Printable Georgia Transfer-on-Death Deed Template

Find Other Popular Transfer-on-Death Deed Templates for Specific States

Does Pennsylvania Have a Transfer on Death Deed - Consulting an estate planning professional can provide clarity on how a Transfer-on-Death Deed fits into broader estate plans.

To further understand the importance and function of a Release of Liability form, it's essential to consider the legal protections it offers. By clearly outlining the risks involved, the form allows participants to make informed decisions before engaging in activities. For comprehensive resources and additional information on drafting these documents, visit OnlineLawDocs.com.

Transfer on Death Deed Illinois Cost - Document can be executed without an attorney in many states, though legal advice may be beneficial.

Misconceptions

Understanding the Georgia Transfer-on-Death Deed can help individuals make informed decisions about their estate planning. However, several misconceptions often arise regarding this legal instrument. Below are four common misunderstandings:

- Misconception 1: The Transfer-on-Death Deed automatically transfers property upon the owner's death.

- Misconception 2: A Transfer-on-Death Deed avoids probate entirely.

- Misconception 3: This deed can only be used for residential property.

- Misconception 4: The deed must be filed before the property owner’s death to be valid.

This is not accurate. While the deed does allow for a transfer of property, it does not take effect until the owner's death. Until that point, the owner retains full control over the property and can sell or change the deed as desired.

While a Transfer-on-Death Deed can simplify the transfer process and may help avoid some probate complications, it does not completely eliminate the probate process. Certain circumstances, such as debts or disputes, may still necessitate probate proceedings.

This is incorrect. The Transfer-on-Death Deed can be utilized for various types of real estate, including commercial properties and vacant land, as long as the property is located in Georgia.

In fact, the deed must be properly executed and recorded with the county before the owner’s death to ensure its validity. If it is not recorded, the transfer will not take effect, and the property may be subject to probate.

Documents used along the form

When dealing with property transfers in Georgia, the Transfer-on-Death Deed form is just one piece of the puzzle. Several other documents often accompany it to ensure a smooth and legally sound process. Here’s a list of essential forms and documents that you may find useful.

- Warranty Deed: This document transfers ownership of property and guarantees that the seller holds clear title. It protects the buyer by ensuring there are no undisclosed claims against the property.

- Quitclaim Deed: A quitclaim deed transfers whatever interest the grantor has in the property without any warranties. It’s often used among family members or to clear up title issues.

- Affidavit of Heirship: This document provides a sworn statement about the heirs of a deceased person. It helps establish who is entitled to inherit property when there’s no will.

- Last Will and Testament: A will outlines how a person wants their assets distributed after their death. It can work alongside a Transfer-on-Death Deed to clarify intentions.

- Free And Invoice PDF Form: The smarttemplates.net/fillable-free-and-invoice-pdf/ serves as a critical tool for business transactions, providing a detailed record of services rendered or goods supplied between two parties.

- Power of Attorney: This legal document allows someone to act on behalf of another person in legal or financial matters. It can be particularly useful if the property owner becomes incapacitated.

- Real Estate Purchase Agreement: This contract outlines the terms of a property sale between a buyer and seller. It includes details such as the purchase price and any contingencies.

- Property Title Search: Conducting a title search confirms the current ownership and any liens or encumbrances on the property. It’s a crucial step before transferring ownership.

Each of these documents plays a vital role in property transactions. Having them prepared and organized can help avoid complications down the road, ensuring that your property transfer goes as smoothly as possible.

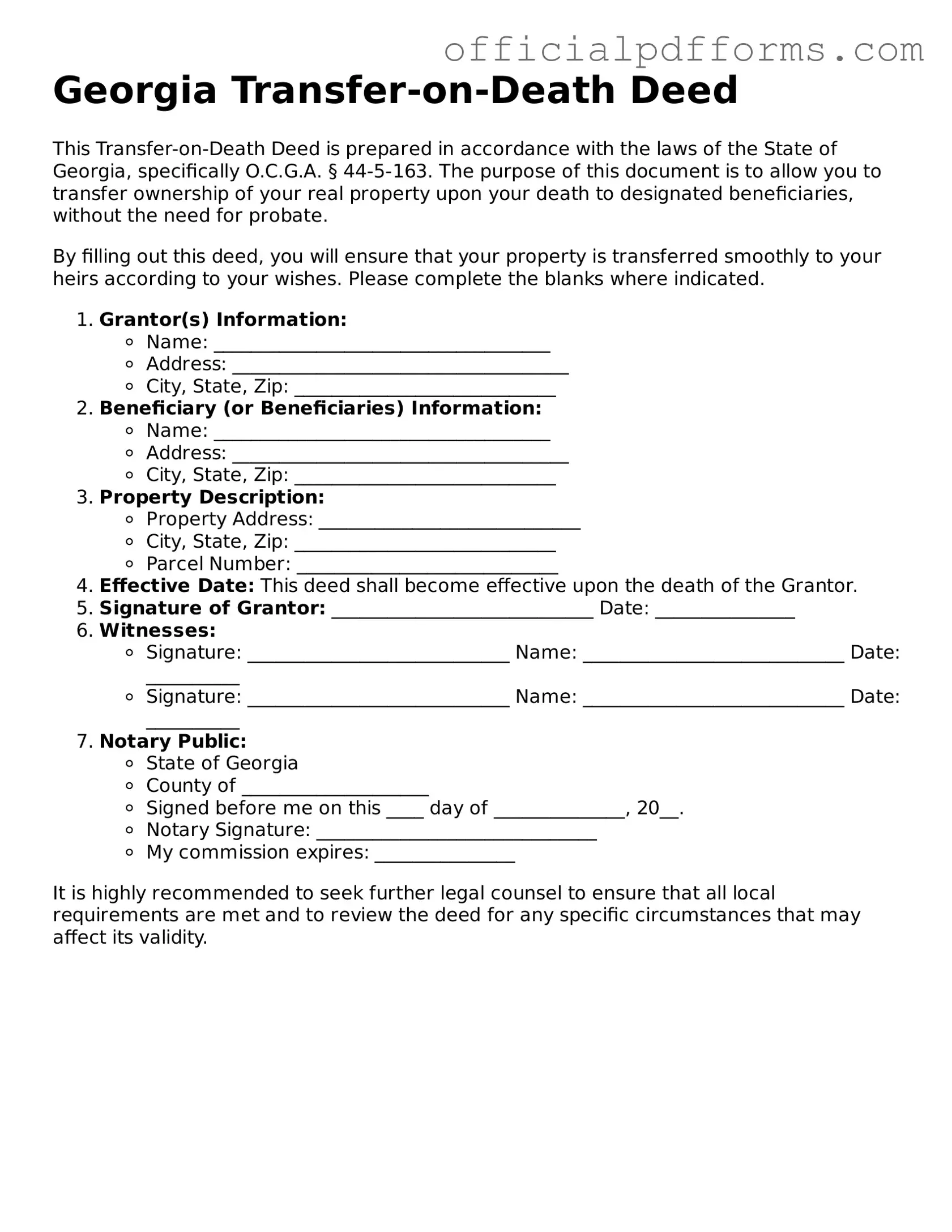

Steps to Filling Out Georgia Transfer-on-Death Deed

Once you have the Georgia Transfer-on-Death Deed form ready, you can begin filling it out. Make sure to have all necessary information on hand, such as property details and beneficiary information. Follow these steps carefully to ensure accuracy.

- Start by entering the name of the property owner at the top of the form. This should be the person transferring the property.

- Provide the address of the property that is being transferred. Include the street address, city, and county.

- Next, include a legal description of the property. This can usually be found on the current deed or property tax records.

- Identify the beneficiary who will receive the property upon the owner's death. Write their full name and relationship to the owner.

- If there are multiple beneficiaries, list them all. Make sure to specify how the property will be divided among them.

- Sign the form in the presence of a notary public. The signature must be dated.

- Have the notary complete their section, confirming the signature and date.

- Finally, file the completed form with the county clerk's office where the property is located. Keep a copy for your records.

Common mistakes

-

Failing to include all required information. Each section of the form must be completed accurately. Missing information can lead to delays or rejection.

-

Not properly identifying the property. Be sure to provide a complete legal description of the property, including parcel numbers and addresses.

-

Using incorrect names for beneficiaries. Ensure that the names of the beneficiaries are spelled correctly and match their legal identification.

-

Neglecting to sign the form. The deed must be signed by the owner(s) in front of a notary public. Without a signature, the deed is not valid.

-

Overlooking witness requirements. Georgia law requires the signature of at least one witness, depending on the specific circumstances of the deed.

-

Not recording the deed. After completing the form, it must be filed with the county clerk’s office to be effective. Failing to do this can nullify the deed.

-

Using outdated forms. Always use the most current version of the Transfer-on-Death Deed form. Outdated forms may not comply with current laws.

-

Ignoring state-specific requirements. Each state may have unique rules regarding transfer-on-death deeds. Familiarize yourself with Georgia’s specific regulations.

-

Not consulting with a legal professional. Many individuals attempt to fill out the form without seeking guidance, which can lead to errors.

-

Failing to consider tax implications. Understand how a transfer-on-death deed may affect estate taxes and other financial responsibilities.

Get Clarifications on Georgia Transfer-on-Death Deed

What is a Transfer-on-Death Deed in Georgia?

A Transfer-on-Death Deed (TODD) is a legal document that allows property owners in Georgia to transfer their real estate to designated beneficiaries upon their death, without the need for probate. This means that the property can pass directly to the beneficiaries, simplifying the transfer process and potentially saving time and costs.

Who can use a Transfer-on-Death Deed in Georgia?

Any property owner in Georgia can use a Transfer-on-Death Deed to designate one or more beneficiaries. This includes individuals, married couples, and even entities like trusts. However, it’s important to ensure that the deed complies with state laws and is executed properly.

How do I create a Transfer-on-Death Deed?

To create a Transfer-on-Death Deed in Georgia, follow these steps:

- Obtain the appropriate form, which is available online or through legal stationery stores.

- Fill out the form with your information, the property details, and the beneficiary's information.

- Sign the deed in the presence of a notary public.

- Record the deed with the county clerk's office where the property is located.

Make sure to keep a copy of the recorded deed for your records.

Is a Transfer-on-Death Deed revocable?

Yes, a Transfer-on-Death Deed is revocable. The property owner can change or revoke the deed at any time before their death. To do this, the owner must create a new deed or a revocation document and record it with the county clerk's office.

What happens if I sell the property after executing a Transfer-on-Death Deed?

If you sell the property after executing a Transfer-on-Death Deed, the deed becomes void. The sale effectively cancels the transfer to the beneficiary. It’s important to communicate any changes in property ownership to your beneficiaries.

Can I name multiple beneficiaries on a Transfer-on-Death Deed?

Yes, you can name multiple beneficiaries on a Transfer-on-Death Deed. You can specify whether the property should be divided equally among them or if certain beneficiaries should receive specific portions. Clear instructions will help avoid confusion later.

Are there any tax implications for beneficiaries receiving property through a Transfer-on-Death Deed?

Generally, beneficiaries do not incur taxes upon receiving property through a Transfer-on-Death Deed. However, they may be responsible for property taxes and any capital gains taxes if they decide to sell the property later. Consulting a tax professional is advisable to understand any potential implications.

Can a Transfer-on-Death Deed be contested?

Yes, a Transfer-on-Death Deed can be contested, just like any other estate planning document. If someone believes the deed was executed under duress, fraud, or if the property owner lacked the mental capacity to make such a decision, they may challenge the deed in court.

Do I need an attorney to create a Transfer-on-Death Deed?

While it is not legally required to have an attorney to create a Transfer-on-Death Deed, it is highly recommended. An attorney can ensure that the deed complies with Georgia law and that your wishes are clearly articulated. This can help prevent future disputes among beneficiaries.

Where do I record the Transfer-on-Death Deed?

You must record the Transfer-on-Death Deed with the county clerk's office in the county where the property is located. Recording the deed makes it a matter of public record and ensures that your beneficiaries can claim the property without complications after your passing.