Printable Georgia Promissory Note Template

Find Other Popular Promissory Note Templates for Specific States

Loan Note Template - Promissory notes can be customized to fit the specific needs and conditions of the loan.

In order to ensure smooth shipping processes, it is important for shippers to properly complete the FedEx Bill of Lading form, which is essential for detailing the logistics of freight transport. More information and templates can be found at smarttemplates.net/fillable-fedex-bill-of-lading, making the task of filling out this critical document much easier.

Promissory Note Illinois - States may have specific rules governing the use of promissory notes.

Ohio Promissory Note Requirements - Promissory notes can be a useful financial instrument for both individuals and businesses.

Simple Promissory Note Template - The use of a promissory note can simplify the lending process.

Misconceptions

Understanding the Georgia Promissory Note form is crucial for both lenders and borrowers. However, several misconceptions can lead to confusion. Here are four common misconceptions:

- All Promissory Notes are the Same: Many people believe that all promissory notes follow a standard format. In reality, each state has its own requirements and variations. The Georgia Promissory Note has specific provisions that must be included to be legally binding.

- A Promissory Note Guarantees Payment: Some assume that signing a promissory note guarantees repayment. While it is a promise to pay, the enforceability of that promise depends on the borrower's ability to repay and the terms outlined in the note.

- Only Lenders Need to Understand the Note: It's a common belief that only lenders need to be familiar with the promissory note. In truth, borrowers should also understand the terms, interest rates, and their obligations to avoid potential pitfalls.

- Verbal Agreements are Sufficient: Many think that a verbal agreement is enough to create a valid promissory note. However, written documentation is essential in Georgia to ensure clarity and enforceability in case of disputes.

Clarifying these misconceptions can help both parties navigate their financial agreements more effectively.

Documents used along the form

When engaging in a lending agreement in Georgia, the Promissory Note is a crucial document. However, it is often accompanied by several other forms and documents that serve to clarify the terms of the loan and protect the interests of both parties. Below is a list of commonly used documents that complement the Georgia Promissory Note.

- Loan Agreement: This document outlines the specific terms of the loan, including the amount borrowed, interest rate, repayment schedule, and any collateral involved. It provides a comprehensive understanding of the obligations of both the lender and the borrower.

- Security Agreement: If the loan is secured by collateral, this agreement details the assets pledged to back the loan. It specifies the rights of the lender in the event of default, ensuring that the lender can recover their investment.

- Trailer Bill of Sale: This document is essential for recording the transfer of ownership of a trailer, ensuring clarity and legality in the transaction. For more information, visit OnlineLawDocs.com.

- Disclosure Statement: This document is designed to inform the borrower of the loan's terms and conditions, including any fees and potential penalties. It promotes transparency and helps borrowers make informed decisions.

- Personal Guarantee: In some cases, a lender may require a personal guarantee from an individual, ensuring that they will be personally responsible for the loan if the borrower defaults. This adds an extra layer of security for the lender.

- Amortization Schedule: This schedule outlines the repayment plan, breaking down each payment into principal and interest components. It helps borrowers understand how their payments will affect the loan balance over time.

- Default Notice: Should the borrower fail to meet their obligations, this document formally notifies them of the default. It typically outlines the consequences and next steps, serving as a critical communication tool in the event of non-payment.

Understanding these accompanying documents is essential for both lenders and borrowers in Georgia. They collectively ensure that all parties are aware of their rights and responsibilities, fostering a clearer and more secure lending process.

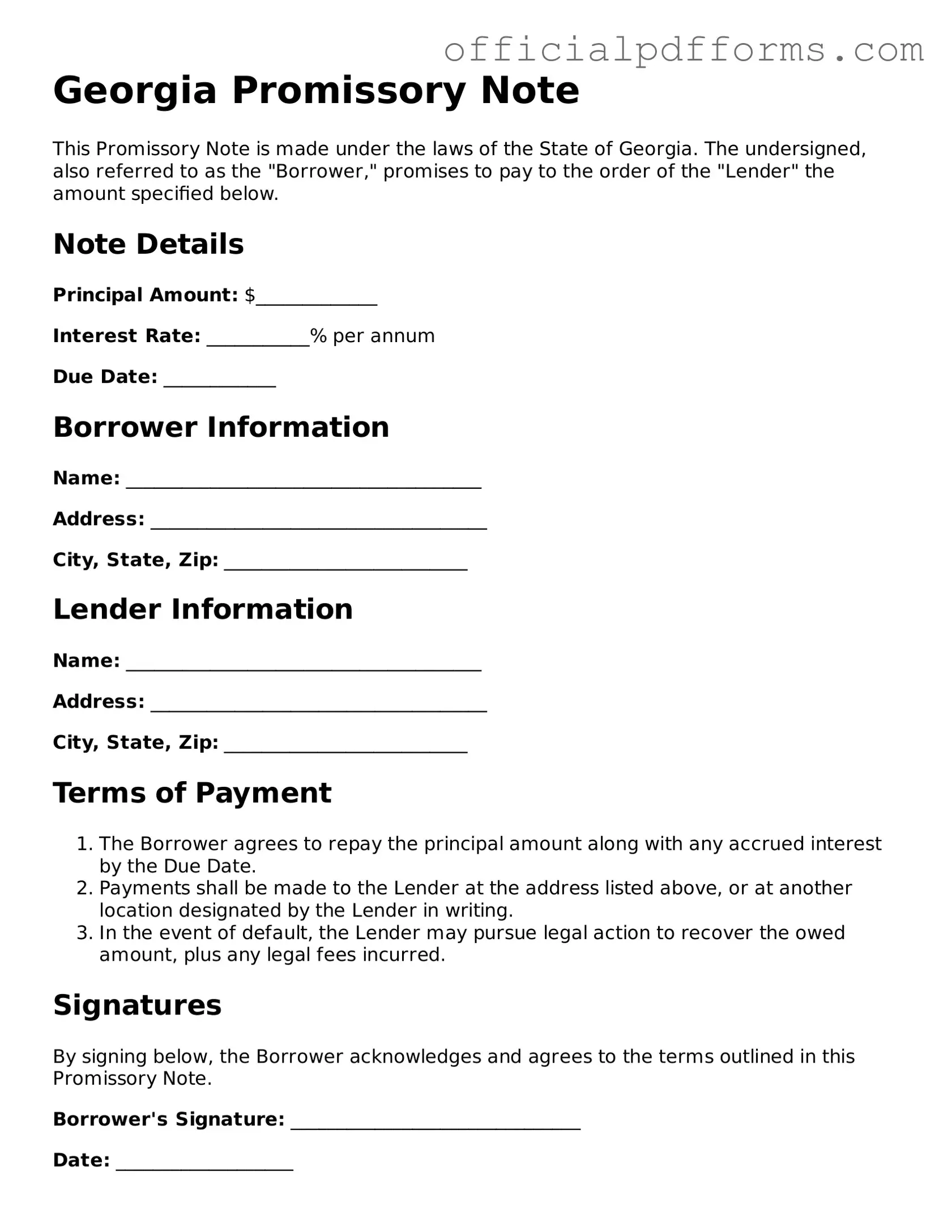

Steps to Filling Out Georgia Promissory Note

Once you have the Georgia Promissory Note form in front of you, it's time to fill it out carefully. Make sure you have all the necessary information at hand, as this will help you complete the form accurately. After you finish, you will be ready to sign and possibly have it notarized, depending on your situation.

- Start by entering the date at the top of the form. Use the format month, day, year.

- Next, write your name and address in the section designated for the borrower. Include your full legal name and current address.

- In the next section, fill in the lender's name and address. This should be the person or entity providing the loan.

- Specify the principal amount of the loan. This is the total amount borrowed, written in both numbers and words.

- Indicate the interest rate, if applicable. This can be a fixed or variable rate, so be clear about which one you are using.

- State the repayment terms. Include how often payments are due (monthly, quarterly, etc.) and the length of the loan.

- Outline any late fees or penalties for missed payments. Be specific about the amounts and conditions.

- Include any prepayment options. If the borrower can pay off the loan early without penalties, state this clearly.

- Review the entire form for accuracy. Ensure that all names, amounts, and terms are correct.

- Finally, sign and date the form. If required, have it notarized for additional legal standing.

Common mistakes

-

Failing to include the correct date. The date should reflect when the note is signed. An incorrect date can lead to confusion regarding the terms.

-

Not clearly stating the loan amount. It is essential to specify the exact amount being borrowed. Ambiguities can result in disputes later.

-

Omitting the interest rate. The interest rate should be explicitly stated. Without this information, the repayment terms may be unclear.

-

Neglecting to outline the repayment schedule. The schedule should detail when payments are due and the amount of each payment. Missing this information can lead to misunderstandings.

-

Not including the names and signatures of all parties involved. All parties must sign the document to validate the agreement. Failure to do so may render the note unenforceable.

-

Using vague language. The terms of the note should be clear and specific. Ambiguous language can create uncertainty regarding obligations.

-

Forgetting to include provisions for default. It is important to specify what happens in the event of a default. This can help protect the lender’s interests.

Get Clarifications on Georgia Promissory Note

What is a Georgia Promissory Note?

A Georgia Promissory Note is a legal document in which one party (the borrower) agrees to pay a specific amount of money to another party (the lender) under agreed-upon terms. It serves as a written promise to repay a loan, detailing the amount borrowed, interest rate, repayment schedule, and any penalties for late payments.

What are the key components of a Georgia Promissory Note?

The essential elements of a Georgia Promissory Note typically include:

- Principal Amount: The total amount of money being borrowed.

- Interest Rate: The rate at which interest will accrue on the principal amount.

- Repayment Terms: A schedule outlining when payments are due and how much will be paid at each interval.

- Maturity Date: The date by which the entire loan must be repaid.

- Signatures: Signatures of both the borrower and the lender to validate the agreement.

Do I need to notarize a Georgia Promissory Note?

While notarization is not legally required for a Georgia Promissory Note to be valid, having it notarized can provide additional legal protection. Notarization verifies the identities of the parties involved and confirms that they signed the document willingly. This can be beneficial if disputes arise in the future.

Can a Georgia Promissory Note be modified after signing?

Yes, a Georgia Promissory Note can be modified after it has been signed, but both parties must agree to the changes. It is advisable to document any modifications in writing and have both parties sign the amended note. This helps prevent misunderstandings and provides a clear record of the agreement.

What happens if the borrower defaults on the Promissory Note?

If the borrower defaults, the lender has several options. They may pursue legal action to recover the owed amount, which could include filing a lawsuit. The lender may also choose to negotiate a new payment plan or settle for a lesser amount. It's important for both parties to communicate openly to find a resolution before taking drastic measures.

Is a Georgia Promissory Note enforceable in court?

Yes, a properly executed Georgia Promissory Note is generally enforceable in court. If a dispute arises, the lender can present the note as evidence of the borrower's obligation to repay the loan. To strengthen the enforceability, ensure that the document is clear, complete, and includes all necessary terms and signatures.

Where can I find a template for a Georgia Promissory Note?

Templates for Georgia Promissory Notes can be found online through legal document services, financial institutions, or legal websites. When using a template, ensure that it complies with Georgia state laws and meets the specific needs of both parties involved. Customizing the template to reflect the terms of the loan is essential for clarity and enforceability.