Printable Georgia Tractor Bill of Sale Template

Find Other Popular Tractor Bill of Sale Templates for Specific States

How to Transfer Ownership of a Tractor - Aids in avoiding potential misunderstandings post-sale.

When engaging in the sale of personal property, it is essential to properly document the transaction using a Texas Bill of Sale form, which can be obtained from resources like OnlineLawDocs.com. This legal document not only details the specifics of the sale but also serves as a crucial piece of evidence for both the buyer and seller, ensuring that the transaction is clear and binding.

Farm Equipment Bill of Sale - A Bill of Sale is essential for legal ownership verification.

Misconceptions

When dealing with the Georgia Tractor Bill of Sale form, several misconceptions can lead to confusion. Understanding the facts can help ensure a smooth transaction. Here are eight common misconceptions:

- It’s only necessary for new tractors. Many believe that a bill of sale is only needed for new purchases. In reality, it’s essential for both new and used tractors to establish ownership and protect both parties.

- Only the seller needs to sign. Some people think that only the seller’s signature is required. However, both the buyer and seller should sign the document to validate the transaction.

- The form must be notarized. While notarization can add an extra layer of security, it is not a requirement for the bill of sale in Georgia. A simple signature from both parties suffices.

- It’s the same as a title transfer. A bill of sale is not a title. It serves as proof of the transaction, but you must also complete a title transfer to officially change ownership.

- It’s unnecessary if there’s a written agreement. Even if there’s a written agreement between the parties, a bill of sale is still important. It provides a clear record of the sale and can help avoid disputes later.

- Only the buyer needs a copy. Many think that only the buyer should keep a copy of the bill of sale. In fact, both the buyer and seller should retain a copy for their records.

- It doesn’t need to include tractor details. Some assume that a simple statement of sale suffices. However, including specific details about the tractor, such as make, model, and VIN, is crucial for clarity.

- It can be filled out after the sale. Waiting to complete the bill of sale after the transaction is risky. It’s best to fill it out and sign it at the time of sale to ensure accuracy and prevent misunderstandings.

Being aware of these misconceptions can help you navigate the process with confidence and clarity. Always ensure that you have the right documentation in place to protect your interests.

Documents used along the form

When completing a transaction involving a tractor in Georgia, several forms and documents may accompany the Tractor Bill of Sale. These documents help ensure a smooth transfer of ownership and compliance with state regulations. Below is a list of common forms used in conjunction with the Tractor Bill of Sale.

- Title Transfer Form: This document officially transfers ownership of the tractor from the seller to the buyer. It is necessary for registering the vehicle with the state.

- Odometer Disclosure Statement: This form records the tractor's mileage at the time of sale. It is required for certain vehicles to prevent odometer fraud.

- IRS 2553 Form: This critical document is used by small businesses to elect S corporation status for tax purposes, allowing eligible entities to be taxed as pass-through entities. For more information, visit https://smarttemplates.net/fillable-irs-2553.

- Affidavit of Sale: This sworn statement confirms that the seller has sold the tractor and provides details about the transaction. It can be useful for legal purposes.

- Sales Tax Form: Buyers may need to complete this form to report the sales tax owed on the purchase. It ensures compliance with state tax laws.

- Power of Attorney: If the seller cannot be present for the transaction, this document allows another person to act on their behalf, facilitating the sale.

- Insurance Documentation: Proof of insurance may be required before the tractor can be registered. This document ensures that the vehicle is covered in case of an accident.

- Vehicle Registration Application: After the sale, the buyer must submit this application to register the tractor in their name with the Georgia Department of Revenue.

- Emission Certification: Depending on the tractor's age and type, an emission certification may be necessary to confirm that it meets environmental standards.

- Bill of Sale for Accessories: If any additional equipment or accessories are included in the sale, a separate bill of sale may be needed to document their transfer.

- Release of Liability: This document protects the seller from future claims related to the tractor after the sale has been completed.

These documents play a crucial role in the buying and selling process of tractors in Georgia. Ensuring that all necessary forms are completed accurately can help avoid potential legal issues and facilitate a smooth transaction.

Steps to Filling Out Georgia Tractor Bill of Sale

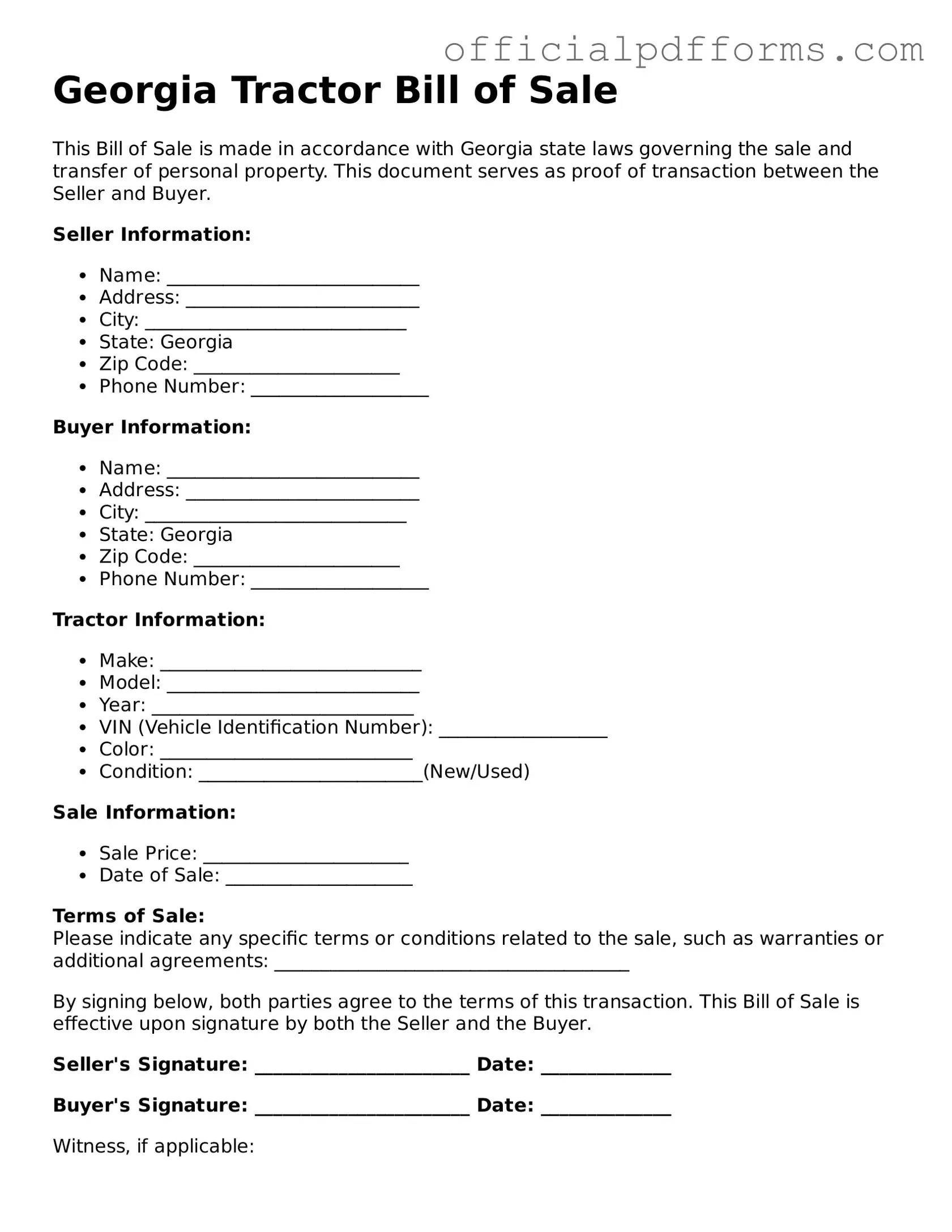

Once you have the Georgia Tractor Bill of Sale form in hand, it’s time to fill it out accurately. This document will help you record the sale of a tractor, ensuring both parties have a clear understanding of the transaction. Here’s how to complete the form step by step.

- Start with the date: Write the date of the sale at the top of the form.

- Seller’s information: Enter the seller's full name, address, and contact number in the designated fields.

- Buyer’s information: Fill in the buyer's full name, address, and contact number as well.

- Tractor details: Provide specific details about the tractor. This includes the make, model, year, and Vehicle Identification Number (VIN).

- Sale price: Clearly state the agreed-upon sale price for the tractor.

- Signatures: Both the seller and the buyer should sign the form. Make sure to include the date of each signature.

- Witness (if applicable): If a witness is required, have them sign and provide their information as well.

After completing the form, both parties should keep a copy for their records. This will serve as proof of the transaction and can be useful for future reference, especially if any questions arise about ownership or the sale itself.

Common mistakes

-

Incomplete Information: One common mistake is failing to provide all necessary details. Buyers and sellers must include the full names, addresses, and signatures of both parties. Missing even one piece of information can lead to complications later.

-

Incorrect Vehicle Identification Number (VIN): The VIN is crucial for identifying the tractor. Errors in this number can create confusion or even legal issues. Always double-check the VIN against the tractor's registration documents.

-

Omitting Sale Price: Not specifying the sale price is another frequent error. The bill of sale should clearly state the amount paid for the tractor. This information is important for both parties, especially for tax purposes.

-

Failure to Date the Document: A date is essential for establishing when the sale took place. Without a date, it can be challenging to prove ownership transfer. Make sure to include the date clearly on the form.

-

Not Keeping Copies: After filling out the form, many forget to make copies. Both the buyer and seller should retain a copy of the bill of sale for their records. This documentation can be vital if disputes arise in the future.

Get Clarifications on Georgia Tractor Bill of Sale

What is a Georgia Tractor Bill of Sale?

A Georgia Tractor Bill of Sale is a legal document that records the sale of a tractor between a buyer and a seller. This form provides proof of ownership transfer and includes essential details about the transaction, such as the purchase price and vehicle identification number (VIN).

Is a Bill of Sale required in Georgia for tractor sales?

While a Bill of Sale is not legally required for all tractor sales in Georgia, it is highly recommended. This document protects both the buyer and seller by providing a written record of the transaction, which can be crucial for registration and tax purposes.

What information should be included in the Bill of Sale?

A comprehensive Bill of Sale should include the following information:

- Names and addresses of the buyer and seller

- Description of the tractor (make, model, year, VIN)

- Purchase price

- Date of sale

- Signatures of both parties

Can I create my own Bill of Sale?

Yes, you can create your own Bill of Sale. However, it is crucial to ensure that all required information is included and that the document complies with Georgia state laws. Using a template can help streamline the process and ensure that you do not miss any important details.

Do I need to notarize the Bill of Sale?

Notarization is not mandatory for a Bill of Sale in Georgia. However, having the document notarized can add an extra layer of authenticity and may be required by some buyers or lenders.

What if the tractor has a lien?

If the tractor has a lien, it is essential to disclose this information in the Bill of Sale. The seller should ensure that the lien is satisfied before completing the sale. Buyers should always verify the status of the title to avoid potential legal issues.

How do I register my tractor after purchase?

After purchasing a tractor, the buyer must register it with the Georgia Department of Revenue. This process typically involves submitting the Bill of Sale, proof of identity, and any applicable fees. Registration is crucial for legal ownership and to avoid penalties.

What should I do if I lose my Bill of Sale?

If you lose your Bill of Sale, you can create a new document that includes all relevant information about the original sale. Both the buyer and seller should sign this new document. It is also advisable to keep multiple copies of important documents in the future.

Can a Bill of Sale be used for other types of vehicles?

Yes, a Bill of Sale can be used for various types of vehicles, including cars, trucks, and trailers. The format may vary slightly, but the essential information required remains largely the same.

Where can I find a Georgia Tractor Bill of Sale template?

Templates for a Georgia Tractor Bill of Sale can be found online through legal websites, state government resources, or local county offices. Ensure that any template you use complies with Georgia laws to avoid issues during the sale.