Printable Georgia Real Estate Purchase Agreement Template

Find Other Popular Real Estate Purchase Agreement Templates for Specific States

How to Make a Purchase Agreement - Sets forth the purchase price for the property.

To simplify the shipping process and ensure compliance with industry standards, utilizing tools like the smarttemplates.net/fillable-fedex-bill-of-lading can significantly enhance efficiency for shippers. This fillable form streamlines the creation of a FedEx Bill of Lading, providing an easy-to-use template that meets all necessary regulations while maintaining accuracy in the transportation of goods.

Pa Purchase Agreement - Negotiated points such as furniture and fixtures can be included in the agreement.

Midland Title Toledo - A well-crafted Real Estate Purchase Agreement can make a significant difference in a transaction's success.

Misconceptions

Understanding the Georgia Real Estate Purchase Agreement is crucial for anyone involved in real estate transactions. However, several misconceptions can lead to confusion. Here are ten common misunderstandings:

- It’s a standard form that doesn’t need customization. Many believe the form is one-size-fits-all. In reality, each transaction may require specific terms tailored to the buyer and seller's needs.

- Only licensed real estate agents can fill it out. While agents are often involved, buyers and sellers can also complete the form, provided they understand the terms.

- It guarantees a successful sale. The agreement outlines terms but does not ensure the sale will close. Various factors can affect the outcome.

- All contingencies are optional. Some contingencies, like financing or inspection, are crucial for protecting parties. Ignoring them can lead to problems.

- Once signed, it cannot be changed. Parties can amend the agreement if both agree. Changes should be documented in writing.

- It’s only for residential properties. The form can also be used for commercial transactions, although additional clauses may be necessary.

- It doesn’t require legal review. While not mandatory, having a lawyer review the agreement can prevent misunderstandings and legal issues.

- It’s the same as a lease agreement. A purchase agreement is for buying property, while a lease is for renting. They serve different purposes.

- All terms are negotiable. While many terms can be negotiated, some may be standard practice and not open to change.

- It only protects the seller. The agreement is designed to protect both parties, outlining rights and obligations for each side.

Being aware of these misconceptions can help buyers and sellers navigate the real estate process more effectively. Knowledge is key to making informed decisions.

Documents used along the form

When engaging in a real estate transaction in Georgia, several important documents often accompany the Real Estate Purchase Agreement. Each of these documents plays a crucial role in ensuring a smooth process for both buyers and sellers. Below is a list of commonly used forms and documents that you may encounter.

- Seller's Disclosure Statement: This document requires the seller to disclose any known issues or defects with the property. It helps buyers make informed decisions by providing transparency about the property's condition.

- Lead-Based Paint Disclosure: If the property was built before 1978, this form must be provided to inform buyers about the potential risks of lead-based paint. It is a vital safety measure for protecting health.

- Operating Agreement: The Operating Agreement is vital for LLCs, as it outlines the ownership and operational procedures specific to the business. To learn more about the importance of this document, visit OnlineLawDocs.com.

- Financing Addendum: This document outlines the terms of any financing arrangements related to the purchase. It details the type of loan, interest rates, and other financial obligations.

- Property Inspection Agreement: Buyers often use this form to arrange for a professional inspection of the property. It sets the terms for the inspection process, ensuring that any issues are identified prior to closing.

- Closing Statement: This document summarizes the financial details of the transaction, including the purchase price, closing costs, and any adjustments. It is reviewed and signed at the closing meeting.

- Title Search Report: A title search is conducted to confirm the seller’s ownership and identify any liens or encumbrances on the property. The report provides assurance that the title is clear for transfer.

- Deed: The deed is the legal document that transfers ownership from the seller to the buyer. It includes important details such as the property description and the names of the parties involved.

- Home Warranty Agreement: This optional document offers protection against certain repairs and replacements for a specified period after the purchase. It can provide peace of mind for buyers.

- Affidavit of Title: This sworn statement by the seller confirms their ownership of the property and the absence of undisclosed liens or claims. It helps protect the buyer’s interests.

Understanding these documents can greatly enhance your real estate experience. Each one serves a specific purpose, contributing to a clear and organized transaction. Being informed about these forms will help you navigate the process with confidence.

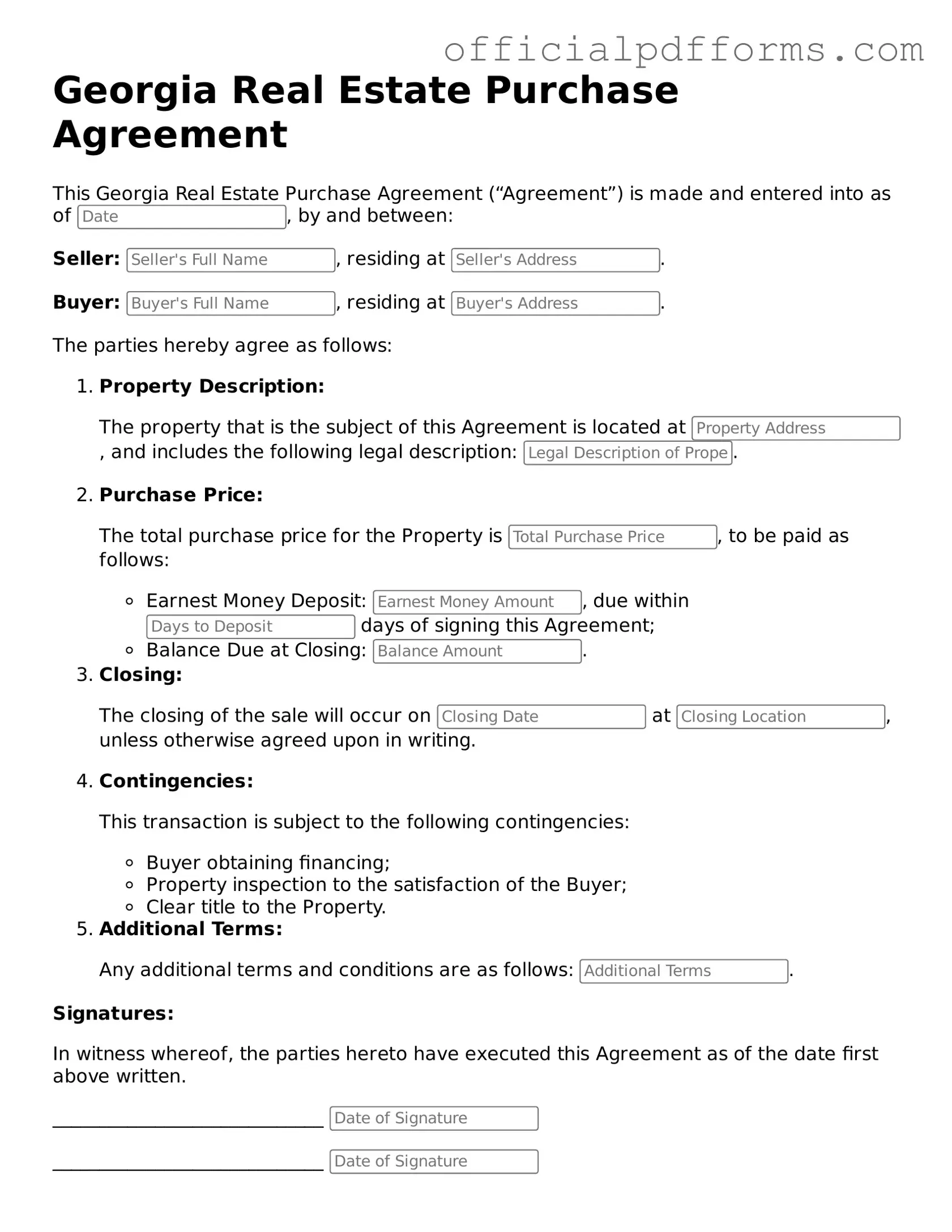

Steps to Filling Out Georgia Real Estate Purchase Agreement

Completing the Georgia Real Estate Purchase Agreement form is an important step in the home buying process. This document outlines the terms of the sale and protects both the buyer and seller. Once you have filled out the form, it will need to be signed by both parties to make it legally binding.

- Read the Instructions: Familiarize yourself with the form and its sections before you begin filling it out.

- Identify the Parties: Enter the names and contact information of the buyer(s) and seller(s) at the top of the form.

- Property Description: Provide a detailed description of the property being sold, including the address and any relevant details.

- Purchase Price: Clearly state the agreed-upon purchase price for the property.

- Earnest Money: Specify the amount of earnest money the buyer will provide and the terms for its handling.

- Closing Date: Indicate the proposed closing date for the transaction.

- Contingencies: List any contingencies that must be met for the sale to proceed, such as financing or inspection requirements.

- Signatures: Ensure both the buyer and seller sign and date the agreement to make it official.

- Review: Double-check all information for accuracy before finalizing the document.

Common mistakes

-

Incomplete Information: One common mistake is failing to provide all required details. Buyers and sellers must ensure that names, addresses, and property descriptions are fully filled out. Omitting any crucial information can lead to misunderstandings or disputes later on.

-

Incorrect Pricing: Another frequent error involves listing the purchase price inaccurately. It's essential to double-check the agreed-upon amount and ensure it is clearly stated. Miscommunication about the price can create complications during the transaction process.

-

Neglecting Contingencies: Many individuals overlook the importance of contingencies. Buyers should include clauses that protect their interests, such as financing or inspection contingencies. Failing to address these can leave buyers vulnerable if issues arise.

-

Ignoring Signatures: Finally, not securing the necessary signatures can invalidate the agreement. Both parties must sign the document to confirm their acceptance of the terms. An unsigned agreement may lead to legal issues or the inability to enforce the contract.

Get Clarifications on Georgia Real Estate Purchase Agreement

What is the Georgia Real Estate Purchase Agreement form?

The Georgia Real Estate Purchase Agreement form is a legal document used in real estate transactions in Georgia. It outlines the terms and conditions under which a buyer agrees to purchase a property from a seller. This form includes essential details such as the purchase price, financing arrangements, and contingencies that must be met before the sale is finalized.

Who should use the Georgia Real Estate Purchase Agreement?

This form is intended for use by individuals or entities involved in the buying and selling of residential real estate in Georgia. Both buyers and sellers should use this agreement to ensure that all parties are clear about their obligations and rights throughout the transaction process.

What key elements are included in the agreement?

The Georgia Real Estate Purchase Agreement typically includes the following key elements:

- Property description

- Purchase price

- Earnest money deposit details

- Closing date

- Contingencies (e.g., financing, inspections)

- Disclosures required by law

- Signatures of both parties

What are contingencies, and why are they important?

Contingencies are conditions that must be met for the sale to proceed. They protect both the buyer and the seller. Common contingencies include:

- Financing contingency: Ensures the buyer can secure a mortgage.

- Inspection contingency: Allows the buyer to conduct a home inspection.

- Appraisal contingency: Ensures the property's value meets or exceeds the purchase price.

These contingencies are crucial as they provide an opportunity for buyers to back out of the deal without penalty if certain conditions are not satisfied.

How is the purchase price determined?

The purchase price is typically negotiated between the buyer and seller. Factors influencing this price may include the property's market value, condition, location, and comparable sales in the area. An appraisal may also be conducted to provide an objective assessment of the property's worth.

What happens after the agreement is signed?

Once both parties sign the Georgia Real Estate Purchase Agreement, the buyer usually submits an earnest money deposit to demonstrate their commitment to the transaction. The agreement then moves into the due diligence phase, where contingencies are addressed, inspections are conducted, and financing is finalized. The transaction will proceed to closing once all conditions are met.

Can the agreement be modified after signing?

Yes, the Georgia Real Estate Purchase Agreement can be modified after signing, but both parties must agree to any changes. Modifications should be documented in writing and signed by both the buyer and seller to ensure clarity and enforceability.

What should I do if I have questions about the agreement?

If you have questions about the Georgia Real Estate Purchase Agreement, it is advisable to consult with a real estate professional or attorney. They can provide guidance tailored to your specific situation and help clarify any legal terms or obligations outlined in the agreement.