address of the donor. This should be the complete address, including street, city, state, and zip code.

- Next, enter the address of the recipient in the same manner as the donor's address.

- State the amount of the gift clearly. Write the amount in both numerical and written form to avoid any confusion.

- Include a statement confirming that the gift is not a loan. This assures the lender that the funds are a true gift.

- Have the donor sign and date the form. This signature is crucial for authenticity.

- Finally, ensure that all information is accurate and legible before submitting the form.

Common mistakes

-

Not Providing Complete Information: Many people forget to fill in all the required fields. This includes details about the donor and the recipient. Missing information can delay the processing of the gift.

-

Failing to Sign the Letter: A common oversight is neglecting to sign the gift letter. Without a signature, the letter may not be considered valid. Both the donor and the recipient should sign to confirm the gift.

-

Incorrectly Stating the Relationship: The relationship between the donor and recipient must be accurately described. Misrepresenting this can raise questions during financial reviews, potentially complicating the transaction.

-

Omitting the Gift Amount: Some individuals forget to specify the amount of the gift. Clearly stating this amount is crucial, as it provides clarity and helps avoid misunderstandings in the future.

Get Clarifications on Gift Letter

What is a Gift Letter?

A Gift Letter is a document that verifies a financial gift from one person to another, typically used in real estate transactions. It outlines the details of the gift, including the amount, the relationship between the giver and the recipient, and the purpose of the gift. This letter helps lenders understand that the funds are a gift and not a loan that needs to be repaid.

Who needs a Gift Letter?

Gift Letters are commonly required for homebuyers who receive monetary gifts to assist with their down payment or closing costs. If you are using gifted funds to buy a home, your lender may ask for this letter to ensure that the gift complies with their underwriting guidelines.

What information should be included in a Gift Letter?

A comprehensive Gift Letter should include:

- The date of the letter.

- The name and address of the donor (the person giving the gift).

- The name and address of the recipient (the person receiving the gift).

- The amount of the gift.

- A statement confirming that the funds are a gift and do not need to be repaid.

- The relationship between the donor and the recipient.

- The donor's signature.

Do I need to provide proof of the gift?

Yes, lenders may require proof of the gift in addition to the Gift Letter. This could include bank statements showing the transfer of funds or a check from the donor. Providing this documentation helps establish the legitimacy of the gift and ensures compliance with lending regulations.

Can anyone give a gift for a home purchase?

While many people can give a gift, lenders often prefer that the donor be a close family member. This includes parents, siblings, grandparents, and sometimes extended family. Some lenders may have specific guidelines regarding who can provide a gift, so it's essential to check with your lender for their requirements.

Is there a limit on how much can be gifted?

There is no universal limit on the amount that can be gifted, but lenders may have their own guidelines. Some may require that the gift amount not exceed a certain percentage of the home’s purchase price. Additionally, the IRS allows individuals to gift up to a specific amount each year without incurring gift tax, which is $17,000 per person as of 2023. It's wise to consult with a tax advisor for more details.

What happens if the Gift Letter is not provided?

If a Gift Letter is not provided when required, it may lead to delays in the mortgage approval process or even denial of the loan. Lenders need to verify the source of the funds to ensure they comply with regulations. Therefore, providing a Gift Letter is crucial for a smooth home buying experience.