Printable Georgia Quitclaim Deed Template

Find Other Popular Quitclaim Deed Templates for Specific States

New Jersey Deed Transfer Form - It’s not a substitute for a thorough property title investigation.

For those looking to understand their rights and obligations during a transaction, our guide provides insights on the effective use of a crucial document: the foundational bill of sale for property transfers. You can access this valuable resource through the link for a complete overview of the necessary steps and considerations: foundational bill of sale for property transfers.

Quick Claim Deed - A quitclaim deed allows a property owner to transfer ownership to another person without warranty.

Quit Claim Deed North Carolina - Many states have specific requirements for the use of Quitclaim Deeds.

Misconceptions

When dealing with real estate transactions in Georgia, the Quitclaim Deed form often leads to misunderstandings. Here are eight common misconceptions about this type of deed:

- A Quitclaim Deed transfers ownership completely. Many believe that a Quitclaim Deed guarantees full ownership rights. In reality, it only transfers whatever interest the grantor has in the property, which may not be complete or clear.

- Quitclaim Deeds are only for family members. While these deeds are often used in family transactions, they are not limited to such situations. Anyone can use a Quitclaim Deed to transfer property interests.

- A Quitclaim Deed eliminates all liabilities. Some people think that using a Quitclaim Deed removes any debts or liens associated with the property. However, the new owner may still be responsible for any existing liabilities.

- Quitclaim Deeds are only for transferring real estate. Although primarily used for real estate, Quitclaim Deeds can also be used to transfer other types of property interests, such as rights to a business or intellectual property.

- Using a Quitclaim Deed is the same as using a Warranty Deed. This is a common error. A Warranty Deed provides guarantees about the title and ownership, while a Quitclaim Deed does not offer any such assurances.

- A Quitclaim Deed does not need to be notarized. Some people believe that notarization is unnecessary. In Georgia, a Quitclaim Deed must be signed in front of a notary public to be valid.

- Quitclaim Deeds can be used to resolve disputes. While they can transfer ownership, Quitclaim Deeds do not resolve legal disputes over property. Legal issues may still need to be addressed separately.

- Once a Quitclaim Deed is filed, it cannot be changed. Some think that a Quitclaim Deed is permanent and unchangeable. In fact, it can be revoked or amended, but this requires additional legal steps.

Understanding these misconceptions can help individuals make informed decisions when considering the use of a Quitclaim Deed in Georgia.

Documents used along the form

When completing a property transfer in Georgia using a Quitclaim Deed, several other documents may be needed to ensure a smooth transaction. Each of these documents plays a vital role in the process, protecting the interests of all parties involved.

- Warranty Deed: This document guarantees that the seller has clear title to the property and can legally transfer it. Unlike a Quitclaim Deed, it offers more protection to the buyer.

- Title Search Report: This report provides information about the property's ownership history. It helps identify any liens or claims against the property that could affect the transfer.

- California ATV Bill of Sale Form: To properly document the sale of an all-terrain vehicle, utilize the essential California ATV Bill of Sale form guide for clarity and compliance.

- Affidavit of Title: This sworn statement confirms the seller’s ownership and outlines any known issues with the title. It adds an extra layer of assurance for the buyer.

- Closing Statement: This document summarizes the financial aspects of the transaction, including costs and fees. It ensures both parties understand their financial obligations.

- Property Transfer Tax Form: This form is required to report the transfer of property for tax purposes. It helps ensure compliance with state regulations.

- Power of Attorney: If the seller cannot be present for the signing, a Power of Attorney allows another person to sign on their behalf. This document must be properly executed to be valid.

Having these documents ready can streamline the property transfer process. It’s always a good idea to consult with a professional if you have questions or need assistance with any of these forms.

Steps to Filling Out Georgia Quitclaim Deed

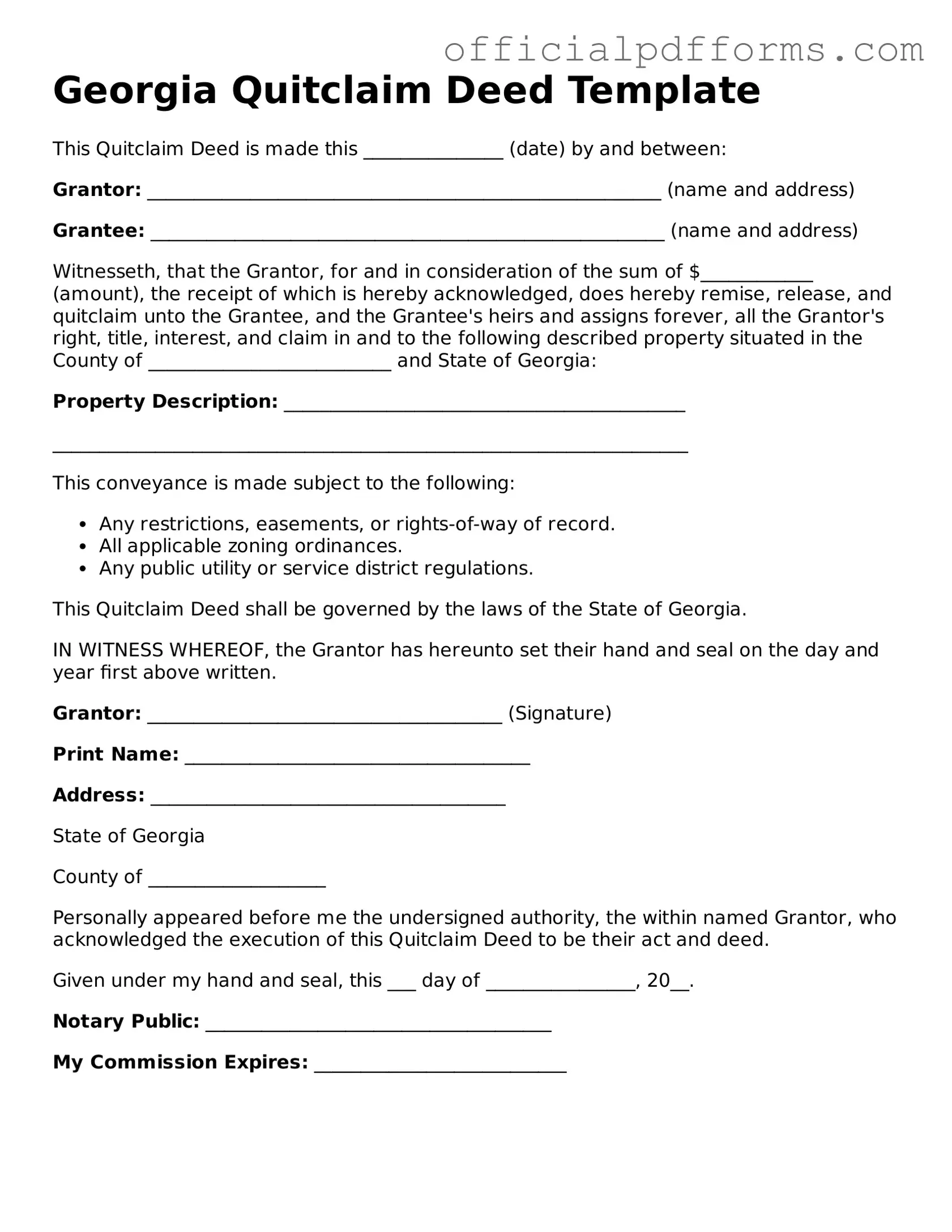

After gathering the necessary information, you are ready to fill out the Georgia Quitclaim Deed form. Follow these steps carefully to ensure accuracy. Once completed, the form must be signed and notarized before it can be filed with the appropriate county office.

- Begin by entering the date at the top of the form.

- In the "Grantor" section, provide the full name and address of the person transferring the property.

- In the "Grantee" section, fill in the full name and address of the person receiving the property.

- Describe the property being transferred. Include the street address and any relevant legal description.

- State the consideration amount, which is the value exchanged for the property. This can be a nominal amount, such as $10, if applicable.

- Sign the form in the presence of a notary public. The grantor must sign, and the notary will then complete their section.

- Ensure that all required information is filled out and that there are no blank spaces.

- Make copies of the completed deed for your records.

- File the original Quitclaim Deed with the county clerk's office where the property is located.

Common mistakes

-

Incorrect Names: One common mistake is failing to accurately list the names of all parties involved. It is essential to use the full legal names of both the grantor (the person transferring the property) and the grantee (the person receiving the property). Any discrepancies can lead to confusion or legal issues in the future.

-

Missing Signatures: The Quitclaim Deed must be signed by the grantor. A frequent error is neglecting to obtain the necessary signatures. If the grantor does not sign the document, it will not be legally binding.

-

Inaccurate Property Description: The description of the property must be precise and complete. Omitting vital details, such as the property address or legal description, can render the deed ineffective. It is crucial to ensure that the description matches public records.

-

Not Notarizing the Document: A Quitclaim Deed typically requires notarization to be valid. Some individuals forget this step, which can lead to complications when trying to record the deed with the county. Without a notary's signature, the document may not be accepted.

-

Failure to Record the Deed: After completing the Quitclaim Deed, it is important to file it with the appropriate county office. Many people overlook this step, which can create problems regarding the legal ownership of the property. Recording the deed ensures that the transfer is documented and accessible to the public.

Get Clarifications on Georgia Quitclaim Deed

What is a Quitclaim Deed in Georgia?

A Quitclaim Deed is a legal document used to transfer ownership of real estate in Georgia. It allows the current owner, known as the grantor, to transfer their interest in the property to another person, known as the grantee. This type of deed does not guarantee that the grantor has clear title to the property. Instead, it simply conveys whatever interest the grantor has, if any.

How do I complete a Quitclaim Deed in Georgia?

To complete a Quitclaim Deed in Georgia, follow these steps:

- Obtain the Quitclaim Deed form. You can find templates online or purchase one from a legal stationery store.

- Fill in the names of the grantor and grantee, along with their addresses.

- Provide a legal description of the property. This information can usually be found on the property deed or tax records.

- Sign the document in the presence of a notary public. The notary will verify your identity and witness the signing.

- Record the completed Quitclaim Deed with the county clerk’s office where the property is located. This step is essential to make the transfer official.

Are there any fees associated with filing a Quitclaim Deed in Georgia?

Yes, there are fees involved in filing a Quitclaim Deed in Georgia. The exact amount can vary by county. Typically, you will need to pay a recording fee when you submit the deed to the county clerk's office. Additionally, if the property is being transferred as part of a sale, there may be transfer taxes applicable. It is advisable to check with the local county office for the most accurate fee information.

Can I revoke a Quitclaim Deed after it has been executed?

Once a Quitclaim Deed is executed and recorded, it cannot be revoked unilaterally. The transfer is considered final. However, the grantor and grantee can agree to reverse the transaction by executing another deed, such as a new Quitclaim Deed, to transfer the property back. It is essential to consult with a legal professional to ensure that all necessary steps are followed correctly.