Valid Gift Deed Document

Gift Deed Forms for Individual US States

Consider More Types of Gift Deed Documents

Correction Deed California - A Corrective Deed requires signatures from all involved parties to be valid.

The Florida Motor Vehicle Bill of Sale form is vital for ensuring a smooth vehicle transaction in the state, as it not only documents the sale but also provides essential details for title transfer. For those looking to fill out this important document correctly, you can find a convenient resource at smarttemplates.net/fillable-florida-motor-vehicle-bill-of-sale/.

Deed in Lieu of Foreclosure Template - Reduces the borrower's financial liability while protecting their credit score more effectively than foreclosure.

Misconceptions

Many people have misunderstandings about the Gift Deed form. Here are ten common misconceptions explained:

- Gift Deeds are only for real estate. While they are often used for transferring property, Gift Deeds can also apply to other assets, such as vehicles or bank accounts.

- You need a lawyer to create a Gift Deed. Although having legal assistance can be helpful, it is not a legal requirement. Many people draft their own Gift Deeds as long as they meet the necessary criteria.

- Gift Deeds are irreversible. This is not entirely true. While they are generally permanent, a Gift Deed can be revoked under certain circumstances, such as fraud or undue influence.

- Only family members can receive gifts through a Gift Deed. Gifts can be made to anyone, including friends, charities, or organizations. There are no restrictions on the recipient.

- You can’t include conditions in a Gift Deed. This is a misconception. You can include specific conditions or terms in the Gift Deed, as long as they are legal and clear.

- Gift Deeds are only valid if notarized. Notarization is not always required, but it is recommended to ensure the document is legally binding and to prevent disputes later.

- All gifts are tax-free. While many gifts are exempt from taxes, larger gifts may trigger gift tax implications. It’s important to understand the limits and regulations set by the IRS.

- Once a Gift Deed is signed, the giver loses all rights. This is misleading. The giver can still have certain rights, especially if the deed includes conditions or if the giver retains some control over the asset.

- Gift Deeds can be used to avoid creditors. This is illegal. Transferring assets to avoid paying debts can be considered fraudulent and can lead to legal consequences.

- Gift Deeds are only for large gifts. There is no minimum amount for a gift. Even small gifts can be documented with a Gift Deed to clarify intentions and avoid future disputes.

Understanding these misconceptions can help individuals make informed decisions when considering a Gift Deed. It’s always wise to do thorough research or consult a professional if needed.

Documents used along the form

A Gift Deed is a legal document that allows one person to transfer ownership of property or assets to another without any payment in return. Along with the Gift Deed, several other forms and documents may be needed to ensure the transfer is valid and properly recorded. Below is a list of commonly used documents associated with a Gift Deed.

- Title Deed: This document proves ownership of the property being gifted. It provides details about the property and confirms the giver's legal right to transfer it.

- Affidavit of Gift: This sworn statement outlines the intent behind the gift. It may include information about the relationship between the giver and receiver and confirms that the gift is made voluntarily.

- Property Tax Records: These documents show the assessed value of the property and any outstanding taxes. They help clarify the financial aspects of the property being transferred.

- Identification Documents: Both the giver and receiver typically need to provide valid identification, such as a driver's license or passport, to verify their identities during the transfer process.

- Trailer Bill of Sale: The OnlineLawDocs.com provides essential information about this form, which documents the transfer of ownership for trailers, facilitating a clear and legal process.

- Witness Statements: Some jurisdictions require witnesses to sign the Gift Deed. These statements confirm that the gift was made without coercion and that the giver was of sound mind.

Having these documents ready can help streamline the process of transferring property through a Gift Deed. Always check local laws and regulations, as requirements may vary by state or jurisdiction.

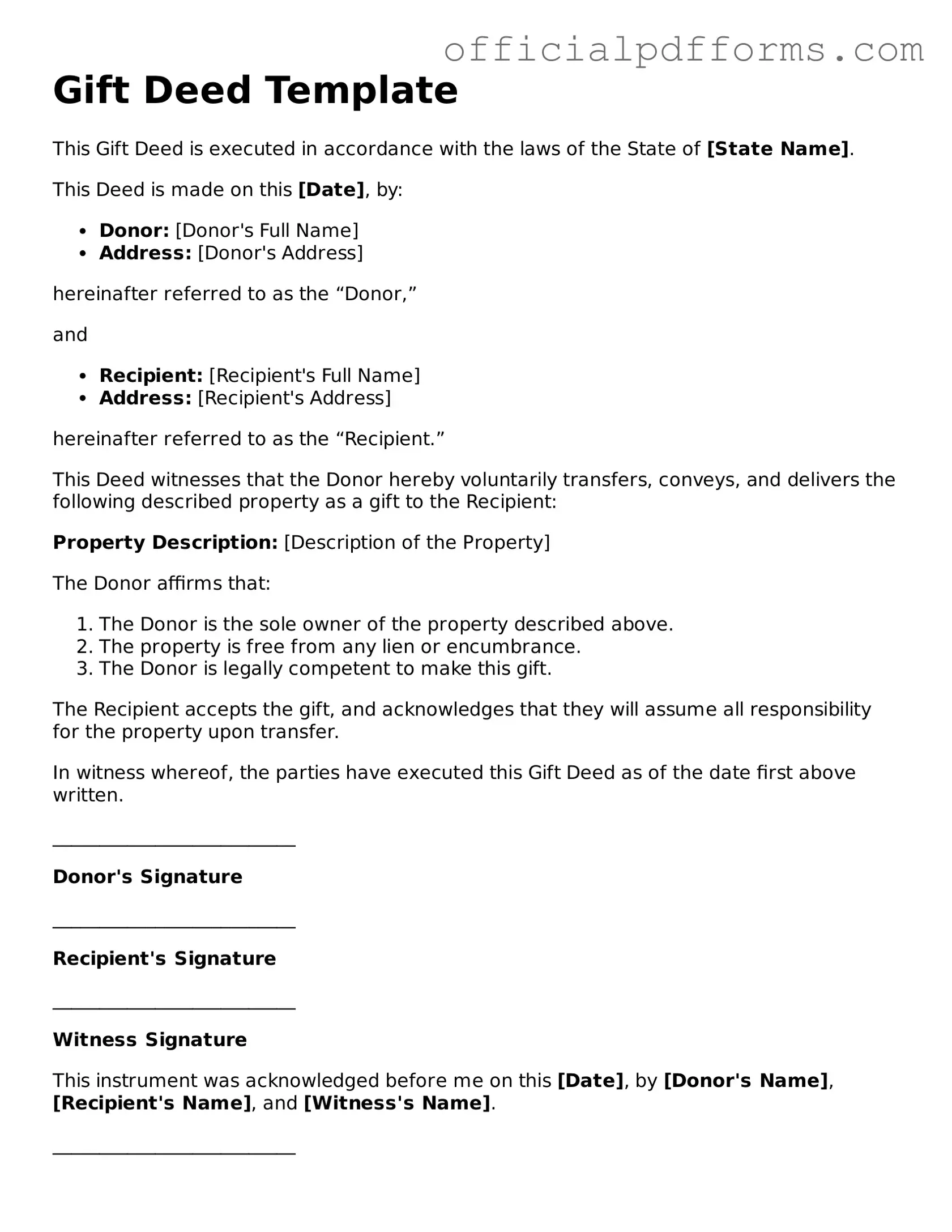

Steps to Filling Out Gift Deed

Filling out a Gift Deed form is a straightforward process. This document formalizes the transfer of property from one individual to another without any exchange of money. It is essential to complete the form accurately to ensure the validity of the gift.

- Begin by entering the date at the top of the form.

- Provide the full name of the donor (the person giving the gift).

- Next, enter the full name of the recipient (the person receiving the gift).

- Include the address of the donor and the recipient, ensuring that all information is current and correct.

- Describe the property being gifted. Include details such as the type of property, location, and any identifying information (like a parcel number for real estate).

- State the intention of the donor to gift the property to the recipient. This can be a simple statement confirming the gift.

- Both the donor and the recipient should sign and date the form. Ensure that signatures are clear and legible.

- If required, have the form notarized to add an extra layer of authenticity.

After completing the form, make copies for both the donor and recipient. It may also be advisable to file the original with the appropriate local government office, depending on the type of property being transferred.

Common mistakes

-

Failing to include all necessary parties. The deed must clearly identify both the donor and the recipient. Omitting one can lead to complications.

-

Not providing a complete description of the property. A vague description can create confusion about what is being gifted.

-

Using incorrect legal names. Ensure that the names match those on official identification to avoid disputes later.

-

Neglecting to include a date. A gift deed should always be dated to establish when the transfer took place.

-

Forgetting to sign the document. Both the donor and the recipient must sign the deed for it to be valid.

-

Not having witnesses. Many states require at least one witness to the signing of the deed.

-

Failing to notarize the document. Notarization can provide additional legal protection and verify the identities of the parties involved.

-

Ignoring local laws. Different states have specific requirements for gift deeds. Always check local regulations.

-

Assuming that a verbal agreement suffices. A gift deed must be in writing to be enforceable.

Get Clarifications on Gift Deed

What is a Gift Deed?

A Gift Deed is a legal document that facilitates the transfer of property or assets from one individual (the donor) to another (the recipient or donee) without any exchange of money or consideration. This document outlines the terms of the gift, ensuring that both parties understand the intent and conditions surrounding the transfer.

Why would someone use a Gift Deed?

People often choose to use a Gift Deed for several reasons:

- To transfer property to family members or friends without the complications of a sale.

- To minimize estate taxes by giving away assets during one’s lifetime.

- To ensure that specific assets are passed on to designated individuals.

What types of property can be transferred using a Gift Deed?

Various types of property can be conveyed through a Gift Deed, including:

- Real estate, such as homes or land.

- Vehicles, like cars or boats.

- Personal property, including jewelry or art.

- Financial assets, such as stocks or bonds.

Are there any tax implications associated with a Gift Deed?

Yes, there can be tax implications. In the United States, the IRS allows individuals to gift a certain amount each year without incurring gift tax. As of 2023, this annual exclusion is $17,000 per recipient. Gifts exceeding this amount may require the donor to file a gift tax return. It's advisable to consult a tax professional for personalized guidance.

Do I need witnesses for a Gift Deed?

While the requirements can vary by state, many jurisdictions do recommend having witnesses sign the Gift Deed. This can provide additional validation of the transaction and may be required for certain types of property, especially real estate. Always check local laws to ensure compliance.

Can a Gift Deed be revoked?

Generally, once a Gift Deed is executed and delivered, it cannot be revoked. However, if the donor retains some control over the property or if the deed was created under duress or fraud, there may be grounds for revocation. Legal advice should be sought in such situations.

How do I create a Gift Deed?

Creating a Gift Deed typically involves the following steps:

- Identify the property to be gifted.

- Gather the necessary information about both the donor and the recipient.

- Draft the Gift Deed, including a clear description of the property and the intent to gift.

- Have the document signed by both parties, and if required, by witnesses.

- File the Gift Deed with the appropriate local government office, if necessary.

Is a Gift Deed the same as a Will?

No, a Gift Deed and a Will serve different purposes. A Gift Deed is an immediate transfer of ownership, while a Will outlines how a person's assets will be distributed after their death. A Gift Deed takes effect during the donor's lifetime, whereas a Will only comes into effect upon the individual's passing.

What happens if the recipient refuses the gift?

If the recipient refuses the gift, the donor may need to draft a new Gift Deed or take other legal steps to clarify the situation. It's important to document any refusals in writing. Depending on the circumstances, the property may revert to the donor or be handled according to the donor's wishes.