Printable Georgia Loan Agreement Template

Find Other Popular Loan Agreement Templates for Specific States

Promissory Note Illinois - Can include an amortization schedule to illustrate payment breakdowns.

In order to effectively manage and operate an LLC in New York, it is essential to have a comprehensive Operating Agreement form, as this document delineates key operational procedures and ownership structures. By securing this agreement, members can prevent potential disputes and ensure clarity in financial matters, making it a cornerstone of the business's foundation. For more insights on crafting this crucial document, visit OnlineLawDocs.com.

Misconceptions

When it comes to the Georgia Loan Agreement form, there are several common misconceptions that can lead to confusion. Understanding these misconceptions can help ensure that you navigate the loan process more smoothly. Here are four key misunderstandings:

-

The Georgia Loan Agreement form is only for large loans.

This is not true. While many people associate loan agreements with significant amounts of money, the Georgia Loan Agreement form can be used for both small and large loans. It provides a clear structure for any lending situation, regardless of the loan size.

-

You must hire a lawyer to complete the form.

Many believe that legal assistance is mandatory for filling out the Georgia Loan Agreement form. In reality, you can complete the form on your own. It is designed to be user-friendly, allowing individuals to understand and fill it out without needing legal expertise.

-

The form is only for personal loans.

This misconception overlooks the versatility of the Georgia Loan Agreement form. It can be used for various types of loans, including business loans and informal loans between friends or family. The form adapts to different lending scenarios.

-

Once signed, the terms cannot be changed.

Some people think that signing the Georgia Loan Agreement form locks them into the terms forever. However, this is not the case. Parties involved can renegotiate terms and create amendments to the agreement as long as both sides consent to the changes.

By dispelling these misconceptions, you can approach the Georgia Loan Agreement form with confidence and clarity. Understanding the true nature of the form will empower you to make informed decisions regarding your lending needs.

Documents used along the form

When entering into a loan agreement in Georgia, several additional forms and documents may be required to ensure clarity and legal compliance. Each of these documents serves a specific purpose and helps protect the interests of both the borrower and the lender.

- Promissory Note: This document outlines the borrower's promise to repay the loan, detailing the amount borrowed, interest rate, repayment schedule, and any penalties for late payments.

- Loan Disclosure Statement: This statement provides essential information about the loan terms, including fees, interest rates, and the total cost of the loan. It ensures that borrowers are fully informed before committing.

- Texas Real Estate Purchase Agreement: This document is crucial for property transactions, outlining the necessary terms and conditions, including the purchase price and closing details. For further information, visit toptemplates.info/.

- Security Agreement: If the loan is secured by collateral, this agreement specifies the assets pledged as security. It outlines the rights of the lender in the event of default.

- Personal Guarantee: In cases where a business is borrowing, a personal guarantee may be required from an owner or principal. This document holds the individual personally liable for the loan if the business fails to repay.

- Credit Application: This form collects the borrower's financial information, including income, debts, and credit history. Lenders use this information to assess the borrower's creditworthiness.

- Loan Closing Statement: This document summarizes the final terms of the loan at closing, including the disbursement of funds, any fees paid, and the final balance owed. It ensures transparency during the final transaction.

Understanding these documents is crucial for anyone involved in a loan agreement. Each plays a vital role in the overall process, helping to establish clear expectations and protect the rights of all parties involved.

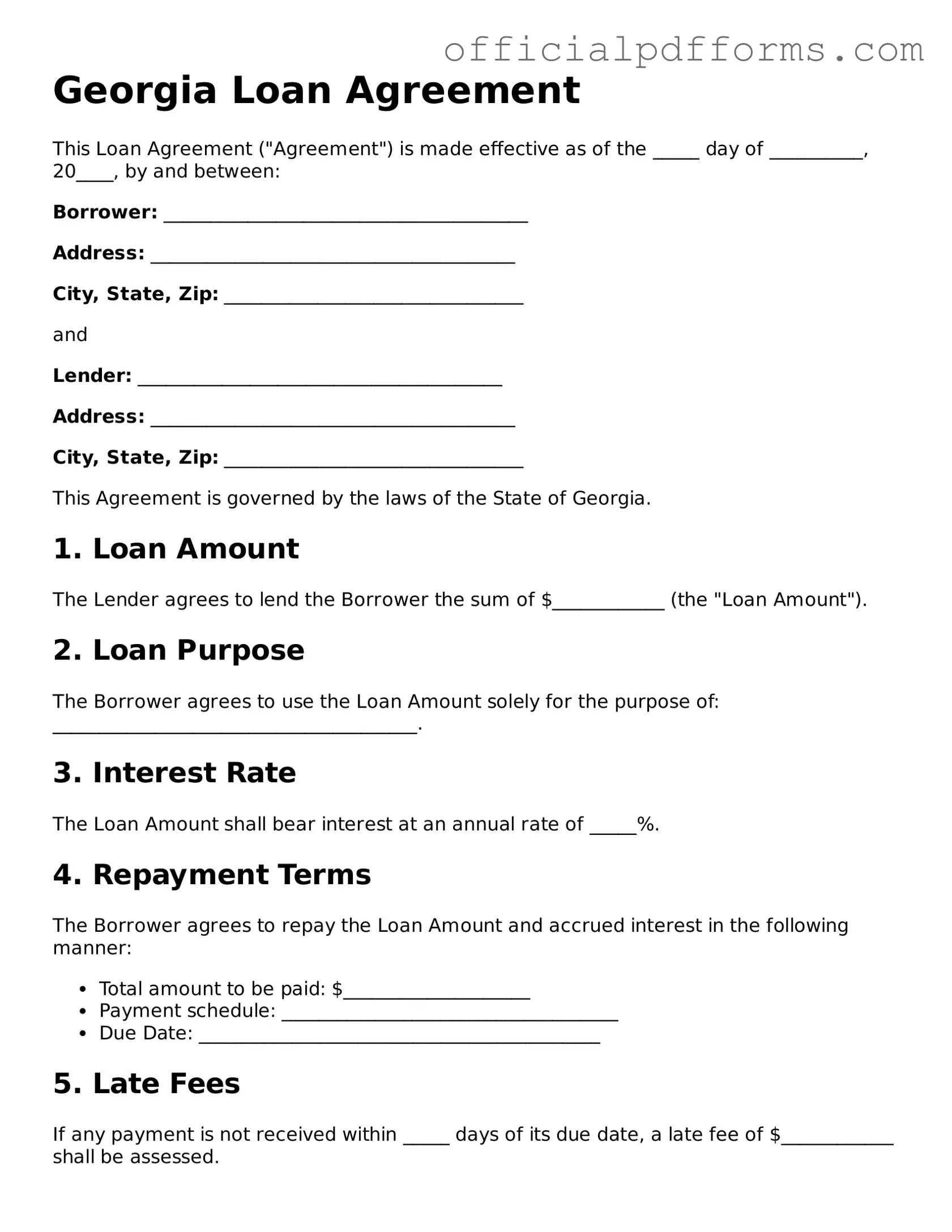

Steps to Filling Out Georgia Loan Agreement

Once you have the Georgia Loan Agreement form in hand, it is essential to fill it out accurately to ensure that all parties involved understand their rights and obligations. Follow these steps to complete the form correctly.

- Read the entire form: Familiarize yourself with all sections before filling it out.

- Enter the date: Write the date on which the agreement is being signed at the top of the form.

- Provide lender information: Fill in the name and address of the lender. Ensure all details are accurate.

- Provide borrower information: Enter the name and address of the borrower, ensuring it matches official identification.

- Specify loan amount: Clearly state the total amount of the loan being provided.

- Detail interest rate: Indicate the interest rate applicable to the loan, whether fixed or variable.

- Outline repayment terms: Specify the repayment schedule, including the frequency of payments and the due date.

- Include late fees: State any late fees that may apply if payments are not made on time.

- Signatures: Ensure both the lender and borrower sign the form. Include printed names and dates next to signatures.

After completing the form, both parties should retain a copy for their records. This ensures that everyone has access to the terms agreed upon in the loan agreement.

Common mistakes

-

Incomplete Information: Many individuals fail to provide all required details. Missing names, addresses, or loan amounts can delay processing.

-

Incorrect Dates: Some applicants mistakenly enter the wrong dates. Ensure that the loan start date and repayment schedule are accurate.

-

Signature Issues: A common error is not signing the form or having an incomplete signature. Always verify that all necessary signatures are present.

-

Misunderstanding Terms: Some people overlook the terms and conditions. Read the agreement carefully to avoid misunderstandings about interest rates and fees.

-

Failure to Review: Neglecting to review the completed form can lead to unnoticed mistakes. Double-check all entries before submission.

Get Clarifications on Georgia Loan Agreement

What is a Georgia Loan Agreement form?

A Georgia Loan Agreement form is a legal document that outlines the terms and conditions of a loan between a lender and a borrower in the state of Georgia. This form serves to protect both parties by clearly stating the amount borrowed, the interest rate, repayment schedule, and any other relevant details related to the loan.

Who needs to use a Georgia Loan Agreement form?

Anyone who is lending or borrowing money in Georgia should consider using a Loan Agreement form. This includes individuals, businesses, and financial institutions. By using this form, both parties can ensure that their rights and obligations are clearly defined, which helps prevent misunderstandings or disputes in the future.

What are the key components of a Georgia Loan Agreement?

A typical Georgia Loan Agreement includes several important elements:

- Loan Amount: The total amount of money being borrowed.

- Interest Rate: The percentage of the loan amount that will be charged as interest.

- Repayment Schedule: Details on when payments are due and how much will be paid at each interval.

- Default Terms: Conditions under which the borrower may be considered in default and the lender's rights in such cases.

- Signatures: Both parties must sign the agreement to make it legally binding.

Is a Georgia Loan Agreement form legally binding?

Yes, once both parties sign the Georgia Loan Agreement form, it becomes a legally binding contract. This means that both the lender and the borrower are obligated to adhere to the terms outlined in the agreement. If either party fails to comply, the other party may have legal recourse to enforce the agreement.

Can the terms of a Georgia Loan Agreement be modified after signing?

Yes, the terms of a Georgia Loan Agreement can be modified after signing, but both parties must agree to the changes. It is advisable to document any modifications in writing and have both parties sign the updated agreement. This helps ensure clarity and avoids potential disputes in the future.

What happens if the borrower defaults on the loan?

If the borrower defaults on the loan, the lender may take several actions as outlined in the Loan Agreement. These actions can include:

- Charging late fees as specified in the agreement.

- Demanding immediate repayment of the full loan amount.

- Taking legal action to recover the owed amount.

It is important for both parties to understand the default terms before entering into the agreement.

Where can I obtain a Georgia Loan Agreement form?

A Georgia Loan Agreement form can typically be obtained from various sources, including:

- Online legal document providers.

- Local law offices or legal aid organizations.

- Financial institutions that offer loan services.

It is important to ensure that the form is up-to-date and complies with Georgia laws.